Get the free New Payment Card Application for Individuals

Get, Create, Make and Sign new payment card application

How to edit new payment card application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new payment card application

How to fill out new payment card application

Who needs new payment card application?

New Payment Card Application Form: Your Comprehensive Guide

Overview of payment card applications

Payment cards are an essential financial tool in today’s economy, providing a convenient method for both online and offline transactions. Understanding how to apply for a new payment card can simplify your financial management significantly.

There are several types of payment cards, primarily credit, debit, and prepaid. Credit cards allow you to borrow funds up to a certain limit for purchases, while debit cards withdraw directly from your bank account. Prepaid cards function similarly but require you to load funds onto them beforehand.

Unlike cash or checks, which can be cumbersome and less secure, payment cards offer enhanced security features and ease of use. Additionally, many cards come with rewards programs, cashback offers, and other benefits that make spending more rewarding.

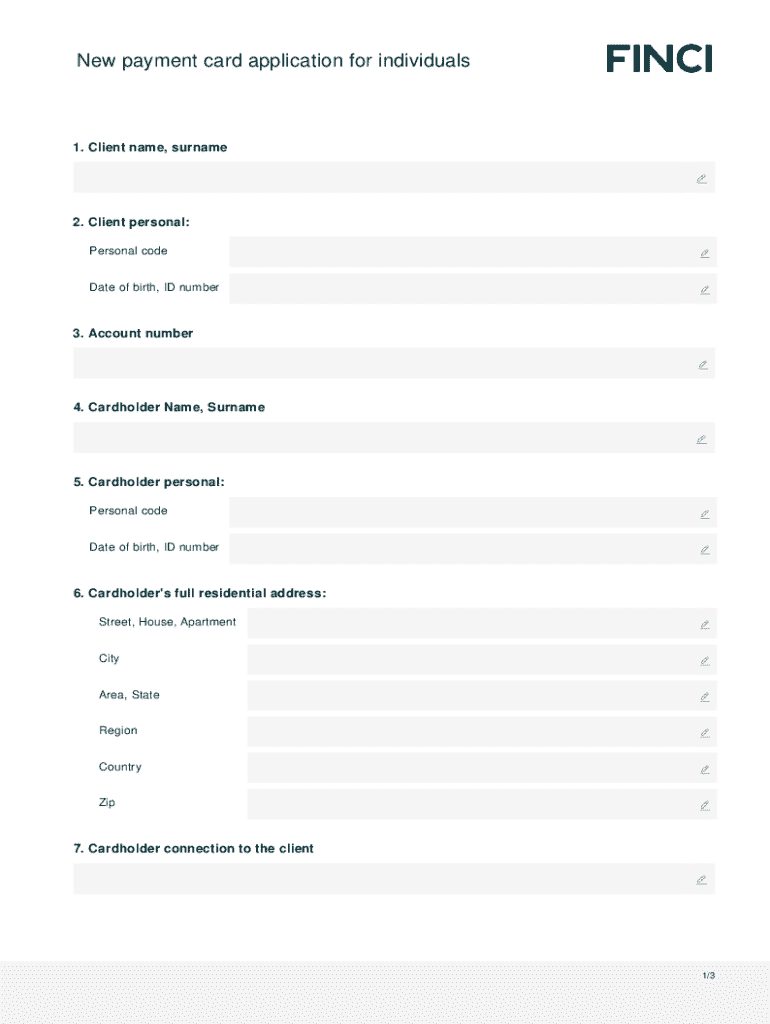

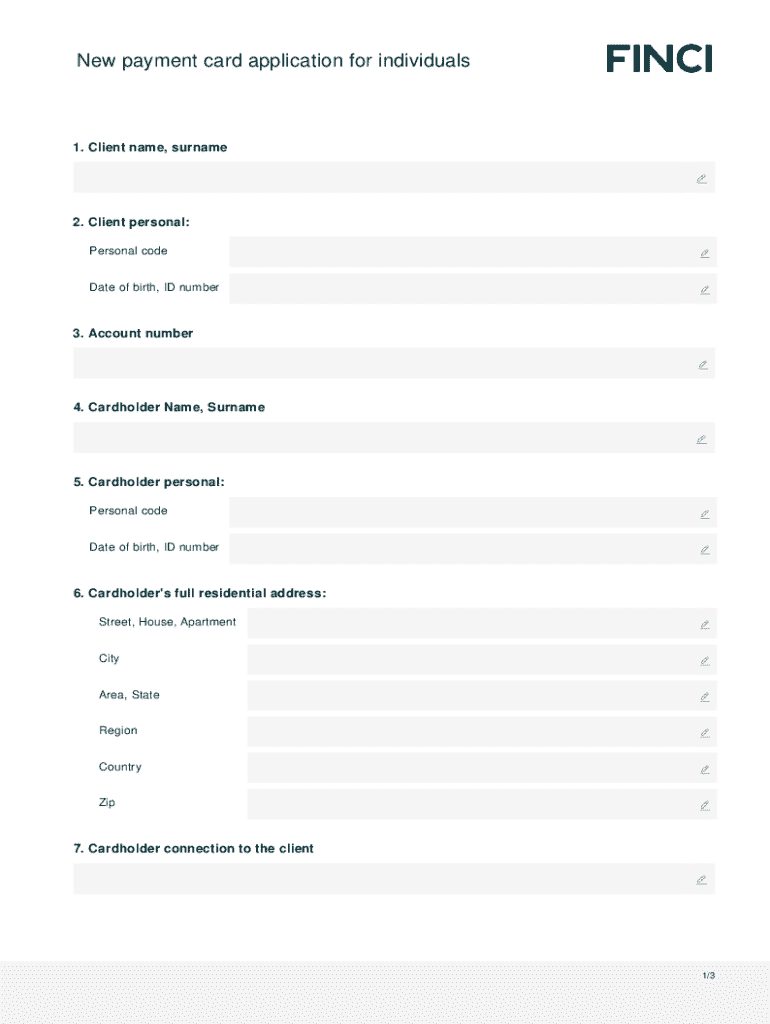

Key features of the new payment card application form

The new payment card application form has been designed to be user-friendly, ensuring a seamless experience for applicants. A clean, straightforward interface allows potential cardholders to navigate the form effortlessly without unnecessary detours.

When applying, you'll need to gather specific information. Typically, you will be asked to provide personal details, financial information, and additional identifiers that help issuers make a quick evaluation.

Interactive tools embedded in the application form provide features that simplify the completion process. For instance, autofill options can save time by populating fields with your information, and live chat support can help answer questions on the go.

Preparing for your application

Before starting the application process, it’s crucial to ensure you meet the eligibility criteria. Typically, most issuers require applicants to be at least 18 years old, possess a valid Social Security number, and have a taxable income.

Gathering the necessary documentation is vital for a smooth application. The essential documents include:

Another important factor is your credit score, as it can greatly influence the outcome of your application. Lenders typically view higher scores more favorably, offering you better terms if your credit is strong.

Step-by-step guide to completing the new application form

To begin the application process, access the new payment card application form on the issuer's website or via pdfFiller. Once on the correct page, you’ll find options to start the application.

Filling out the required fields correctly is vital. Pay special attention to:

When preparing to upload supporting documents, ensure they are in acceptable formats (usually PDFs or images). Follow guidelines carefully to avoid submission delays. After filling everything out, review your application thoroughly to ensure accuracy before clicking submit.

After submission: tracking your application status

Once you've submitted your application, staying informed about its status is imperative. Most issuers provide methods to check application progress through their websites or mobile apps.

The approval process can vary but generally involves assessing your creditworthiness and verifying your details. Expect to hear back within a few days to a couple of weeks depending on the issuer’s processing times. If your application experiences delays, common reasons may include:

Managing your new payment card

Upon receiving your new payment card, prompt activation is essential. Usually, you can activate your card online or via the issuer's customer service number.

Setting up online account management simplifies your financial oversight. Most issuers have platforms where you can view transactions, pay bills, and set spending limits. To avoid financial pitfalls, always adhere to responsible card usage, such as keeping track of purchases to avoid overspending.

Lastly, understanding how to make online and offline transactions enhances your operational flexibility. Payment cards can be seamlessly integrated into various wallets and payment apps, ensuring smooth transactions anytime, anywhere.

Frequently asked questions

Several queries often arise regarding the payment card application process. Among them, many ask about the turnaround time for card issuance; this usually ranges from a few days to several weeks, depending on the card issuer.

Others inquire if it’s possible to apply for a payment card with bad credit. While challenges exist, some issuers cater to individuals with less than ideal credit scores.

In case of denial, follow-up is crucial. It’s wise to understand the reasons for the rejection and take corrective measures. Additionally, users often wonder about joint applications, an option available with many issuers. Lastly, inquire about security measures in place for enhanced protection regarding your payment card.

Common pitfalls to avoid during the application process

While applying for a new payment card, steering clear of specific pitfalls can greatly influence the outcome. Understanding the terms and conditions is critical; always read through them carefully.

Also, providing inaccurate information can lead to immediate disqualification. Always ensure you double-check entries. Don't overlook the fine print regarding fees and charges because hidden costs can accumulate unnoticed, diminishing cardholder benefits.

Enhancements of pdfFiller for your application needs

pdfFiller offers a versatile platform tailored to streamline your payment card application needs. This cloud-based solution allows users to access documents from anywhere, ensuring convenience.

One notable feature is eSigning. You can sign your payment card application quickly and securely without needing to print documents. Collaboration features also enable sharing your application with team members for review, ensuring that you don't miss any critical details.

Furthermore, editing tools allow users to make corrections effortlessly before submission, providing peace of mind that all details are accurate.

Personal stories and testimonials

Real user experiences can be illuminating. Many individuals have shared their success stories with the payment card application process, highlighting the ease of use provided by pdfFiller.

First-time users often express how pdfFiller made the daunting task of filling out seemingly complex applications smooth and straightforward. Testimonials focus on clarity, efficiency, and user support, emphasizing how the platform positively impacts the overall application experience.

Learning from others can also be beneficial. Many users suggest keeping a checklist of required items and being prepared to avoid mistakes.

Helpful tips for future payment card applications

For those contemplating future payment card applications, maintaining up-to-date financial information is vital. Regularly checking and improving your credit score can yield better terms on future applications.

Strategizing about when to apply can be beneficial, as market trends often indicate peak application times when issuers may offer significant rewards or incentives.

Overall, every new application offers a chance to learn and grow. Understanding the ever-evolving landscape of payment options can maximize your financial benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the new payment card application electronically in Chrome?

How can I edit new payment card application on a smartphone?

How do I edit new payment card application on an iOS device?

What is new payment card application?

Who is required to file new payment card application?

How to fill out new payment card application?

What is the purpose of new payment card application?

What information must be reported on new payment card application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.