Get the free New Zealand Tax Residency Questionnaire 2025

Get, Create, Make and Sign new zealand tax residency

How to edit new zealand tax residency online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new zealand tax residency

How to fill out new zealand tax residency

Who needs new zealand tax residency?

Understanding the New Zealand Tax Residency Form: A Comprehensive Guide

Understanding New Zealand tax residency

Tax residency in New Zealand represents the government’s classification of an individual's tax obligations based on their residency status. Establishing tax residency is crucial as it determines whether you are liable for New Zealand taxes on your worldwide income or just income sourced from New Zealand.

Tax residency differs from immigration status; an individual can reside in New Zealand for tax purposes even if they are not a permanent resident or citizen. For example, someone on a temporary work visa could be classified as a tax resident based on the time spent in the country. Determining this status not only affects tax rates but also impacts eligibility for various tax credits and deductions.

Establishing your tax residency is vital because it influences your total tax liability. For instance, New Zealand residents pay tax on their global income, while non-residents are only taxed on New Zealand-sourced income. Understanding your residency status from the outset can save you significant financial repercussions later.

Who needs to complete a tax residency form?

Several categories of individuals may need to complete a New Zealand tax residency form. Firstly, individuals relocating to New Zealand for work or education purposes must establish their residency status for tax compliance. This also applies to returning Kiwis, who, despite being citizens, may need to clarify their residency status upon returning home.

Temporary workers and expatriates living and working in New Zealand may be required to fill out a tax residency form to determine their tax obligations accurately. Each of these categories faces unique tax implications that can range from eligible tax credits to the specific calculation of taxable income.

Becoming a New Zealand tax resident

Becoming a tax resident in New Zealand involves meeting specific criteria outlined by New Zealand’s Inland Revenue Department (IRD). One of the key criteria is the 183-day rule, which states that if you are in New Zealand for more than 183 days in any 12-month period, you will generally be considered a tax resident.

Beyond this, tax residency can also hinge on your ties to New Zealand. This includes your social connections, family presence, and whether you own or rent a home in the country. Additionally, the definition of a permanent place of abode becomes significant; it essentially refers to your permanent home, which could affect your residency status.

Changes in your residency status can occur based on various factors, such as leaving New Zealand for an extended period or changing your primary place of residence.

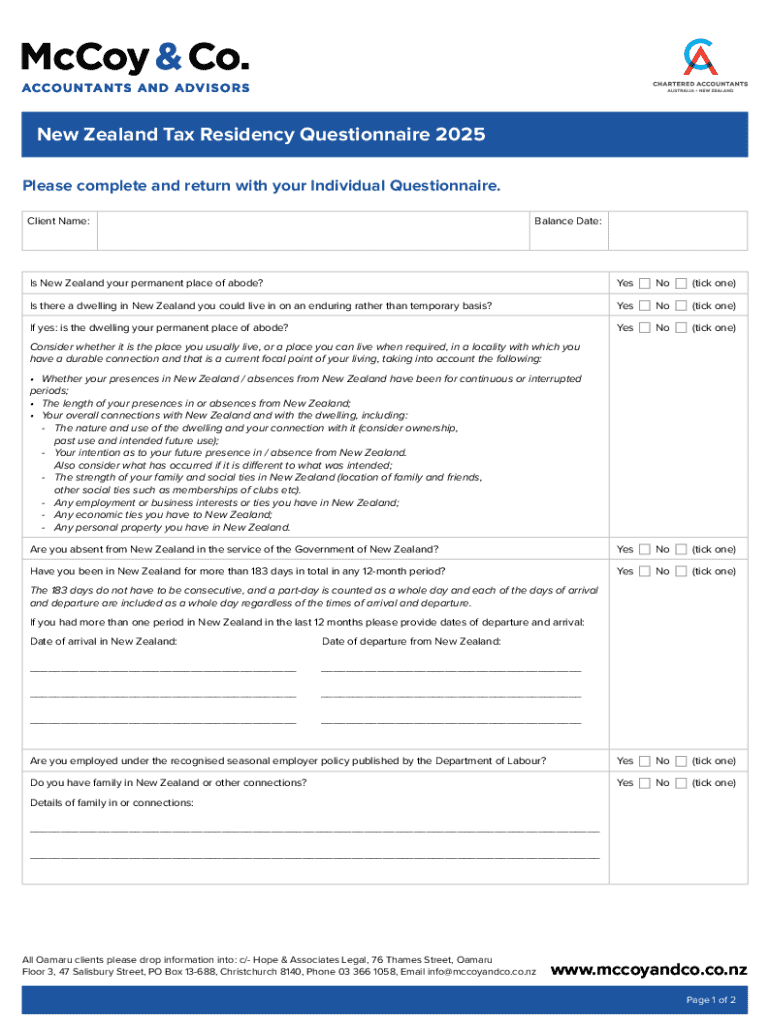

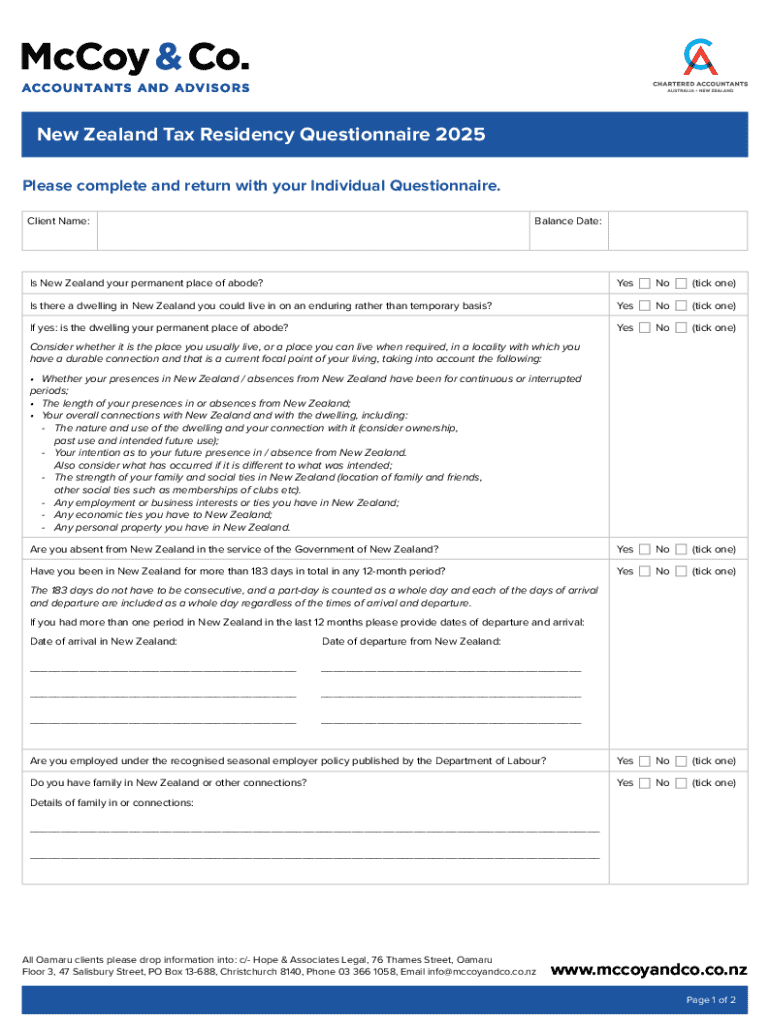

Completing the New Zealand tax residency form

Filling out the New Zealand tax residency form can feel daunting, but breaking it down into a step-by-step guide simplifies the process. First, access the New Zealand tax residency form via the IRD website or designated financial services platform such as pdfFiller.

Common errors to avoid include not specifying your residency details accurately or failing to provide necessary supporting documentation. Attention to detail in filling out the form can prevent compliance issues in the future.

Managing your tax residency status

Once you establish your tax residency status in New Zealand, it’s crucial to monitor and maintain it over time. If your circumstances change, such as moving abroad or altering your working status, you need to report these changes to the IRD quickly to ensure compliance with tax obligations.

Ongoing compliance is important, especially as tax laws and regulations may evolve, impacting your residency classification. Keeping the IRD informed about changes to your residency status is not only a legal requirement but also ensures that you are taxed appropriately.

Resources and tools for tax residency implications

For those navigating the complexities of New Zealand tax residency, a wealth of resources is available. Online platforms provide extensive guidelines, including the IRD's official website where users can find detailed information on closure procedures. Interactive tools, like those available on pdfFiller, allow for easy document management and completion of the tax residency form.

Moreover, reviewing examples of completed forms can serve as practical references to ensure accuracy while filling out your own document.

Special cases in tax residency

Certain groups face unique tax residency considerations in New Zealand. For instance, seasonal workers, like those in horticulture, may only be tax residents during their periods of work in the country. Fishing crew members also have specific criteria for tax residency based on their work schedules.

Additionally, government workers posted abroad or international students may navigate distinct taxation rules. Understanding these exceptions is crucial to ensure compliance and maximize eligibility for potential tax benefits.

FAQs about New Zealand tax residency

Navigating tax residency can prompt a barrage of questions. Common queries often revolve around definitions, criteria, and how changes in status affect tax obligations. For example, individuals frequently ask what happens if they spend less than 183 days but maintain strong ties to New Zealand or if rental properties influence their residency status.

Real-world case studies provide insight into complex scenarios, helping potential residents understand nuanced situations that may apply to them.

Utilizing pdfFiller for document management

pdfFiller offers an efficient cloud-based platform for creating, sharing, and editing necessary documents, including the New Zealand tax residency form. Users can easily edit and customize forms to suit their needs, making the process smoother and more accessible.

Utilizing pdfFiller's eSigning features, teams can collaborate and finalize documents, ensuring that submissions are not only accurate but also timely. This functionality uniquely positions pdfFiller as an invaluable resource for managing residency forms seamlessly.

Contact information for tax residency queries

For direct queries regarding tax residency, always refer to New Zealand's Inland Revenue Department (IRD) for official guidance. Their contact details are readily available on the IRD’s website, providing an accessible resource for your inquiries.

Additionally, for any assistance concerning document handling and managing your tax residency form, you can easily reach out to pdfFiller’s support team for personalized help.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my new zealand tax residency in Gmail?

How can I modify new zealand tax residency without leaving Google Drive?

How do I edit new zealand tax residency on an iOS device?

What is new zealand tax residency?

Who is required to file new zealand tax residency?

How to fill out new zealand tax residency?

What is the purpose of new zealand tax residency?

What information must be reported on new zealand tax residency?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.