Get the free Mutual Fund Application Form - Individual

Get, Create, Make and Sign mutual fund application form

Editing mutual fund application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mutual fund application form

How to fill out mutual fund application form

Who needs mutual fund application form?

Mutual Fund Application Form - How-to Guide

Understanding mutual fund application forms

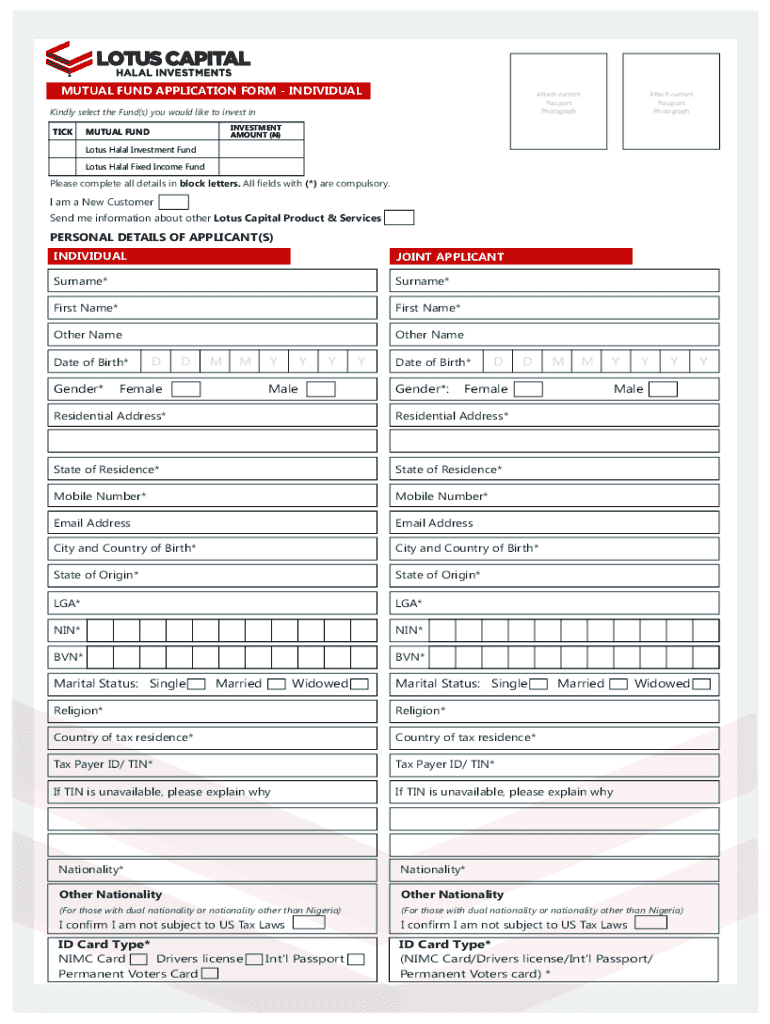

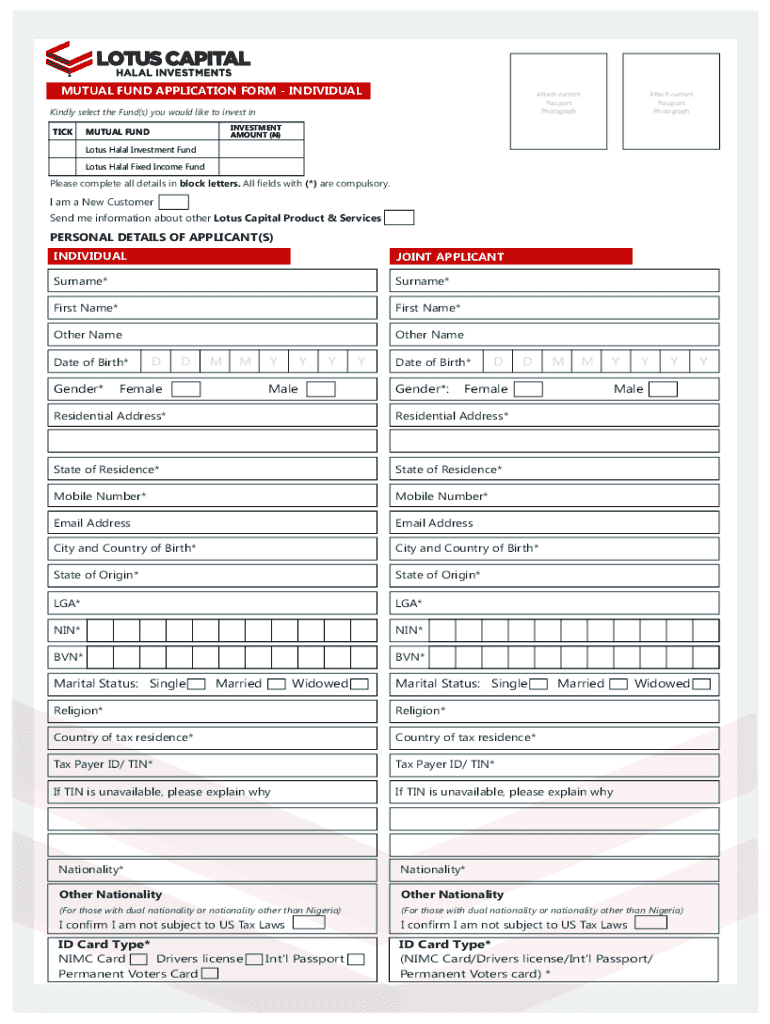

A mutual fund application form serves as the gateway for individuals to invest in mutual funds. This critical document captures essential information about the investor, including personal identification and investment preferences. As a first step in the investment journey, the application form is pivotal in ensuring compliance with regulatory requirements and facilitating the smooth execution of investment choices.

The importance of the mutual fund application form cannot be overstated. It not only helps mutual fund companies to verify the identity of their investors but also ensures that investments align with the regulatory framework designed to protect investors and maintain market integrity.

Preparing for the application

Before diving into the complexities of the mutual fund application form, it's crucial to gather all necessary documentation. This step ensures a smooth and efficient application process. Essential documents typically include identity proof, address verification, and income documentation.

For identity proof, investors can present documents like a PAN Card or Aadhar Card. Address proof can include utility bills or a passport. Income proof might consist of recent salary slips or bank statements. Collecting these documents ahead of time streamlines the application process significantly.

Eligibility criteria

Another aspect to consider is the eligibility criteria for investing in mutual funds. Generally, investors must be of a certain age—usually at least 18 years old—and should meet residency and citizenship requirements as specified by the fund house.

Completing the KYC (Know Your Customer) process is mandatory for all investors. This includes validating personal details and ensuring compliance with financial regulations, which prevents illegal activities such as money laundering.

Understanding investment goals

Before completing the application, it's vital to assess personal investment goals. Factors such as risk appetite and investment horizon should be taken into account. For instance, someone with a low-risk tolerance might prefer debt funds, while another with a longer investment horizon could lean towards equity funds.

Setting clear investment goals will not only help in choosing the right funds but also aid in future financial planning.

Step-by-step guide to filling out the mutual fund application form

Filling out the mutual fund application can seem daunting, but breaking it down into sections simplifies the process. The primary sections include personal information, investment details, nominee information, and bank account information.

Section 1: Personal Information

This section requires basic personal details such as your name, address, and date of birth. It’s crucial to provide accurate information to avoid discrepancies that may delay processing.

Double-check spelling errors and ensure that details align with the documents you are submitting.

Section 2: Investment Details

Choosing the type of mutual fund is a crucial step. Investors should specify the desired fund category (equity, debt, or hybrid) as well as the investment amount and frequency, whether it's a one-time investment or an SIP (Systematic Investment Plan).

Section 3: Nominee Information

Nominating a beneficiary is vital for ensuring that your investment is transferred smoothly to a designated individual in case of unforeseen events. Fill in the nominee details accurately to avoid complications later.

Section 4: Bank Account Information

Linking your bank account for transactions is another critical component of the application. Make sure to double-check the account number and IFSC code for accurate processing of investment transactions.

Interacting with the mutual fund application form

Once the form is filled out, you may need to make changes. Tools like pdfFiller can help you edit application forms without losing the original format, ensuring clarity in all modifications.

Editing filled forms

Using pdfFiller’s editing features enables you to adjust the document in real time, enhancing accuracy and efficiency in the editing process.

Signing the application form

After completing the application, you may opt for eSigning, which is legally recognized and simplifies the submission process. This method allows you to sign the document electronically, saving both time and effort.

Submitting the application

Submission can be completed online through the fund house's website or physically at a designated branch. Expect to receive an acknowledgment confirming your application, which may take a few days to process.

Managing your mutual fund application post-submission

Tracking your application status is essential for knowing where you stand in the investment process. You can typically check your application status through the fund house's website or by contacting their customer support.

Making changes post-submission

Should any corrections be necessary after submission, most fund houses allow updates through a formal request process. It's recommended to contact customer support for guidance on the necessary steps to make corrections.

Understanding communication and notifications

Once your application is submitted, you can expect various communications from the fund house, including confirmations, investment updates, and important notices. Staying in touch with the mutual fund company ensures that you are informed about key milestones and developments related to your investments.

Utilization of interactive tools on pdfFiller

pdfFiller offers a range of document management features that make it easier for users to organize their investment documentation securely in the cloud. The platform allows for collaboration, making it ideal for team scenarios where multiple individuals might contribute to investment planning.

How to utilize document management features

Investors can easily organize and retrieve their documents, ensuring that essential records are at their fingertips. This can be especially beneficial for maintaining an organized financial portfolio.

Resources for further assistance

pdfFiller provides access to user guides and FAQs that can answer common questions regarding the mutual fund application process. Engaging with customer support can offer personalized help for specific queries.

Conclusion of the application process

In summary, completing a mutual fund application form is a straightforward process if approached systematically. By gathering the necessary documents, understanding investment goals, and accurately filling out each section of the form, investors can pave the way for a successful investment journey.

Making informed investment decisions also involves continuous learning about mutual funds and utilizing handy tools available on platforms like pdfFiller to manage documentation efficiently.

Frequently asked questions (FAQ)

A variety of queries can arise during the mutual fund application process. Common questions might include what to do if there are discrepancies in the application, how to contact customer support, or how long it usually takes for application approval.

For troubleshooting common issues, it is advisable to refer to the FAQs on the mutual fund company's website or reach out directly to customer support for more tailored assistance.

Additional guidance for future reference

Investors should periodically review and update their investment profiles to reflect any changes in their financial situation or investment goals. This proactive approach ensures that individuals remain aligned with their financial objectives.

Additionally, learning about other investment opportunities can further enhance one's financial portfolio. pdfFiller can be a valuable resource in managing and executing these various investment strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete mutual fund application form online?

Can I edit mutual fund application form on an iOS device?

How do I complete mutual fund application form on an iOS device?

What is mutual fund application form?

Who is required to file mutual fund application form?

How to fill out mutual fund application form?

What is the purpose of mutual fund application form?

What information must be reported on mutual fund application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.