Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Form 8-K: The Comprehensive Guide

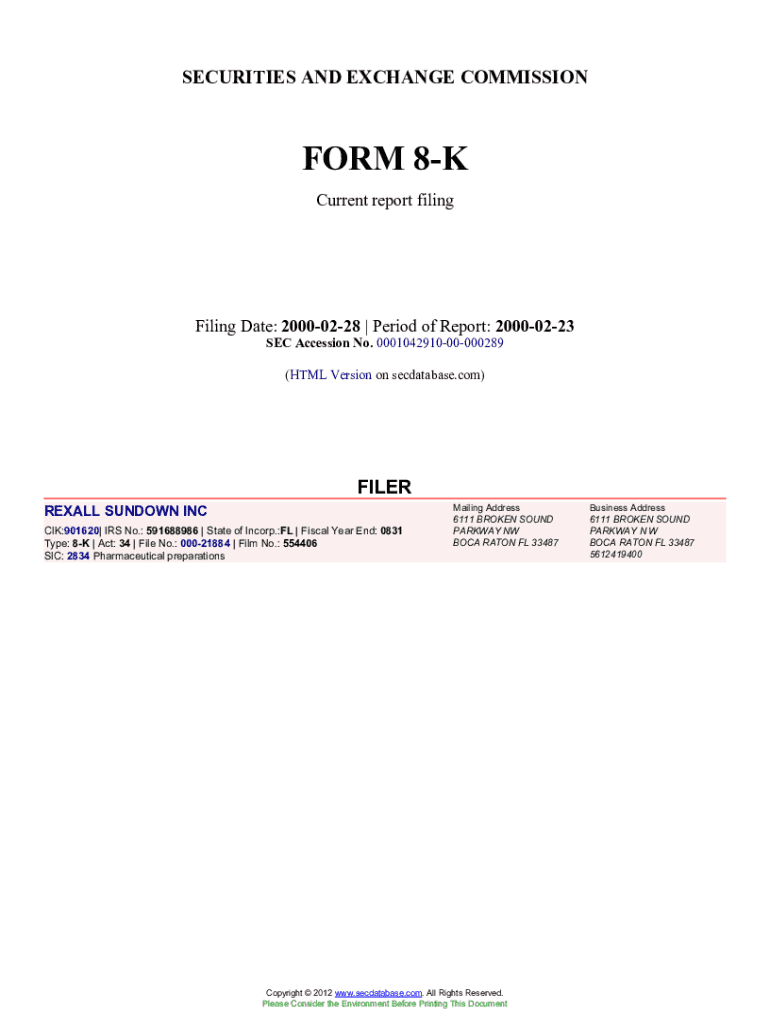

Understanding Form 8-K

Form 8-K is a critical tool in the arsenal of publicly traded companies, designed to ensure transparency in corporate events that might affect investors. It serves as a report of unscheduled material events or corporate changes that may be important to shareholders. The primary purpose of this form is to keep investors informed, thereby enhancing trust and accountability in the market.

The importance of Form 8-K in financial reporting cannot be understated. It provides stakeholders with timely information about major changes in a company’s financial status or operations—information that could influence investment decisions. By filing a Form 8-K, companies fulfill their legal obligation to disclose significant information in a prompt manner, thereby adhering to the principles of corporate governance.

Circumstances requiring Form 8-K filings

Several circumstances can trigger the need for filing a Form 8-K. Among these, acquisitions and mergers are particularly common, as they significantly alter a company's structure and need immediate disclosure to avoid misleading investors. Similarly, events related to bankruptcy or insolvency necessitate a Form 8-K, as they fundamentally impact the financial health of a business.

Changes in executive leadership, such as appointments or departures of key figures, also require Form 8-K filings. These changes can influence company strategy and operations, thus impacting shareholder value. Timely reporting of these events is crucial for maintaining transparency. Any delays can lead to misinformation, resulting in market volatility or loss of investor confidence.

How to read and interpret Form 8-K

Understanding the structure of Form 8-K is vital for effective analysis. The form consists of multiple sections, including the company name, the date of the event triggering the filing, and a description of the event itself. Key information is located in specific areas of the form; thus, knowing where to look can save time and enhance comprehension.

Complex disclosures often use technical language; however, a breakdown of the key terms can help in interpretation. It is advisable to highlight or summarize critical aspects of the disclosures to ensure that essential points stand out, thus facilitating a quick review for investors and stakeholders.

Detailed exploration of Form 8-K items

Form 8-K encompasses various reporting requirements, each identified by an item number. For example, Item 1.01 pertains to the entry into a material definitive agreement, requiring a company to report if it has entered into agreements that significantly affect its operations. In contrast, Item 1.02 addresses the termination of such agreements.

Other item numbers cover matters such as changes in a company's certifying accountant (Item 4.01), a departure of directors or senior officers (Item 5.02), and reports of financial statements (Item 9.01). Familiarity with these items can guide investors in evaluating the implications of the disclosures made on Form 8-K.

Historical context of Form 8-K

Form 8-K has evolved over the years, reflecting changes in regulatory frameworks and public expectations for corporate reporting. Initially introduced as part of initiatives to improve corporate governance, it has undergone numerous updates, particularly after significant financial scandals. These updates have reinforced the importance of transparency and full disclosure in corporate dealings.

Landmark 8-K filings, such as those involving large-scale bankruptcies or transformative mergers, have also shaped how the market reacts to similar events in the future. Companies must now recognize that their disclosures can significantly influence market sentiment and stock performance, leading to a culture of more proactive communication.

Benefits of using Form 8-K

Submitting Form 8-K fosters enhanced investor confidence. By ensuring timely disclosures, companies build trust with their stakeholders. This transparency not only aids investors in making informed decisions but also strengthens the company's credibility in the marketplace.

Additionally, maintaining market integrity is vital for minimizing systemic risks. Corporations that adhere to legal obligations and file promptly help preserve fair trading conditions. Furthermore, thorough reporting aids in legal compliance and risk management, protecting the company from potential regulatory penalties.

Frequently asked questions about Form 8-K

Companies must file Form 8-K within four business days of the triggering event. This prompt action is critical to maintaining investor trust and ensuring compliance with regulatory standards. Failure to meet this timeline could have severe ramifications, including regulatory fines or reputational damage.

If a company does not file on time, it may face penalties from the SEC, including monetary penalties or increased scrutiny. Investors may react negatively to delays, believing the company has something to hide, further impacting stock prices and overall market confidence.

Tools for filing Form 8-K effectively

Utilizing online platforms like pdfFiller can streamline the Form 8-K filing process. With intuitive document management tools, pdfFiller provides an easy way to create, edit, eSign, and collaborate on Form 8-K filings. This can significantly reduce the time and effort involved in completing the form.

By following a step-by-step guide through pdfFiller, companies can ensure all details are correctly filled out, documents are signed off efficiently, and deadlines are met without confusion. Collaborative features enable teams to work together seamlessly, sharing feedback and revisions in real time, minimizing errors.

Staying updated on Form 8-K news & resources

To remain informed about upcoming filings, investors and companies can subscribe to alerts on the SEC's website or use third-party financial news services. Keeping track of relevant filings is essential for staying updated on a company's performance and any changes that could impact stocks.

Furthermore, engaging with professional communities through forums and seminars can provide valuable insights and shared experiences regarding Form 8-K filings. Continuous education on financial disclosures helps enhance understanding and promotes better investment decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8-k to be eSigned by others?

How do I complete form 8-k online?

How can I fill out form 8-k on an iOS device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.