Get the free pdf filler

Get, Create, Make and Sign pdf filler form

How to edit pdf filler form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdf filler form

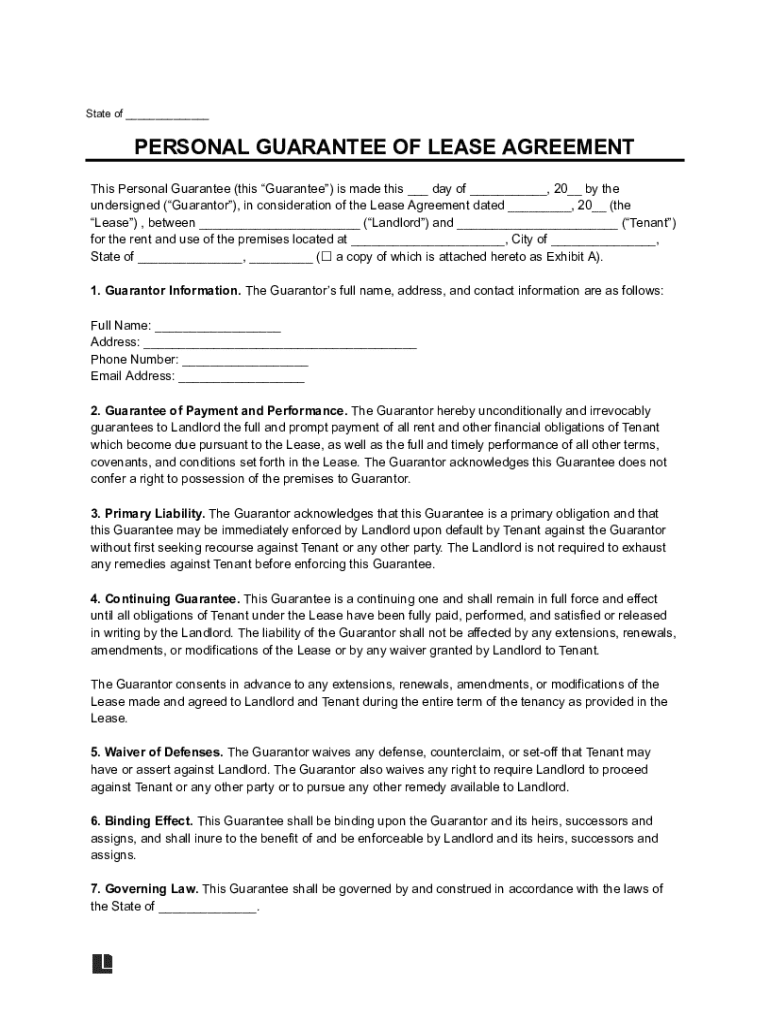

How to fill out personal guarantee of lease

Who needs personal guarantee of lease?

Personal Guarantee of Lease Form: A Comprehensive Guide

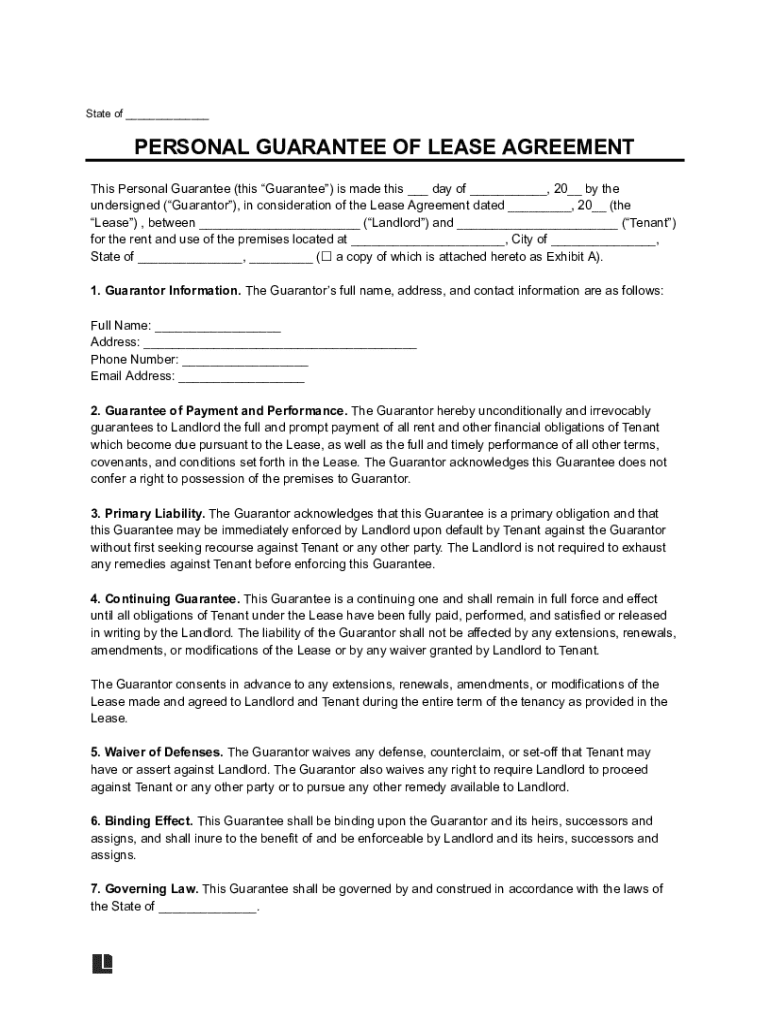

Understanding the personal guarantee of lease form

A personal guarantee of lease form acts as a legally binding contract that obligates a third party, known as a guarantor, to cover the lease payments if the primary tenant defaults. This instrument is crucial in commercial leasing, where landlords seek financial assurance that their lease will be honored, regardless of the tenant's financial circumstances.

The legal implications of this form are significant. By signing, the guarantor assumes responsibility for the lease obligations alongside the tenant. This means that if the tenant cannot meet the rental payments or damages the property, the landlord has the right to pursue the guarantor for compensation. Understanding this function of the form is fundamental for potential guarantors to assess their financial exposure.

Why is a personal guarantee important in leases?

A personal guarantee is vital for landlords as it mitigates risks associated with leasing property. Without a personal guarantee, landlords may find it challenging to ensure rent payments from tenants who may be financially unstable or untested. Landlords effectively use personal guarantees as a protective measure, ensuring they can recover losses through the financial backing of the guarantor.

Additionally, a personal guarantee offers a form of financial assurance that can be necessary for lease negotiations. It strengthens the tenant's application from the landlord’s perspective, thus making it easier for them to secure lease agreements even if the tenant has a limited credit history. The presence of a guarantor can be a decisive factor in lease approval processes.

Key components of a personal guarantee of lease form

Understanding the components of the personal guarantee of lease form can guide both tenants and guarantors in completing and negotiating this document effectively. Here are the key elements included in the form:

Responsibilities and liabilities

Understanding the responsibilities stipulated in the personal guarantee of lease form is crucial for both tenants and guarantors. Key areas of focus include payments for utilities, maintenance responsibilities, and conditions of default.

Here are the important responsibilities and liabilities:

Legal considerations

Legal aspects of personal guarantees can vary widely depending on jurisdiction. Each state may have different laws and regulations that affect lease agreements and guarantees. It is vital for both tenants and guarantors to understand the governing laws applicable to their specific lease agreements.

Consulting with a legal professional familiar with local real estate laws can help clarify obligations and rights, ensuring compliance and reducing the risk of unexpected liabilities. For instance, certain states may require specific disclosures or have limits on a guarantor’s liability, making due diligence essential.

Related templates and resources

Understanding the differences between personal and corporate guarantees is essential for those involved in property leasing. Personal guarantees generally require an individual’s assets and income to back the lease, while corporate guarantees use a company's financial standing.

For those exploring lease agreements, various online templates can help make the drafting process more efficient. These templates typically include standard clauses necessary for compliance with lease laws and can be customized to suit specific leasing situations.

Frequently asked questions (faq)

Many potential guarantors have questions about the scope and implications of signing a personal guarantee of lease. Here are commonly inquired topics:

Expert tips for completing the form

Completing the personal guarantee of lease form requires careful attention to detail to avoid common mistakes. Here are steps to ensure you're filling it out correctly:

Best practices also suggest that individuals negotiate terms that suit their financial capacity before agreeing to the guarantee. Understanding your financial limits can help avoid future disputes.

Utilizing pdfFiller for your personal guarantee of lease form

pdfFiller offers interactive tools designed to simplify the process of creating and managing your personal guarantee of lease form. Users can easily edit their forms to include necessary information, ensuring all essential details are precise.

The eSigning process is secure and user-friendly, making it simple for all parties involved to sign off on the document electronically. This feature eliminates the hassles of physical signatures and expedites the leasing process.

Moreover, collaboration tools provided by pdfFiller allow multiple stakeholders to work together efficiently on lease documents, making adjustments and ensuring clarity in roles and responsibilities.

Understanding your rights and obligations

It is vital for guarantors to understand the consequences of defaulting on a personal guarantee. If a tenant fails to pay rent or violates lease terms, the guarantor may be called upon to fulfill those obligations, leading to potential financial strain.

To manage any disputes related to the lease or guarantee, parties should look for dispute resolution mechanisms included in the lease agreement. These may range from arbitration to mediation, providing structured pathways to address disagreements amicably.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pdf filler form in Gmail?

Can I create an electronic signature for signing my pdf filler form in Gmail?

How can I edit pdf filler form on a smartphone?

What is personal guarantee of lease?

Who is required to file personal guarantee of lease?

How to fill out personal guarantee of lease?

What is the purpose of personal guarantee of lease?

What information must be reported on personal guarantee of lease?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.