Get the free Bridging Finance Application Form

Get, Create, Make and Sign bridging finance application form

Editing bridging finance application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bridging finance application form

How to fill out bridging finance application form

Who needs bridging finance application form?

A Comprehensive Guide to Bridging Finance Application Form

Understanding bridging finance

Bridging finance is a type of short-term loan designed to bridge the gap between immediate cash needs and long-term financial solutions. This financing is commonly used in property transactions, enabling buyers to secure funding while awaiting the sale of an existing property or the completion of a new mortgage.

The importance of bridging finance in property transactions cannot be overstated. It can facilitate quick purchases, allowing buyers to secure properties before their existing homes are sold. This financial instrument is crucial for avoiding missed opportunities in competitive real estate markets.

Common scenarios where bridging finance comes into play include buying a property at auction, waiting for a traditional mortgage to complete, or financing renovations on a new property before selling the old one. Each scenario showcases the flexibility and utility of bridging finance.

Overview of the bridging finance application process

The application process for bridging finance can seem daunting at first, but breaking it down into manageable steps can simplify it significantly. Typically, the process begins with researching potential lenders and assessing their terms. Once a lender is selected, applicants fill out the bridging finance application form, providing detailed information about their financial situation and the property in question.

Key document requirements generally include proof of identity, proof of income, details of the property to be purchased, and any existing mortgage statements. Ensuring that these documents are organized ahead of time can expedite the application process.

The timeline for approval can vary widely, but many lenders aim to provide a decision within 24 to 48 hours of receiving the application. Having all documents ready and understanding the lender’s criteria can help speed up the process.

Navigating the bridging finance application form

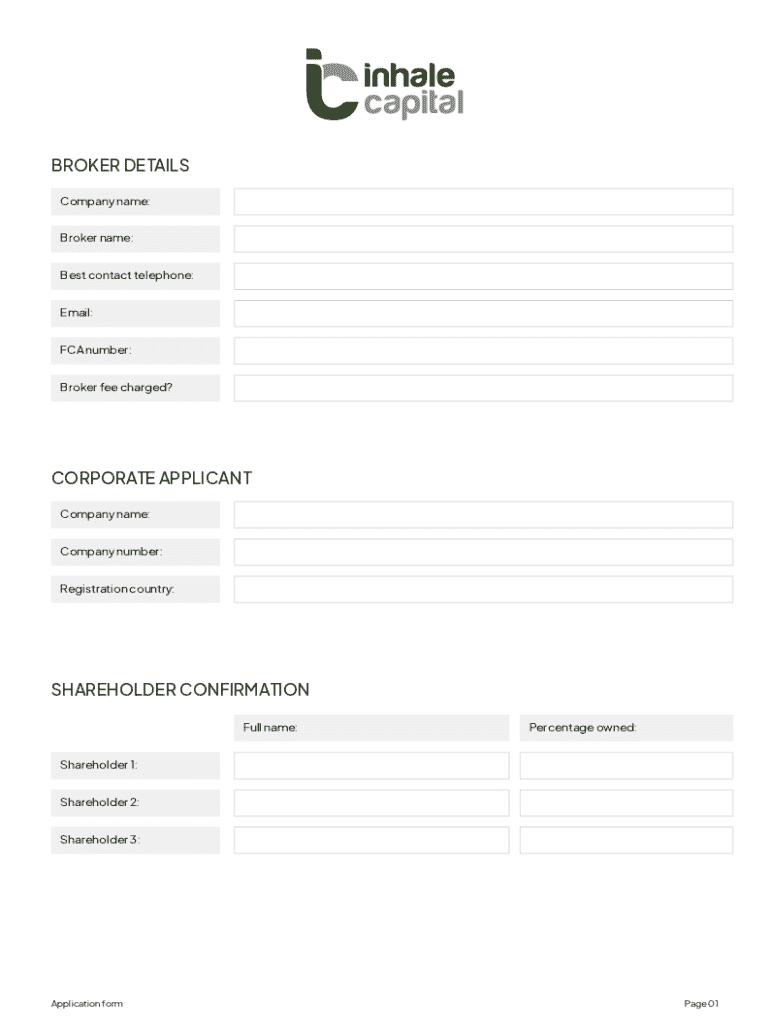

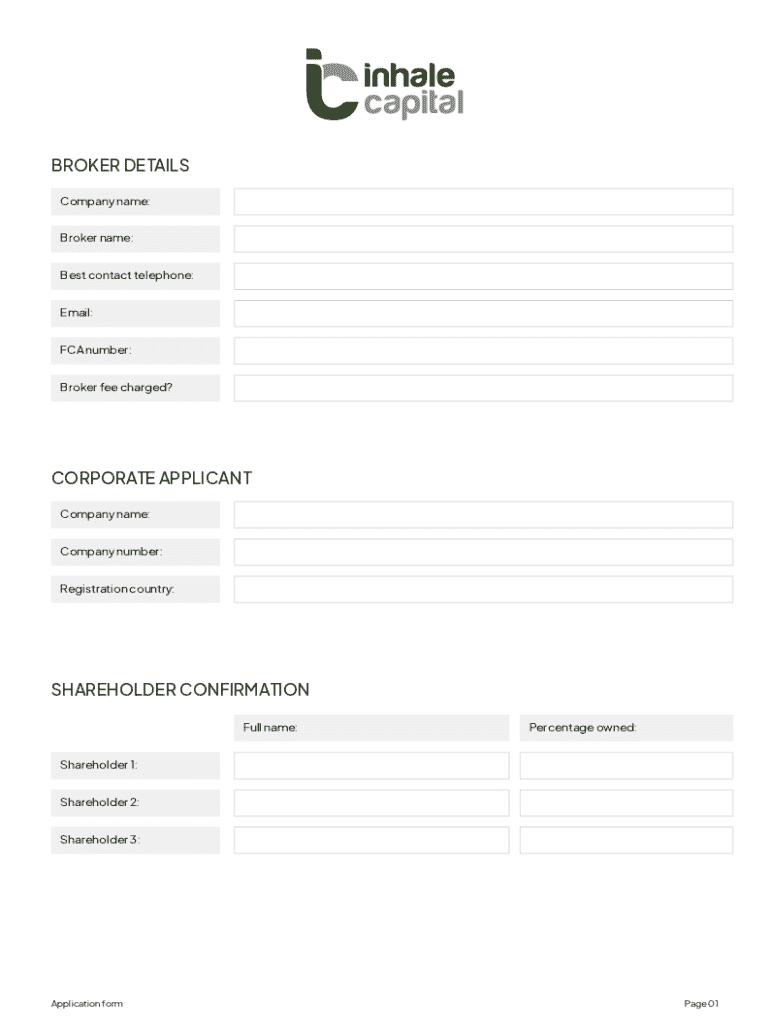

The bridging finance application form typically consists of several key sections that need to be filled out accurately to avoid delays. These sections include personal information, property details, and financial information.

Sections of the application form

Detailed instructions for each section

Filling out the personal information section requires precise and accurate data entry. Make sure to double-check contact information and employment details, as inaccuracies can lead to delays.

In the property details section, provide a comprehensive overview of the property. Any documentation that can validate the property's value or condition should be included, such as property listings or recent appraisal reports.

Establishing financial standing involves presenting your financial future and current obligations. Required documentation includes pay slips, bank statements, and tax returns, all of which help verify your capability to repay the loan.

Tips for a successful application

While filling out the bridging finance application form, several common mistakes can impact your approval chances. One significant error is failing to provide complete and honest information, which can lead to suspicions or a decline.

The accuracy of your financial documentation is crucial. Inaccurate figures can delay the approval process or result in adverse lending decisions. It's essential to provide relevant documents that support your claims, such as proof of income or bank statements.

To present a compelling case for bridging finance, articulate the urgency of your situation in your application. Clear communication about how the funds will be utilized and how they fit into your overall financial strategy will boost confidence in your application.

After submitting your application

Once your bridging finance application is submitted, it's crucial to know what happens next. Generally, the lender will review your application and documentation. You may receive feedback or approval within a couple of days, depending on their workload.

During the evaluation, anticipate questions from lenders regarding your financial situation or the property details. Being prepared with additional information can facilitate a smoother process.

How to prepare for a follow-up

Preparation for follow-ups is key. Be ready to provide further documentation or clarification if needed. Keeping a line of communication open with lenders can help ease anxieties and demonstrate your willingness to collaborate.

Having all relevant information accessible, including any correspondence with the lenders, is integral to effectively managing follow-ups and remaining proactive.

Additional resources for bridging finance

Navigating through bridging finance applications can raise various queries. Frequently Asked Questions (FAQs) offer solutions to typical concerns regarding eligibility, documentation, and timelines.

A glossary of terms related to bridging finance could also be beneficial, making technical terms easier to understand for applicants unfamiliar with financial jargon. Additionally, various calculators and tools are available online to assess bridging finance needs accurately.

Related financing options

While bridging finance serves a very specific purpose, understanding alternative financing solutions can broaden your options. For example, development finance differs from bridging finance as it's intended to fund construction or renovations on properties, while bridging finance focuses on quick liquidity.

Specialist lending offers tailored solutions for unique circumstances, particularly for those with less traditional financial profiles. In this context, knowing how bridging finance fits into your overall financial strategy is crucial to making informed decisions.

Getting started with pdfFiller

Utilizing pdfFiller for your bridging finance application simplifies each stage of the process. The platform’s capabilities allow for seamless editing and signing of PDFs, essential for those managing their documents online. Users can easily fill out and submit their forms without the hassle associated with traditional paper submissions.

Collaboration is made easy with pdfFiller's collaborative features, allowing teams to work together on applications efficiently. This can streamline the application process and minimize the likelihood of errors occurring.

Interactive tools to simplify the application process

The platform also provides document management and tracking tools, enabling applicants to monitor the status of their applications in real time, ensuring they stay informed throughout the entire journey.

Contacting pdfFiller support for assistance

If you encounter challenges while filling out your bridging finance application form, pdfFiller's customer support is readily available to assist with document-related inquiries. They can provide guidance on formatting, submission, and any other concerns you may face.

Additionally, utilizing the help center can provide answers to common queries and offer a robust resource for navigating through the functionalities of the platform. Engaging with the community forum can also provide valuable insights and shared experiences from fellow users.

Client success stories

Client success stories stand testament to the effectiveness of bridging finance applications and the ease of using pdfFiller. Several case studies reveal how users successfully navigated the application process and swiftly secured financing, allowing them to capitalize on timely property opportunities.

Testimonials from users highlight the benefits of choosing pdfFiller for their documentation needs, emphasizing the user-friendly interface and the efficiency with which they could complete their applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my bridging finance application form in Gmail?

How do I make edits in bridging finance application form without leaving Chrome?

How do I fill out the bridging finance application form form on my smartphone?

What is bridging finance application form?

Who is required to file bridging finance application form?

How to fill out bridging finance application form?

What is the purpose of bridging finance application form?

What information must be reported on bridging finance application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.