Get the free Retirement Direct Deposit Authorization and Input Form Co-1068 Rev. 05/2025 - osc ct

Get, Create, Make and Sign retirement direct deposit authorization

Editing retirement direct deposit authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out retirement direct deposit authorization

How to fill out retirement direct deposit authorization

Who needs retirement direct deposit authorization?

How to Complete a Retirement Direct Deposit Authorization Form

Understanding the Retirement Direct Deposit Authorization Form

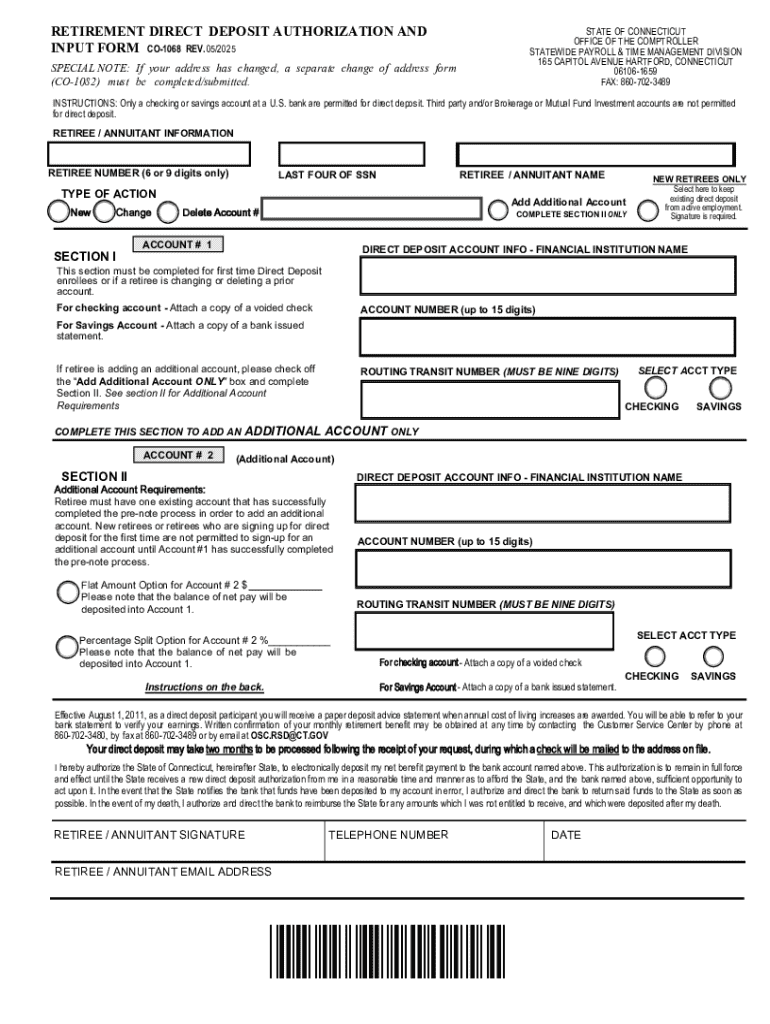

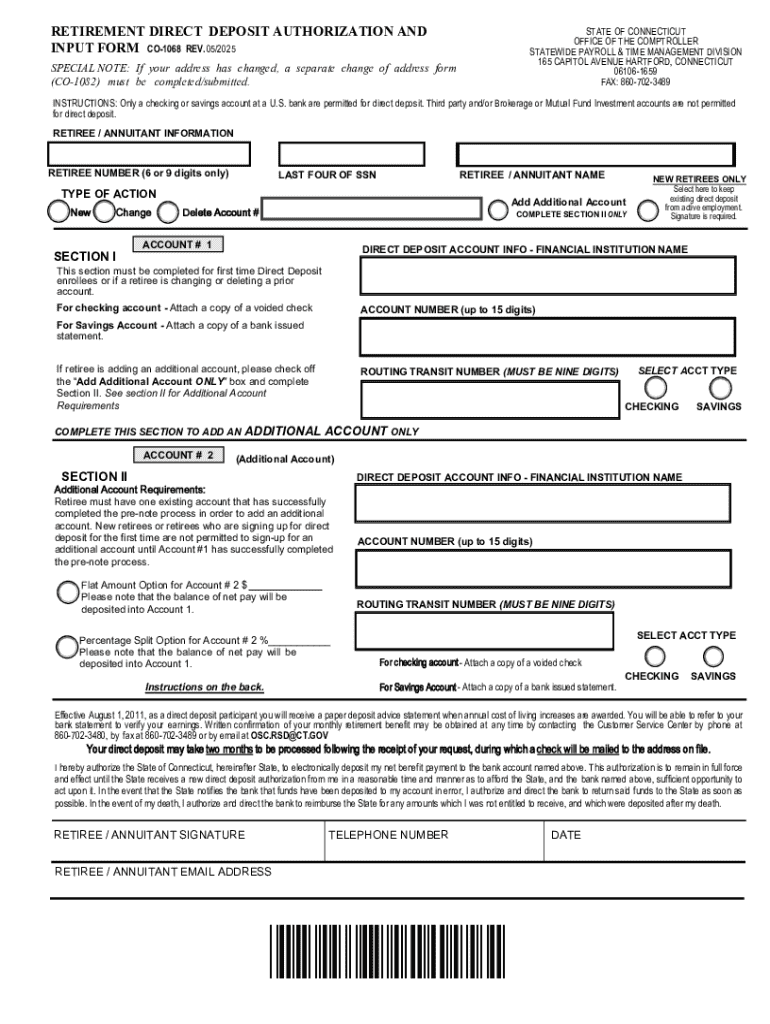

The Retirement Direct Deposit Authorization Form is a vital document allowing retirees to receive their pension payments directly into their bank accounts. This form facilitates a seamless transition from receiving checks in the mail to electronically deposit funds, ensuring retirees have quicker access to their earnings. The importance of this process cannot be overstated, as it significantly reduces the chance of lost or stolen checks, provides convenience, and automates the deposit process.

This form is primarily designed for retirees, state employees, vendors, and any individual in need of direct deposit for their retirement funds. Common scenarios include when a retiree changes their bank account, moves to a new location, or simply wishes to establish a more efficient payment method that provides peace of mind.

Key components of the Retirement Direct Deposit Authorization Form

Understanding the structure of the Retirement Direct Deposit Authorization Form is essential for its correct completion. Each section is clearly labeled and requires specific information to ensure accurate processing. Key fields often include the retiree's personal details, bank account information, and authorizing signatures. Each component serves a purpose; for example, the personal details ensure that the right individual is receiving the correct payment, while the banking information guarantees that funds are deposited into the appropriate account.

Common terms featured on the form include 'routing number' (which identifies the financial institution), 'account number' (which indicates the specific account), and 'authorization' which signifies the retiree's consent to process the direct deposit.

Step-by-step guide to completing the form

Before diving into filling out the Retirement Direct Deposit Authorization Form, preparation is key. Gather necessary documents such as your social security card, a recent bank statement, and other identification proofs. This ensures you have all required information at your fingertips to complete the form seamlessly.

Step 1: Fill out personal information

Begin by entering your full name as it appears on your official documents. Next, insert your Social Security number in the designated field and provide any additional contact information like your phone number or email address. Make sure to double-check for any typographical errors; a small mistake could delay your direct deposit.

Step 2: Enter banking information

Next, move on to the banking information section. Start with the routing number, which is typically found on your checks or bank statements. Ensure this number is accurate by cross-referencing it with your bank's official information. Following this, input your account number. This is crucial, as it directs the funds to your specific account. Missing or incorrect details can lead to misdirected funds.

Step 3: Sign and date the form

Finally, sign and date the form in the designated areas. Your signature must match what is on file with your financial institution to avoid any complications. An unsigned or improperly dated form may result in rejection, so it’s essential to ensure this step is meticulously followed.

Options for submitting the Retirement Direct Deposit Authorization Form

Once you’ve completed the Retirement Direct Deposit Authorization Form, you have several options for submitting it. Electronic submission is a preferred method for many, as it allows for immediate processing. To upload the form electronically, use the pdfFiller platform. Simply navigate to the upload section, drag your completed form into the designated area, and follow the instructions to send it securely.

Mail submission

If you choose to mail the form, ensure you send it to the correct address specified on the retirement office's website. Use a secure envelope and consider utilizing a tracked postal service to confirm receipt. It's often wise to include a cover letter explaining the enclosed document, particularly if you’re submitting multiple forms.

In-person submission

For those who prefer face-to-face interactions, in-person submissions can be made at designated retirement office locations. It's advisable to check the office hours beforehand and, if possible, make an appointment. Bring along identification, as it may be required to process your request on the spot.

Troubleshooting common issues

Even with careful preparation, issues may arise during the submission process of your Retirement Direct Deposit Authorization Form. One of the most common mistakes includes input errors, such as incorrect bank account details. Before submission, always double-check your information against reliable sources. Ensure that your routing and account numbers are correct, and seek clarification if any terms are unclear.

In the event that your form is denied, don't panic. Contact the retirement office directly to understand the reason for the denial. Often, correcting simple errors, such as misspelled names or transposed numbers, can lead to a successful re-submission.

Managing your retirement direct deposit after submission

After submitting your Retirement Direct Deposit Authorization Form, it's important to monitor the status of your application. This often can be done through your account with the retirement office or by contacting their customer service. Stay proactive by checking in regularly, especially if there's a payment scheduled soon.

Should there be changes necessary to your direct deposit information, such as switching banks or updating your contact information, you’ll need to fill out a new form. Stay organized and make it a habit to notify your retirement office of any changes as soon as they occur. Additionally, understanding payment changes, including any potential fluctuations in deposit amounts, may require regular follow-ups to ensure you remain informed.

Frequently asked questions (FAQs)

As you navigate the complexities of the Retirement Direct Deposit Authorization Form, you may encounter several questions that arise more frequently among your peers. For instance, one common inquiry is whether multiple accounts can be linked for direct deposit. The answer generally depends on the policies of the particular pension plan, so it's advisable to check with the retirement office for specifics.

Another prevalent concern is related to changes in banking institutions. If you've switched banks, you will need to complete a new Retirement Direct Deposit Authorization Form to ensure future payments are directed to your new account.

Additional tools and resources

Utilizing pdfFiller offers interactive tools for individuals looking to edit, sign, or manage PDF documents such as the Retirement Direct Deposit Authorization Form. Users can take advantage of the platform's features that allow you to make adjustments to your form, eSign it, and share it seamlessly with retirement offices.

Additionally, understanding the advantages of electronic signatures can significantly enhance the efficiency of your document management process. Electronic signatures are legally recognized in most states and offer a quick, secure way to authorize forms without the hassle of printing and mailing.

Contacting support

If you find yourself needing assistance with the pdfFiller platform, they offer various support channels to address your queries. You can reach customer support through live chat, email, or phone, depending on your preference. The team is dedicated to helping users navigate the document completion process effortlessly.

For additional help, community forums provide a rich resource for users wanting to connect with others who may have similar questions or challenges. These forums can be a valuable asset when searching for tips and best practices about using the Retirement Direct Deposit Authorization Form effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get retirement direct deposit authorization?

How do I complete retirement direct deposit authorization online?

How do I edit retirement direct deposit authorization online?

What is retirement direct deposit authorization?

Who is required to file retirement direct deposit authorization?

How to fill out retirement direct deposit authorization?

What is the purpose of retirement direct deposit authorization?

What information must be reported on retirement direct deposit authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.