Get the free M109a

Get, Create, Make and Sign m109a

How to edit m109a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out m109a

How to fill out m109a

Who needs m109a?

Understanding the m109a form: A comprehensive guide

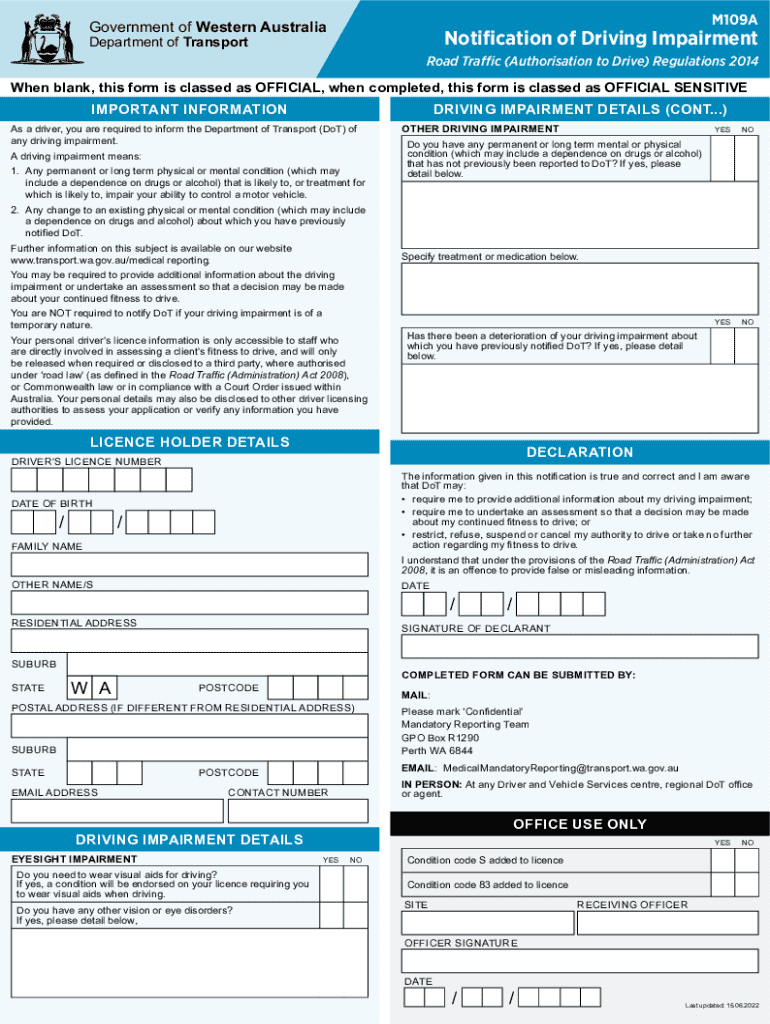

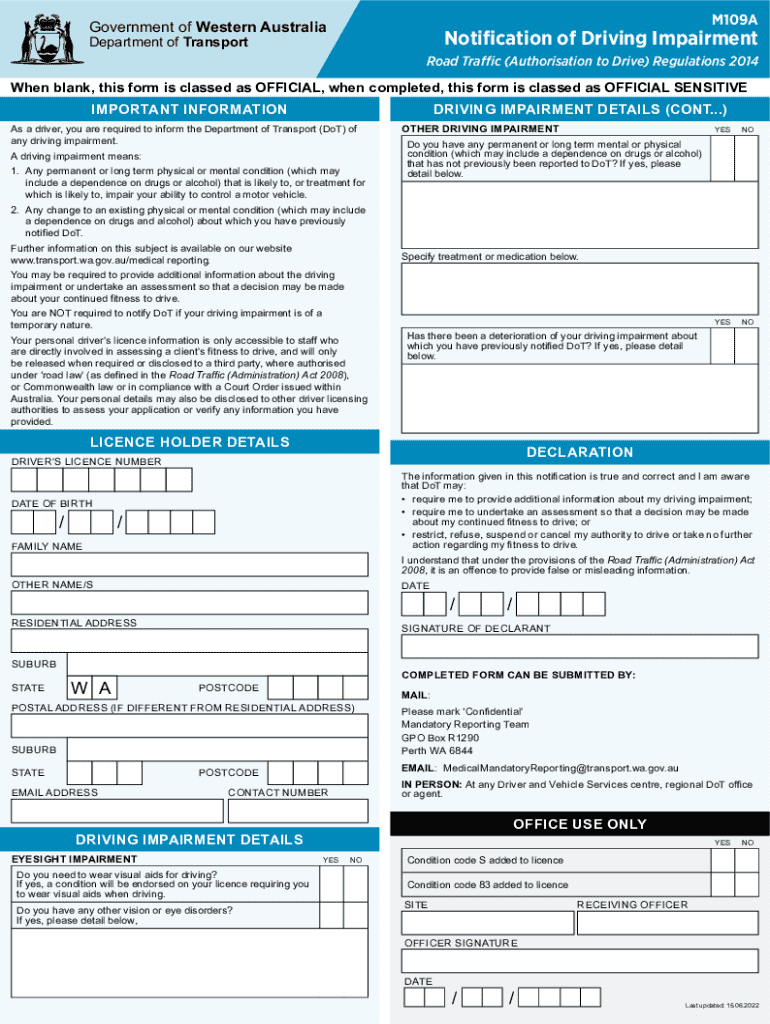

Understanding the m109a form

The m109a form is an essential document in various administrative and legal processes. Primarily, it serves as a request for a specific action or service, often related to financial transactions or official inquiries. Understanding its nuances is crucial for individuals and organizations to navigate bureaucratic requirements effectively.

The purpose of the m109a form extends beyond its immediate requirements; it acts as a formal communication tool that links the applicant with the processing authority. Accurate completion is vital, as errors or omissions can lead to delays, rejections, or even legal implications. Therefore, familiarity with the m109a form's structure and intent is paramount.

Who needs the m109a form

The m109a form is targeted towards both individuals and organizations seeking to complete bureaucratic procedures. Job applicants, property owners, and businesses often find themselves needing this form for various purposes, including tax submissions, loan applications, and compliance documentation.

Common scenarios that require the m109a form include appealing a decision, requesting reconsideration of an official action, or submitting claims for benefits. For individuals, this might involve tax claims or social security requests. Meanwhile, for organizations, the form is often a requirement for compliance audits or financial reporting.

Key components of the m109a form

Familiarity with the components of the m109a form is crucial for successful completion. The form typically includes several key sections that require specific information to clarify the request and establish the validity of the submission.

The primary sections include personal information requirements, financial data inclusions, and certification or signature areas. Each component plays a critical role in ensuring that the form is processed accurately. Personal information identifies who is making the request, while financial data verifies eligibility or need for assistance. The certification area signifies that the information provided is true and accurate, preventing fraudulent misuse.

How to fill out the m109a form

Filling out the m109a form can feel daunting, but a systematic approach simplifies the process. Start by gathering all necessary information, including identification, financial records, and any supporting documents. This foundational step ensures consistency in the data you provide.

Next, complete each section of the m109a form accurately. Pay close attention to detail and double-check for common mistakes like typos or miscalculations. Using clear and concise language is beneficial, as it helps convey your message effectively.

Editing the m109a form with pdfFiller

Editing the m109a form has never been easier, thanks to tools like pdfFiller. This platform offers interactive capabilities allowing users to customize the form effortlessly. You can access the m109a form directly through pdfFiller and tap into an array of editing features designed to enhance your experience.

With pdfFiller, users can add text, checkboxes, or even signatures directly on the form. These features not only streamline the editing process but also contribute to maintaining a professional appearance for all your documents. The advantage of editing online contrasts sharply with traditional methods, offering a more efficient, clutter-free, and accessible solution.

Signing the m109a form

The significance of signing the m109a form cannot be overstated. An electronic signature (eSignature) adds a layer of legality and formality to your submission, confirming your intent and commitment to the request. By using pdfFiller, signing the form is simple and straightforward.

pdfFiller supports eSigning features that ensure your m109a form is legally valid and accepted by authorities requiring submissions. This shift towards electronic signatures not only enhances convenience but also complies with the latest regulations governing digital documentation.

Collaborating on the m109a form

Collaboration on the m109a form is seamless with pdfFiller. This cloud-based platform allows teams to work together, track changes, and manage versions effectively. Sharing the form for feedback or input can dramatically improve the quality and accuracy of the completed document.

By utilizing the collaborative features of pdfFiller, teams can streamline processes and ensure that every stakeholder has a say in the final version, promoting greater accountability and precision in submissions. Managing changes collectively reduces errors and enhances overall workflow efficiency.

Managing the m109a form post-completion

Once completed, managing the m109a form is simple with pdfFiller’s robust features for storing and organizing documents. Completed forms can be accessed anytime, anywhere, thanks to the cloud-based storage options available. This allows for easier retrieval and management of your documents when required.

Moreover, pdfFiller offers various sharing options, allowing users to send their completed m109a forms to any recipient effortlessly. You can also export the form into different formats, such as PDF or Word, accommodating varying administrative requirements.

Troubleshooting common issues with the m109a form

While navigating the m109a form process, you might encounter several common issues, from filling errors to concerns about submission guidelines. It’s essential to stay informed and prepared to address these challenges. Frequently asked questions often arise, such as how to edit the form after submission or what to do if the form is rejected.

Finding solutions to these issues typically involves consulting authoritative resources or using platforms like pdfFiller, which often provide tooltips and detailed advice on filling, signing, and submitting the m109a form successfully.

Frequently asked questions about the m109a form

The m109a form generates many inquiries concerning its purpose and usage. Common questions revolve around who needs to complete the form, what information is required, and the step-by-step process for submission. Clarifying these aspects is pivotal for successful document management and compliance with legal standards.

Additionally, users often seek clarification on the legal implications of electronic signatures and how they conform to regulatory frameworks. Be sure to address these inquiries with comprehensive resources to ensure users feel equipped to navigate the m109a form confidently.

Related documents and forms

Several documents may be related to the m109a form, depending on the context in which it is used. For example, forms related to tax filings or loan applications often require accompanying documentation that complements the m109a submission. Understanding these interrelations can improve workflow efficiency.

Connecting these forms within your procedures ensures that all necessary documentation is gathered and submitted collectively, streamlining processes and minimizing administrative back-and-forth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my m109a directly from Gmail?

Can I sign the m109a electronically in Chrome?

How do I fill out m109a on an Android device?

What is m109a?

Who is required to file m109a?

How to fill out m109a?

What is the purpose of m109a?

What information must be reported on m109a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.