Get the free pdf filler

Get, Create, Make and Sign pdf filler form

Editing pdf filler form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdf filler form

How to fill out prohibition on money laundering

Who needs prohibition on money laundering?

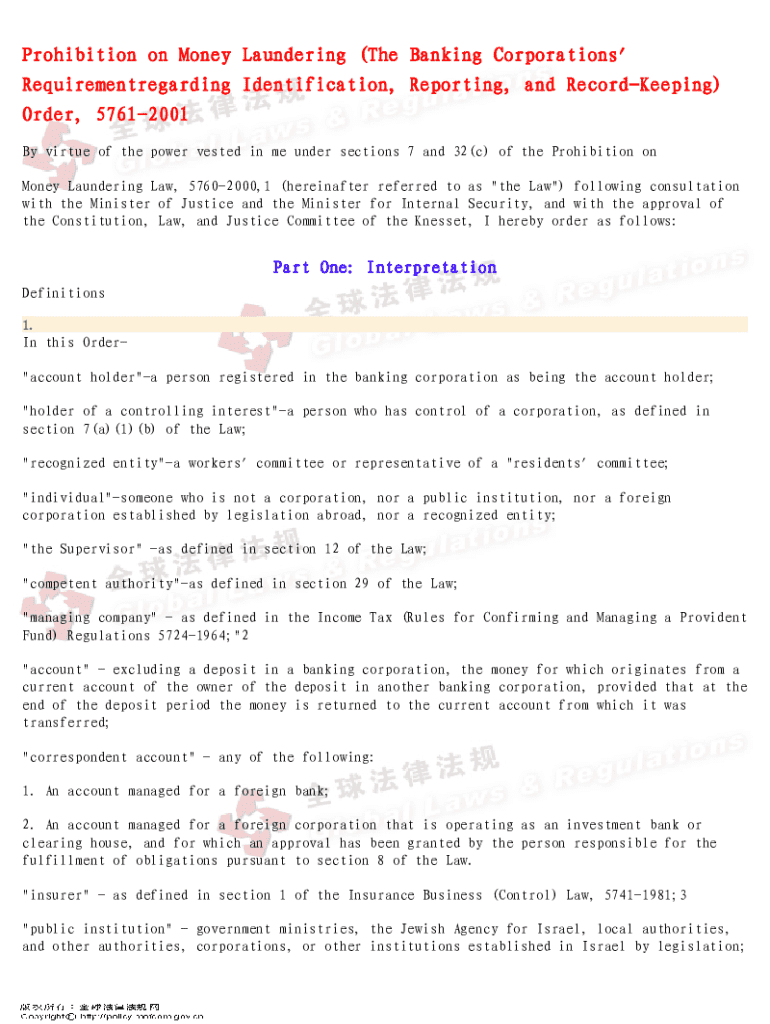

Understanding the Prohibition on Money Laundering Form

Understanding money laundering

Money laundering is the process of making illegally obtained money appear legitimate. This involves three main stages: placement, layering, and integration. At the placement stage, illicit funds are introduced into the financial system. The layering stage obscures the origins of the money through complex transactions. Finally, in the integration stage, the funds are reintroduced into the economy, often as seemingly legitimate income.

Anti-money laundering (AML) policies are crucial as they aim to prevent and detect instances of this specific crime. Financial institutions and businesses must comply with stringent regulations to ensure that their operations do not facilitate the laundering of illicit funds. This is essential not only for protecting the integrity of financial systems but also for promoting economic stability and public trust.

Key concepts related to money laundering include predicate crimes, which are initial criminal offenses that generate the proceeds needing laundering. Understanding the timeline of money laundering helps authorities identify suspicious activities more effectively. By implementing a systematic approach to prevention, organizations can mitigate risks and comply with drawn regulations.

Historical context of anti-money laundering laws

Anti-money laundering regulations have evolved significantly since the 20th century, driven largely by increasing awareness of the links between organized crime, terrorism, and financial crime. The United States established the first comprehensive set of AML laws in the early 1970s, marking a pivotal development in the fight against money laundering.

Key legislation impacting money laundering in the U.S. includes the Bank Secrecy Act (BSA), enacted in 1970, which requires financial institutions to report certain suspicious activities. The USA PATRIOT Act, passed after the events of September 11, 2001, expanded AML regulations to include provisions aimed at combating terrorist financing. Together, these laws have formed the backbone of the AML framework in the U.S.

International cooperation is crucial in the fight against money laundering. The Financial Action Task Force (FATF) plays a significant role in developing policies to combat money laundering and terrorist financing globally. As countries align their efforts, global trends in anti-money laundering reveal an increasing focus on technology, information sharing, and the implementation of risk-based approaches.

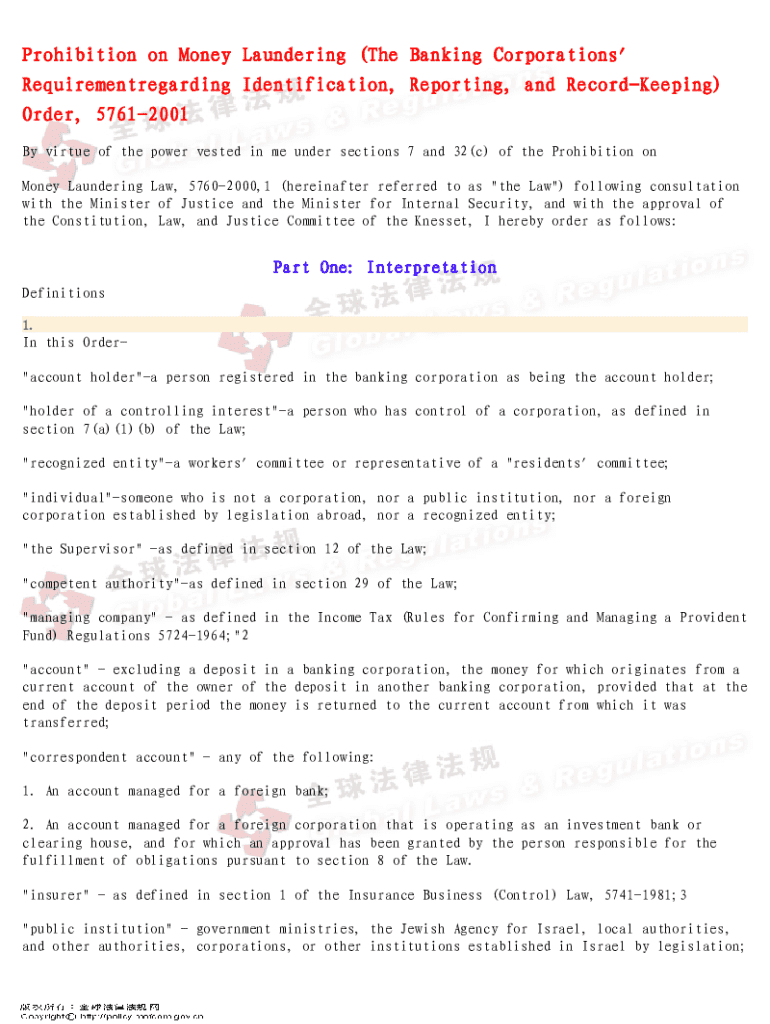

Overview of the prohibition on money laundering form

The Prohibition on Money Laundering Form is a vital document for entities involved in financial services. This form is designed to help institutions comply with AML laws by providing essential information related to the sources of funds, financial transactions, and any suspicious activities.

Filling out this form accurately is critical not only for compliance but also for the protection of the organization against potential legal repercussions. Regulatory bodies require this form to track and report suspicious activities effectively, thus protecting the financial system from abuse.

Entities required to use this form include financial institutions, real estate companies, and certain other businesses deemed to be at risk for encountering money laundering activities. Non-compliance can lead to severe penalties, including fines and damage to reputation, so understanding and adhering to these requirements is crucial.

Detailed steps for completing the prohibition on money laundering form

Before filling out the Prohibition on Money Laundering Form, it's essential to prepare adequately. Gather all necessary information and documents, including identification, transaction records, and any other required particulars to ensure a smooth process. Identifying applicable sections before filling out the form can save valuable time.

The step-by-step instructions include:

Best practices for maintaining accuracy include updating the form promptly whenever there is a change in information and keeping thorough records of all submissions. Consistently reviewing the documentation can prevent complications in compliance.

Tools for managing the prohibition on money laundering form

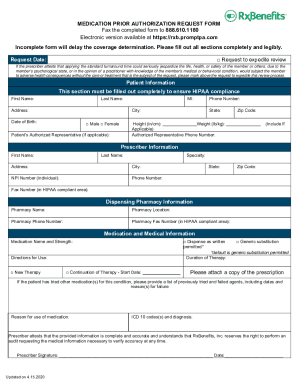

Digital solutions have transformed how businesses manage documents, including the Prohibition on Money Laundering Form. Using a platform like pdfFiller for document creation allows users to access a wide range of interactive features that simplify the process. The platform enables easy filling, editing, and sharing of documents, making compliance management straightforward and efficient.

eSigning and collaborating in a secure environment are crucial for compliance. pdfFiller offers various options for electronic signatures that adhere to legal standards, ensuring that all documents remain legally binding. Collaborative tools allow teams to work together seamlessly on compliance documents, assisting in managing responsibilities effectively.

Document management, including storing and tracking submissions, is another area where pdfFiller excels. Users can maintain a records system that ensures easy retrieval of documents and adherence to record-keeping guidelines. This significantly reduces the risks associated with non-compliance and strengthens the overall compliance framework.

Best practices post-completion of the prohibition on money laundering form

Once the Prohibition on Money Laundering Form is completed and submitted, it is important to review and confirm the submission. Verification ensures that all information was processed by regulatory bodies correctly, minimizing the risks of future issues.

Understanding your obligations after submission is critical. Organizations should regularly assess their compliance practices and remain vigilant about interactions that may require additional reporting. Staying updated on compliance changes is necessary to adapt to evolving legislation efficiently.

Importance of continuous learning and adaptation cannot be overstated. Engaging with resources such as industry newsletters, regulatory updates, and professional development opportunities will ensure that organizations stay informed about the latest compliance requirements and best practices.

FAQs about the prohibition on money laundering form

Common questions about the prohibition on money laundering form often revolve around the requirements for its completion and the consequences of non-compliance. For instance, individuals frequently ask about the necessary documentation needed for accurate reporting and how to address issues that arise during form submission.

Troubleshooting issues typically include contact points for further assistance. Most regulatory bodies provide clear guidance on how to rectify mistakes or clarify requirements in case problems arise. It’s recommended to maintain a list of such contact points and resources for quick reference.

Additional considerations

Technology has played a transformative role in enhancing compliance efforts related to money laundering. Many forward-thinking organizations utilize advanced software that integrates features for monitoring transactions, evaluating risk, and generating reports automatically to streamline compliance.

The future trends in money laundering prevention involve greater integration of artificial intelligence and machine learning to detect anomalies and patterns indicative of laundering activities. Organizations that embrace these technologies will gain a competitive edge in compliance adherence and risk management.

pdfFiller aligns with these emerging regulatory needs by continuously updating its platform to support compliance requirements. By focusing on user-friendly document management and compliance tools, pdfFiller empowers individuals and teams to navigate the complexities of regulations effectively and confidently.

Sidebar menu

The sidebar includes resources such as related documents, important definitions, and links to relevant regulatory bodies for easy navigation and reference. These resources are essential for users looking to deepen their understanding of compliance-related topics.

Footer menu

Accessible footer menus provide contact information for support, legal disclaimers, and privacy policies, ensuring that all aspects of user concerns are addressed efficiently. This organization fosters trust and transparency in the compliance process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pdf filler form in Gmail?

How can I send pdf filler form for eSignature?

How do I edit pdf filler form online?

What is prohibition on money laundering?

Who is required to file prohibition on money laundering?

How to fill out prohibition on money laundering?

What is the purpose of prohibition on money laundering?

What information must be reported on prohibition on money laundering?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.