Get the free Budget Worksheet for Girl Scout Events

Get, Create, Make and Sign budget worksheet for girl

Editing budget worksheet for girl online

Uncompromising security for your PDF editing and eSignature needs

How to fill out budget worksheet for girl

How to fill out budget worksheet for girl

Who needs budget worksheet for girl?

Creating a Budget Worksheet Tailored for Young Women

Understanding the importance of a budget worksheet

A budget worksheet is a crucial tool for managing finances, especially for young women embarking on their financial journey. It provides a structured approach to track income, expenses, and savings. By organizing financial information, a budget worksheet helps in making informed decisions, ultimately leading to financial stability.

Creating a budget comes with a multitude of benefits for young women. Primarily, it fosters financial independence, empowering individuals to take control of their financial futures. Additionally, it allows them to set and achieve savings goals, whether it's for education, travel, or emergencies. The process of budgeting cultivates financial responsibility, teaching essential skills that will be invaluable throughout life.

Preparing to use the budget worksheet

Before diving into the budget worksheet, it's important to identify your financial goals. Short-term goals might include saving for a new phone or clothes, while long-term goals could focus on future education or starting a business. Prioritizing these goals based on your lifestyle can help streamline your budgeting process.

Gathering necessary financial information is the next step. Track all income sources—this could include allowances, part-time jobs, or gifts from family. Additionally, collect data on your monthly expenses, encompassing fixed costs like rent and variable expenses such as groceries. Understanding your spending habits is essential, as it lays the groundwork for an effective budgeting strategy.

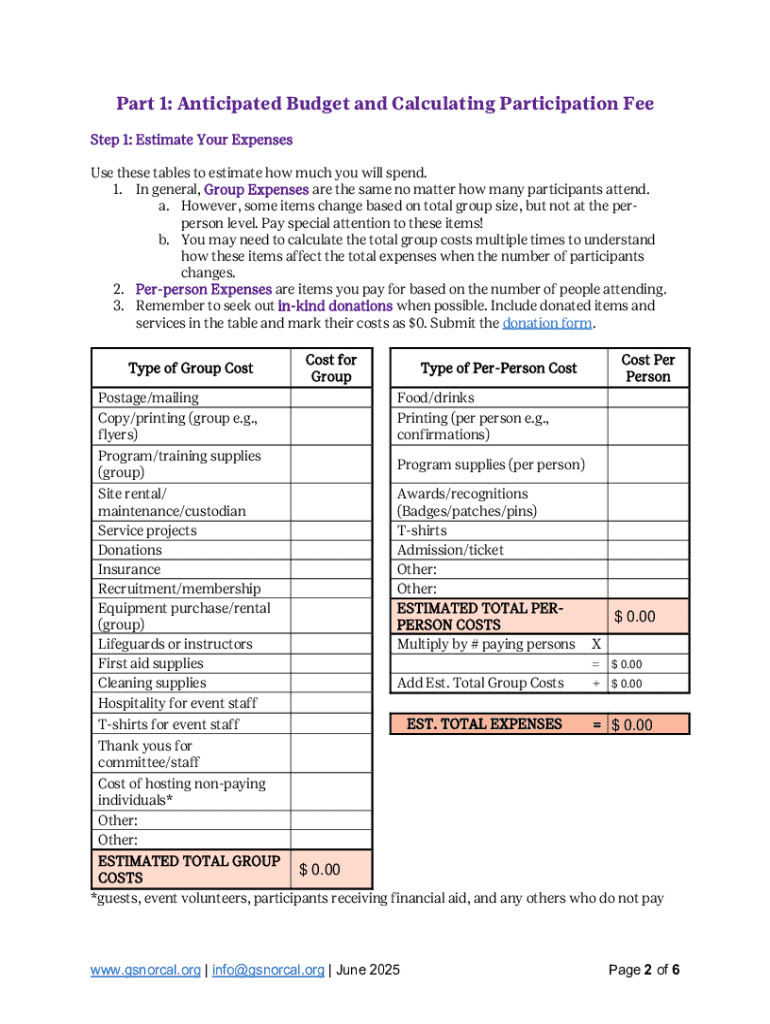

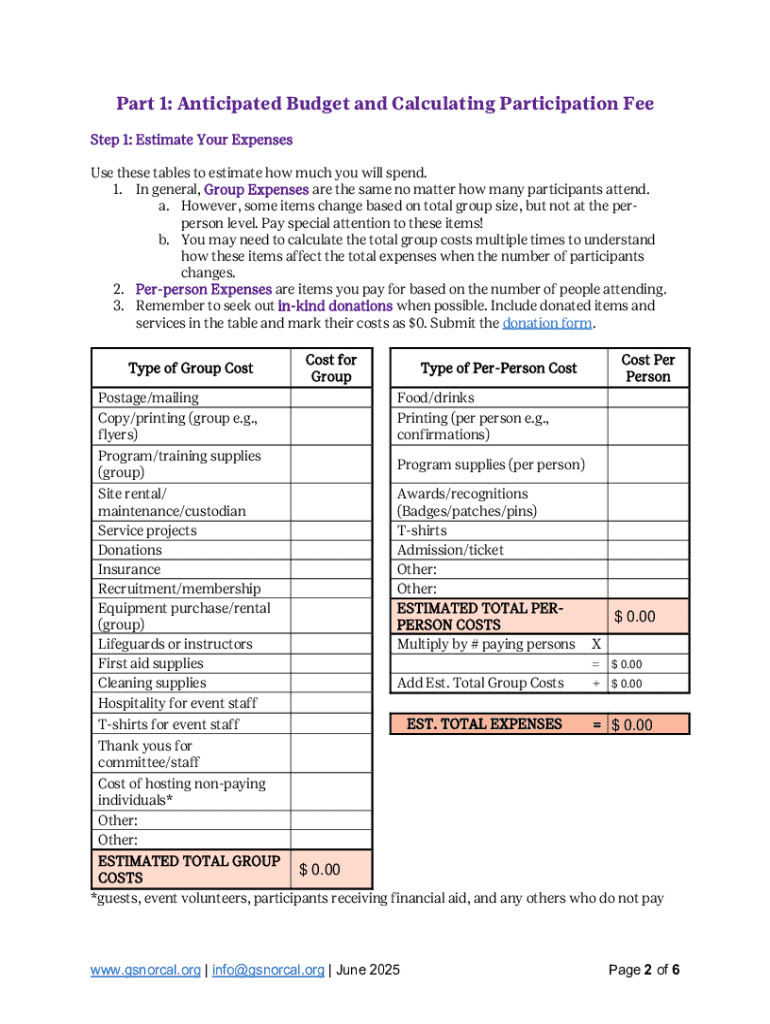

Step-by-step guide to filling out the budget worksheet

Filling out your budget worksheet may feel daunting, but by breaking it down into manageable steps, it becomes a straightforward task. Start with documenting your income. List different income categories, such as your allowance, earnings from part-time jobs, or any other cash inflows.

The next step is to list your fixed expenses. These are unavoidable costs, including rent and subscription services, that need to be paid regularly. It's crucial to also identify variable expenses, which can fluctuate from month to month, such as groceries, entertainment, and personal care items.

After listing these costs, allocate a specific percentage of your income to savings. This step is vital for building financial security, whether you're saving for emergencies or future goals. Finally, analyze your budget by reviewing it regularly and adjusting as necessary. Identify areas to cut back on, or times when you can afford a little extra spending without straying from your goals.

Tools for creating and managing your budget worksheet

Utilizing digital solutions like pdfFiller’s budget worksheet template can simplify the budgeting process significantly. Accessing and editing the template is straightforward and offers features such as eSigning and collaboration with friends or family, enhancing the budgeting experience.

Deciding between a printable or digital worksheet is essential. Printable worksheets can be beneficial for those who prefer writing by hand, while digital tools offer the advantage of adaptability. Each method has its benefits; choose the one that aligns best with your budgeting style.

Common budgeting mistakes and how to avoid them

One of the most common mistakes is failing to track all expenses. Overlooking irregular expenses, such as annual subscription fees or occasional purchases, can lead to budget shortfalls. Additionally, setting unrealistic expectations can be discouraging, so ensure your goals are attainable.

Another pitfall is not reviewing the budget regularly. Life circumstances change, and your budget should reflect that. It's essential to revisit and modify your budget, allowing it to stay relevant and useful for your current financial situation.

Tips for sticking to your budget

Maintaining discipline while adhering to a budget can be challenging. Setting reminders and checking in on your progress regularly can help. Additionally, it can be beneficial to reward yourself for staying within budget—maybe treat yourself to a small purchase or a fun outing when you hit a savings milestone.

Involving friends or family can enhance accountability through a budgeting buddy system. Sharing your goals and progress encourages mutual support, making it easier to stick to your budget. This community aspect can be motivating and make budgeting a more enjoyable experience.

Additional resources for financial education

Expanding your financial literacy can be immensely beneficial. A few recommended budgeting books specifically for girls include 'Girl, Get Your Money Straight!' by L. Michelle Smith, and 'Broke Millennial' by Erin Lowry. Online blogs and financial literacy courses further provide a wealth of information.

Moreover, numerous tools and apps exist to track expenses and manage money effectively. Resources like Mint and YNAB (You Need A Budget) are popular for their user-friendly interfaces and powerful tracking capabilities, allowing you to keep an eye on your budget effortlessly.

Conclusion

Embracing the use of a budget worksheet is a critical step toward achieving financial empowerment for young women. It not only helps in tracking income and expenses but also in setting achievable financial goals. As you start this journey, remember that budgeting is not just about restrictions but about gaining the freedom to make informed financial choices.

Empower yourself to set financial goals and keep track of your progress. With dedication and the right tools, you can attain a sustainable and rewarding budget, leading to enhanced financial well-being.

Follow along: Share your progress

Engaging with your community can boost your budgeting success. Share your experiences with friends and online platforms; this not only motivates you but also encourages others on their budgeting journey. Consider utilizing social media to document your journey, using hashtags related to budgeting success to inspire and connect with others.

FAQs about budget worksheets

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit budget worksheet for girl in Chrome?

Can I create an electronic signature for the budget worksheet for girl in Chrome?

Can I edit budget worksheet for girl on an Android device?

What is budget worksheet for girl?

Who is required to file budget worksheet for girl?

How to fill out budget worksheet for girl?

What is the purpose of budget worksheet for girl?

What information must be reported on budget worksheet for girl?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.