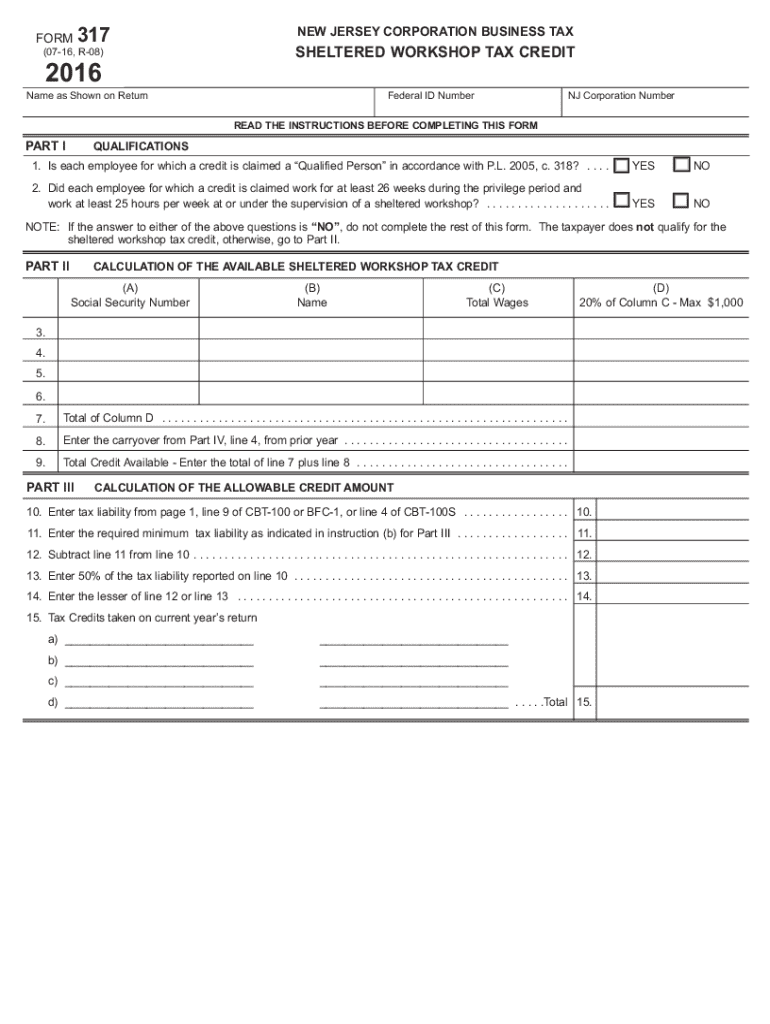

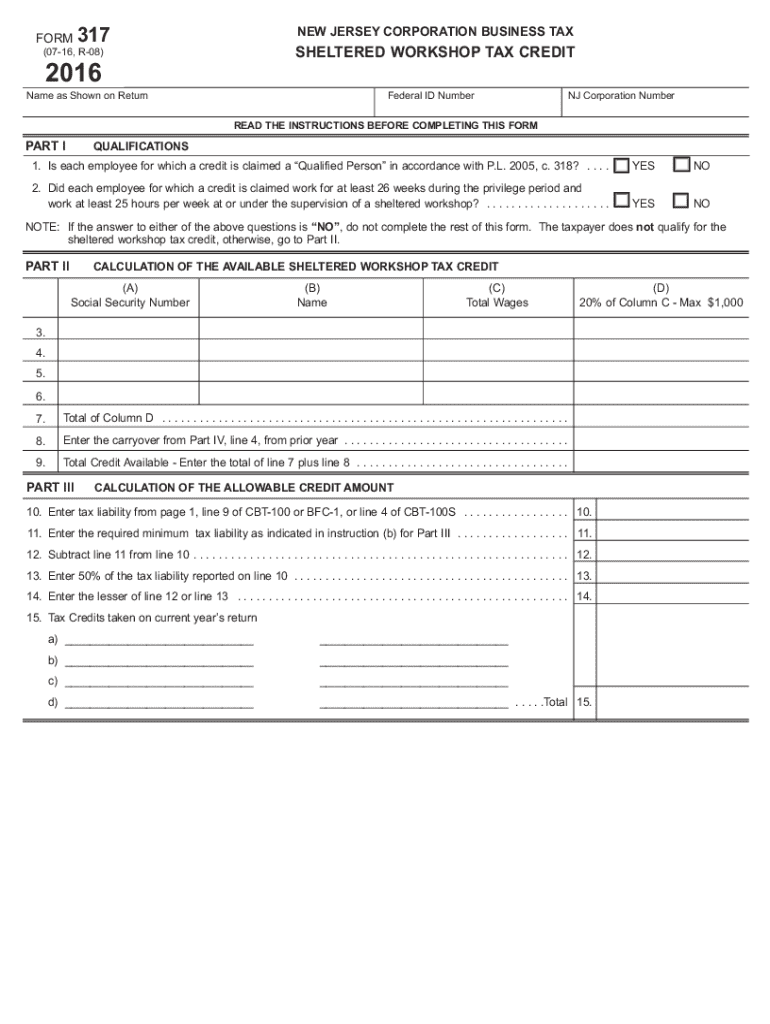

Get the free New Jersey Corporation Business Tax 317

Get, Create, Make and Sign new jersey corporation business

Editing new jersey corporation business online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new jersey corporation business

How to fill out new jersey corporation business

Who needs new jersey corporation business?

Navigating the New Jersey Corporation Business Form

Understanding the New Jersey corporation business form

The New Jersey corporation business form is an essential element for entrepreneurs seeking to establish a corporate entity in the state. It determines the legal structure, governance, and operational guidelines of the business. Understanding the importance of various corporate business forms can significantly impact a company’s long-term success. This guide will walk you through the various forms, requirements, and processes related to incorporating a business in New Jersey.

Establishing a corporation provides distinct advantages, such as limited liability for owners, increased credibility, and the ability to raise capital efficiently. However, navigating the various requirements is crucial for ensuring compliance and operational viability.

Types of corporations in New Jersey

New Jersey recognizes several types of corporations, each tailored to different operational requirements. Understanding these differences is vital for making an informed decision when establishing your business.

It's also important to note the differences between corporations and Limited Liability Companies (LLCs). Corporations tend to have more formalities and regulatory obligations compared to LLCs, which provide flexibility and easier management.

Starting a New Jersey corporation

The journey to establishing a corporation in New Jersey involves several key steps. Each step requires careful consideration to ensure compliance with state regulations.

Post-incorporation steps

After successfully incorporating, several essential steps must be undertaken to solidify the corporation's operational foundation.

Ongoing compliance and management

Maintaining your corporation's good standing requires diligence in compliance and management tasks. New Jersey has specific requirements that must be adhered to annually.

Special considerations for foreign entities

Foreign entities looking to register in New Jersey need to navigate specific requirements. This is often beneficial for businesses wanting to tap into the New Jersey market.

FAQs about New Jersey corporations

Addressing common concerns regarding the incorporation process is crucial for potential business owners. Here are some frequently asked questions:

Pros and cons of incorporating in New Jersey

Choosing to incorporate in New Jersey has its advantages and disadvantages, which impact business decisions significantly.

Seeking professional help

Navigating the incorporation process can be complex. Knowing when to seek professional assistance ensures your business adheres to legal regulations.

Utilizing pdfFiller for document management

pdfFiller emerges as a powerful tool for managing the New Jersey corporation business form, making document creation and management seamless for all users. The platform offers an array of features designed to simplify the incorporation process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit new jersey corporation business from Google Drive?

How do I make changes in new jersey corporation business?

How do I complete new jersey corporation business on an iOS device?

What is new jersey corporation business?

Who is required to file new jersey corporation business?

How to fill out new jersey corporation business?

What is the purpose of new jersey corporation business?

What information must be reported on new jersey corporation business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.