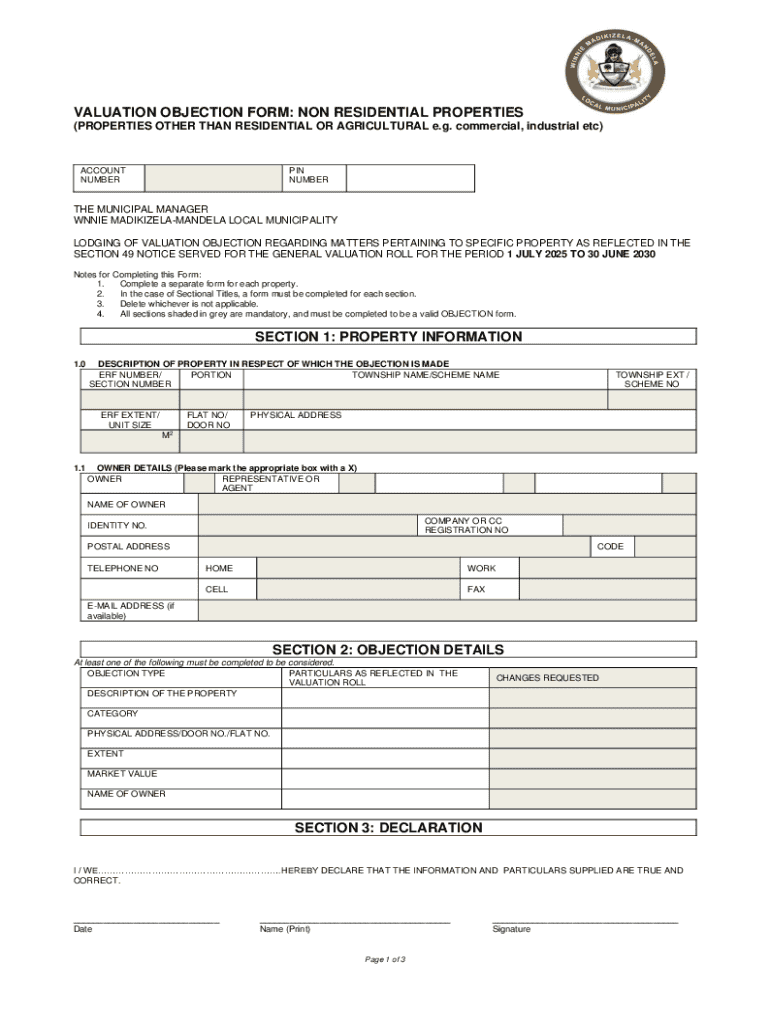

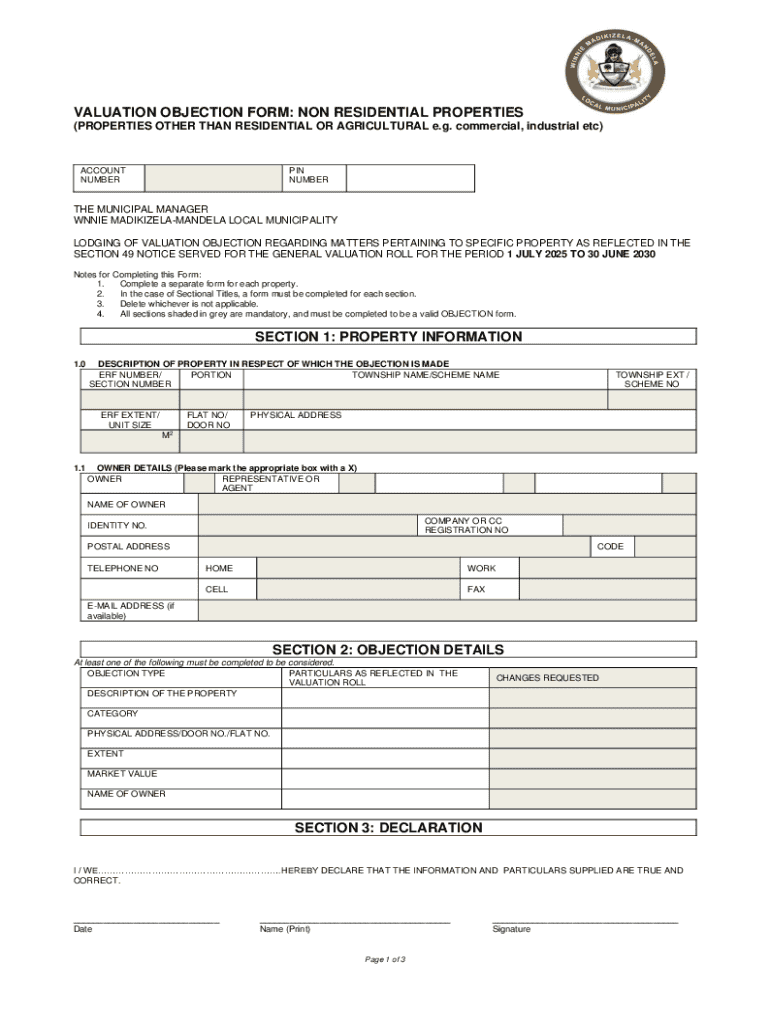

Get the free Valuation Objection Form: Non Residential Properties

Get, Create, Make and Sign valuation objection form non

Editing valuation objection form non online

Uncompromising security for your PDF editing and eSignature needs

How to fill out valuation objection form non

How to fill out valuation objection form non

Who needs valuation objection form non?

Valuation Objection Form Non Form: A Comprehensive Guide

Understanding valuation objections

A valuation objection is a formal request to review and potentially alter a property assessment that one believes to be inaccurate. This process is essential for property owners who feel they are being overtaxed or unfairly assessed. Filing a valuation objection can lead to significant financial implications, making it a crucial step in property ownership.

The importance of filing a valuation objection lies in its potential to correct assessment errors that can affect not only property taxes but also market value perception. By disputing a valuation, property owners can ensure they are not overpaying or facing unfavorable market conditions due to an inflated value.

When to use a valuation objection form vs. non form

Choosing between a valuation objection form and a non-form method can significantly impact the outcome of your objection. A standard form is often structured and may need specific information, while a non-form approach allows for more flexibility in presenting your case.

In situations where detailed narratives or unique evidence are required, a non-form submission can be highly beneficial. For instance, unique property features or market trends might not be appropriately addressed through a standard form.

Failure to utilize the standard form when required can result in delays or outright rejection of the objection. Understanding local regulations is vital to navigate this process effectively.

Step-by-step guide to filing a valuation objection

Preparation is key when filing a valuation objection, even when using a non-form approach. Begin by gathering all necessary documentation related to the property’s assessment. This includes the original property valuation notice, evidence of property characteristics, and comparisons with similar properties.

Preparing your documentation

Once your documentation is ready, ensure data accuracy. Verify all information presented aligns with tax records and market data. This verification process is crucial for building a compelling case.

Filling out the valuation objection non form

When filling out a non-form objection, pay close attention to key sections. Start with a concise introduction that outlines your objection's basis, followed by detailed justifications supported by your evidence.

Once completed, submit your non-form objection to the appropriate local tax office or assessment board. Ensure to keep a copy of your submission for your records.

Submitting your objection

Frequently asked questions (FAQs) about valuation objection forms

Filing a valuation objection often comes with questions. Understanding the nuances can help demystify this process.

Interactive tools for managing your valuation objection

Using pdfFiller, managing your valuation objection becomes a streamlined process, utilizing interactive tools that enhance efficiency and clarity in documentation.

Additional insights on related topics

Staying informed on updates in land tax assessment regulations is vital for property owners. Regularly reviewing local policies can help you understand potential changes impacting your property assessment.

Leveraging pdfFiller for your document needs

pdfFiller presents a robust platform for managing all document-related needs, including valuation objections. Its functionalities make document creation, editing, and collaboration seamless.

Dissemination of information

Sharing your valuation objection strategies can empower other property owners. Community forums often facilitate discussions where individuals can exchange tips and insights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit valuation objection form non from Google Drive?

Where do I find valuation objection form non?

Can I edit valuation objection form non on an Android device?

What is valuation objection form non?

Who is required to file valuation objection form non?

How to fill out valuation objection form non?

What is the purpose of valuation objection form non?

What information must be reported on valuation objection form non?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.