Get the free Non-convertible Structured Note Product Acknowledgment

Get, Create, Make and Sign non-convertible structured note product

Editing non-convertible structured note product online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-convertible structured note product

How to fill out non-convertible structured note product

Who needs non-convertible structured note product?

Non-convertible structured note product form: A comprehensive guide

Understanding non-convertible structured notes

Non-convertible structured notes are hybrid financial securities that combine features of both debt and derivatives. Unlike convertible structured notes, which allow investors to exchange them for equity in the issuing company, non-convertible structured notes do not offer such a conversion option. These instruments are designed to generate specific payoffs based on the performance of underlying assets such as stocks, indices, or interest rates.

The distinct characteristics of non-convertible structured notes make them important tools for investors looking to add structured products to their portfolios. They often serve to diversify investments while providing customizable risk and return profiles tailored to individual investment strategies.

Key features of non-convertible structured notes

One of the key features of non-convertible structured notes is their investment characteristics, which can include either fixed or variable returns based on the predetermined conditions. These notes often incorporate embedded derivatives, which serve to enhance the potential return with a predefined risk exposure. This structure enables investors to speculate on market movements without directly investing in the underlying assets.

Maturity terms for these notes can vary widely, generally ranging from one to ten years. Investors should carefully consider liquidity because these instruments may not be easily tradable in secondary markets without incurring price concessions. Another crucial element is the tax implications; structured notes might be treated differently than traditional fixed-income securities, affecting how interest income is taxed.

How non-convertible structured notes work

The mechanism of payment structures in non-convertible structured notes is designed to provide specific cash flow scenarios based on the performance of underlying assets. For instance, an investor may receive regular interest payments as well as a return of principal at maturity, depending on the performance indicators specified at the outset. This clear structure allows for precise foresight of expected returns, aiding in strategy development.

Cash flow scenarios often hinge on various market conditions. For example, if the underlying asset performs well, the note can generate high returns, whereas poor performance might limit returns to just the principal. Understanding how the underlying assets influence valuation is critical for investors who plan to add these notes to their portfolios.

Benefits of non-convertible structured notes

One of the primary benefits of non-convertible structured notes is their potential to diversify an investment portfolio. By offering unique risk-reward profiles, these notes enable investors to hedge against market volatility. Compared to traditional fixed-income securities, structured notes may provide higher yields, appealing to income-focused investors seeking better returns.

Additionally, the risk management strategies embedded within structured note products provide avenues for investors to customize their exposure to specific market conditions. This ensures that investors can align their portfolios with their risk tolerance levels while still capitalizing on potential profit opportunities.

Risks associated with non-convertible structured notes

Despite the advantages, non-convertible structured notes also come with significant investment risks. Credit risk is paramount; if the issuer faces financial difficulties, investors may not receive their expected payments. It’s essential to evaluate the reliability of the issuer, particularly in a volatile market.

Market risk is another crucial consideration. The value of these notes is sensitive to the performance of the underlying assets, and adverse market fluctuations can significantly impact investor returns. Furthermore, understanding liquidity risk is vital, as these structured notes may lack a robust secondary market, making it challenging to sell the investment before maturity without incurring substantial costs.

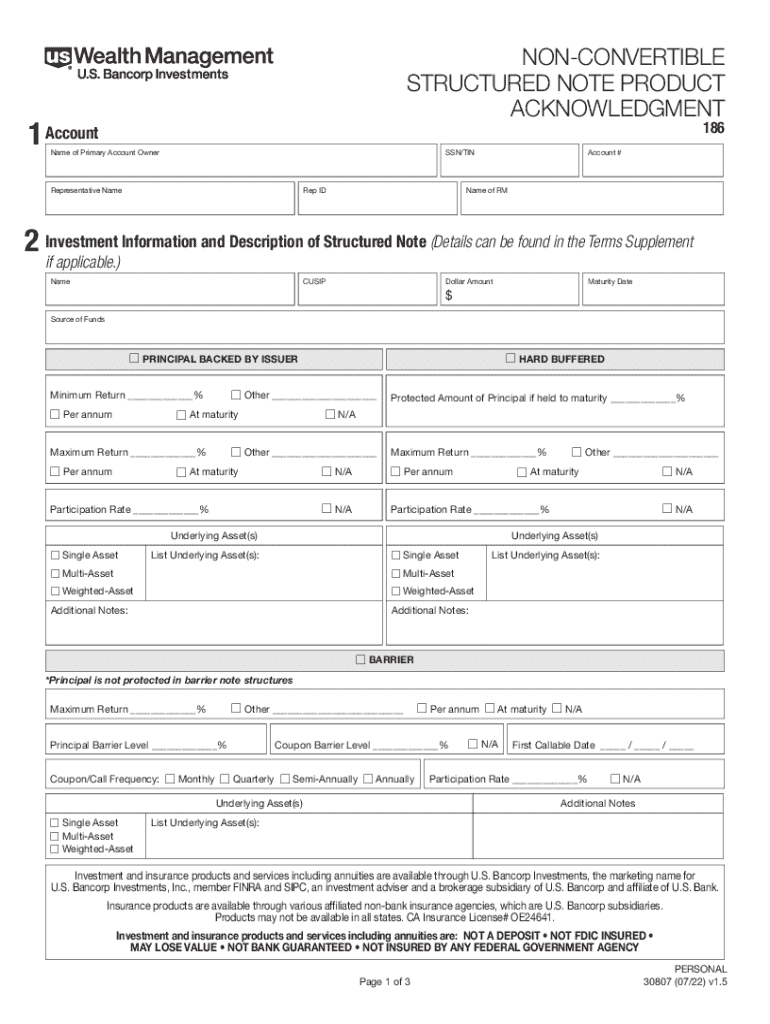

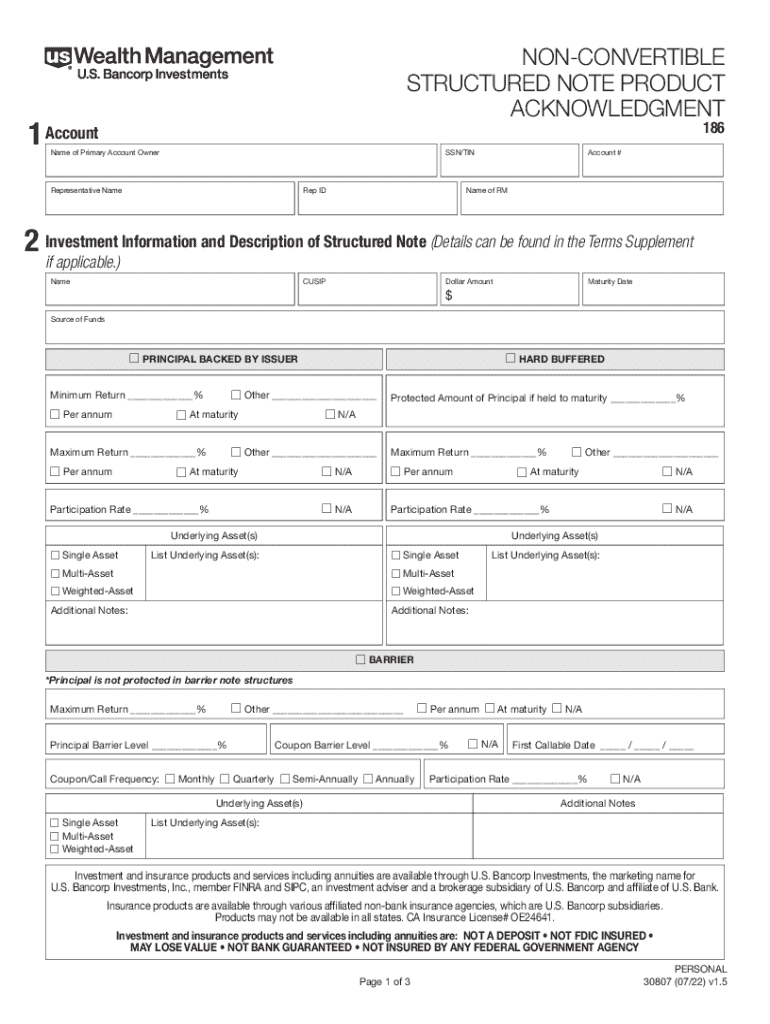

Filling out the non-convertible structured note product form

Filling out the non-convertible structured note product form requires careful attention to detail. Start by gathering all necessary information, such as personal identification, account details, and financial goals. Each section of the form is critical, so reviewing the requirements and questions thoroughly can help ensure accuracy and completeness.

Common pitfalls to avoid include providing incomplete information and misunderstanding the objectives for which the notes are being purchased. Make sure to double-check numerical values and ensure that you are familiar with all terms used in the documentation. Clarity in this process is necessary to avoid delays and complications in your investment.

Editing and managing your non-convertible structured note documentation

Utilizing pdfFiller can streamline the editing and management of your non-convertible structured note documentation. It allows you to edit PDFs seamlessly, ensuring that your forms are always up to date with accurate information. The platform also supports eSigning, making it easy to send and receive signed documents without the hassle of printing and scanning.

Collaboration with financial advisors is simplified through pdfFiller’s features, which enable real-time sharing and feedback. Implementing best practices for document version control can ensure that you are working on the most current version of your documents, which is crucial in the fast-paced financial environment.

Interactive tools for investors

Interactive calculators available through pdfFiller can assist investors in estimating the potential returns of non-convertible structured notes. These tools allow for user-defined variable inputs, reflecting various scenarios based on underlying asset performance. By adjusting these variables, investors can gain insights into the risk profiles associated with each structured note.

Moreover, comparison tools enable investors to evaluate non-convertible structured notes against other investment options. Accessing these analytical resources aids in making informed decisions based on potential returns, associated risks, and alignment with long-term financial goals.

Case studies and scenarios

Examining real-world examples of non-convertible structured note performance reveals how market conditions can directly influence investment outcomes. For instance, during a prevalent market downturn, some non-convertible notes may have delivered a fixed return, while others linked to equities might have faced depreciation.

These scenarios illustrate the need for diligent analysis prior to investment. Investors benefit from reviewing case studies of past structured note offerings to extract valuable lessons and insights, particularly in understanding how different market conditions influence their investments.

Frequently asked questions (FAQ)

When considering non-convertible structured notes, investors often have questions about their structure and market behavior. A common inquiry relates to the typical terms associated with structured notes, including maturity lengths, risk profiles, and return conditions. Additionally, understanding how market fluctuations impact the valuation of these notes is crucial when devising an investment strategy.

Strategies often encompass various approaches to using structured notes, including hedging against volatility through carefully chosen instruments. By engaging with these FAQs, investors can clarify their doubts, enabling them to make more informed choices concerning their investments.

Engagement with financial advisors

Investors may benefit from consulting with financial advisors when navigating complex instruments like non-convertible structured notes. Recognizing when to seek expert advice is crucial; informed questions can help clarify the risks and benefits associated with these products. It is essential to understand how structured notes fit into your broader financial goals and portfolio.

Investors should create a list of discerning questions for their advisors, addressing critical elements such as risk management strategies and potential outcomes. A well-informed investor can effectively align structured note investments with overall financial plans, maximizing potential and minimizing unwanted risks.

Regulatory considerations

The landscape of structured notes is governed by a range of regulations designed to protect investors and ensure market integrity. Understanding these regulations is vital; they can dictate the terms and conditions under which non-convertible structured notes are marketed, sold, and traded. Regulatory bodies scrutinize issuers for their financial health and compliance with disclosure requirements.

Additionally, potential changes in these regulations could impact market access and the type of protections available to investors. Staying abreast of these developments ensures that investors are empowered to navigate the complexities of structured notes effectively.

Stay informed on market trends

Investors seeking to enhance their knowledge of non-convertible structured notes and associated market trends can benefit from a subscription to relevant financial updates. Accessing timely insights enables individuals to align their investment strategies with market fluctuations and shifts in regulatory landscapes.

Using tools provided by pdfFiller, investors can stay informed about essential changes in the market. These resources offer valuable perspectives and keep you in touch with developments in the investment space, ensuring that you remain a proactive participant in your financial journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my non-convertible structured note product directly from Gmail?

How can I send non-convertible structured note product to be eSigned by others?

How do I complete non-convertible structured note product online?

What is non-convertible structured note product?

Who is required to file non-convertible structured note product?

How to fill out non-convertible structured note product?

What is the purpose of non-convertible structured note product?

What information must be reported on non-convertible structured note product?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.