Get the free Campaign Finance Receipts & Expenditures Report - ethics ks

Get, Create, Make and Sign campaign finance receipts expenditures

How to edit campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

A comprehensive guide to campaign finance receipts expenditures form

Understanding campaign finance: Key terms and concepts

Campaign finance is vital to the electoral process in democratic societies, encompassing the funds raised and spent on political campaigns. The proper management of campaign finances ensures candidates can articulate their positions and connect with voters while adhering to legal and ethical standards. Transparency in political financing is crucial as it fosters trust among voters, deterring misconduct such as corruption and bribery. Campaigns must report their financial activities accurately to provide visibility into the funding sources and expenditures supporting their candidacy.

In political campaigns, financial activities are categorized into two primary components: receipts and expenditures. Receipts refer to the funds or contributions received by a campaign, which can come from various sources, including individuals, corporations, and Political Action Committees (PACs). Meanwhile, expenditures represent how campaign funds are utilized, covering multiple categories, such as advertising, salaries, and operational costs. Understanding these terms is the first step toward successful campaign financial management.

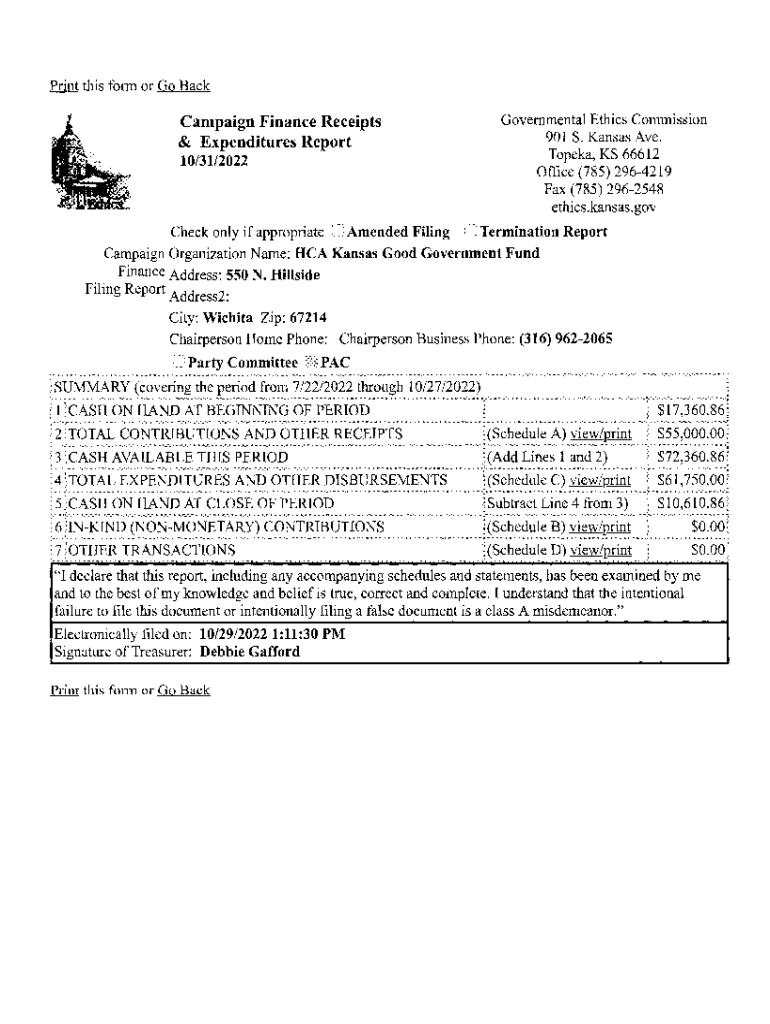

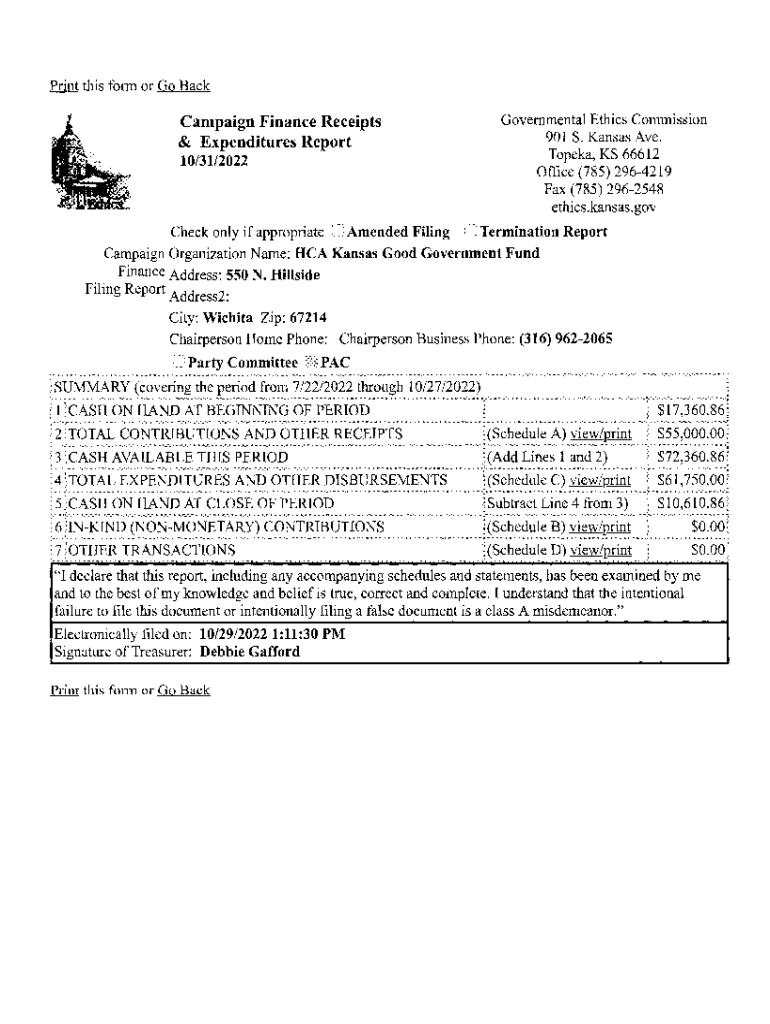

Overview of campaign finance receipts expenditures form

The campaign finance receipts expenditures form is a vital document used by candidates and political committees to report their financial activities to election authorities. This form serves multiple purposes, including providing transparency regarding campaign funding, ensuring compliance with election laws, and informing the public about where campaign funds come from and how they are spent. All candidates seeking public office—regardless of their level—must file this form.

Legal requirements vary by jurisdiction, but typically, candidates must disclose all contributions received and expenditures made within a specific reporting period. The frequency of submissions varies, often requiring quarterly, semi-annual, or even monthly reports leading up to an election day. Regular filings enable election authorities to track campaign financing more effectively, allowing for timely interventions if discrepancies arise.

Detailed breakdown of the form sections

The campaign finance receipts expenditures form is structured into several key sections, each designed to capture specific financial information necessary for compliance and reporting. Understanding these sections is critical for accurate reporting.

Tools and resources for filling out the form

Filling out the campaign finance receipts expenditures form can seem daunting, but tools and resources, such as pdfFiller, make the process straightforward and manageable. pdfFiller empowers users with a cloud-based platform to seamlessly edit PDFs, eSign documents, collaborate, and manage forms effectively.

Filing and submitting your form

Once the campaign finance receipts expenditures form is completed, candidates must submit it according to the requirements set by their local election authority. Filing electronically is often the fastest method, typically allowing candidates to submit their forms through specialized online portals designed for campaign finance management.

Alternatively, mail-in submissions are also accepted and require careful attention to ensure all forms are enclosed and correctly signed. A step-by-step process includes printing the completed form, checking for errors, and mailing it to the appropriate authority. Deadlines for filing submissions must be strictly adhered to as missing them can result in penalties or fines. Keeping meticulous records of all submissions is crucial for future compliance checks and potential audits.

Common challenges and how to overcome them

Navigating the intricacies of campaign finance reporting can present challenges. Understanding and meeting complex reporting requirements can feel overwhelming, especially for first-time candidates. Candidates should arm themselves with knowledge about local laws and regulations relevant to campaign finance. Understanding potential discrepancies and being able to differentiate between acceptable practices and violations are essential.

Maintaining compliance beyond initial reporting

Campaign finance management doesn't stop once the forms are submitted. Developing ongoing record-keeping practices is vital for maintaining compliance and preparedness for potential audits. Candidates should cultivate a culture of financial diligence, ensuring that all contributions and expenditures are documented consistently throughout the campaign.

Understanding the audit process involves knowing what triggers audits and being prepared with adequate documentation for records beyond financial reports. Utilizing resources such as financial advisors can provide critical insights, while staying informed about any changes in campaign finance laws ensures candidates remain compliant and secure throughout their political journey.

Case studies: Successful campaigns and their financial strategies

Successful campaigns demonstrate the importance of strategic financial management. For instance, campaigns that effectively allocate funds to targeted advertising often see higher engagement from their desired demographic. Taking cues from prominent candidates can offer valuable lessons in handling and reporting campaign finances adeptly.

FAQs: Addressing common questions on campaign finance reporting

Navigating the campaign finance landscape often presents questions, particularly for newcomers. Candidates frequently inquire about the specifics of what qualifies as a reportable expense or contribution. Establishing clear criteria for tracking types of spending and understanding reporting thresholds can alleviate confusion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out campaign finance receipts expenditures using my mobile device?

How can I fill out campaign finance receipts expenditures on an iOS device?

How do I fill out campaign finance receipts expenditures on an Android device?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.