Get the free pdf filler

Get, Create, Make and Sign pdf filler form

Editing pdf filler form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdf filler form

How to fill out ensuring that tenant guarantor

Who needs ensuring that tenant guarantor?

Ensuring That Tenant Guarantor Form: A Comprehensive Guide

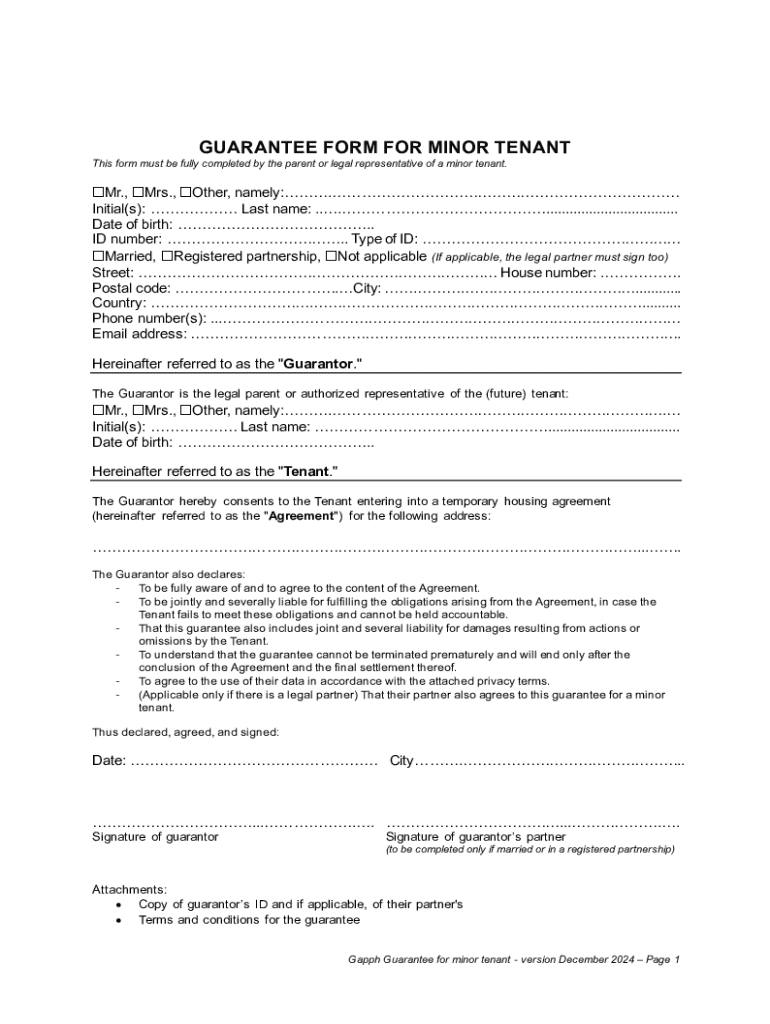

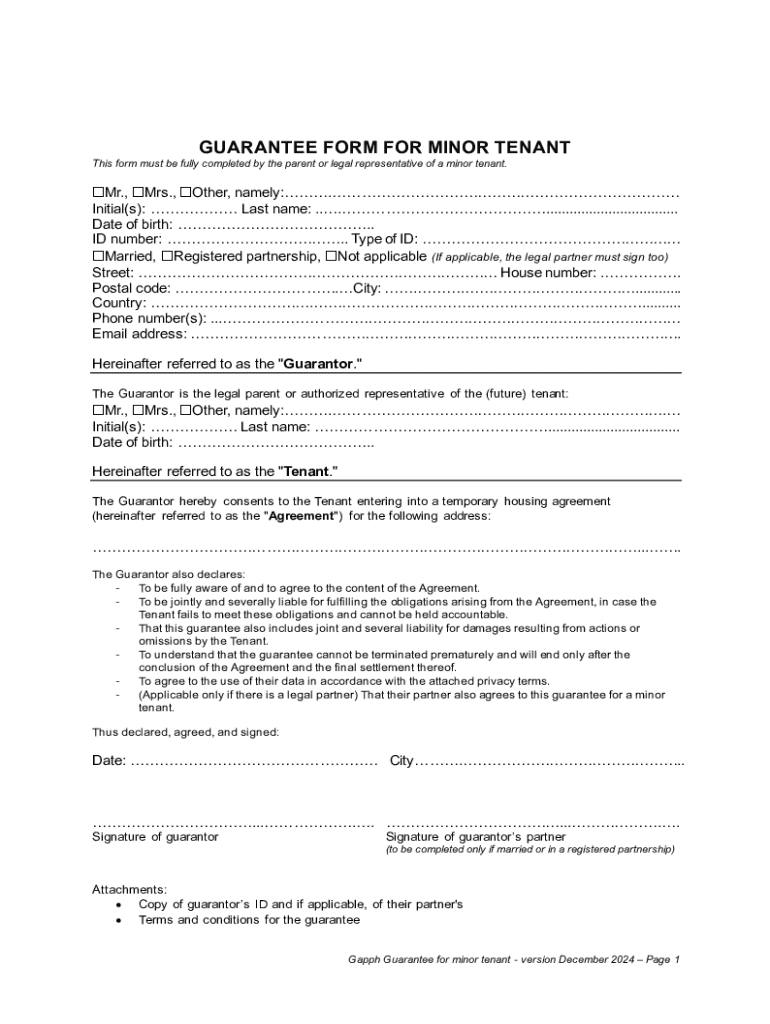

Understanding the tenant guarantor form

A tenant guarantor form serves as a crucial document in rental agreements, providing landlords with a security measure when leasing to tenants with insufficient credit history or income. The purpose of this form is to legally bind a third party—known as the guarantor—who agrees to take financial responsibility for the tenant's obligations, including rent payments. Without a guarantor, landlords may hesitate to rent to individuals without a solid financial background.

In the context of rental agreements, the tenant guarantor form holds significant importance. It acts as a safety net for landlords, ensuring that rent will be covered even if the tenant fails to pay. Key components of a guarantor form typically include the names of the tenant and guarantor, their contact details, the rental property address, and a declaration of the guarantor's financial capability to cover the rent if necessary.

Who needs a tenant guarantor?

Several types of individuals might require a tenant guarantor due to varying financial situations. For instance, those with limited credit history, such as recent graduates or individuals new to the workforce, may find it challenging to secure a rental property independently. Landlords may require additional assurance that rent payments will be met, often leading to the need for a guarantor.

Similarly, students and young professionals often lack established credit profiles; hence, having a guarantor significantly boosts their chances of securing a lease. Freelancers and self-employed individuals can also face hurdles, as their income can be variable and less predictable compared to those with steady employment. Corporate applicants occasionally require a guarantor if their company policy states that personal guarantees are essential for lease approval.

The role of a guarantor

Guarantors play a vital role in the leasing process. They are typically responsible for ensuring rent is paid in full and on time if the tenant fails to do so. This obligation includes covering any damages to the rental property, unpaid utility bills, or lease-breaking penalties, which can ultimately lead to significant financial responsibility for the guarantor.

However, the role of a guarantor comes with its own risks and considerations. By agreeing to be a guarantor, individuals take on a potential financial burden that could impact their credit rating if the tenant defaults. Thus, it’s crucial to fully understand the form being signed, as it requires taking a leap of faith in the tenant's reliability and commitment.

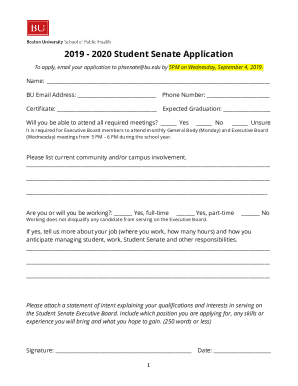

How to fill out a tenant guarantor form

Completing a tenant guarantor form involves several steps to ensure all necessary details are accurately provided. First, gather the required personal information, including full names, residential addresses, dates of birth, and Social Security numbers. Additionally, financial information, like proof of income and employment details, should be ready to validate the guarantor's capability.

Each section of the form must be carefully reviewed. Start by entering personal details clearly, as inaccuracies can lead to processing delays. Next, accurately provide the guarantor's financial information, ensuring it reflects their current situation. Remember to double-check for any mistakes before submission, as common errors can lead to unenforceable agreements.

Legal framework for guarantor agreements

Understanding the legal framework surrounding guarantor agreements is essential for both landlords and guarantors. Different jurisdictions have specific landlord-tenant laws that govern these agreements, and it’s important to be aware of these regulations to ensure compliance. Failure to adhere to these laws can lead to significant legal challenges or disputes.

For instance, some states may require guarantors to meet specific criteria such as income levels or credit scores, thereby impacting the enforceability of the agreement. Always consult local laws to ascertain that all legal aspects are properly addressed, ensuring the agreement is binding and enforceable.

Common issues with tenant guarantor forms

Common issues often arise when filling out tenant guarantor forms, leading to unenforceable agreements. Errors or vague language can render the document invalid, creating confusion in responsibilities. Moreover, if the terms appear unfair or unclear, this can lead to disputes between the landlord, tenant, and guarantor. Transparency in the document is critical to mitigate these issues.

Equally, it's vital that all parties communicate openly about the terms of the agreement. Hidden clauses or unclear expectations can create resentment or unexpected financial burdens for the guarantor, potentially jeopardizing the landlord-tenant relationship.

Tips for ensuring the enforceability of a guarantor agreement

To ensure the enforceability of a guarantor agreement, clarity is paramount. The language used in the form should be straightforward, leaving no room for ambiguity. Additionally, required signatures from both the tenant and the guarantor must be obtained, and where necessary, notarization should be performed to legitimize the document.

Record-keeping is also essential. Both landlords and guarantors should maintain copies of the signed agreement. This practice not only protects individual rights but also serves as a reference point in case of future disputes. Regularly reviewing the agreement can help all parties stay aligned and informed about their responsibilities.

Addressing unfair terms in guarantor agreements

Identifying and negotiating unfair terms within guarantor agreements is crucial for protecting all parties involved. Fair agreements should be easy to read and understand, without imposing excessive burdens on the guarantor. If you believe certain terms are unfair, engaging in a dialogue with the landlord can lead to more equitable outcomes.

Legal advice and support resources are often available for those who need guidance or assistance in understanding their rights. Familiarizing oneself with tenant protections and rights can arm individuals with knowledge, enabling them to negotiate effectively and advocate for fairer terms.

Special scenarios and considerations

In certain cases, specific considerations arise, especially for corporate applicants needing a guarantor. The approval of corporate leases might include additional layers of scrutiny compared to individual applications, requiring stringent financial evaluations. Applicants without available references or eligible guarantors may face challenges in securing leases but can explore other alternatives, such as offering larger security deposits to mitigate risk.

Understanding how different tenant types can impact guarantor requirements is vital for both tenants and landlords. For example, those with unconventional job histories, such as gig workers, may find it more challenging to secure a guarantor. Conversely, landlords must adjust their expectations and explore different options tailored to specific applicant situations.

Interactive tools for managing tenant guarantor forms

pdfFiller offers a robust platform equipped with features designed to simplify the management of tenant guarantor forms. Users can easily edit PDFs, eSign documents, collaborate with others, and manage their forms seamlessly from one cloud-based solution. This accessibility enhances efficiency by eradicating the need for cumbersome paperwork.

Utilizing pdfFiller for tenant guarantor forms not only streamlines the completion process but also ensures that necessary tools are readily available. Users can engage in a step-by-step guide to fill out forms accurately, make changes, and ensure compliance. The platform allows for efficient record-keeping, making it easy to revisit documents when needed.

Frequently asked questions about tenant guarantor forms

Queries regarding tenant guarantor forms often emerge. One common question involves what to do if a guarantor cannot fulfill their role. In such instances, tenants may need to present alternative guarantors or discuss other options with their landlords. It’s vital to proactively communicate any challenges to avoid misunderstandings.

Additionally, tenants without available guarantors often seek alternative arrangements. Options may include increased upfront payments or co-signers. Understanding how to terminate a guarantor agreement, if necessary, can also be crucial, allowing for both parties to navigate modifications in circumstances without causing disruption.

Next steps after completing the guarantor form

After completing the tenant guarantor form, the next step is to submit it to the landlord for processing. This typically involves following any specific submission guidelines outlined in the rental agreement. After the submission, it’s important to maintain open lines of communication with both the landlord and the tenant, ensuring all parties are aware of the form's acceptance status.

Eligible follow-up actions may include gathering additional documentation if requested or discussing any concerns regarding the rental agreement. Staying proactive and engaged can create a smoother rental process and set a solid foundation for the relationship between landlords, tenants, and guarantors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute pdf filler form online?

Can I create an electronic signature for the pdf filler form in Chrome?

How do I edit pdf filler form straight from my smartphone?

What is ensuring that tenant guarantor?

Who is required to file ensuring that tenant guarantor?

How to fill out ensuring that tenant guarantor?

What is the purpose of ensuring that tenant guarantor?

What information must be reported on ensuring that tenant guarantor?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.