Get the free Maryland Tangible Net Benefit Worksheet

Get, Create, Make and Sign maryland tangible net benefit

How to edit maryland tangible net benefit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland tangible net benefit

How to fill out maryland tangible net benefit

Who needs maryland tangible net benefit?

Understanding the Maryland Tangible Net Benefit Form: A Complete Guide

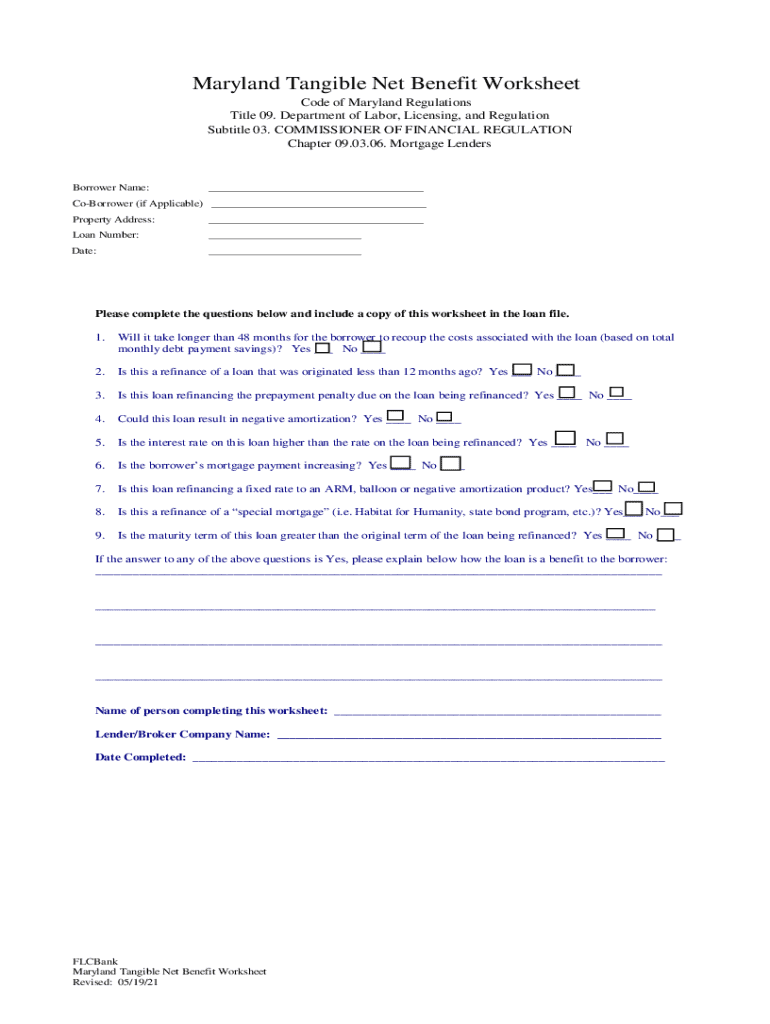

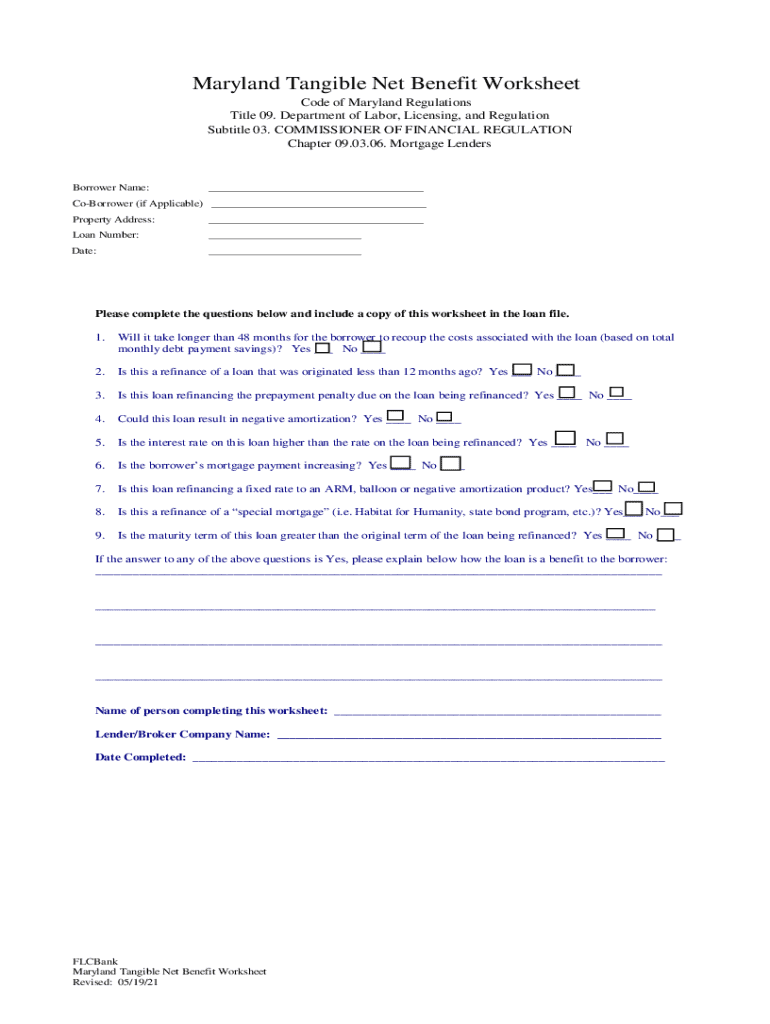

Overview of the Maryland Tangible Net Benefit Form

The Maryland Tangible Net Benefit Form is a critical document designed to ensure that homeowners evaluate the financial advantages of refinancing their mortgage. It provides a framework for lenders to demonstrate that the proposed transaction offers a concrete financial benefit to the borrower. This form is essential in protecting consumers from unnecessary or detrimental refinancing arrangements by mandating that borrowers receive specific benefits.

The importance of this form cannot be overstated, as it serves to prevent borrowers from falling into unfavorable loan agreements. It is particularly relevant for homeowners considering options such as refinancing their existing loans or modifying current loan terms. Various stakeholders, including lenders, mortgage brokers, and homeowners, must understand this form to effectively navigate Maryland’s housing finance landscape.

Understanding tangible net benefit

Tangible Net Benefit (TNB) is a vital concept pertaining to the financial advantage realized by refinancing. It quantifies the actual benefits gained from a new loan compared to the existing mortgage. Evaluating TNB involves multiple factors, including interest rates, terms of the loan, and associated closing costs. Each of these components plays a crucial role in determining whether refinancing is advantageous.

Interest rates directly affect monthly payments; even a slight decrease can lead to significant savings over time. Similarly, loan terms determine how long borrowers will be paying off their loans, impacting the overall cost. Closing costs, which can add up quickly, must be weighed against the potential savings to ensure that refinancing is indeed a sound financial decision. Homeowners need to conduct a thorough analysis of these factors to make well-informed mortgage decisions.

When to use the Maryland Tangible Net Benefit Form

The Maryland Tangible Net Benefit Form is used primarily in specific scenarios such as mortgage refinancing and loan modifications. When homeowners opt to refinance, the form is crucial to assess whether the new loan will yield a tangible benefit over their existing loan structure. Thus, it is not only a regulatory requirement but also a valuable tool for borrowers to understand financial implications.

Additionally, this form may be necessary for loan modifications when lenders alter the terms of an existing mortgage. Filing the Maryland Tangible Net Benefit Form helps clarify and document how the changes will positively impact the borrower's financial situation, ensuring transparency throughout the process.

Step-by-step guide to completing the Maryland Tangible Net Benefit Form

Completing the Maryland Tangible Net Benefit Form requires careful attention to detail across various sections. Below is a breakdown of each section to help ensure accurate submission.

Section 1: Borrower Information

This section captures essential personal details of the borrower, including their full name, contact information, and property address. It's vital to ensure all information is current and matches what is found on official documents to avoid discrepancies that can delay processing.

Section 2: Lender Information

In this part, include the lender's name, contact information, and license number. Accurate information is crucial as it influences future correspondence regarding the loan.

Section 3: Existing Mortgage Information

Disclosure of details related to the current mortgage, such as loan balance and interest rate, is required here. Noting specific terms helps set the stage for accurately evaluating the tangible benefits of the proposed refinancing.

Section 4: New Loan Information

This section should include key metrics that outline the proposed new loan, such as the new interest rate and closing costs. Properly understanding and entering these metrics is vital for a clear comparison against existing mortgage terms.

Section 5: Tangible Net Benefit Calculation

Finally, the TNB calculation brings together the information presented in previous sections. Assessing how much a borrower stands to save or benefit from refinancing hinges on accurately entering all figures. Various online tools and calculators are available to support this calculation if needed.

Tools and features of pdfFiller for managing your form

Utilizing pdfFiller for the Maryland Tangible Net Benefit Form simplifies the process significantly. The platform's extensive PDF editing features allow users to make instant changes to the form, ensuring their information remains current and relevant.

Moreover, pdfFiller includes eSign functionalities, enabling users to sign their forms digitally without the need for printing. This streamlining of the process benefits both individuals and teams, allowing for collaboration on form completion, which is especially useful in situations where multiple parties are involved in a mortgage application.

Common mistakes to avoid when filling out the Tangible Net Benefit Form

Filling out the Maryland Tangible Net Benefit Form requires diligence, as common mistakes can derail the process. Both misreporting information and inaccurate TNB calculations pose significant risks to borrowers. These errors might lead to delays or even disapproval of refinancing applications.

To prevent such mistakes, borrowers should double-check each section of the form and ensure that all numbers align with their financial records. Conducting a thorough review before submission can mitigate issues and enhance the overall accuracy of the application.

Understanding the implications of the Tangible Net Benefit Form

Submitting an inaccurate Maryland Tangible Net Benefit Form can lead to serious legal implications, potentially impacting borrower rights and obligations. If discrepancies arise after submission, lenders may require additional documentation, which can delay processing and lead to frustration.

It's crucial for borrowers to be proactive in correcting any inaccuracies post-submission by communicating openly with their lenders. Understanding the implications beneath the surface can help to navigate the complex waters of mortgage refinancing in Maryland.

Final steps after completing the form

After completing the Maryland Tangible Net Benefit Form, it's essential to ensure proper submission and tracking. First, the form must be submitted to the relevant lender or mortgage broker. Users should inquire about their preferred submission method, whether electronically or via mail, to ensure compliance.

Once submitted, tracking the form is equally important. Borrowers can follow up with lenders to confirm receipt and to ask about any next steps necessary. Proactive communication will also help in alleviating any concerns regarding the status of the refinance application.

Maryland-specific requirements for Tangible Net Benefit Forms

Maryland has specific regulations governing the use of the Tangible Net Benefit Form to protect borrowers. Among these regulations is the requirement for lenders to clearly disclose all associated costs and benefits to the borrowers during the refinancing process. Consumers must ensure they fully understand the terms they are entering into.

Additionally, necessary disclosures that accompany the form must include detailed explanations of how TNB is calculated and what it means for the borrower. These requirements are designed to promote transparency and foster informed decision-making among Maryland homeowners.

FAQs about the Maryland Tangible Net Benefit Form

The Maryland Tangible Net Benefit Form often raises numerous questions among homeowners contemplating refinancing options. Common queries include what constitutes a tangible net benefit and how it can influence mortgage decisions. Expert insights suggest closely examining financial scenarios, especially regarding any potential long-term savings or costs associated with refinancing.

For many people, understanding specific terms or clauses within the form can be overwhelming. Seeking clarification from lenders or utilizing resources like pdfFiller can make the process simpler and less daunting, ensuring that consumers feel confident in their refinancing decisions.

Customer testimonials and success stories

Many users have experienced firsthand the advantages of utilizing the Maryland Tangible Net Benefit Form through pdfFiller. Customer testimonials often highlight how the platform has simplified their document management processes. Users appreciate the ease of electronically filling out forms and the ability to collaborate directly with lenders remotely.

Success stories showcase individuals and teams who have successfully navigated refinancing hurdles with the aid of pdfFiller, emphasizing how access to reliable document management tools can alleviate stress and enhance efficiency.

Sign up for pdfFiller today!

With the complexities surrounding the Maryland Tangible Net Benefit Form, an efficient document management solution like pdfFiller is essential. By signing up with pdfFiller, users can take advantage of comprehensive tools that simplify editing, sharing, and managing forms—all from a single, cloud-based platform. Being well-prepared helps ensure that refinance applications are successful and financially beneficial.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find maryland tangible net benefit?

How do I edit maryland tangible net benefit in Chrome?

How do I fill out maryland tangible net benefit on an Android device?

What is maryland tangible net benefit?

Who is required to file maryland tangible net benefit?

How to fill out maryland tangible net benefit?

What is the purpose of maryland tangible net benefit?

What information must be reported on maryland tangible net benefit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.