Get the free pdf filler

Get, Create, Make and Sign pdf filler form

How to edit pdf filler form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdf filler form

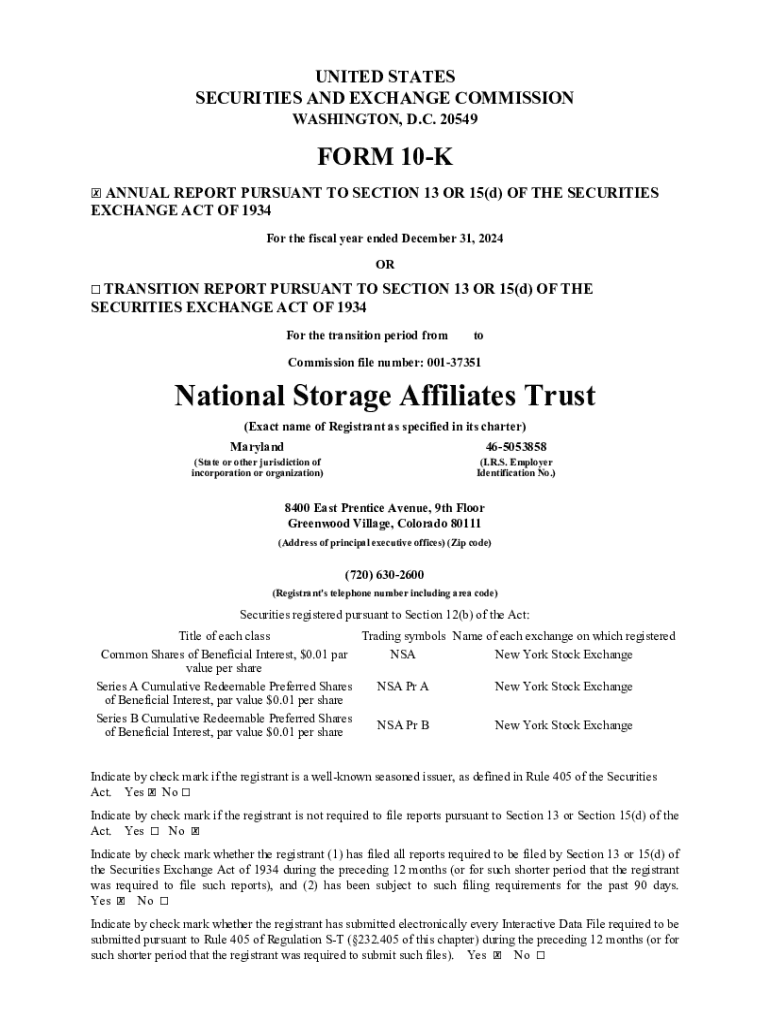

How to fill out form 10-k

Who needs form 10-k?

Form 10-K: A Comprehensive How-to Guide

Understanding the form 10-K

The Form 10-K is a comprehensive annual report that publicly traded companies must file with the U.S. Securities and Exchange Commission (SEC). This document provides a detailed summary of a company's financial performance and includes a wealth of information crucial for investors and stakeholders. Unlike regular press releases, the 10-K offers in-depth and audited data that allows for clear insights into a company's operations, risks, and financial stability.

The significance of the Form 10-K lies in its role in corporate transparency; it ensures that investors have access to key information needed for informed decision-making. This transparency fosters trust and confidence among stakeholders, which is vital in today's competitive finance landscape.

Importance for investors and stakeholders

The Form 10-K is an invaluable tool for investors looking to assess the long-term viability of a company. By dissecting the critical components of this document, investors can make informed decisions on where to allocate their capital. The comprehensive data within the 10-K supports investment analysis, helping stakeholders identify both opportunities and potential risks.

In addition, the Form 10-K plays a pivotal role in risk assessment. It outlines a company’s risk factors, management discussion, and legal standings, enabling investors to gauge potential downsides. By examining risk disclosures, stakeholders can better understand the challenges the company faces, making it an essential part of the investment evaluation process.

Key components of the form 10-K

The Form 10-K consists of several key sections, each serving a specific purpose in providing essential information about the company. Understanding the structure of the form is important to maximize its utility.

Explanation of each item in the form

Each item in the Form 10-K is crucial for providing clarity and insight into the company’s operations. Here’s a brief overview of key items:

Filing requirements and deadlines

Not all companies need to file a Form 10-K. The obligation typically falls upon publicly traded companies, as well as certain foreign companies that have registered with the SEC. Understanding who is required to file is essential for both compliance and market integrity.

The deadlines for filing vary based on the company's public float. For example: - Larger accelerated filers must submit their Form 10-K within 60 days after the fiscal year end. - Accelerated filers face a deadline of 75 days, while non-accelerated filers have 90 days to submit. Ensuring timely and accurate filing is critical to maintaining stakeholder trust and avoiding regulatory penalties.

How to access and retrieve form 10-Ks

Accessing Form 10-K documents is straightforward, thanks to the SEC’s Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system. Investors can efficiently search for filings by navigating to the EDGAR database, where they can find a range of filings.

To locate specific company filings, follow these steps: 1. Visit the SEC's EDGAR website. 2. Use the 'Search' bar to input the company name or ticker symbol. 3. Filter your search results by document type, selecting '10-K'. 4. Click on the applicable filing to view the full document.

Filling out a form 10-K: Step-by-step instructions

Completing a Form 10-K can be a complex but manageable task, especially with the right preparation. Before filling out the form, companies should gather necessary financial documents and supporting information, ensuring accuracy throughout the process.

Collaboration is key. Teams should work together to streamline data collection, making use of tools that facilitate communication and document sharing. Follow these steps to fill out each section effectively: 1. Break down the form into manageable parts. 2. Assign team members specific sections based on their expertise. 3. Use standardized templates to ensure consistency. 4. Review each section for compliance and accuracy before final submission.

Editing and managing your form 10-K with pdfFiller

pdfFiller offers a robust solution for editing and managing Form 10-K documents. Its user-friendly interface allows for seamless uploading of Form 10-K templates, enabling quick edits and updates to ensure compliance.

Collaboration features, such as real-time commenting and editing, enhance team communication. Users can add notes and comments to sections, making it easier to track changes and facilitate discussions. If you need to enhance your document further, pdfFiller provides various editing tools to modify text, insert images, and format the document to meet your specific needs.

When it comes to signing, pdfFiller guarantees compliance and security with its secure eSigning solutions. Steps for eSigning your Form 10-K include: 1. Upload your completed document. 2. Use the eSignature tool to add your digital signature. 3. Send it out for signatures if necessary.

Common challenges when filing form 10-K

Navigating the intricacies of disclosure requirements when filing Form 10-K can pose challenges. Companies often grapple with adhering to the extensive regulatory obligations, ensuring that all necessary information is disclosed accurately and timely.

Data accuracy and consistency are also primary concerns. Companies may struggle to maintain reliable records, leading to potential compliance issues. Lastly, staying updated on regulatory changes is vital for ensuring that the filing process aligns with current standards, necessitating regular training and awareness among the compliance team.

Best practices for a successful form 10-K filing

In navigating the complexity of Form 10-K filings, adopting best practices can significantly enhance the accuracy and efficiency of the process. Here are effective strategies: - Prioritize comprehensive reporting by including all relevant information, disclosing potential risks, and explaining financial discrepancies clearly. - Ensure transparency and clarity in language, avoiding jargon that may confuse stakeholders. Use charts and graphs for better illustration of data.

Furthermore, utilizing pdfFiller to manage document workflows can improve collaboration and efficiency among team members. By leveraging the entire suite of pdfFiller tools, teams can stay organized, maintain clear communication, and achieve seamless document submission.

Related forms you should know

Understanding related forms is crucial for a comprehensive approach to corporate compliance. The Form 10-Q is a quarterly report that provides a less comprehensive overview compared to the 10-K, typically focusing on just three months of financial data.

Another important form is the Form S-1, which is used for registering new securities with the SEC. Knowing the distinctions between these forms helps stakeholders choose the right documents for specific regulatory needs.

Engage with current trends and updates

The regulatory landscape is continually evolving, and recent changes affect how Form 10-K filings are approached. The adoption of technology in document submission, such as XBRL (eXtensible Business Reporting Language), enhances data sharing and usability, paving the way for more accessible investment insights.

As companies increasingly adopt digital tools, staying engaged with current trends will be vital for compliance officers and financial teams to ensure responsiveness to evolving expectations and standards.

Conclusion: Elevating your form 10-K mastery

Mastering the Form 10-K process can significantly enhance a company's transparency and stakeholder trust. By understanding its components, staying updated on filing requirements, and utilizing tools like pdfFiller for document management, companies can streamline their reporting processes.

With these strategies and resources, you'll be well-positioned to navigate the complexities of Form 10-K filings and leverage them effectively to support business growth and investment opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit pdf filler form from Google Drive?

Can I sign the pdf filler form electronically in Chrome?

How do I edit pdf filler form on an Android device?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.