Get the free BUK-Individual-self-certification-form.pdf - Tax compliance

Get, Create, Make and Sign buk-individual-self-certification-formpdf - tax compliance

How to edit buk-individual-self-certification-formpdf - tax compliance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out buk-individual-self-certification-formpdf - tax compliance

How to fill out buk-individual-self-certification-formpdf - tax compliance

Who needs buk-individual-self-certification-formpdf - tax compliance?

Everything You Need to Know About the buk-individual-self-certification-formpdf - Tax Compliance Form

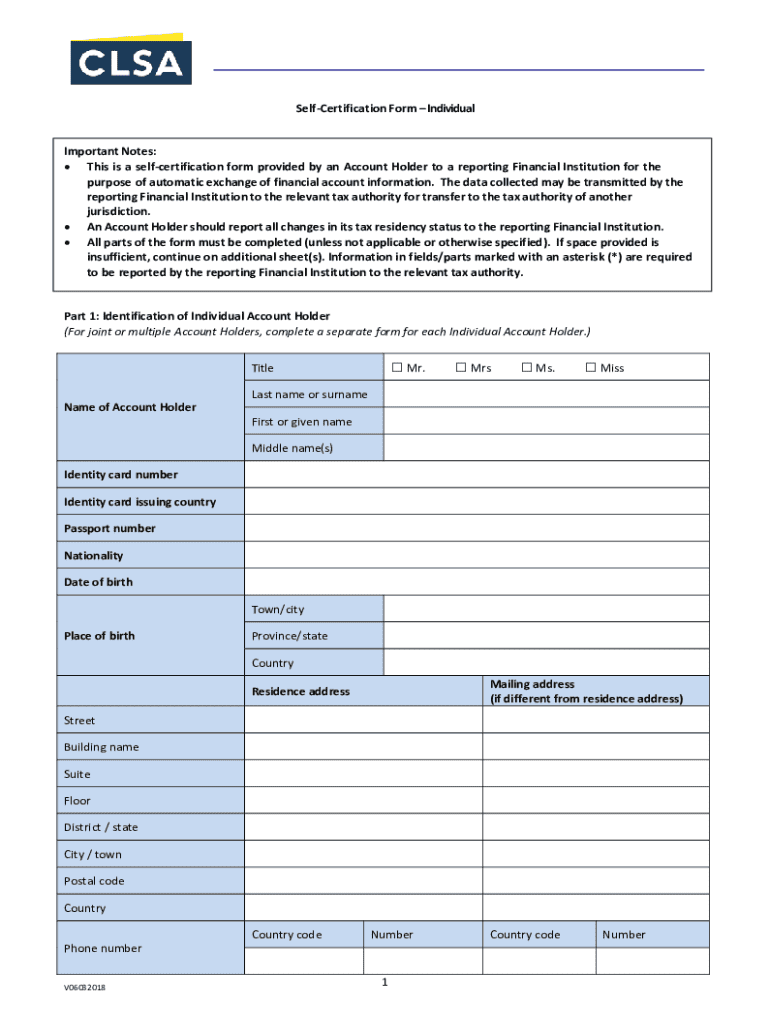

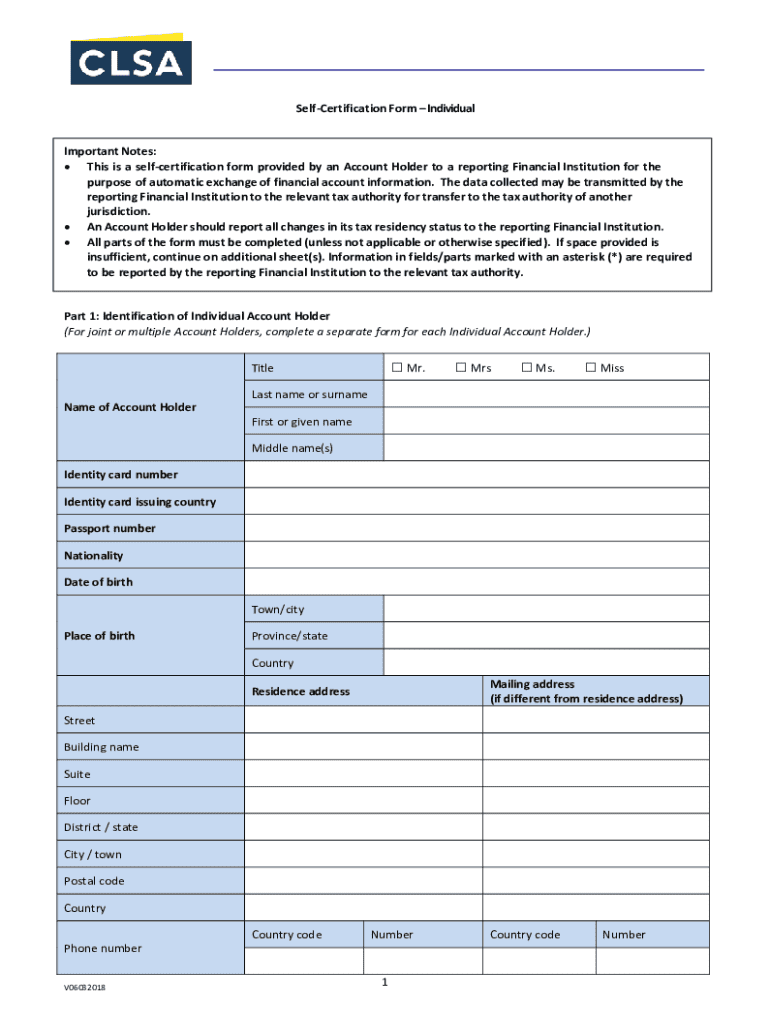

Understanding the Individual Self-Certification Form

The buk-individual-self-certification-formpdf plays a crucial role in the realm of tax compliance. Designed to declare an individual's tax residency status, it serves as an essential tool for financial institutions to ensure they are adhering to local and international tax regulations. By completing this form, individuals confirm their tax obligations, allowing institutions to accurately report information to tax authorities.

Tax compliance is not just a legal obligation; it also comes with significant implications. By complying with tax regulations, individuals can enjoy benefits like smoother banking transactions, eligibility for credit opportunities, and reduced risk of audits or penalties from tax authorities. Conversely, failure to comply can lead to criminal charges or substantial fines, affecting both personal finances and future financial opportunities.

Key elements of the individual self-certification form

The individual self-certification form encompasses several vital components that require careful attention. Understanding each element is crucial for successful completion and compliance.

Familiarizing yourself with common terms and definitions associated with this form, such as 'tax residency' or 'withholding taxes,' further enables you to make informed declarations.

Step-by-step guide to filling out the form

Completing the buk-individual-self-certification-formpdf may seem daunting, but following a structured approach can simplify the process.

Editing and managing your completed form

Once you've completed the buk-individual-self-certification-formpdf, you may need to make changes over time. pdfFiller provides efficient tools to edit your form conveniently.

eSigning your individual self-certification form

The legal acceptance of electronic signatures has simplified document finalization significantly. When it comes to the buk-individual-self-certification-formpdf, eSigning provides an efficient method to complete your submissions.

Submitting the individual self-certification form

Submitting your completed buk-individual-self-certification-formpdf is the final step in your tax compliance journey. Understanding your submission options ensures your form reaches the right destination.

Troubleshooting common issues

As you navigate the process of filling out the buk-individual-self-certification-formpdf, you may encounter challenges. Recognizing these common issues will help you overcome them efficiently.

Guidelines for maintaining compliance post-submission

Once your buk-individual-self-certification-formpdf is submitted, your responsibility doesn't end there. Maintaining compliance is a continuous process.

Interactive tools and resources available on pdfFiller

pdfFiller enhances your experience with various interactive tools and resources that support tax compliance efforts.

Final thoughts on the importance of tax compliance

Completing the buk-individual-self-certification-formpdf is an integral part of managing your tax obligations. Through compliance, you not only adhere to legal requirements but also lay the groundwork for future financial opportunities.

Utilizing pdfFiller simplifies the process of document management, from filling and editing to eSigning and storing. By employing this comprehensive platform, you can focus more on your financial planning while ensuring all documentation is up-to-date and compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete buk-individual-self-certification-formpdf - tax compliance online?

Can I create an electronic signature for the buk-individual-self-certification-formpdf - tax compliance in Chrome?

How can I edit buk-individual-self-certification-formpdf - tax compliance on a smartphone?

What is buk-individual-self-certification-formpdf - tax compliance?

Who is required to file buk-individual-self-certification-formpdf - tax compliance?

How to fill out buk-individual-self-certification-formpdf - tax compliance?

What is the purpose of buk-individual-self-certification-formpdf - tax compliance?

What information must be reported on buk-individual-self-certification-formpdf - tax compliance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.