Get the free Tax Organizer

Get, Create, Make and Sign tax organizer

How to edit tax organizer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax organizer

How to fill out tax organizer

Who needs tax organizer?

Everything You Need to Know About the Tax Organizer Form

Overview of the tax organizer form

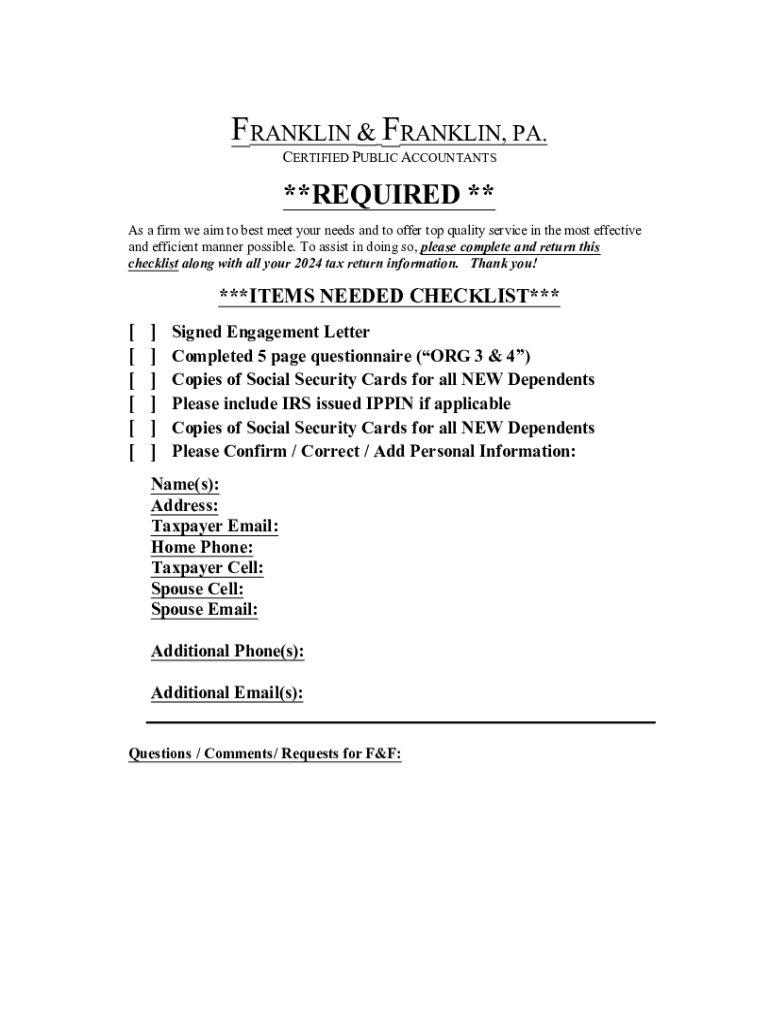

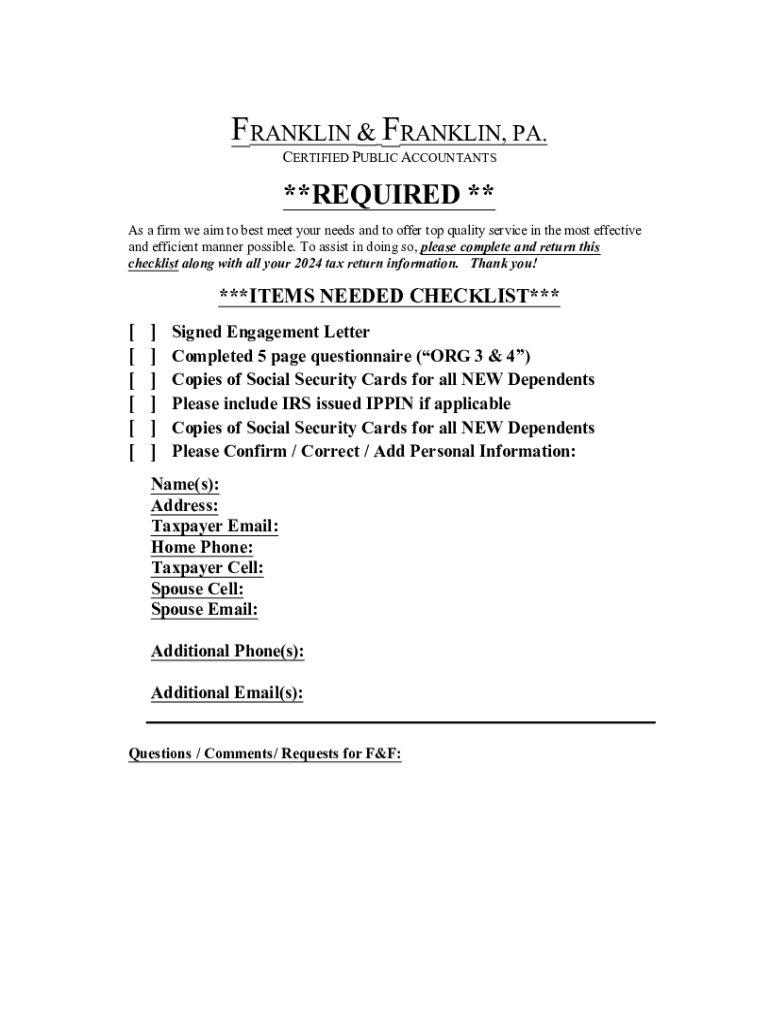

A tax organizer form is a structured document designed to help taxpayers compile and organize the necessary information required for accurate tax filing. This form typically serves as a checklist, guiding individuals and businesses in gathering their tax-related documents, ensuring no essential information is overlooked during the filing process.

The importance of a tax organizer in the filing process cannot be overstated. For many, the complexity of tax laws and the requirement to report a myriad of income sources can be overwhelming. A tax organizer simplifies this process, streamlining the collection of necessary documents and data, resulting in a more efficient and less stressful tax preparation experience.

Getting started with your tax organizer form

When it comes to tax organizer forms, there are primarily two types available: the Individual Tax Organizer and the Business Tax Organizer. The Individual Tax Organizer is designed for personal taxpayers, while the Business Tax Organizer caters to business owners and entities. Each serves distinct needs, and selecting the right form is crucial for effective tax preparation.

Choosing the appropriate tax organizer form depends on your unique tax situation. Individuals may focus on personal income, deductions, and credits, while businesses should include information relevant to their operations, including income from sales, payroll details, and business expenses. Comprehensive templates can be found on pdfFiller, which provides easy access to both types of tax organizers.

Detailed instructions for completing your tax organizer form

Filling out a tax organizer form may seem daunting at first, but breaking it down into manageable steps can simplify the process. Start by collecting all necessary documentation. This includes personal identification documents such as your driver's license, any income statements like W-2s and 1099s, and records of deductible expenses. Ensuring you have everything ready will save you time later.

Once you have gathered your documents, move on to inputting personal information. Essential details include your name, address, and Social Security number. Be meticulous in entering this information, as inaccuracies can lead to delays in processing your tax return.

Additionally, utilizing interactive tools available on pdfFiller can help ensure that filling out your form is both efficient and accurate.

Editing and customizing your tax organizer form

PdfFiller offers various editing tools that allow you to tailor your tax organizer form to fit your specific needs. You can add custom fields if you need to collect additional information or insert digital signatures for a more formal touch. This flexibility makes it easy to ensure your form is comprehensive and personalized.

Collaboration is also simplified using pdfFiller. You can easily share your tax organizer form with others involved, such as accountants or financial advisors, while setting permissions to control who can view and edit the document. This collaborative approach streamlines the process, making it easier to gather insights and finalize your tax preparation.

Managing your tax organizer form

Efficient document management is essential during tax season. Best practices include organizing your tax documents systematically, so everything is in order when you're filling out forms. PdfFiller features high-level security to protect your sensitive information, giving you peace of mind as you work through your paperwork.

Saving and exporting your completed tax organizer form is straightforward with pdfFiller. You have the option to store your completed form securely in the cloud, allowing you to access it from anywhere, at any time. This cloud-based solution ensures that your information is continually protected and readily available whenever needed.

eSigning your tax organizer form

Digital signatures have revolutionized the way we handle forms, including tax documents. A critical benefit of using e-signatures on your tax organizer form is the efficiency it brings to the signing process. Rather than printing and faxing, you can quickly sign and submit documents electronically, saving time and reducing paper waste.

To eSign your tax organizer on pdfFiller, simply navigate to the designated area for signatures, follow the prompts to create or insert your digital signature, and finalize the document. Ensure that compliance checks are in place to verify that your eSigned forms meet required regulations before submission. This adds an extra layer of assurance when filing your taxes.

Frequently asked questions

Mistakes can happen even with the best preparation. If you realize you've made an error on your tax organizer form, the first step is to correct the mistakes as soon as possible. Depending on the nature of the error, you might need to adjust your tax return accordingly to reflect accurate information.

If you can’t locate your tax organizer form, pdfFiller’s intuitive search options can help you recover it. Additionally, if you have specific questions about deductions or credits applicable to your situation, don't hesitate to consult with a tax professional for tailored guidance. In case you need further assistance, pdfFiller's support team is readily available to help you navigate any hiccups in your form completion process.

Related topics and further reading

Gaining a deeper understanding of the tax filing process can enhance your preparedness as a taxpayer. Exploring tips for maximizing tax deductions will ensure that you are not leaving money on the table. You may also want to familiarize yourself with other useful tax forms and worksheets that complement your tax planning. Lastly, the role of tax software in simplifying your tax obligations cannot be underestimated, with many options available to help you streamline your filing process.

By effectively utilizing a tax organizer form, alongside other resources, you can navigate tax season with confidence and clarity, ensuring that all information is accurate and comprehensively presented for your best financial advantage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in tax organizer without leaving Chrome?

Can I create an electronic signature for the tax organizer in Chrome?

How do I complete tax organizer on an iOS device?

What is tax organizer?

Who is required to file tax organizer?

How to fill out tax organizer?

What is the purpose of tax organizer?

What information must be reported on tax organizer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.