Get the free Charitable Giving Form

Get, Create, Make and Sign charitable giving form

Editing charitable giving form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charitable giving form

How to fill out charitable giving form

Who needs charitable giving form?

Charitable Giving Form: A Comprehensive Guide

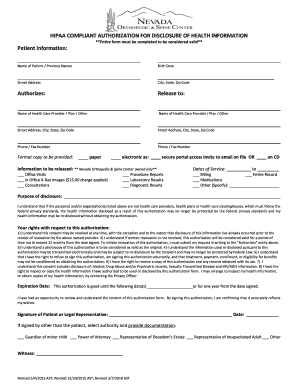

Understanding charitable giving forms

A charitable giving form is essential documentation used by nonprofits to collect details about donations. Its primary purpose is to facilitate contributions while ensuring accurate records for both the donor and the charitable organization. These forms verify the legitimacy of donations, enabling charities to maintain compliance and providing donors with an avenue for tax deductions.

For many donors, understanding the importance of these forms extends beyond mere paperwork. They serve as guarantees for tax deductions, allowing individuals and businesses to receive benefits for their philanthropic activities. Proper recordkeeping, thanks to these documents, can significantly ease year-end tax preparations.

Key elements of charitable giving forms

Charitable giving forms typically require specific key elements to be valid and effective. Donor details, including the full name, mailing address, and preferred contact information, form the core of the document. Additionally, it must outline donation specifics such as the amount, purpose, and method of contribution, whether cash, check, or credit card.

Organizational details are equally important. This includes the charity's name, tax identification number, and a contact person within the organization. This clarity ensures that both the donor and the organization have the necessary information for proper recordkeeping and compliance.

Legal requirements set forth by the IRS further outline the need for thorough documentation. Organizations must ensure compliance with these regulations as they are vital for maintaining tax-exempt status and ensuring that donations are adequately accounted for.

How to fill out a charitable giving form

Filling out a charitable giving form can be straightforward when approached methodically. Start by downloading the form from the organization's website or accessing it through a platform such as pdfFiller.

Once you have the form ready, accurately fill out your donor information, ensuring all necessary details are complete. Specify the type of donation you are making, along with the amount, making sure to indicate if it is a one-time or recurring donation. If applicable, add any personal notes or designations that can guide the organization in allocating your gift.

Using pdfFiller for charitable giving forms

pdfFiller provides an efficient way to edit charitable giving forms. The platform allows you to customize forms as per your needs, streamlining what can often be a tedious process. Users can easily insert their donor information, specify donation types, and include relevant notes with just a few clicks.

The use of eSignatures is crucial for adding legitimacy to your forms. pdfFiller offers integrated eSignature options, simplifying the signing process. Once completed, you can save your form directly within the platform for convenient access later.

Sharing and submitting forms is straightforward with pdfFiller. You can securely send your completed forms directly to charitable organizations through the platform, while also keeping thorough records of all submissions for your personal reference.

Specialty forms for different donation types

Different types of donations often require specific forms to ensure proper compliance and tracking. For cash donations, it's vital to utilize the designated cash donation forms. These forms outline whether the donation is a one-time gift or a recurring pledge, facilitating seamless financial tracking.

In-kind donations, which involve non-cash benefits, also necessitate specific documentation. These forms often require a valuation method to determine the worth of the goods or services donated. Properly recording this information can provide significant advantages for both tax deductions and organizational inventory management.

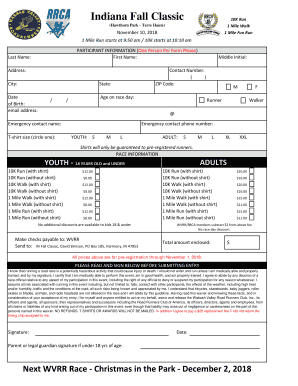

When participating in events, event ticket donation forms may be required. These help streamline the process of documenting ticket purchases and can often serve as receipts for donors, which are essential for financial records.

Unique considerations for charitable giving

One unique aspect of modern charitable giving is the availability of automated donation receipts. These receipts, usually electronic, simplify the process of recordkeeping for donors. By setting up automated systems for monthly contributions, donors can ensure that they receive electronic receipts promptly, which can be crucial during tax season.

When it comes to year-end tax receipts, gathering and saving your donation receipts becomes essential. Utilizing pdfFiller can simplify this process; it allows you to maintain organized records and provides easy access when tax preparation begins.

Creating a personal log of donations with correct documentation is vital for tracking your charitable contributions. With pdfFiller, you can efficiently manage and analyze your contribution patterns, which can aid in planning future donations.

Case studies and real-life examples

Numerous inspiring stories demonstrate the power of effective charitable giving forms. One notable example involved a local charity that streamlined its donation process through strategically designed forms. As a result, the organization saw a 30% increase in donations during the following fundraising campaign, showcasing how effective documentation can significantly impact charitable efforts.

Testimonials from individuals and teams leveraging pdfFiller add additional context. Users often share positive feedback about how easy it is to edit, sign, and manage their charitable giving forms, highlighting the platform's role in enhancing their experience with charitable contributions.

Engaging with the charitable community

Engagement within the charitable community extends beyond just monetary contributions. Participating in fundraising events can significantly enhance visibility and support for causes. By incorporating well-organized forms into the event logistics, charities can easily track donations and enhance the overall experience for attendees.

Spreading awareness about charitable giving through social media and online platforms is crucial. Encouraging group or corporate giving initiatives can amplify the impact of charitable efforts, creating a culture of giving within organizations. The right charitable giving forms can support these campaigns by ensuring all contributions are well-documented and compliant.

Volunteering opportunities present another avenue for engagement. Individuals seeking to make an impact beyond donations can organize and manage volunteer commitments using pdfFiller to track their schedule and responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute charitable giving form online?

How do I edit charitable giving form online?

How can I fill out charitable giving form on an iOS device?

What is charitable giving form?

Who is required to file charitable giving form?

How to fill out charitable giving form?

What is the purpose of charitable giving form?

What information must be reported on charitable giving form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.