Get the free Customer Application – Credit Card Payment

Get, Create, Make and Sign customer application credit card

Editing customer application credit card online

Uncompromising security for your PDF editing and eSignature needs

How to fill out customer application credit card

How to fill out customer application credit card

Who needs customer application credit card?

Your Guide to Filling Out a Customer Application Credit Card Form

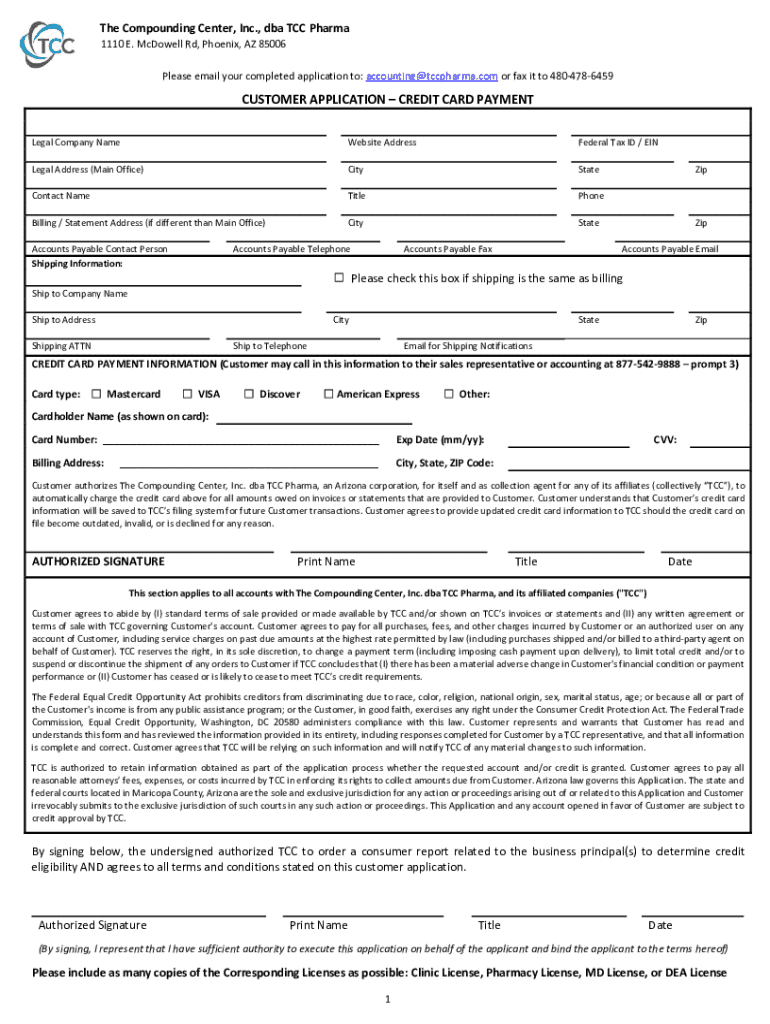

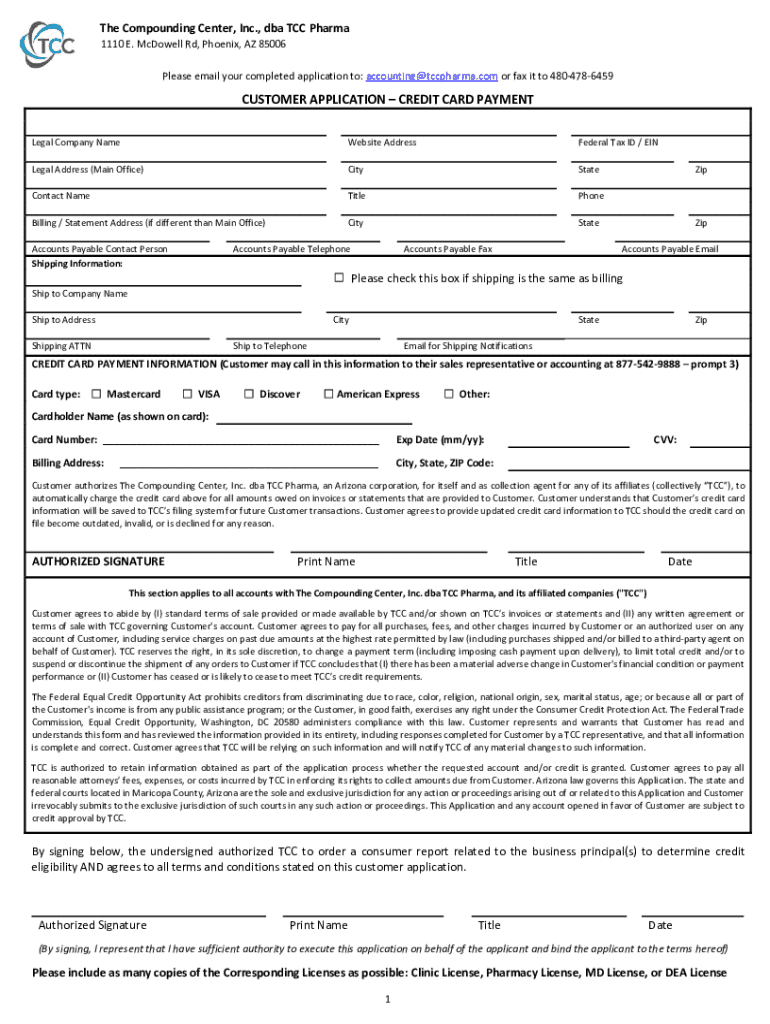

Understanding the customer application credit card form

A customer application credit card form is a vital document in the financial services industry. It collects essential information from card applicants, allowing banks and financial institutions to assess creditworthiness. Understanding the intricacies of this form is crucial for anyone looking to apply for credit cards, whether personal or for business use.

The importance of these forms cannot be overstated; they serve as the foundation for credit evaluation processes. A well-prepared application can significantly enhance your chances of approval, while an incomplete or inaccurate submission may result in disqualification.

There are primarily two types of credit card applications: personal and business. Personal applications are designed for individual consumers, while business applications cater to organizations. The information requested typically includes:

Getting started with pdfFiller

pdfFiller is a cloud-based document solution that simplifies the process of filling out forms like the customer application credit card form. This platform allows users to edit, sign, and manage their documents seamlessly from anywhere, making it an ideal choice for individuals and teams.

Utilizing pdfFiller for credit card forms offers numerous advantages, including:

Step-by-step guide to filling out a customer application credit card form

To effectively complete your customer application credit card form, preparation is key. Start by gathering the necessary documentation, including personal identification, proof of income, and employment verification. Ensuring the accuracy of your financial details is paramount, as any errors could delay the approval process.

Once you have your information ready, the next step is accessing the credit card application template on pdfFiller. This platform provides a user-friendly interface that guides you through each section of the form.

While filling out the form, pay close attention to each section. Common fields include:

Editing and customizing your credit card application

After filling out the initial application, you may find the need to edit or customize specific fields. pdfFiller allows you to make changes easily, ensuring your application accurately reflects your current situation.

Utilize pdfFiller's annotation and editing tools to add comments or additional information where necessary. You can also attach extra documents, such as bank statements or identification, to enhance your application.

Signing the customer application credit card form

Once your application is complete, you'll need to eSign it using pdfFiller's electronic signature feature. eSigning is not only convenient, but also offers legal validity, ensuring that your application can be processed without delay.

For a secure signing experience, ensure you are using a trusted device and network. Keep your login credentials private to maintain the security of your financial information.

Managing your credit card application documents

pdfFiller provides robust document management features that help you store and organize your credit card application and supporting documents. You can categorize your files for easy retrieval, ensuring important documents are never lost.

Additionally, tracking the status of your credit card application is essential. Some banks and issuers provide updates through pdfFiller, allowing you to stay informed about the progress of your submission.

FAQs: common questions about customer application credit card forms

After submitting a credit card application, many applicants have questions regarding the next steps. Common queries include:

Best practices for successful credit card applications

Improving your chances of credit card approval begins with understanding your credit score. Regularly check your score and ensure it matches your expectations before applying. Additionally, familiarizing yourself with the terms and conditions of various credit card offerings is vital.

Some key mistakes to avoid include:

Following up on your application is also essential; after a week, consider contacting the issuer for an update.

Related topics and resources

Understanding credit scores is crucial, as they directly impact your applications. Familiarize yourself with various types of credit cards to find one that suits your financial needs best. Effective credit card management also depends on financial literacy and responsible use.

Get started today with pdfFiller

To experience the benefits of filling out customer application credit card forms with ease, start a free trial with pdfFiller today. With pricing plans tailored for individuals and teams, pdfFiller empowers users to manage their documents efficiently through a single, cohesive platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify customer application credit card without leaving Google Drive?

How can I send customer application credit card to be eSigned by others?

How do I make changes in customer application credit card?

What is customer application credit card?

Who is required to file customer application credit card?

How to fill out customer application credit card?

What is the purpose of customer application credit card?

What information must be reported on customer application credit card?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.