Get the free Electronic Payment and Remittance Enrollment

Get, Create, Make and Sign electronic payment and remittance

Editing electronic payment and remittance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out electronic payment and remittance

How to fill out electronic payment and remittance

Who needs electronic payment and remittance?

Understanding Electronic Payment and Remittance Forms

Understanding electronic payment and remittance forms

An electronic payment and remittance form is a digital document used to facilitate the transfer of funds from one party to another. These forms have become vital in streamlining financial transactions, allowing individuals and businesses to send money securely and efficiently without relying on traditional banking methods.

The importance of electronic payments in modern transactions cannot be overstated. With a surge in online shopping and the increase in remote work, the need for quick and reliable payment solutions is prevalent. These forms eliminate the physical constraints of paper checks and currency, promoting a seamless transaction experience.

Understanding how these forms work involves recognizing that they typically require the sender's and recipient's financial details, the transaction amount, and any relevant notes. Once completed, the submission initiates a verification process, allowing funds to be transferred without the need for physical interaction.

Key features of electronic payment and remittance forms

The primary features of electronic payment and remittance forms enhance the user experience and ensure secure transactions. First and foremost, security is paramount. Advanced encryption technologies protect sensitive data, making these forms reliable for processing payments. Users can rest assured that personal and financial information is safeguarded against cyber threats.

Secondly, electronic payment forms provide instant processing and confirmation. Unlike traditional banking methods that could take days, transactions can be completed within minutes. This layout is increasingly favored, especially in fast-paced business environments where time is money.

Accessibility from any device is another hallmark of these forms. Whether using a smartphone, tablet, or desktop, individuals can conveniently access and process payments. Integration with various payment methods such as credit/debit cards, e-wallets, and bank transfers makes these forms incredibly versatile, catering to different user preferences.

Types of electronic payment and remittance forms

Electronic payment and remittance forms can be classified into several categories based on their use. Individual payment forms are typically utilized for personal transactions concerning services or goods. They facilitate peer-to-peer payment solutions like Venmo or PayPal, simplifying the process of sending money to friends or families.

Business payment forms encompass a wide range of financial activities. Payroll processing is crucial for companies to ensure employees receive their salaries promptly. Additionally, vendor payments and invoices require forms tailored for business transactions to maintain accurate records and facilitate timely payments.

International remittance forms are designed for cross-border transactions, handling currency conversion and additional fees that may arise. These forms cater to individuals and businesses engaged in sending money overseas while adhering to specific regulations and compliance standards.

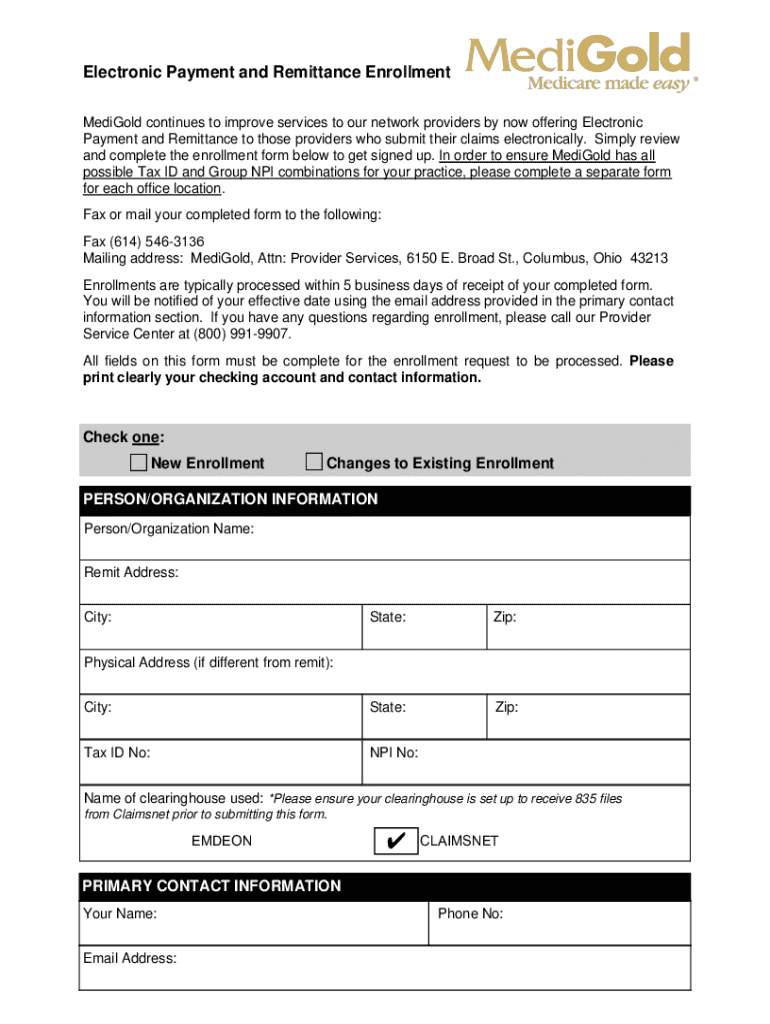

Navigating the electronic payment and remittance form

Completing an electronic payment and remittance form can seem daunting at first, but following a step-by-step guide can simplify the process. First, identify the required information, including sender and recipient details, transaction amount, and account numbers. Each detail is crucial in ensuring the funds are directed to the correct location.

Next, enter personal and payment details accurately. Double-checking your information minimizes the risk of errors, such as sending funds to the wrong account. Afterward, it’s wise to review the terms and conditions related to the transaction. Understanding these details will help you avoid unexpected fees or complications.

Finally, confirm your payment method. Choose the most suitable option based on your preference and the form's capabilities. Common pitfalls during this step include neglecting to verify total amounts before finalizing the payment, which can lead to unintentional mistakes.

Editing and managing your electronic payment and remittance form

Editing a submitted electronic payment and remittance form can vary based on the platform used. Users on pdfFiller can easily access a previously submitted form, make necessary edits, and resubmit it. This flexibility is essential for ensuring that all transaction details are accurate.

Managing multiple payment forms from a single platform enhances workflow efficiency. pdfFiller allows users to maintain organized records for all their transactions, providing a clear overview of payment histories and outstanding amounts. To support this, keeping a proper record of invoices and payment confirmations is recommended.

Tracking payments effectively is crucial, especially for businesses with frequent transactions. Utilize pdfFiller’s integrated features for notifications and receipts to stay updated on the status of each payment.

Collaboration features for teams

Collaboration among team members on electronic payment and remittance forms can boost productivity, particularly in larger organizations. One way to enhance teamwork is by inviting team members to review or edit forms, allowing for collective input and faster processing.

Managing permissions for document access is essential to protect sensitive financial information. With pdfFiller, administrators can set privileges, ensuring only authorized personnel can view and alter critical forms. This control mechanism helps maintain compliance with company policies and data security regulations.

Real-time collaboration tools available on pdfFiller also contribute significantly to efficient workflow. Team members can communicate instantaneously within the platform, addressing any discrepancies or queries related to payment forms.

Ensuring compliance and security

Legal compliance for electronic payments is a complex arena influenced by local and international regulations. Each electronic payment and remittance form must adhere to financial laws and privacy regulations governing the transfer of money to provide both users and companies with protection.

Best practices for ensuring data security are the cornerstone of maintaining trust in electronic transactions. The use of secure sockets layer (SSL) certificates and compliance with Payment Card Industry Data Security Standard (PCI DSS) guidelines are essential. pdfFiller incorporates cutting-edge security measures to encrypt sensitive information, thereby upholding compliance and security standards.

By leveraging these features, users can confidently utilize electronic payment and remittance forms, knowing that their data is actively protected against breaches or misuse.

Troubleshooting common issues

Encountering issues while submitting an electronic payment and remittance form can be frustrating. One common issue is payment submission errors, usually caused by incorrect account information or exceeding transaction limits. To resolve this, verify all input data carefully before finalizing your submission.

Another frequent challenge is when payments are declined. This can occur due to insufficient funds or the recipient's account settings. In such cases, contacting the bank or payment provider directly can shed light on the root cause and provide potential solutions.

Utilizing pdfFiller’s support features can be invaluable. Users can access help documentation or contact customer support for assistance with any issues related to electronic payment forms, ensuring a smooth experience.

Frequently asked questions about electronic payment and remittance forms

First-time users often have several queries regarding electronic payment and remittance forms. Common questions touch upon the security of their data, processing times, and associated fees. It is essential to communicate clearly that reputable platforms like pdfFiller employ advanced security measures to protect users' information.

Furthermore, addressing concerns about payment timing is vital. Understanding that processing can vary based on the payment method and banking circumstances allows users to set realistic expectations. Cost transparency is also critical; providing clear information about any transaction fees or service charges ensures that users are well-informed before proceeding.

Ensuring that users have the right answers can enhance their experience and confidence when using electronic payment forms.

Exploring interactive tools for enhanced experience

Interactivity within electronic payment and remittance forms can significantly improve user experience. pdfFiller offers interactive PDF editing tools that allow users to customize their forms seamlessly. Such features not only aid in personalizing documents but also help maintain consistency in records.

Additionally, the benefit of eSigning directly within the form streamlines the approval process, making it quicker and more efficient. Unique features available on pdfFiller position it as a go-to platform for document management, thereby enhancing workflow and productivity across various teams and individual users.

By leveraging these capabilities, users can create and manage electronic payment and remittance forms that are tailored to their specific needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send electronic payment and remittance to be eSigned by others?

How do I execute electronic payment and remittance online?

Can I sign the electronic payment and remittance electronically in Chrome?

What is electronic payment and remittance?

Who is required to file electronic payment and remittance?

How to fill out electronic payment and remittance?

What is the purpose of electronic payment and remittance?

What information must be reported on electronic payment and remittance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.