Get the free Application for Individual Life Insurance

Get, Create, Make and Sign application for individual life

Editing application for individual life online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for individual life

How to fill out application for individual life

Who needs application for individual life?

Application for Individual Life Form - A Comprehensive How-to Guide

Understanding individual life insurance

Individual life insurance is a contract between an insurer and a policyholder, designed to provide financial protection to the beneficiaries upon the policyholder's death. The main purpose is to secure financial stability for loved ones and cover expenses such as funeral costs, outstanding debts, and living expenses. Life insurance acts as a safety net, ensuring that dependents can maintain their quality of life while navigating the loss of a financial provider.

The key benefits of individual life insurance include peace of mind knowing loved ones are protected, potential tax advantages, and the ability to accumulate cash value in certain types of policies. Furthermore, obtaining life insurance early can lock in lower premium rates based on your age and health.

Types of individual life insurance policies

Several types of individual life insurance policies cater to different needs. The most common are term life and whole life policies. Term life insurance provides coverage for a specified period—typically 10, 20, or 30 years—while whole life insurance offers lifelong protection with a cash value component. Universal and variable life insurance present more flexible cash value options, allowing policyholders to adjust premiums and death benefits according to their financial situation.

Choosing the right policy involves evaluating personal circumstances, including financial obligations, family needs, and long-term goals. Critical factors influencing policy selection include age, health status, budget, and the purpose of coverage.

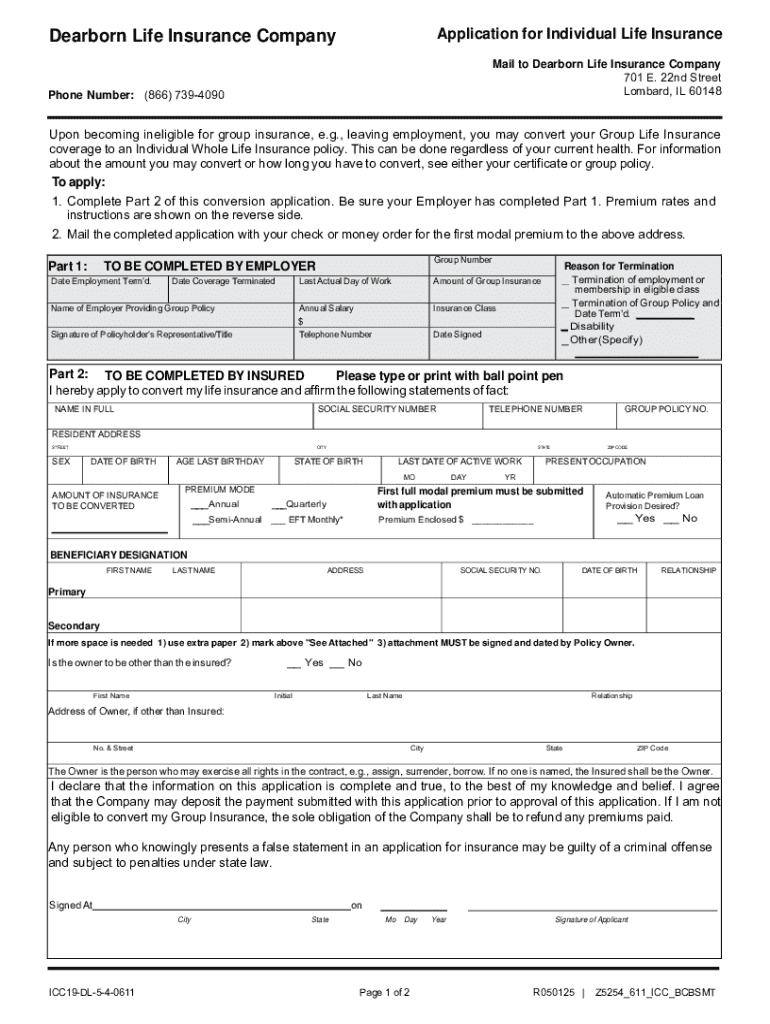

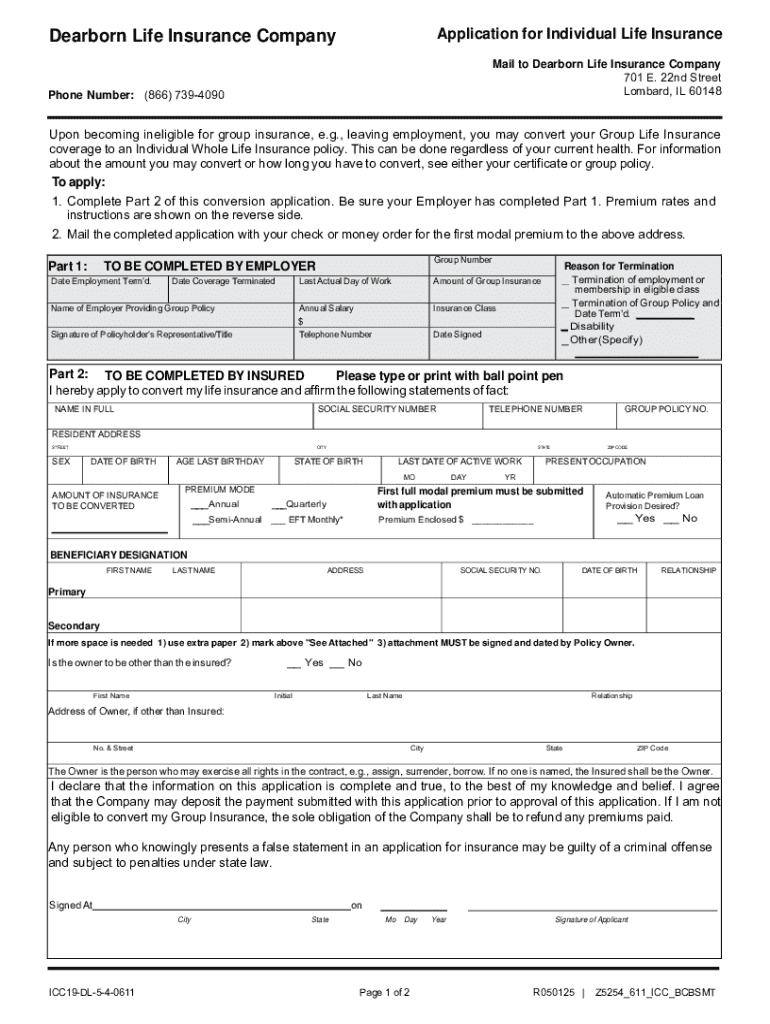

Preparing your application for individual life form

Completing an application for an individual life form requires careful preparation. Start by gathering essential personal information, such as your name, address, date of birth, and Social Security number. Beyond basic demographics, insurers seek insight into your health history and lifestyle choices, including the use of tobacco or alcohol, as well as relevant medical conditions that could influence underwriting.

In addition to health information, financial considerations play a crucial role in your application. Insurers often ask for details about your income, financial obligations like debts and mortgages, and your family's financial situation post your demise. The goal is to determine risk levels associated with insuring you.

Documentation required for application

Beyond personal and financial details, several documents are vital during the application process. Typical requirements include:

Organizing these documents efficiently is crucial. Consider creating a checklist and using secure folders—both digital and physical—to manage your paperwork. This preparation ensures a smoother application process and an expedited review by the insurer.

Filling out the application for individual life form

Completing the application requires attention to detail. Begin by accurately filling in your personal policyholder information. This section should include your full legal name, date of birth, and contact information. Next, designate your beneficiaries. It's crucial to specify both primary and contingent beneficiaries—the latter serves as a fallback if the primary beneficiary is unable to claim the benefit.

The health questions section is another critical part of the application. Here, you’ll answer questions about your medical history and authorize the insurer to access relevant medical records. Be honest; discrepancies could lead to complications later. Include accurate financial and employment information as well. Remember, inaccuracies can delay the approval process.

Common pitfalls to avoid include overlooking questions, errors in personal details, or failing to provide ample health information. Each of these oversights can lead to delays or even denial of coverage.

Editing and managing your application

Once your application for the individual life form is filled out, it’s crucial to ensure everything is accurate and clear. Using tools like pdfFiller can help streamline this process. With pdfFiller's user-friendly editing tools, you can easily make changes to your application, add notes, or clarify sections that may need elaboration.

For effective management, utilize cloud-based storage options offered by pdfFiller. This not only secures your document against loss but also provides access from any device at any time. By saving your application on the cloud, you're ensuring that you have the latest version on hand for future reference or for when you need to make amendments.

eSigning your application

Electronic signing (eSigning) has become an integral part of modern administrative processes, including insurance applications. The importance of eSigning your application lies in its legal validity and added security. An eSignature is legally recognized and holds the same weight as a handwritten signature, making it a convenient alternative.

To eSign your application with pdfFiller, follow a straightforward process. First, ensure all application details are complete and accurate. Then, use pdfFiller’s eSignature tool. You can either draw your signature, type it, or upload a scanned version. Always review the signature requirements specified by your insurer to ensure compliance with their guidelines.

Submitting your application for individual life insurance

After completing and eSigning your application, the next step is submission. Choosing the right submission method is crucial. Many insurers provide online submission options—making it seamless to upload directly through their website. If you prefer traditional methods, ensure your application is securely packed for mailing, and consider in-person submissions at your insurer’s office for immediate confirmation.

After submission, your application enters the review and underwriting phase. This process involves verifying the information provided and assessing risk. Understanding this timeline will help set realistic expectations for approval, typically ranging from a few days to several weeks, depending on the insurer's policies and the completeness of your application.

Common FAQs about the application for individual life form

As you navigate your application for individual life insurance, several common questions often arise. One crucial concern is, 'What if I make a mistake on my application?' Most insurers allow for corrections; contact your insurer as soon as you identify an error. Ensuring accurate data is paramount to avoid delays.

Many applicants wonder how to track the status of their application. Most insurers provide an online portal or phone service for this purpose. Should you need to make changes post-submission, reach out to your insurance provider as soon as possible—early communication can help avert complications.

Managing your individual life insurance policy post-application

Once your individual life insurance policy is in place, maintaining updated information is essential. Regularly reviewing and updating your policy ensures that your beneficiaries, contact information, and coverage align with your current life situation. Consider significant life events—such as marriage, divorce, or the birth of a child—as triggers for updates.

Understanding renewals, conversions, and claims is integral to managing your policy effectively. Depending on the policy type, you may have options to convert your term policy into a permanent one. For claims, familiarize yourself with the process to file a claim upon the event of a policyholder's passing to ensure your beneficiaries can access the funds smoothly.

Interactive tools and resources

pdfFiller not only assists in completing your application for individual life insurance but also provides a suite of interactive tools to enhance your experience. Features include access to templates and past submissions, making it easier to manage documents. The platform ensures any form or application you need is at your fingertips.

Additionally, pdfFiller offers a comprehensive form library covering various life insurance needs. This includes change of address forms and other administrative documents essential for effective policy management. Keeping these resources organized can save time during future interactions with your insurance provider.

Your journey towards securing individual life insurance

Upon submitting your application for an individual life form, it's vital to stay proactive. Engaging with your insurer and following up on your application status can help mitigate any potential issues. Completion of this step marks the beginning of your financial security journey for your loved ones.

Additionally, staying informed about life insurance policies through continuous education will benefit you significantly. Explore resources such as webinars, articles, and tools available through pdfFiller and other credible sites. Knowledge is power, and being well-informed can help you make the best decisions regarding your life insurance coverage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my application for individual life in Gmail?

How can I edit application for individual life from Google Drive?

How do I complete application for individual life on an Android device?

What is application for individual life?

Who is required to file application for individual life?

How to fill out application for individual life?

What is the purpose of application for individual life?

What information must be reported on application for individual life?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.