Get the free Choosing a super fund

Show details

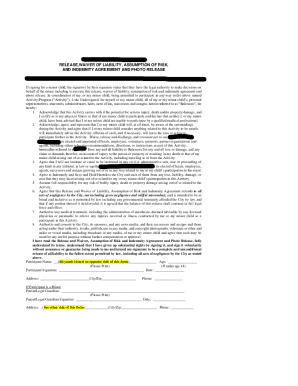

Use this form to offer eligible employees their choice of super fund. You must fill in the ... You must attach copies of the following documents to support your SMS ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign choosing a super fund

Edit your choosing a super fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your choosing a super fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit choosing a super fund online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit choosing a super fund. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out choosing a super fund

How to fill out choosing a super fund:

01

Research and evaluate different super funds: Start by researching and comparing different super funds available in the market. Look into factors such as fees, investment options, performance history, and additional features. Evaluate each fund based on your own investment goals and risk tolerance.

02

Consider your investment strategy: Determine your investment strategy based on your financial goals, time horizon, and risk appetite. Decide whether you want a conservative, balanced, or growth-focused investment approach. This will help you narrow down the super funds that align with your strategy.

03

Assess the fees and charges: Pay attention to the fees and charges associated with each super fund. Compare administration fees, investment management fees, and any other additional costs involved. Consider the impact of fees on your overall investment returns, as high fees can significantly eat into your long-term savings.

04

Understand the investment options: Familiarize yourself with the different investment options offered by the super fund. These can include diversified portfolios, sector-specific investments, or even ethical investment options. Ensure that the investment options available align with your preferences and financial objectives.

05

Check the performance and track record: Review the historical performance of each super fund. Look at their track record over different time periods and compare it to industry benchmarks. While past performance doesn't guarantee future results, it can give you insights into the fund's ability to deliver consistent returns.

06

Consider insurance and other benefits: Many super funds offer insurance options such as life insurance, Total and Permanent Disability (TPD) cover, and income protection. Assess whether these insurance options meet your needs and how they may impact your ongoing contributions and overall super balance.

07

Seek professional advice if needed: If you feel overwhelmed or uncertain about choosing a super fund, it may be beneficial to seek advice from a financial professional. They can provide guidance tailored to your individual circumstances and help you make an informed decision.

Who needs choosing a super fund?

01

Anyone who is employed: Choosing a super fund is essential for all working individuals, whether you are a full-time employee, part-time worker, or contractor. Superannuation is a mandatory requirement in many countries, and selecting the right super fund ensures that your retirement savings are being managed effectively.

02

People changing jobs: If you change jobs, you usually have the option to either stick with your existing super fund or choose a new one. It's important to assess your current fund and compare it to other options to ensure you're getting the best value for your money.

03

Self-employed individuals: As a self-employed individual, you have the responsibility of managing your own superannuation. Selecting an appropriate super fund is crucial to secure your retirement and ensure that you're making the most of potential tax advantages and investment opportunities.

04

Individuals looking to consolidate their super: If you have multiple super funds from previous employments, consolidating them into one fund can simplify your finances and potentially reduce fees. Choosing a suitable super fund becomes important when considering consolidation options.

05

Those planning for retirement: As you approach retirement, reviewing your super fund becomes crucial. You may want to reassess your investment strategy, consider transitioning to more conservative options, or explore pension income streams. Choosing the right super fund at this stage can significantly impact your retirement lifestyle.

Remember, choosing a super fund is a personal decision, and it's important to consider your individual circumstances and long-term financial goals. Take the time to educate yourself, seek professional advice if needed, and make an informed choice that aligns with your needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is choosing a super fund?

Choosing a super fund is the process of selecting a fund to deposit your superannuation contributions.

Who is required to file choosing a super fund?

All employees are required to select a super fund to receive their superannuation contributions.

How to fill out choosing a super fund?

To fill out choosing a super fund, employees need to provide their employer with the details of their chosen super fund.

What is the purpose of choosing a super fund?

The purpose of choosing a super fund is to ensure that your superannuation contributions are deposited into a fund that meets your retirement savings goals.

What information must be reported on choosing a super fund?

Employees must report the name of the chosen super fund, the super fund's unique identifier, and any additional details required by their employer.

How can I manage my choosing a super fund directly from Gmail?

choosing a super fund and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Where do I find choosing a super fund?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific choosing a super fund and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I edit choosing a super fund on an iOS device?

Use the pdfFiller mobile app to create, edit, and share choosing a super fund from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your choosing a super fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Choosing A Super Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.