Get the free Financial Hardship Assistance Application

Get, Create, Make and Sign financial hardship assistance application

Editing financial hardship assistance application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial hardship assistance application

How to fill out financial hardship assistance application

Who needs financial hardship assistance application?

Understanding and Completing the Financial Hardship Assistance Application Form

Understanding financial hardship assistance

Financial hardship refers to a situation where an individual or family struggles to meet their financial obligations. This hardship can stem from various sources such as job loss, unexpected medical expenses, or natural disasters. Applying for financial hardship assistance can provide much-needed relief, allowing individuals to access resources and support that may alleviate their financial burden.

Many individuals encounter situations that necessitate financial assistance. Common reasons include unemployment or underemployment, significant medical expenses, housing instability, and educational costs. Each situation requires a thorough understanding of the application process to access available aid effectively.

The importance of applying for financial hardship assistance cannot be overstated. It serves as a critical lifeline during difficult times, ensuring that individuals can maintain basic living standards and seek pathways towards financial recovery.

Who is eligible for financial hardship assistance?

Eligibility for financial hardship assistance varies among different organizations and programs, but common criteria typically include demonstrating need based on income and expenses. Many programs prioritize individuals or families facing imminent financial crises, but eligibility can also be extended to wider demographics.

Documentation is critical in establishing eligibility. Generally, you may need to provide the following:

Special considerations may apply for specific demographics such as students facing tuition costs, seniors with limited income, or families with dependents. It’s important to research if any tailored programs exist for your situation.

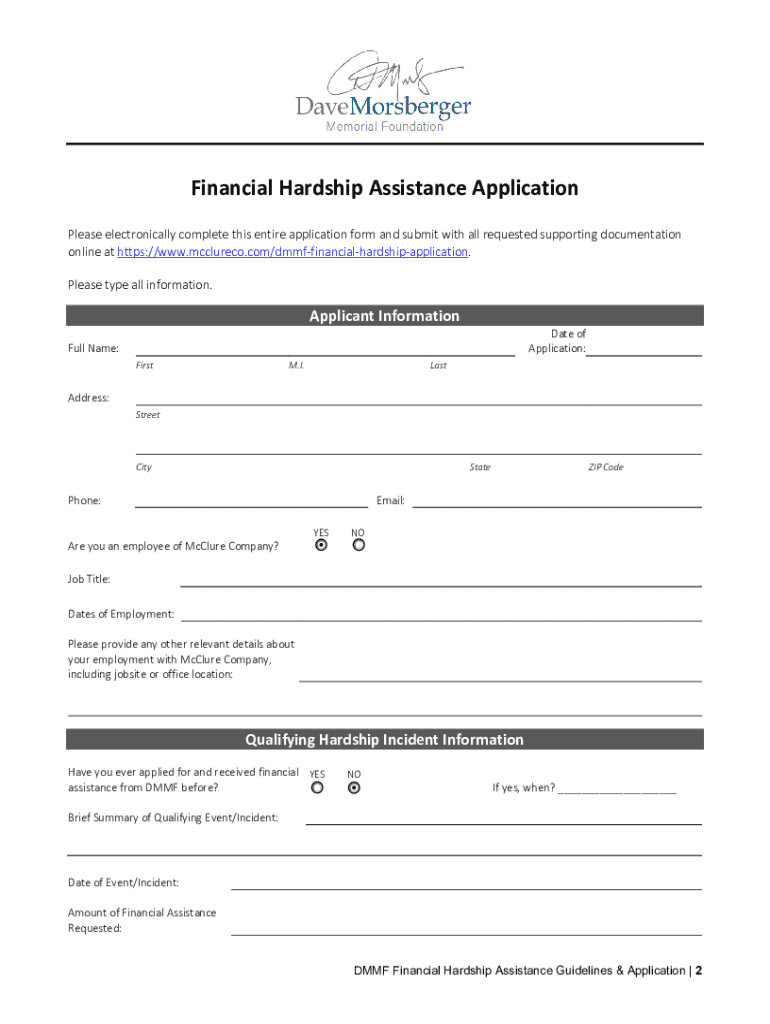

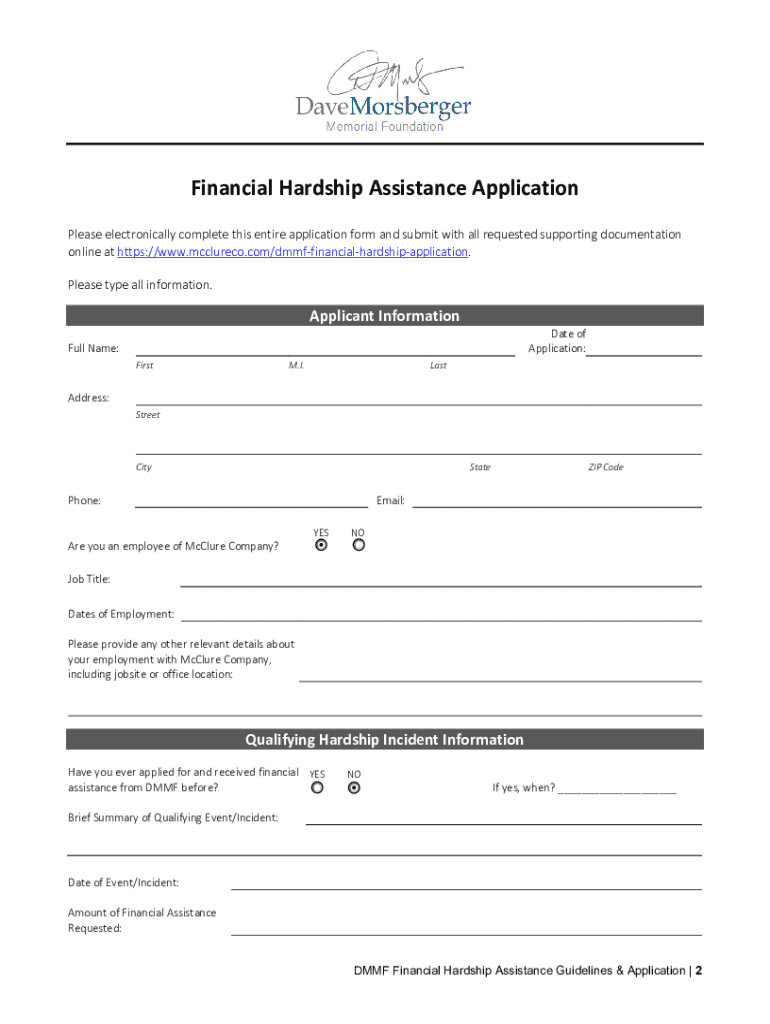

Preparing to complete the financial hardship assistance application form

Before embarking on the application process, gathering all necessary documents is essential. A checklist can help streamline this preparation. Key documents include proof of identity, financial statements, and any relevant legal documentation pertaining to your hardships.

Additionally, tips for collecting your financial information include reviewing all bank and credit statements systematically and organizing receipts for outstanding bills. Being thorough will not only expedite your application process but also strengthen your case for receiving assistance.

It's also beneficial to familiarize yourself with common terminology found in the application form. Understanding terms related to your financial status, assistance programs, and quantitative measurements (like monthly expenses) will ensure you fill out the form accurately.

Step-by-step guide to filling out the application form

To navigate the application form effectively, follow this structured approach:

Using pdfFiller to edit and manage your application

pdfFiller is an invaluable tool for users looking to streamline their financial hardship assistance application process. It offers seamless editing capabilities that enable you to fill out PDF forms easily, allowing for better organization and presentation of your information.

Beyond just editing, pdfFiller supports collaboration. This means you can work with family members or advisors to ensure that your application is as comprehensive as possible. Plus, eSigning directly within the platform simplifies the signing process, reducing barriers to submission.

To upload and edit the application form using pdfFiller, follow these steps: First, log in to your pdfFiller account and select 'Upload Document.' Choose your PDF form to begin editing. Make sure to save and organize completed applications logically for future reference.

Submitting your application for financial hardship assistance

Once your application form is complete, it’s time to submit it. There are various submission methods, including online portals, email, or by mail. Ensure that you choose the method appropriate for the specific assistance program.

After submission, you can expect a confirmation of receipt via email or message, depending on the method used. Processing timelines can vary greatly; it's beneficial to check the specifics related to the organization you are applying to.

Follow-up after submission

Following up after your application is submitted is crucial. You can typically check the status of your application through the organization’s website or by contacting their support. Delays may happen due to various factors, but persistent yet polite inquiry can often yield important updates.

If your application is denied, it’s important to understand the reasons provided. Many organizations allow for an appeals process where you can challenge the decision or provide additional documentation that may lead to a different outcome.

FAQs about financial hardship assistance applications

Many applicants have concerns regarding the financial hardship assistance application process. Common questions often revolve around eligibility, what counts as a valid hardship, and the complexity of the application itself.

Addressing myths versus facts about financial assistance is essential. For instance, some may believe that financial assistance is only for those completely out of work, while many programs cater to individuals experiencing part-time unemployment or those with unforeseen expenses. Enhancing your application through clarity and thorough documentation can significantly increase the chances of approval.

Resources for further assistance

There are numerous resources available for individuals seeking financial hardship assistance. Several organizations provide grants, loans, and other forms of financial support tailored to various needs. It can be beneficial to reach out directly to these organizations for personalized assistance.

Additionally, utilizing online resources ensures you have access to templates and guides that can aid in your application preparation. Websites, including pdfFiller, offer tools to help manage documentation and prepare future applications efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my financial hardship assistance application directly from Gmail?

How can I send financial hardship assistance application to be eSigned by others?

How do I fill out the financial hardship assistance application form on my smartphone?

What is financial hardship assistance application?

Who is required to file financial hardship assistance application?

How to fill out financial hardship assistance application?

What is the purpose of financial hardship assistance application?

What information must be reported on financial hardship assistance application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.