Get the free Nonprofit Entity Affidavit of Authority to Vote

Get, Create, Make and Sign nonprofit entity affidavit of

Editing nonprofit entity affidavit of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nonprofit entity affidavit of

How to fill out nonprofit entity affidavit of

Who needs nonprofit entity affidavit of?

Understanding the Nonprofit Entity Affidavit of Form

Understanding the nonprofit entity affidavit of form

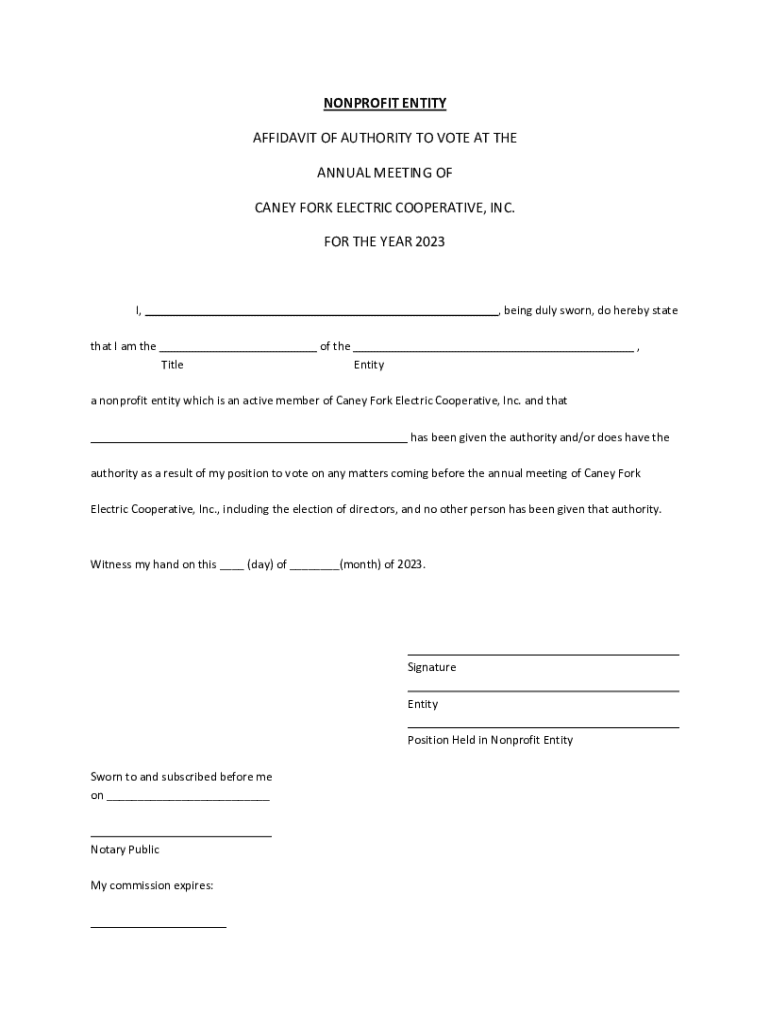

A nonprofit entity affidavit is a sworn statement that confirms the status and operations of a nonprofit organization. This document serves as legal proof that an organization adheres to the regulations governing nonprofit entities, ensuring compliance with state and federal laws.

The primary purpose of the nonprofit entity affidavit is to establish transparency within the organization. It reassures stakeholders, including donors and regulatory bodies, that the nonprofit is operating within the legal framework and fulfilling its mission responsibly. Without this affidavit, organizations could face scrutiny that could jeopardize their status and operations.

Importance of accuracy

Accurate completion of the nonprofit entity affidavit is vital for several reasons. Firstly, any inaccuracies can lead to delays in processing the document, potentially putting the organization at risk of non-compliance. Moreover, problems such as incorrect information can lead to penalties or even loss of nonprofit status, severely impacting fundraising and operational capabilities.

Errors in the affidavit could trigger audits from regulatory bodies and tarnish the organization’s reputation. Thus, it's crucial for individuals responsible for filling out this document to pay meticulous attention to detail and ensure all information is not only accurate but also up-to-date.

Overview of the affidavit requirements

The nonprofit entity affidavit typically consists of several key sections that need careful attention. These sections include identifying details of the nonprofit organization, such as its legal name, address, and IRS designation. Each part plays a significant role in establishing the nonprofit's legitimacy.

Another critical component is the declaration statement, which usually requires a signature from an authorized representative of the nonprofit. The affidavit must also contain relevant dates, including when the affidavit was completed and any deadlines for filing.

Supporting documents needed

In addition to the affidavit itself, several supporting documents are often required. These could include the nonprofit's incorporation papers, IRS determination letter, and financial reports. Together, these documents provide a comprehensive view of the nonprofit's compliance and operational integrity.

Moreover, notarization is typically a compliance requirement for the affidavit. This step adds a layer of validation, ensuring that the identities of the signatories have been verified and that the document can stand up in court if necessary.

Step-by-step guide to filling out the nonprofit entity affidavit

Preparing to fill out the nonprofit entity affidavit is an essential first step. Begin by gathering all necessary information, including organization details and required documents. Familiarizing yourself with the legal terminology can also be beneficial to ensure clarity in what is being communicated in the affidavit.

The first section to complete is organization information. This includes the legal name and physical address of the nonprofit, as well as the IRS designation—whether it is a 501(c)(3) or another category. It is crucial to ensure that this information matches what appears on official documents to avoid discrepancies.

Next, you will complete the affidavit declaration, including a statement affirming the truthfulness of the information provided. This section typically requires the signature of the authorized official, confirming that they accept the legal responsibilities associated with the affidavit.

Lastly, ensure that you include any necessary signatures and witness statements as per your organization’s requirements. Notarization is often imperative at this stage, adding legitimacy and confirming that the affidavit can be reviewed without disputes.

Reviewing the completed form

Before submission, review the completed nonprofit entity affidavit thoroughly. Key points to double-check include verifying names, addresses, IRS statuses, and ensuring all required signatures are present. Attention to these details can alleviate issues during the filing process.

Common pitfalls to avoid include leaving sections blank, using outdated information, or failing to properly notarize the affidavit. Each of these can lead to rejection by regulatory bodies, obstructing your organization’s operations and compliance status.

Editing and managing your affidavit with pdfFiller

Using pdfFiller for managing your nonprofit affidavit streamlines the process significantly. To begin, upload your completed document to the pdfFiller platform. The intuitive editing tools will assist you in correcting any mistakes and ensuring compliance with legal standards.

pdfFiller also offers comprehensive options for eSigning the affidavit. With its seamless eSigning capabilities, users can sign documents electronically, ensuring a secure signature process that upholds the validity of the affidavit.

Submitting your nonprofit entity affidavit

Once the affidavit is thoroughly reviewed and finalized, it is time to submit it. Depending on your local or state requirements, submission locations may vary. Many nonprofits file the affidavit at their state’s secretary of state office or a designated regulatory agency applicable to their services.

After submission, keep an eye out for confirmation of receipt from the agency. This confirmation is essential as it provides proof that your organization has complied with its obligations. Additionally, maintaining follow-up documents on file aids in organizational transparency and can be instrumental if any inquiries arise.

Troubleshooting common issues

Frequently encountered errors in affidavit submission often stem from missing information or administrative oversights. For instance, an organization might neglect to add a required document or fail to notarize a signature appropriately. A thorough review of all requirements prior to submission can help in mitigating these common issues.

If problems do arise, rectifying them is crucial. Contact the regulatory body immediately to understand the nature of the issue and seek proper guidance on how to amend any errors. Additionally, consulting with a legal professional can provide clarity and ensure compliance moving forward.

Additional tips for nonprofit organizations

To maintain an efficient operation, best practices for document management are vital. Creating a centralized digital repository for important documents allows for easy access and ensures that nothing is lost. Leveraging tools like pdfFiller enhances not only document management but also promotes collaboration amongst team members.

Additionally, staying updated with regulatory changes in nonprofit laws is imperative. Regular training and resources available through platforms such as pdfFiller can aid organizations in remaining compliant, which is essential for sustaining public trust and operational legitimacy.

Leveraging pdfFiller beyond the affidavit

Beyond the nonprofit entity affidavit, pdfFiller offers comprehensive document creation solutions tailored to nonprofit needs. From essential forms to templates that assist in various organizational functions, the platform serves as an invaluable resource. Collaboration tools foster teamwork, ensuring that multiple stakeholders can contribute to document preparation.

Moreover, the cloud-based access ensures that nonprofits can manage their documents securely from anywhere. Data security measures integral to pdfFiller’s platform safeguard sensitive information against unauthorized access while allowing ease of use.

Interactive tools and resources on pdfFiller

Engagement with the community is essential for a thriving nonprofit environment. pdfFiller provides a section dedicated to frequently asked questions that tackles common queries around nonprofit entity affidavits. Additionally, a community forum allows users to exchange experiences and advice, further fostering support networks among nonprofits.

Interactive form features enable real-time assistance as users complete their affidavits. The availability of fillable PDF templates for related documents simplifies the process, enhancing user experience and efficacy in managing necessary paperwork.

Encouragement for active engagement

The landscape of nonprofit operations is ever-evolving. Users are encouraged to leave feedback on their experiences with pdfFiller, shaping a community that supports continuous improvement and innovation. Sharing testimonials and case studies enriches the knowledge base and allows organizations to learn from each other.

Engaging with users not only fosters a collaborative environment but also enhances the overall effectiveness of nonprofit operations. By leveraging the collective expertise, organizations can navigate challenges more effectively and empower one another in achieving their missions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my nonprofit entity affidavit of directly from Gmail?

How do I execute nonprofit entity affidavit of online?

Can I create an electronic signature for the nonprofit entity affidavit of in Chrome?

What is nonprofit entity affidavit of?

Who is required to file nonprofit entity affidavit of?

How to fill out nonprofit entity affidavit of?

What is the purpose of nonprofit entity affidavit of?

What information must be reported on nonprofit entity affidavit of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.