Get the free pdf filler

Get, Create, Make and Sign pdf filler form

How to edit pdf filler form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdf filler form

How to fill out form 10-k

Who needs form 10-k?

Understanding Form 10-K: The Comprehensive Guide

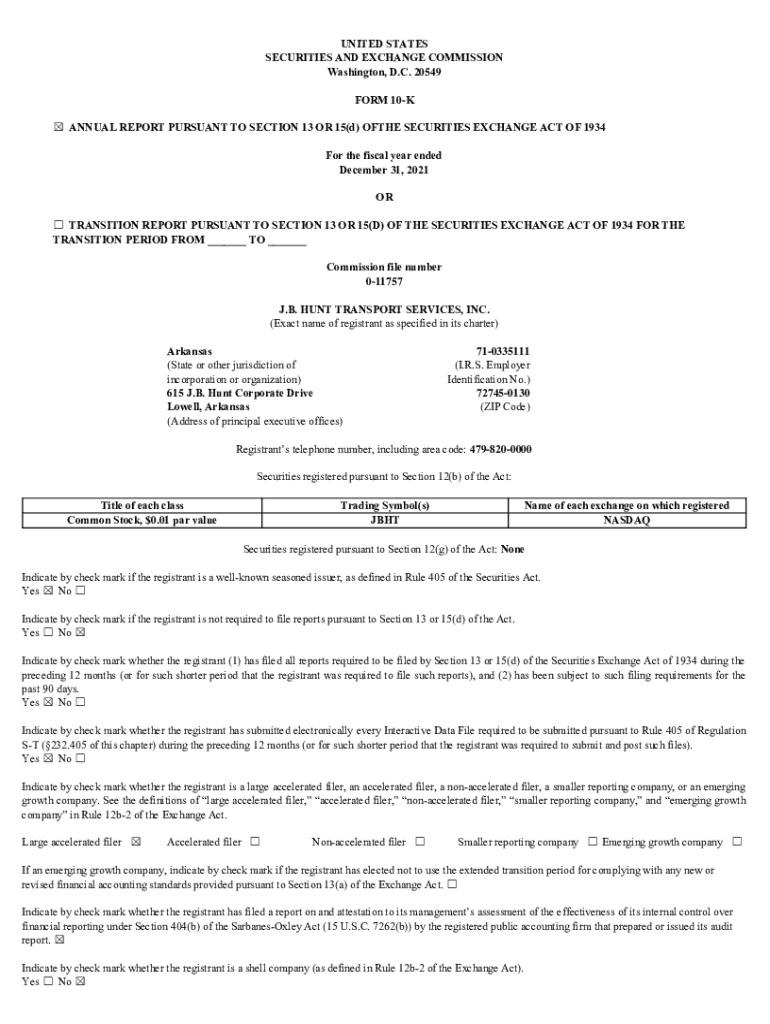

What is Form 10-K?

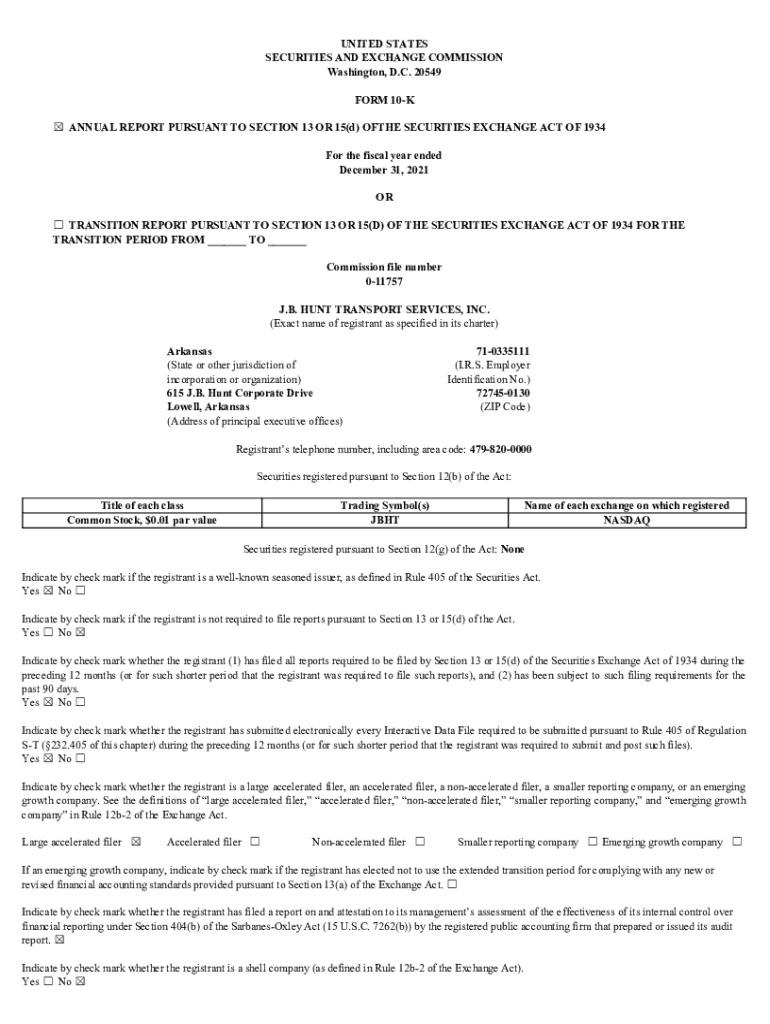

Form 10-K is a comprehensive report filed annually by public companies with the U.S. Securities and Exchange Commission (SEC). Its primary purpose is to provide a detailed overview of a company’s financial performance, operations, risks, and management discussions, offering stakeholders critical insights into the company’s health. Unlike other disclosures, the 10-K is a more robust document that provides a complete picture of a company's financial status and future prospects.

The importance of Form 10-K cannot be overstated. It serves as a vital tool for investors, analysts, and regulators by ensuring transparency in companies' financial reporting. Public companies are required to file this form annually, reinforcing corporate accountability. The information presented in a 10-K enables stakeholders to make informed decisions regarding their investments, contributing to market efficiency.

Required content for Form 10-K typically includes a summary of financial data, risk factors, legal proceedings, and management discussion and analysis. Each section captures significant details that are essential for understanding the company’s strategic direction and potential concerns.

Components of Form 10-K

The Form 10-K is divided into four main parts, each containing essential components that collectively represent a company’s operational and financial narrative. Understanding these sections can help you analyze the complete spectrum of a company's performance and outlook.

Filing deadlines for Form 10-K

Every public company must file its Form 10-K within 60 to 90 days after the end of its fiscal year, with specific deadlines depending on the company's public float. For example, large accelerated filers have 60 days, while non-accelerated filers have 90 days to submit their documentation. Companies that fail to meet these deadlines risk penalties and may find their access to capital markets restricted.

Extensions may be granted, allowing up to 15 additional days for filing through a Form 12b-25 application. However, reliance on extensions should be avoided, as repeated late filings can trigger SEC scrutiny and damage investor confidence in the company's governance.

Penalties for non-compliance with Form 10-K filing requirements can be severe, including fines, legal actions, and adverse effects on stock prices. Regulators also monitor for accuracy in the disclosures to ensure that stakeholders receive precise and complete information.

How to complete and submit Form 10-K

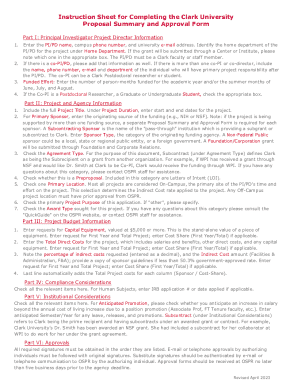

Preparing and submitting Form 10-K requires meticulous attention to detail as it is a public document that reflects the company's operations and financial integrity. A comprehensive strategy includes gathering financial data, assessing risks, and getting inputs from various departments, particularly finance, legal, and compliance.

Several tools can enhance the document creation process. For instance, pdfFiller offers powerful solutions for editing PDFs, allowing users to easily insert financial tables, charts, and relevant data into the 10-K form. The platform also provides eSigning capabilities, ensuring that necessary signatories can complete the process without the hassle of physical paperwork.

Interactive template features play a significant role in easing the workload. Companies can opt for pre-built templates that guide them through each section of the form, ensuring that no critical detail is overlooked. The submission process typically involves electronically filing the report through the SEC’s EDGAR system, ensuring compliance and facilitating timely access for investors.

Understanding the five percent ownership threshold

The five percent ownership threshold plays a crucial role in shareholder reporting obligations outlined in Form 10-K. If an individual or entity holds five percent or more of a company's shares, they are required to disclose this ownership through Schedule 13D or 13G, depending on the purpose of the acquisition.

Accurate reporting of ownership is critical, as failure to disclose can lead to significant penalties. It's essential for both management and investors to be aware of ownership structures, as this can influence the company's governance and strategy.

Tips for analyzing a Form 10-K

Analyzing the Form 10-K requires a strategic approach to identify crucial information that can inform investment decisions. Stakeholders should focus on key highlights such as revenue growth, net income, and cash flow figures, as these metrics provide insights into the company's operational efficiency.

Overall, a thorough analysis of a Form 10-K can reveal patterns and trends that are pivotal for shareholders and stakeholders when evaluating potential investment opportunities.

Navigating related forms

In addition to Form 10-K, public companies must also be familiar with other related forms such as Form 10-Q and Form 8-K. These documents serve different purposes but contribute to a company’s ongoing transparency.

While all these forms contain financial data, the Form 10-K is more comprehensive, offering a laser-focused view of the entire fiscal year. Understanding the distinctions between these forms can help stakeholders maintain an accurate perspective on corporate affairs.

Finding and accessing Form 10-K reports

Accessing Form 10-K reports is straightforward, thanks to robust online resources. The SEC’s EDGAR database is an invaluable tool, allowing users to search for company filings efficiently. By inputting the company name or ticker symbol, stakeholders can access the latest and historical reports with ease.

In addition to the SEC database, many companies maintain an investors' relations section on their corporate websites where 10-K filings are available. This direct access ensures that all institutional and individual investors can stay informed about the financial health and strategic developments of the companies they have an interest in.

Frequently asked questions about Form 10-K

Understanding Form 10-K can raise several inquiries about its purpose and impact. Here are some commonly asked questions along with their answers:

Additional considerations for filing

Ensuring accuracy and compliance in Form 10-K filings is paramount. Companies should conduct thorough internal reviews and potentially seek external audit opinions where necessary to validate the integrity of the data.

Transparency and clarity in reporting enhance the credibility of the information presented in Form 10-K. This approach not only builds trust with investors but also mitigates the chances of misinterpretations and legal issues down the line.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pdf filler form directly from Gmail?

How do I fill out the pdf filler form form on my smartphone?

Can I edit pdf filler form on an Android device?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.