Get the free Nonprofit Corporation Articles of Dissolution

Get, Create, Make and Sign nonprofit corporation articles of

Editing nonprofit corporation articles of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nonprofit corporation articles of

How to fill out nonprofit corporation articles of

Who needs nonprofit corporation articles of?

Understanding Nonprofit Corporation Articles of Form

Understanding nonprofit corporation articles of incorporation

Articles of incorporation serve as a foundational document for nonprofit organizations, outlining their structure and purpose. It is crucial for establishing the organization as a legal entity that is recognized by both state and federal authorities. This document not only provides legitimacy but also delineates the organization's mission, governance, and policies.

Nonprofit articles differ significantly from those of for-profit entities, primarily in their objectives and operational mandates. While for-profits focus on generating profit for shareholders, nonprofits are centered around fulfilling a public or community benefit. The implications are vast, as nonprofits must adhere to specific regulatory requirements to maintain their tax-exempt status and ensure compliance with applicable laws.

Why incorporate a nonprofit organization?

Incorporating a nonprofit organization provides a wealth of benefits that are essential for operational sustainability and legal protection. One of the primary advantages is limited liability for members and directors, which protects personal assets from organizational debts or lawsuits. Another key benefit is the ability to apply for grants and secure tax exemptions, vital for funding and support.

Despite these benefits, there are also common misconceptions that may deter organizations from pursuing incorporation. Some may believe it is unnecessary for small groups, while others worry about the complexities involved. However, even small nonprofits stand to gain legitimacy and access to resources that can be invaluable for their missions, making incorporation a worthwhile consideration for most.

Key components of nonprofit articles of incorporation

When drafting nonprofit articles of incorporation, several key components must be included. These elements help define the organization's identity, structure, and purpose, and ensure compliance with legal requirements. First and foremost is the name of the nonprofit organization, which must be unique and comply with state naming regulations. Additionally, outlining the duration of the organization and providing a clear purpose and mission statement are fundamental.

The articles should also contain specific clauses that address the nonprofit nature of operations, the composition and roles of the board of directors, and any provisions related to membership. Furthermore, a necessary detail is the procedure for amending the articles in the future, which provides flexibility for organizational growth and change.

Drafting your nonprofit articles of incorporation

Drafting nonprofit articles of incorporation can be a detailed process. To start, it’s essential to research state-specific requirements since laws can vary significantly from one jurisdiction to another. This research will ensure compliance with all legal stipulations. Choosing a compliant name is the next step, followed by crafting a mission statement that succinctly communicates the organization's purpose.

After drafting the articles, it can be helpful to reference sample templates that showcase the format and components needed. These templates often serve as a valuable guide. Modifying an existing example can save time and minimize errors. However, beware of common pitfalls, such as overlooking required clauses or failing to check for name availability, which can delay the incorporation process.

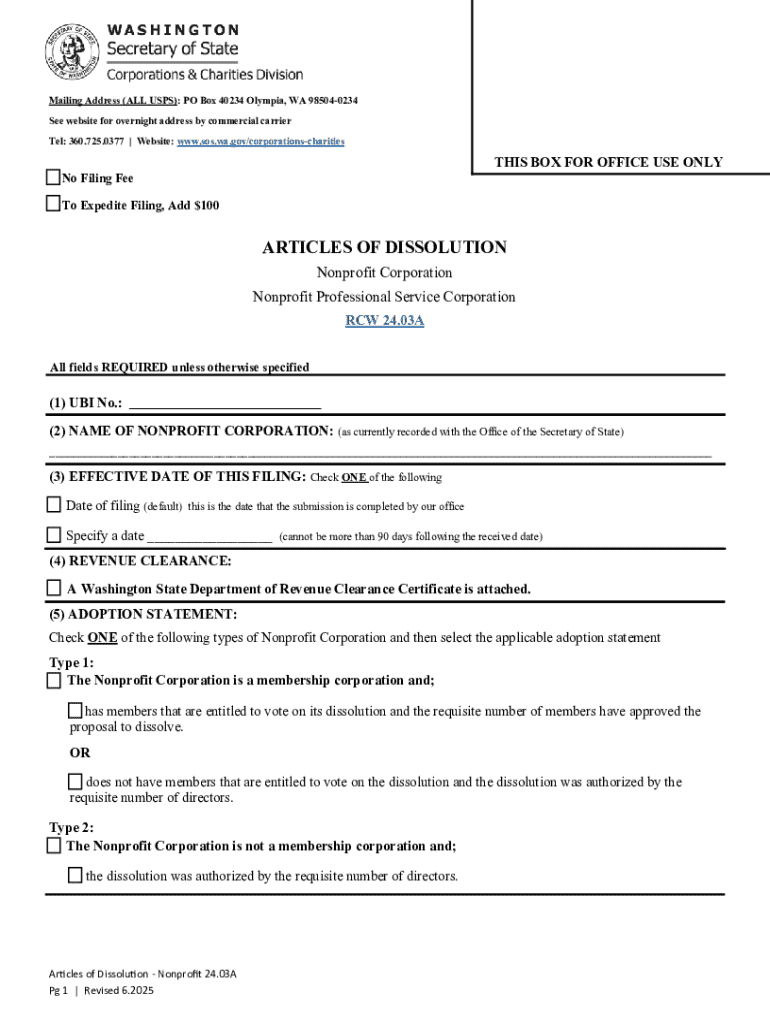

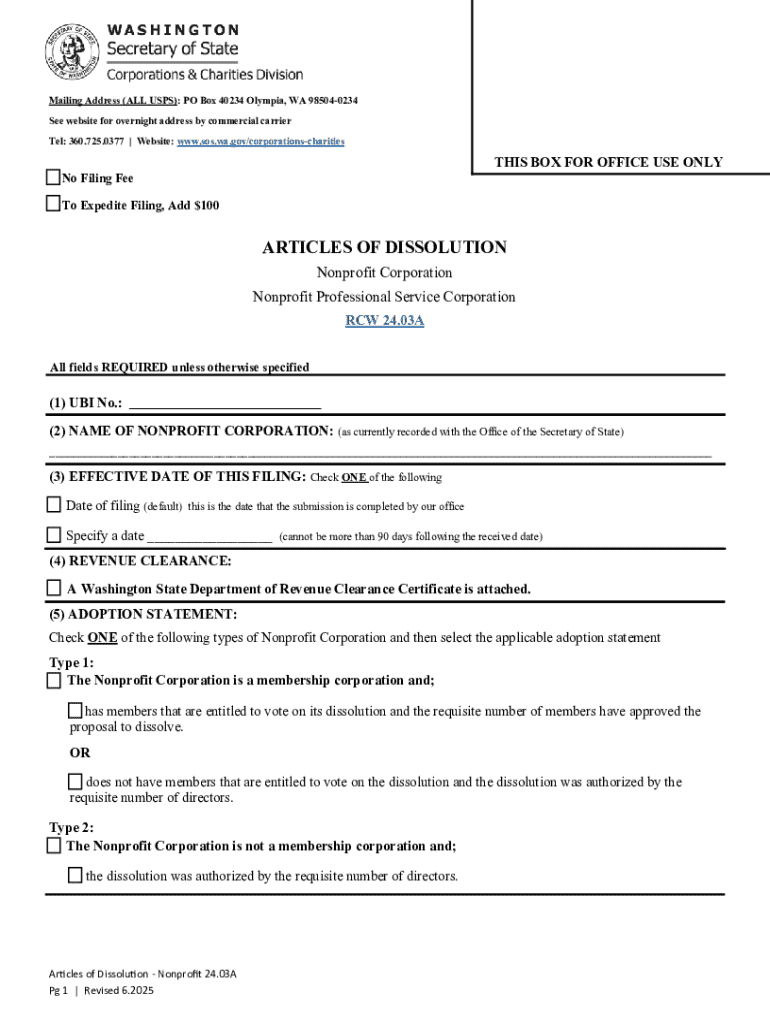

Filing your nonprofit articles of incorporation

Filing your nonprofit articles of incorporation marks an important step towards becoming a legally recognized entity. This process typically involves submitting the completed articles to the Secretary of State or a similar government office. It is essential to check which specific office handles these filings in your state, as requirements may vary.

Fees for filing can also differ by state and may range from nominal amounts to several hundred dollars. Once your articles are filed, the waiting period for approval can vary, so being prepared for potential delays is prudent. After filing, organizations often receive confirmation of incorporation, which allows them to proceed with additional steps such as applying for an Employer Identification Number (EIN).

Post-incorporation steps to consider

Once your nonprofit is incorporated, several post-incorporation steps are essential to ensure legal compliance and operational readiness. Applying for an Employer Identification Number (EIN) is critical, as this number is necessary for tax purposes and financial operations. Additionally, understanding both state and federal compliance requirements is vital for maintaining good standing as a nonprofit.

One of the most significant next steps is applying for tax-exempt status, typically defined under section 501(c)(3) of the IRS codes. This application process can require specific forms and documentation, so handling these detailed tasks diligently and tracking key timelines is crucial for the success of the organization.

Maintaining your nonprofit corporation in good standing

Maintaining good standing for your nonprofit organization requires regular attention to legal obligations and periodic filings. This includes submitting annual reports and maintaining comprehensive records of activities and financial transactions. It is not only a legal obligation but also essential for transparency and accountability to stakeholders and potential donors.

Additionally, there may come a time when amending the Articles of Incorporation becomes necessary. Understanding when and how to make these amendments is crucial, as failing to comply with the requisite processes can lead to fines or the loss of good standing. Regular reviews of the organization's bylaws and articles can help identify any necessary adjustments in a timely manner.

Case studies: Successful nonprofits and their articles of incorporation

Examining successful nonprofits and their articles of incorporation offers valuable lessons and insights. Organizations like the American Red Cross and Habitat for Humanity have effectively established their missions through clearly defined articles that emphasize their core values and operational guidelines. By analyzing their founding documents, aspiring nonprofits can gain insights into creating compelling, legally compliant articles that reflect their vision and goals.

These case studies reveal how understanding the structure and essentials of articles of incorporation contributes to stability and efficient governance in nonprofit organizations. For example, recognizing the importance of a transparent board structure and clear mission objectives in these documents can guide new organizations in their incorporation journey.

Frequently asked questions about nonprofit articles of incorporation

Navigating the complexities of nonprofit articles of incorporation can raise various questions. Common queries often revolve around specific incorporation requirements, necessary documents, and the overall process. It’s essential to clarify misconceptions that may hinder organizations from pursuing their goals, such as the belief that incorporation is an overly complex task or that only larger organizations need it.

Best practices for drafting articles and completing the incorporation process include seeking legal counsel, utilizing available templates, and understanding the specific requirements of your state. Organizations can enhance their chances of a successful incorporation by preparing thoroughly and efficiently addressing any uncertainties that arise.

Interactive tools for nonprofit document management

Using innovative tools can significantly enhance the process of managing nonprofit documentation, including articles of incorporation. pdfFiller provides a comprehensive platform designed specifically for organizations looking to efficiently handle their documents. Its features allow users to easily edit, sign, and collaborate on forms, ensuring that all necessary documents are completed accurately and swiftly.

With access to various templates directly through the platform, nonprofit organizations can quickly find the documents they need to incorporate, apply for tax-exempt status, or manage ongoing compliance. By simplifying document management, pdfFiller empowers organizations to focus more on their mission and less on administrative burden.

Unique features of pdfFiller for nonprofit organizations

pdfFiller offers unique features tailored to meet the needs of nonprofit organizations. Its user-friendly solutions facilitate the editing of PDFs, ensuring that necessary documents are completed accurately without significant time investment. Furthermore, the cloud-based management system allows for easy access to incorporation documents from anywhere, providing flexibility and responsiveness.

Moreover, integration with eSigning solutions ensures that nonprofits can comply with requirements efficiently, making the entire process—from drafting articles of incorporation to signing and filing—rapid and hassle-free. By providing tools specifically designed for document management, pdfFiller contributes to the operational excellence of nonprofits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my nonprofit corporation articles of in Gmail?

Can I sign the nonprofit corporation articles of electronically in Chrome?

How can I fill out nonprofit corporation articles of on an iOS device?

What is nonprofit corporation articles of?

Who is required to file nonprofit corporation articles of?

How to fill out nonprofit corporation articles of?

What is the purpose of nonprofit corporation articles of?

What information must be reported on nonprofit corporation articles of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.