Get the free pdf filler

Get, Create, Make and Sign pdf filler form

Editing pdf filler form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdf filler form

How to fill out self employed incomeexpenses

Who needs self employed incomeexpenses?

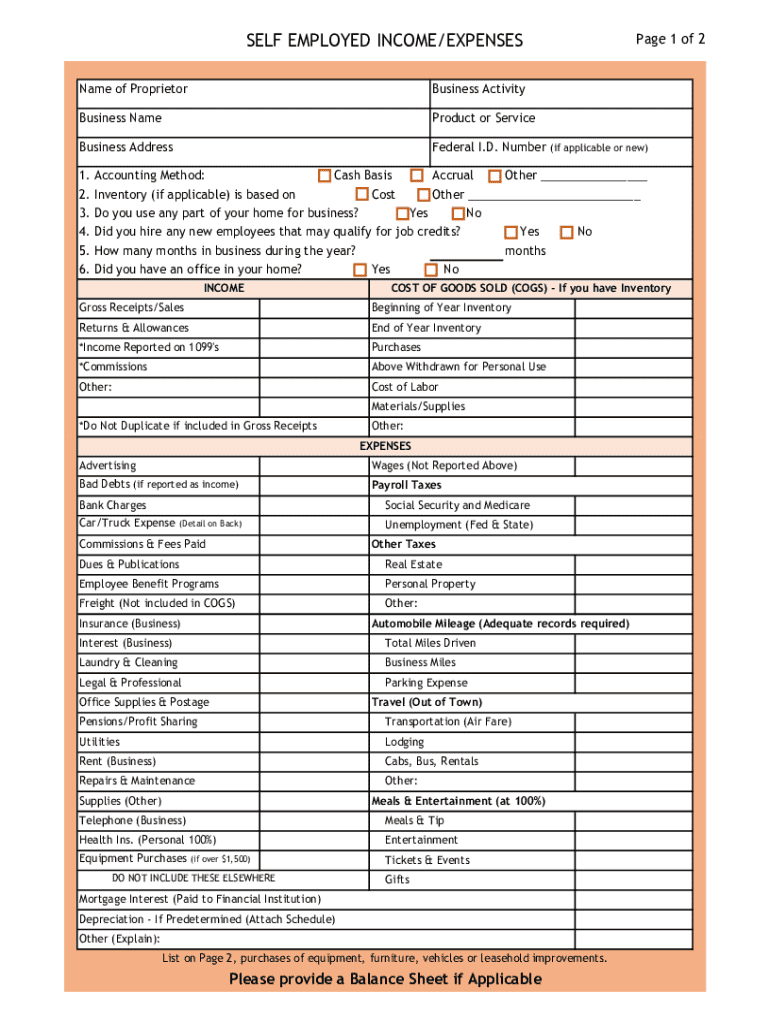

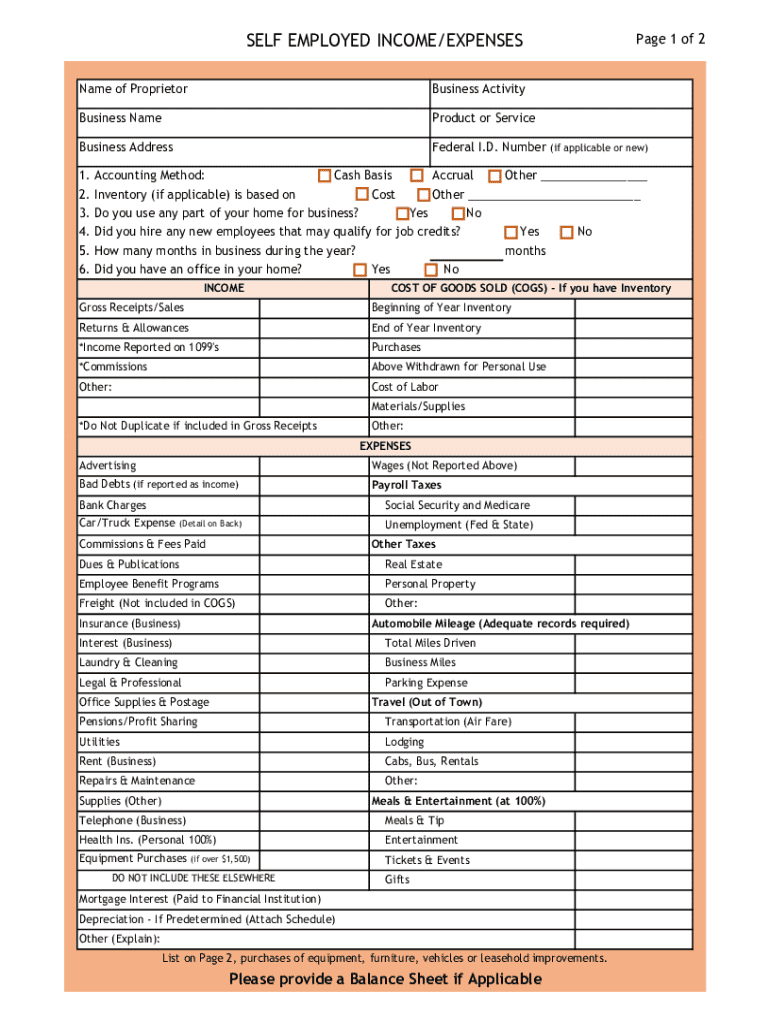

Self Employed Income/Expenses Form: A Comprehensive How-To Guide

Understanding self-employed income and expenses

Self-employment offers a unique opportunity for individuals to control their work and income. However, it also introduces complexities, particularly when it comes to taxes. Understanding how to accurately track and report income and expenses is crucial for self-employed individuals. This not only affects their financial health but also has significant implications for tax obligations.

Types of income vary widely among self-employed individuals. Common categories include revenue from contract work, freelance projects, services provided, and product sales. Each type may have different implications for tax reporting, making it essential to categorize them correctly. On the expense side, self-employed individuals can deduct costs that are necessary and ordinary for their business operations, such as office supplies, utilities, and travel expenses.

Essential forms for reporting self-employed income and expenses

Accurate tax reporting for self-employed income and expenses typically involves several critical forms. The U.S. Individual Tax Return, Form 1040, acts as the foundation for your annual tax return. Schedule C, which details profit or loss from business operations, is a vital component that feeds into your Form 1040. It’s imperative to complete Schedule C carefully, since it outlines your income streams and allowable business expenses.

Another important document is the Form 1099-NEC, used if you received payments totaling $600 or more from a single client during the tax year. This form signifies nonemployee compensation and should be included with your tax filings. For those claiming deductions for a home office, Form 8829 is essential. This form details the expenses related to the business use of your home, while Schedule SE covers self-employment tax and ensures you're compliant with tax laws.

Collecting documentation for your income and expenses

Effective record-keeping is essential for self-employed individuals. Tracking income and expenses throughout the year not only simplifies the tax filing process but also provides a clear financial picture. Maintaining a habit of good record-keeping can save you time and stress during tax season.

Organizing receipts and invoices is vital. Creating a systematic method for keeping documents can help eliminate confusion later on. Both physical and digital records should be preserved, with digital receipts backed up on a secure cloud storage system. For this purpose, utilizing tools like pdfFiller can streamline your process, allowing you to manage documents efficiently.

Filling out the self-employed income/expenses form

Filling out tax forms can be daunting, but a step-by-step approach can simplify the process. Begin by gathering all income sources and categorize them accordingly on Schedule C. Cross-reference your collection of receipts and invoices to ensure all expenses listed are substantiated. Be meticulous in transferring totals from Schedule C to Form 1040; accuracy is key in avoiding errors that could trigger audits or fines.

It's also beneficial to be aware of common mistakes that can occur when self-reporting income. Double-check figures, confirm that all relevant deductions are included, and ensure that your calculations are correct. Interactive tools available through pdfFiller can assist with calculations to ensure all amounts are accurate.

Filing your taxes as a self-employed individual

Choosing your filing method can impact your tax experience significantly. While electronic filing offers convenience and instant confirmation, paper filing allows for a thorough review before submission. Each self-employed individual should choose the process that best suits their comfort level and needs. Keep in mind important deadlines. For most, the tax day falls on April 15 each year, and it's prudent to remain aware of extension deadlines if additional time is necessary.

What happens after filing is equally important. If you discover an error post-submission, promptly prepare to amend your filing using Form 1040-X. Understanding these steps can ease the anxiety commonly associated with tax season.

Understanding your rights and responsibilities

Self-employed individuals must navigate their tax obligations, which include making estimated tax payments quarterly. The responsibility to adhere to these guidelines is crucial to avoid penalties. This means understanding how to calculate estimated taxes based on previous income and ensuring timely payments. Failure to do so can affect future credit and business viability.

Compliance with tax requirements offers benefits beyond avoiding penalties. Establishing a history of on-time payments can foster strong relationships with financial institutions and can improve credit ratings, critically impacting future business opportunities.

Leveraging pdfFiller for self-employed document management

Managing your self-employment documentation becomes streamlined with pdfFiller. The platform offers seamless editing and collaboration tools, allowing you to share forms and receive input from clients or partners effortlessly. This enhances the efficiency of document management, reducing the time spent on administrative tasks.

Moreover, the e-signature capability enables rapid transactions, cutting down on the turnaround time for contracts and agreements. Paired with cloud-based storage, pdfFiller ensures your documents are accessible and secure, allowing for easy retrieval from any location, maximizing your productivity.

Final thoughts on managing income and expenses as a self-employed professional

Maintaining financial awareness is paramount for sustainable success in self-employment. Consistent tracking of income and expenses not only aids in accurate tax submissions but also informs sound business decisions. Developing good financial habits, such as regular reviews of your financial statements and adjusting budgets where necessary, can lead to long-term profitability.

Additionally, planning for future tax implications is critical. Self-employed individuals should keep an eye out for changes in their income or business structure to adapt their tax strategies accordingly. This foresight can save headaches down the road and ensure continued compliance with tax obligations.

FAQs about self-employed income/expenses forms

Self-employed individuals commonly encounter numerous questions regarding income and expense management when filing taxes. Addressing these queries can ease concerns and provide clarity in a complex area. Common issues include how to report income accurately, what receipts are necessary for deductions, and tips for accounting for mixed-use expenses, such as those related to a personal and business vehicle.

To aid in this regard, resources are available from governmental and financial websites that offer further insights and support. Understanding these fundamental aspects can provide a solid foundation for managing your self-employed taxes more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pdf filler form in Gmail?

How can I get pdf filler form?

Can I create an electronic signature for signing my pdf filler form in Gmail?

What is self employed incomeexpenses?

Who is required to file self employed incomeexpenses?

How to fill out self employed incomeexpenses?

What is the purpose of self employed incomeexpenses?

What information must be reported on self employed incomeexpenses?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.