Get the free Buchanan County Senior Real Estate Property Tax Relief Program

Get, Create, Make and Sign buchanan county senior real

How to edit buchanan county senior real online

Uncompromising security for your PDF editing and eSignature needs

How to fill out buchanan county senior real

How to fill out buchanan county senior real

Who needs buchanan county senior real?

Navigating Buchanan County Senior Real Form: A Comprehensive Guide

Overview of senior real forms in Buchanan County

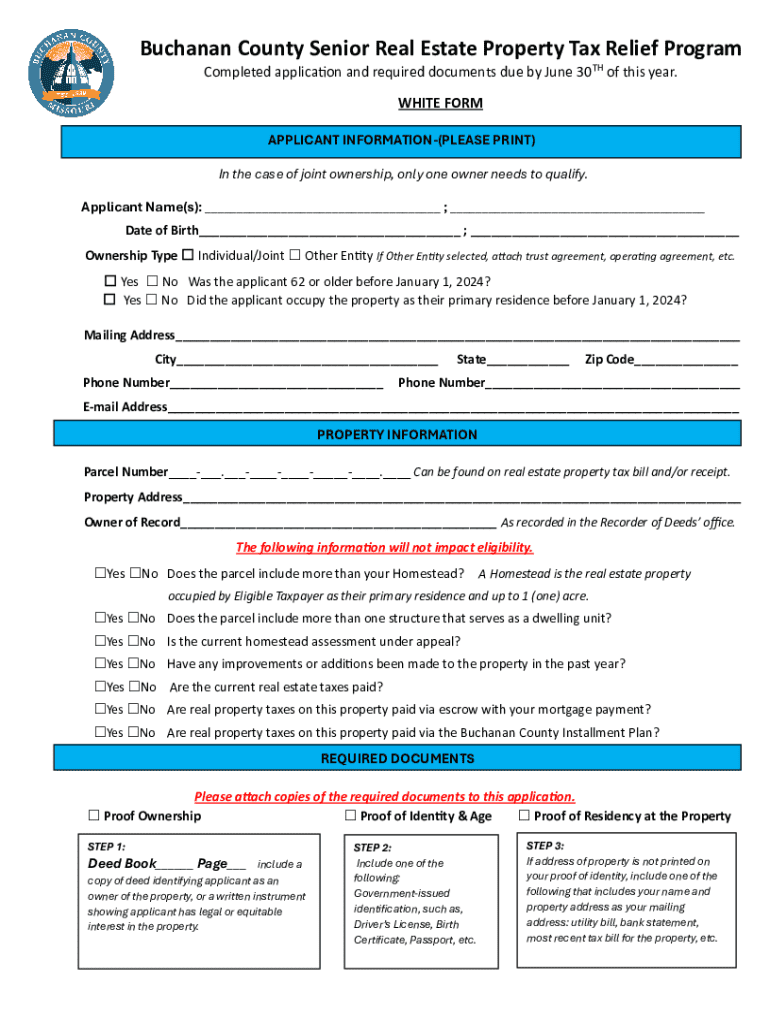

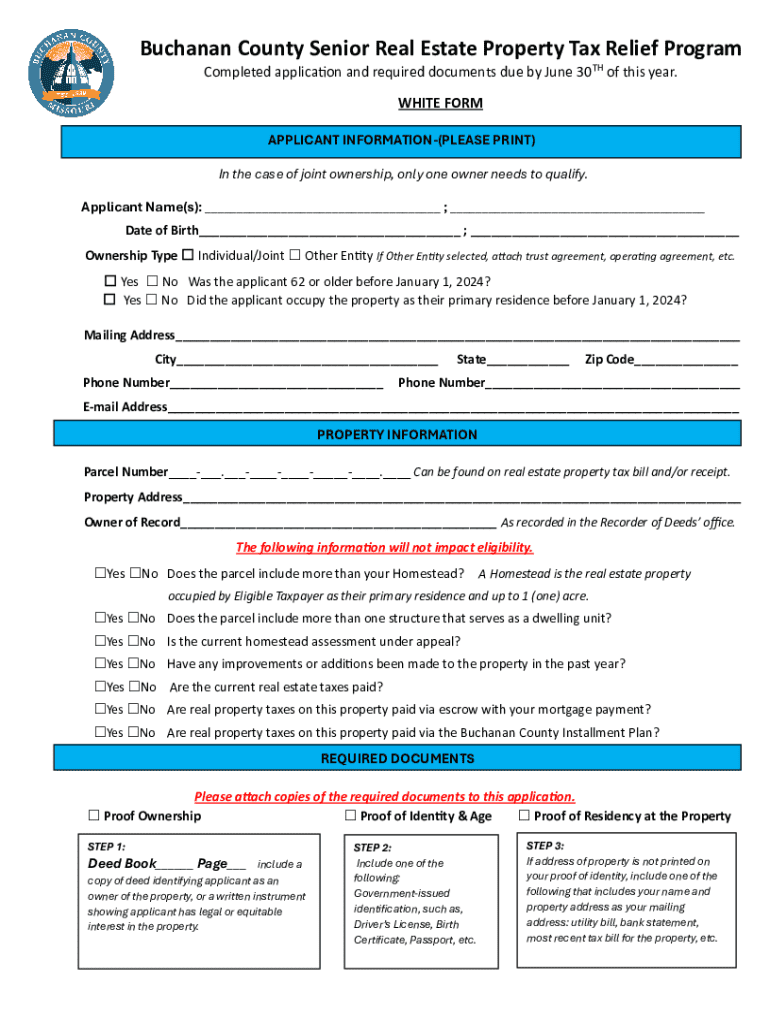

Senior real forms play a crucial role in assisting elderly citizens of Buchanan County with financial relief. Understanding these forms helps navigate the often-complex world of property taxes and benefits tailored for seniors. These forms not only help seniors qualify for financial assistance but also help in understanding their rights and benefits associated with property ownership. As such, they serve as an essential resource.

To be eligible for these senior real forms, applicants typically need to meet certain criteria, primarily age and residency requirements. Most forms are designed for seniors over the age of 65, although exceptions may exist for veterans or those with disabilities. Common types of real forms available include applications for tax relief, property tax exemptions, and additional benefits for seniors with disabilities, ensuring that this demographic can enjoy financial assistance tailored to their needs.

Detailed breakdown of senior real forms

Understanding what a senior real form entails is essential for any eligible individual. A senior real form, specifically in Buchanan County, relates to various entitlements available to senior citizens, focusing on financial relief through tax exemptions. The purpose of this form is to streamline the application process for seniors requiring assistance with their property taxes. The benefits help mitigate the cost of living, allowing seniors to allocate their finances towards necessities such as healthcare.

Eligibility requirements often revolve around age, often making seniors aged 65 and older the primary candidates for these benefits. However, some forms also require applicants to demonstrate financial need, as income restrictions can be applicable. Furthermore, application forms vary with options for real estate tax relief, personal property tax exemptions, and special allowances for seniors who are also disabled, supporting diverse needs across the senior citizen population.

Step-by-step instructions for completing the senior real form

Completing the senior real form efficiently is crucial for a successful application. The first step is gathering all the required information; essential documents may include proof of age, residency, and income. Avoiding common pitfalls—such as missing signature fields or incorrect personal details—can significantly improve the chances of application approval. Seniors should ensure they have their Social Security numbers, tax returns, and other necessary documents ready.

Filling out the senior real form can be daunting without clear guidance. Each section of the form typically requires specific details: personal information, property details, income disclosures, and the necessary signatures. Accomplishing this comprehensively reduces the likelihood of rejections. Finally, accepting submission methods—whether online through platforms like pdfFiller, mail, or in-person visits—should be aligned with expected timelines for processing applications to maintain an informed approach.

Interactive tools and resources for senior real forms

Navigating the complexities of submitting forms can be simplified using digital tools. Platforms like pdfFiller provide invaluable assistance in filling out real forms through their user-friendly interface. Features such as interactive prompts and templates guide users throughout the process, making completion less overwhelming. Utilizing these features means users can approach form filling with confidence and clarity.

Furthermore, collaboration options through pdfFiller allow seniors to share completed forms with family members or financial advisors. This versatility means real-time edits can be made, and comments can be added, ensuring that the final submission is both accurate and complete. This collaborative approach is an innovative way to ensure support from loved ones while managing important tasks.

Managing your senior real form efficiently

Post submission activities can be just as critical as filling out the form itself. If any changes are needed after a senior real form is submitted, knowing how to edit these documents correctly is vital. Regularly updating personal information and financial details and ensuring you communicate any changes to the tax office can prevent future complications. Keeping meticulous records demonstrates diligence and readiness should verification be needed.

Seniors can track the status of their applications through various tools available, often online through the Buchanan County Tax Office. Having easy access to contact information for inquiries—like case status or additional requirements—helps maintain transparency and reduces anxiety regarding the application process.

Additional considerations for seniors

Understanding available tax credits and benefits is essential for seniors looking to ease their financial responsibilities. Programs specifically designed for senior citizens in Buchanan County provide significant opportunities for tax relief. By staying informed about these programs, seniors can access various benefits that contribute to lowering their overall living costs, ultimately enhancing their financial stability.

Additionally, various local bureaus and organizations offer resources for financial planning and assistance. Knowing where to seek help—be it through community centers or online financial management tools—ensures seniors effectively manage their resources. These available resources provide the support needed to navigate the complexities of personal finance in retirement.

FAQs about Buchanan County senior real form

Several common questions often arise when navigating the senior real form. For example, how can seniors address concerns about application denials? What steps can be taken if there are disputes about eligibility? Understanding these nuances ensures seniors are not only aware of how the system works but also feel empowered to advocate for their rights.

Clarifications on complex issues regarding documentation needs or specific eligibility criteria can also aid in streamlining the process. Engaging with local representatives or utilizing online resources can provide clearer answers, ensuring seniors feel confident and informed about their applications and benefits.

Contact information for further assistance

For seniors in Buchanan County needing assistance with their senior real form, reaching out to the Buchanan County Tax Office is an important step. Their contact details are typically available online and often include a phone number for direct inquiries, email support for questions, and hours of operation for face-to-face assistance. This ensures seniors have access to the help they need whenever they encounter difficulties.

In addition to local resources, platforms like pdfFiller offer dedicated support services. Their customer service representatives can guide users through document management challenges, reinforcing the user-friendly experience. By leveraging these resources, seniors can navigate the complexities of the senior real form process more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the buchanan county senior real electronically in Chrome?

How do I fill out the buchanan county senior real form on my smartphone?

How do I complete buchanan county senior real on an Android device?

What is buchanan county senior real?

Who is required to file buchanan county senior real?

How to fill out buchanan county senior real?

What is the purpose of buchanan county senior real?

What information must be reported on buchanan county senior real?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.