Get the free New Payment Card Application for Legal

Get, Create, Make and Sign new payment card application

Editing new payment card application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new payment card application

How to fill out new payment card application

Who needs new payment card application?

New Payment Card Application Form: A Comprehensive How-to Guide

Understanding the new payment card

A new payment card is an innovative financial tool designed to facilitate both online and offline transactions with ease and security. These cards are not only convenient but often come with advanced features tailored to modern consumer needs.

Key features of the new payment card include enhanced security measures, such as chip technology and two-factor authentication, contactless payment options for faster checkouts, and various rewards and benefits that appeal to users looking to maximize their spending.

Choosing a new payment card can significantly impact your financial management, allowing you to streamline your expenditures and enjoy perks that traditional payment methods may not offer.

Benefits of using the new payment card

The convenience of cashless transactions cannot be understated. With a new payment card, users can make purchases securely without the need for physical currency, which can be aged, lost, or stolen. This expediency is especially useful in today's fast-paced world.

Moreover, a new payment card aids in budget management and tracking through online statements and spending alerts, allowing users to develop better financial habits.

By utilizing a new payment card, consumers can unlock a plethora of benefits, optimizing their spending and enhancing their financial strategies.

Eligibility criteria for the new payment card

Before applying for a new payment card, it's critical to understand the eligibility criteria. Generally, applicants must meet specific age requirements, usually at least 18 years old, alongside verification of employment and income status to ensure responsible financial management.

Additionally, essential documentation is required to process applications effectively.

Having these documents ready not only ensures a smooth application process but also showcases your preparedness to manage a new payment card effectively.

Steps to apply for the new payment card

Applying for a new payment card involves several straightforward steps. The process is designed to be user-friendly, ensuring that anyone—whether tech-savvy or not—can navigate through it with ease.

Follow these steps to successfully apply:

By adhering to these steps, you can ensure that your application for a new payment card proceeds without any hitches.

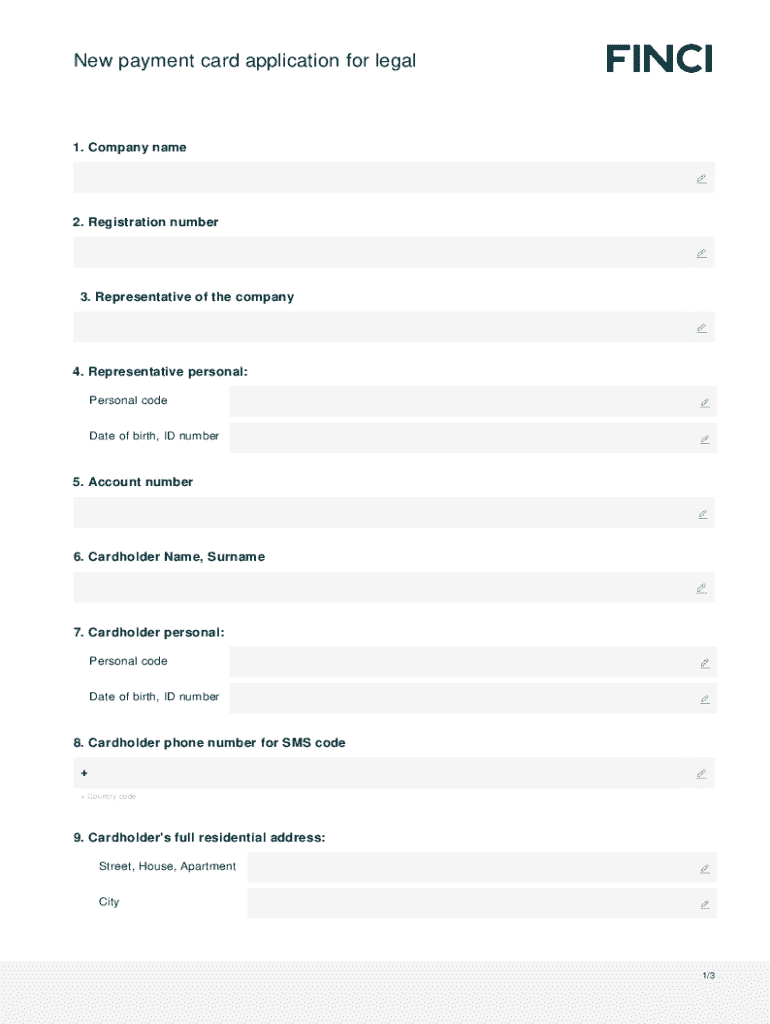

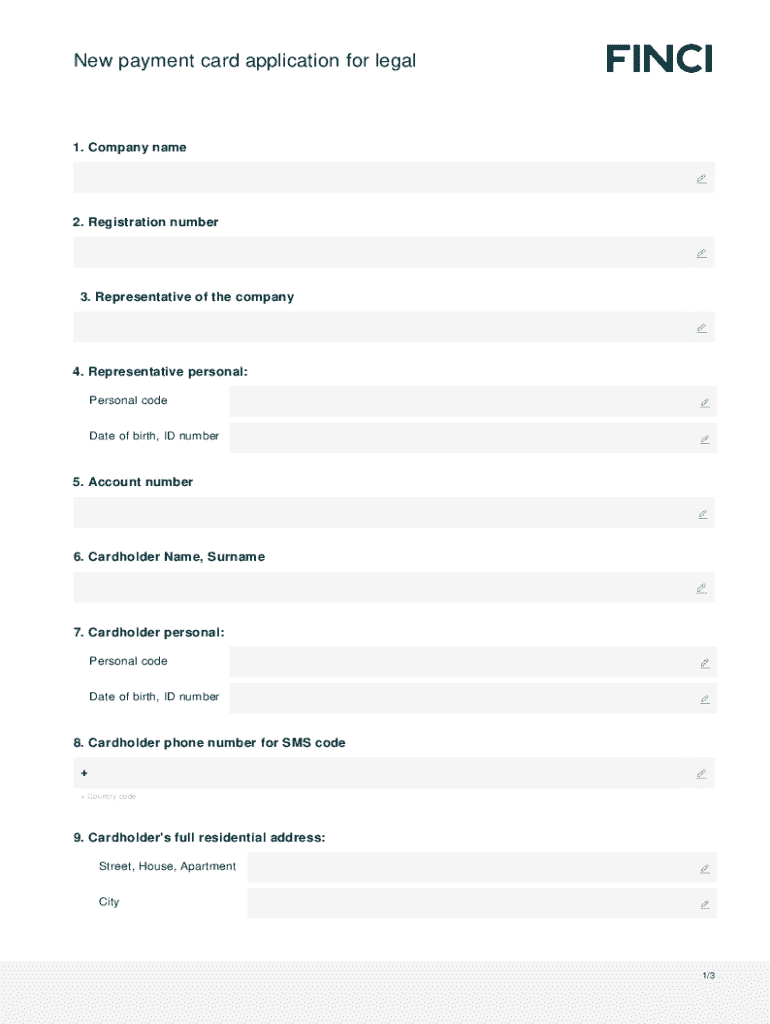

Filling out the new payment card application form

When filling out the new payment card application form, attention to detail is vital. Applications typically contain multiple sections that require standard personal information, employment, and financial data.

Start by entering your personal information, such as full name, date of birth, and contact details.

Next, provide employment information, including your current job title and employer details, and finally, enter your financial information, primarily your income and existing financial obligations.

Common mistakes include incomplete documentation or errors in personal details, which may delay processing. Reviewing your entries is crucial to avoid such issues.

Editing, signing, and managing your application

Before submitting your application, ensure that you can edit any necessary details. Most online forms offer the option to modify your entries up until submission.

After filling out your application, you will need to eSign it securely, a step that has become the norm in digital transactions. This provides an extra layer of authenticity and can expedite processing.

By understanding these elements, you can manage your application effectively, ensuring timely responses.

After application submission: what’s next?

Once you submit your application for a new payment card, the approval timeline typically varies, but it is usually communicated through email or SMS notifications.

In case of denial, don't be discouraged. Review the reasons, and consider addressing any issues before reapplying.

Staying informed and prepared can enhance your chances of successful approval.

Frequently asked questions (FAQs)

Numerous queries arise concerning the new payment card application process. Addressing common concerns helps demystify the experience and empowers applicants to move forward.

Being equipped with the right information boosts confidence during the application process.

Troubleshooting common issues

As with any online process, technical problems may arise during the application. If you encounter issues, be prepared with viable solutions.

Should you face challenges, reaching out to customer support can resolve many issues effectively.

Being proactive and patient can help streamline your experience.

Additional tips for a smooth application experience

Preparation is key for a successful application. Familiarizing yourself with potential eligibility checks can set realistic expectations.

Moreover, employing best practices for filling out online forms—such as double-checking your entries and ensuring document accuracy—can lead to efficient processing.

Implementing these strategies will not only smooth the application process but also enhance your overall experience.

Insights on securing your new payment card

Once your new payment card arrives, securing it becomes paramount. Setting up fraud alerts and other security features will protect your finances.

Moreover, understanding the terms and conditions, as well as maintaining regular checkups on your account activity, can prevent potential issues.

Taking these steps will empower you to enjoy the benefits of your new payment card safely.

How to maximize the benefits of your new payment card

Maximizing the benefits of your new payment card is not just about usage; it’s also about responsible management. Educating yourself on how to utilize rewards and cashback offers effectively can enhance your financial standing.

Consistent management of account statements and timely payments will contribute to a healthy credit profile.

By following these guidelines, you can reap the full benefits of your new payment card while safeguarding your financial wellbeing.

Exploring related services

In addition to the new payment card, various services can complement your financial management strategy, such as budgeting tools or accounting services.

For anyone looking for integrated solutions, many card issuers offer other card options and services that work seamlessly together.

By exploring these services, you can create a comprehensive approach to manage your finances effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new payment card application to be eSigned by others?

Can I create an electronic signature for signing my new payment card application in Gmail?

How do I complete new payment card application on an iOS device?

What is new payment card application?

Who is required to file new payment card application?

How to fill out new payment card application?

What is the purpose of new payment card application?

What information must be reported on new payment card application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.