Get the free Guide to IRS Form 1040, Individual Income Tax Return

Get, Create, Make and Sign guide to irs form

How to edit guide to irs form online

Uncompromising security for your PDF editing and eSignature needs

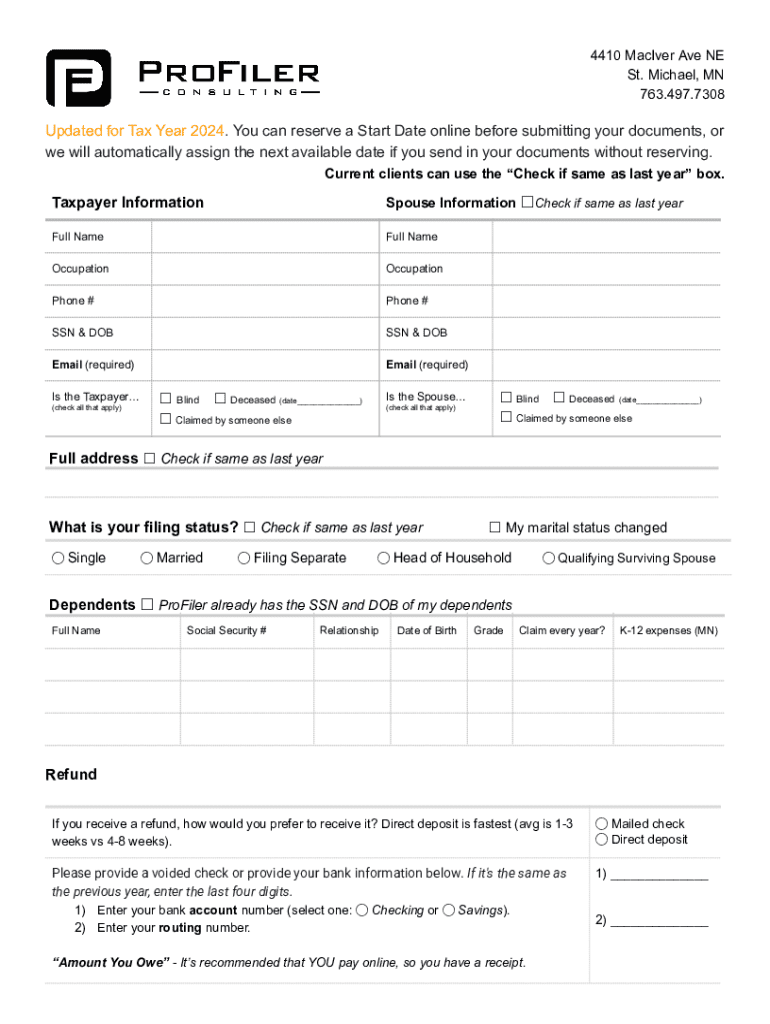

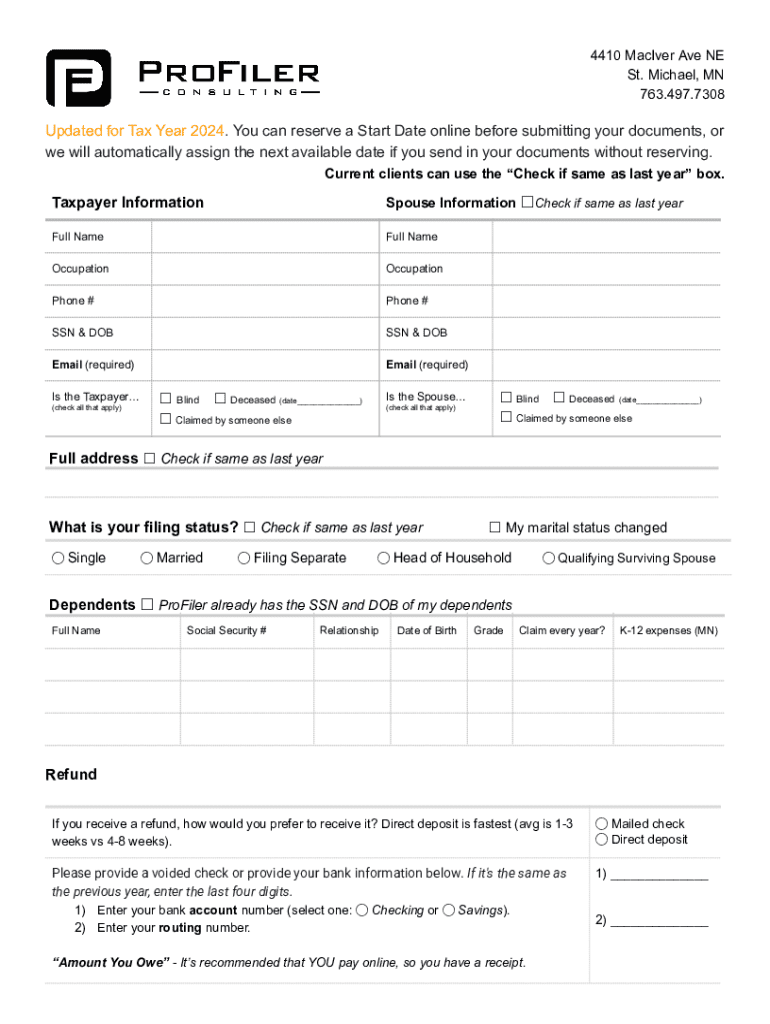

How to fill out guide to irs form

How to fill out guide to irs form

Who needs guide to irs form?

Guide to IRS Form: A Comprehensive Overview

Understanding IRS forms: An essential component of tax filing

IRS forms are documents required by the Internal Revenue Service (IRS) for taxpayers to report their income, calculate their tax obligation, and claim deductions or credits. Each form serves a specific purpose, and using the correct one is crucial for compliance and accuracy during tax filing.

Filing the appropriate form based on your individual tax situation ensures that your taxes are processed smoothly and helps you avoid potential penalties or audits. Familiarizing yourself with various IRS forms will streamline your tax filing process and maximize your returns.

Overview of key IRS forms in 2025

When preparing for tax filing in 2025, it’s essential to know the key IRS forms that affect both individuals and businesses. Understanding these forms helps you identify what you need to complete your tax return accurately.

Detailed instructions for completing key IRS forms

Completing IRS forms accurately is essential for minimizing errors and securing your tax benefits. Here, we’ll provide step-by-step guidance for some key forms.

Interactive insights: Tools for efficient form management

In our digital age, managing your IRS forms can be streamlined through various online tools and resources.

Common issues and how to resolve them

Despite best efforts, issues can arise during the tax filing process. Understanding these challenges will help you resolve them quickly.

Tips for efficient IRS form filing

Efficient management of your tax obligations involves careful planning and resource utilization.

FAQs about IRS forms and filing

As you delve into the world of IRS forms, several questions may arise regarding filing procedures.

Wrapping up your tax filing journey

Successfully navigating your tax responsibilities can seem daunting, but with the right tools and knowledge, it becomes manageable.

Utilizing digital solutions like pdfFiller not only simplifies the process of filling out forms but also ensures your data is securely managed and accessible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the guide to irs form electronically in Chrome?

Can I create an eSignature for the guide to irs form in Gmail?

How do I complete guide to irs form on an Android device?

What is guide to irs form?

Who is required to file guide to irs form?

How to fill out guide to irs form?

What is the purpose of guide to irs form?

What information must be reported on guide to irs form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.