Get the free Credit Application Form - East Sussex National

Get, Create, Make and Sign credit application form

How to edit credit application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application form

How to fill out credit application form

Who needs credit application form?

Comprehensive Guide to the Credit Application Form

Understanding the credit application form

A credit application form is a formal document used by individuals or businesses seeking to borrow money or obtain a line of credit. This form serves as a vital tool for potential borrowers to provide information that lenders require to assess creditworthiness. By filling out a credit application form, borrowers enable lenders to make informed decisions regarding whether to grant credit and on what terms.

The importance of the credit application form cannot be overstated. For borrowers, it serves as a means to secure necessary funds for purchases like homes, cars, or business expansions. A well-completed application increases the likelihood of approval and favorable terms. For lenders, it’s an essential tool for risk assessment — understanding the financial stability of the borrower helps in deciding loan limits and interest rates.

Preparing your information

Before filling out a credit application form, it’s essential to gather all necessary documentation to streamline the process and avoid errors. Start by collecting personal identification, which may include a government-issued ID or social security card. Additionally, financial history documents, including your credit score, can provide lenders with a snapshot of your creditworthiness. Employment and income verification materials, such as pay stubs or tax returns, further support your application.

Commonly, credit application forms ask for specific information to assess eligibility. You'll typically need to provide your personal details like name, address, and social security number, alongside your financial information. This includes your total monthly income and any existing debts you may have. Clearly outlining the loan specifics, such as the amount requested and the intended purpose for the loan, is crucial for both you and the lender.

Step-by-step guide to completing the credit application form

Filling out a credit application form requires careful attention to detail. In the first step, you should accurately input your personal information. Ensuring that all names, addresses, and identifiers are correct is crucial, as discrepancies can lead to approval delays or rejections. To prevent mistakes, double-check for typos and use the tips provided in guides or walkthroughs for clarity.

Next, disclose your financial information with honesty. Present your income and expenses transparently, as lenders often verify this information. Understanding your debt-to-income ratio is essential; it reflects your ability to manage monthly payments. An ideal debt-to-income ratio is typically below 36%.

Then, move on to providing your employment details. Lenders usually ask for your employment history, including job titles and duration of employment. Consistency in employment indicates reliability to lenders. Lastly, specify the loan details by clearly stating the loan amount desired and its intended use. Be aware of the interest rate types — fixed or variable — and understand how they will affect your repayment.

Editing and reviewing your application

Proofreading your credit application form is a vital step that often goes overlooked. Many applicants fail to catch simple errors that can jeopardize their chances of approval. Common mistakes include incorrect personal information, mismatched financial details, or leaving required fields blank. Using tools for spelling and grammar checks can significantly reduce these errors.

Utilizing pdfFiller tools can enhance your application thoroughly. With features designed for editing and collaboration, you can make necessary changes easily and even invite others to review your application. Ensuring all information is accurate and complete before submission not only reflects professionalism but boosts confidence in your application.

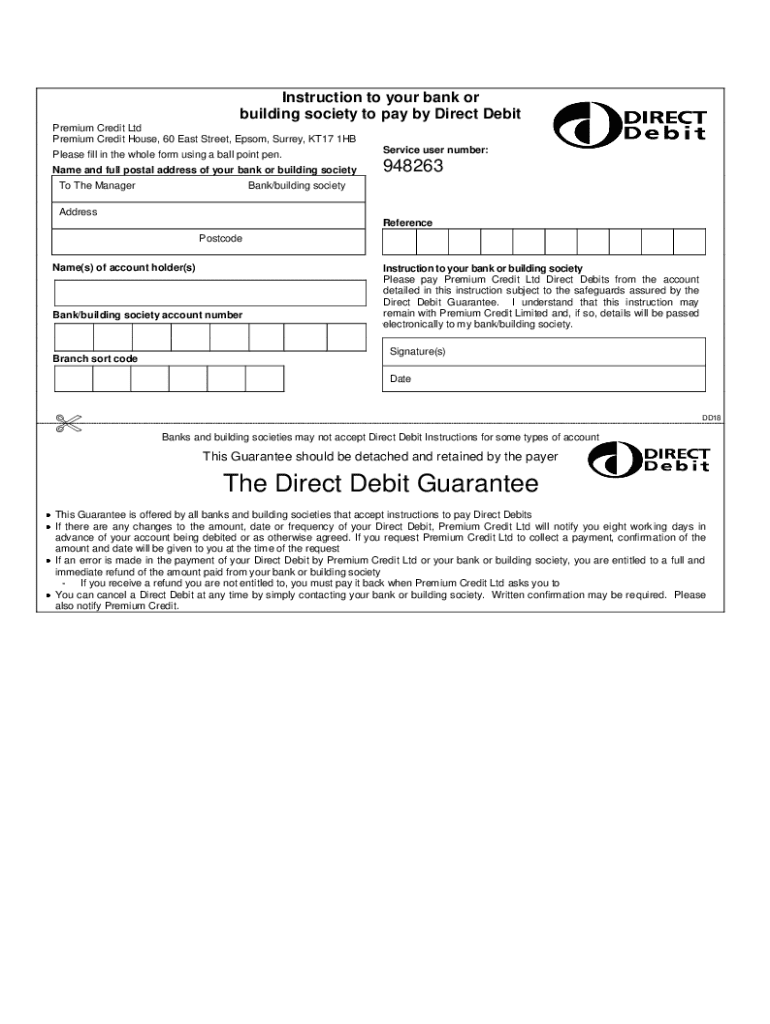

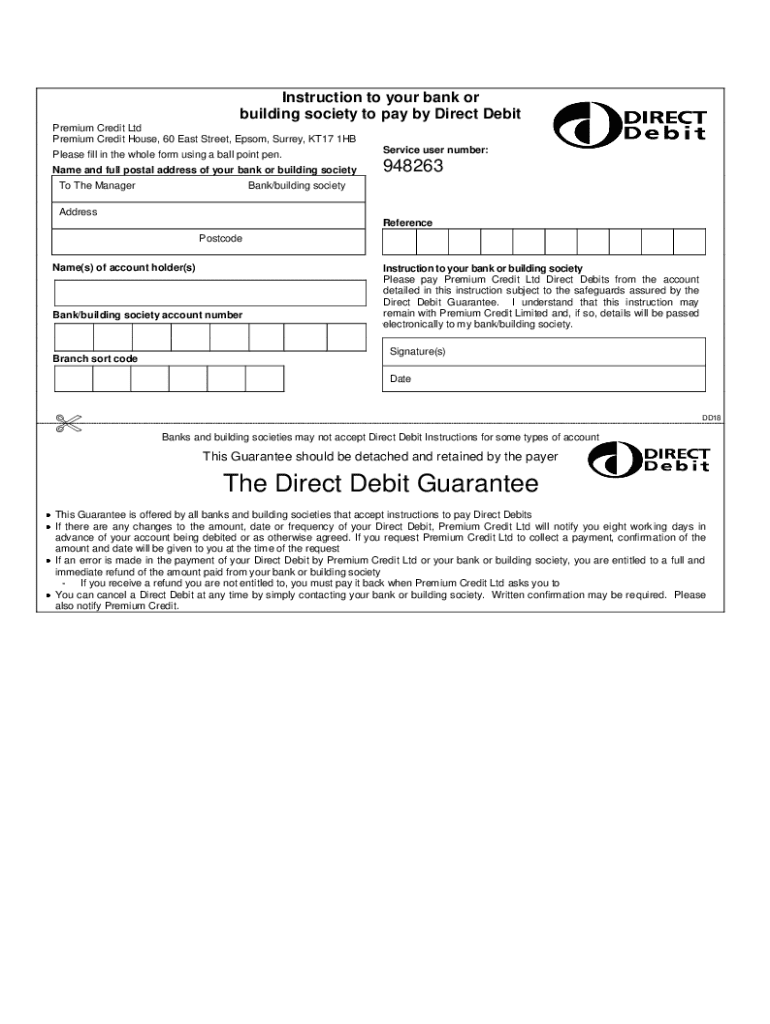

Signing the credit application form

The signature you provide on your credit application form serves as a confirmation of the accuracy of the information you've submitted. Nowadays, electronic signatures are widely accepted and hold legal standing. Using platforms like pdfFiller for eSigning is simple; it guides you through the steps of signing your document securely, ensuring that the process is seamless.

Additionally, using secure platforms for signing is paramount in ensuring the safety of your personal information. pdfFiller provides robust security features, allowing users to sign documents with peace of mind. This encryption means that your data remains protected against unauthorized access throughout the signing process.

Submitting the credit application form

When it comes to submission, following best practices can significantly enhance the likelihood of a successful application. First, double-check the lender’s submission guidelines, as they may prefer specific formats like PDF over others. Submit through secure channels recommended by the lender to safeguard your personal information.

After submitting your credit application form, it's vital to understand response timelines. While lenders often review applications promptly, follow perspectives differ. Many lenders will inform you of their decision within a few days to a week. If you don’t hear back during this time, an effective way to follow up is to call or email the lender directly, inquiring about the status of your application.

Managing your credit application post-submission

While awaiting approval, actively monitoring your credit score and overall financial health is beneficial. This period can be an opportunity to ensure your finances are in order, as lenders may reach back with further questions or requests for additional information on your financial health.

In case your application is denied, don’t be discouraged. Understanding the reason for rejection is crucial. Perhaps your credit score is lower than needed or there were inconsistencies in your application. Take the time to address these areas and make necessary improvements for future applications.

Frequently asked questions (FAQs)

Understanding common queries about credit applications can bolster your confidence in the application process. For instance, many applicants ask how long it typically takes to fill out a credit application. While this varies by complexity and individual familiarity with the forms, most can finish within 30 minutes to an hour. Another pressing concern is the impact of bad credit; even if you have less-than-ideal credit, applying for credit with a co-signer can enhance your approval chances.

Addressing these FAQs proactively can also alleviate anxiety surrounding the credit process.

Tips for future credit applications

Improving your credit for future applications is a continuous process that requires knowledge and dedication. Start by regularly reviewing your credit report and addressing any errors or delinquencies. Consistently paying bills on time and reducing existing debts are also vital strategies for enhancing your overall credit score over time.

Ensuring your credit application is always accessible and well-prepared can save time and stress when opportunities arise. Utilizing pdfFiller’s cloud solutions allows you to easily store and access your application, enabling quick edits and updates whenever necessary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit application form directly from Gmail?

How can I send credit application form for eSignature?

How do I complete credit application form on an iOS device?

What is credit application form?

Who is required to file credit application form?

How to fill out credit application form?

What is the purpose of credit application form?

What information must be reported on credit application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.