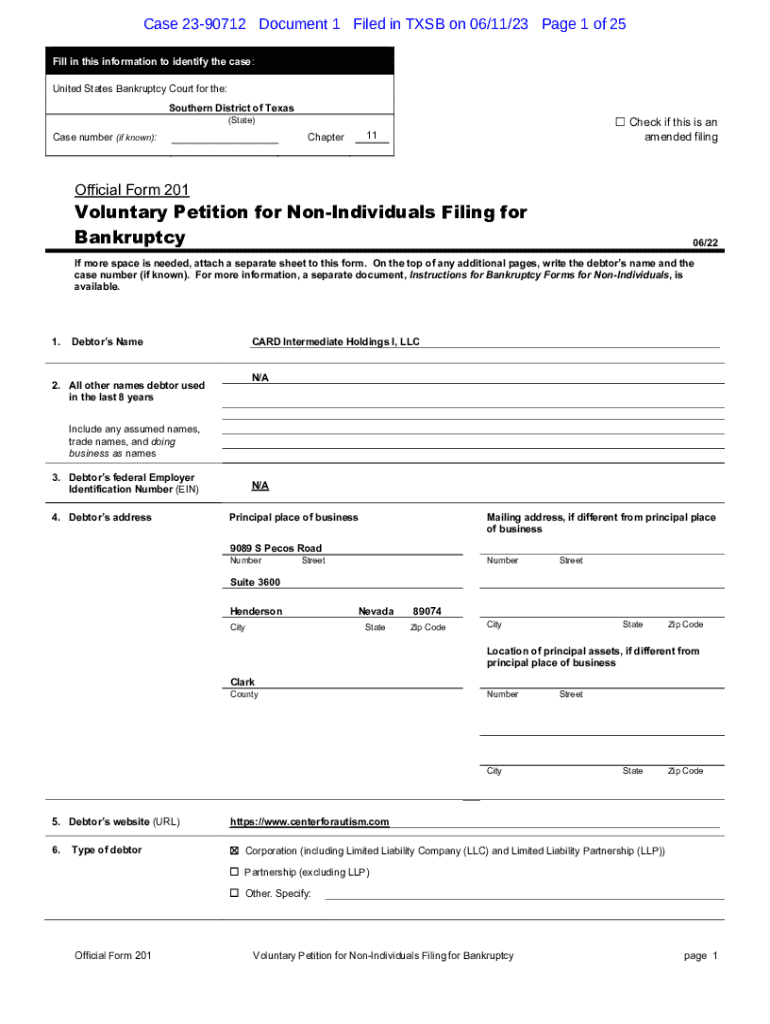

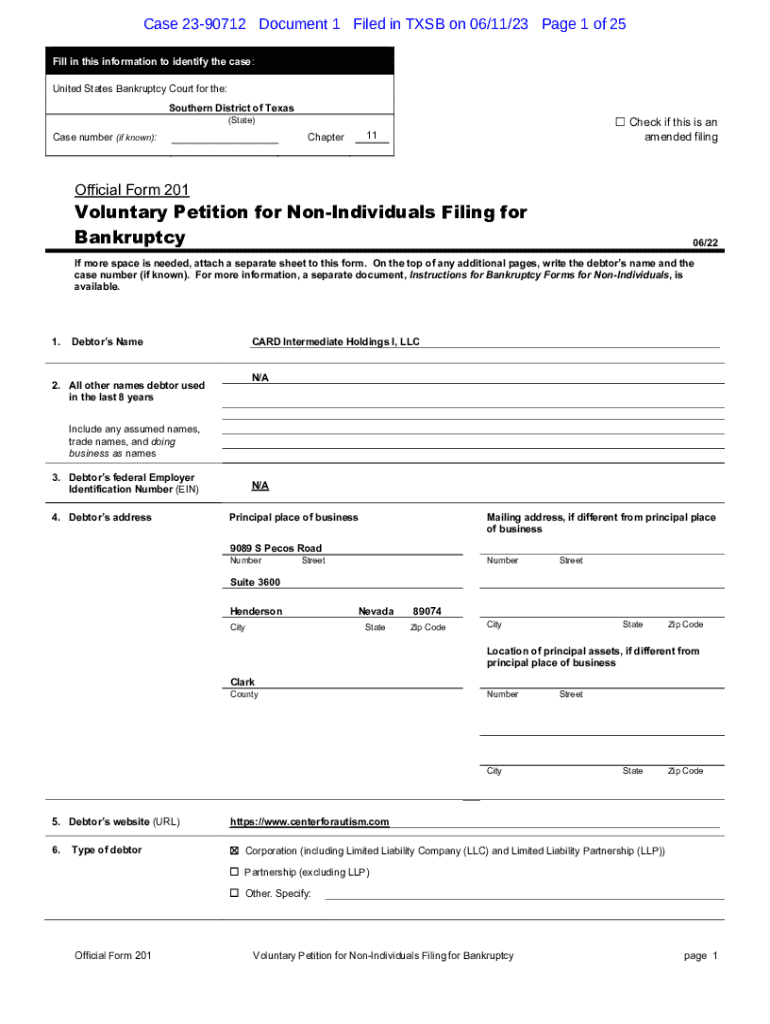

Get the free Official Form 201

Get, Create, Make and Sign official form 201

How to edit official form 201 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out official form 201

How to fill out official form 201

Who needs official form 201?

A Comprehensive Guide to the Official Form 201 Form

Understanding the Official Form 201

The Official Form 201 is a crucial document in the realm of bankruptcy filings. Specifically designed for individuals and businesses seeking debt relief under Chapter 7 of the United States Bankruptcy Code, it serves as the initial step in the legal process of bankruptcy. This form not only outlines the debtor’s financial situation but also establishes the legal grounds for the case.

The importance of Form 201 cannot be overstated, as it provides a snapshot of the debtor's financial affairs, detailing their assets, liabilities, and overall economic challenges. Completing this form accurately is vital, as it can impact the outcome of the bankruptcy proceedings. Therefore, understanding when to use Official Form 201 is equally important, typically required at the outset of a bankruptcy case.

Key components of the Official Form 201

The Official Form 201 is structured to facilitate a systematic collection of detailed information about the debtor's finances. Users can expect to encounter a variety of sections that guide them through the necessary data. Primarily, the form includes sections for debtor information, estate property, income and expenses, and a statement of financial affairs.

Understanding the common terminology associated with Form 201 is equally critical. Terms like 'debtor,' 'creditor,' and 'exempt properties' play significant roles in comprehending the legal implications of the document.

Step-by-step guide to filling out the Official Form 201

Filling out the Official Form 201 can be a straightforward process if you proceed methodically. Start by collecting necessary information to prevent any mistakes or omissions. Identification requirements typically include government-issued IDs, while financial information should encompass recent pay stubs, bank statements, and a list of your creditors.

Editing and modifying the Official Form 201

Once the Official Form 201 has been submitted, making amendments may become necessary. Procedures for amendments can vary by jurisdiction, but generally, you can file a motion to amend your documents. It’s vital to approach this process cautiously as changes can potentially delay your proceedings or alter the course of the case.

If you're utilizing pdfFiller, editing becomes significantly simplified. The platform provides robust features for document management, permitting users to adjust their forms without needing to print or rewrite entire sections. The ease of making corrections is one of the key advantages of using the cloud-based solution. Features include real-time editing, document comparisons, and easy access to a history of changes.

Signing the Official Form 201

Signing the Official Form 201 comes with significant legal responsibilities. By signing, you are affirming the accuracy of the information provided and acknowledging the serious nature of the bankruptcy process. Your signature can also have implications for your legal standing, so it is essential to ensure all information is correct before proceeding.

For those preferring electronic options, pdfFiller offers various electronic signature solutions. With just a few clicks, you can e-sign your documents securely, allowing for a faster submission process without the need of physical paperwork. This feature not only streamlines the process but also enhances the overall efficiency of your document management.

Submitting the Official Form 201

When it comes to submitting the Official Form 201, adherence to submission guidelines is essential. Individuals typically submit this form at their local bankruptcy court. You may also have the option to submit electronically based on the court's capabilities, further expediting your application process.

Frequently asked questions about the Official Form 201

Questions often arise regarding the Official Form 201, notably what actions to take if the form is rejected. If your submission is returned for corrections, promptly address any issues and resubmit as instructed. Additionally, accessing copies of submitted forms may vary; however, most courts maintain records that you can request.

Additional tips for managing your Official Form 201

Effective document management throughout the bankruptcy process is essential for minimizing stress. Adopting best practices, such as organizing your documents in a folder specific to your bankruptcy case, can significantly ease the burden during this challenging time.

Utilizing pdfFiller not only allows for seamless collaboration with team members but also ensures secure access to your documents from anywhere. The platform’s collaborative features, such as commenting and real-time sharing, enable teams to work together efficiently, making the form-filling process smoother.

Unique features of using pdfFiller for niche forms

PdfFiller offers comprehensive tools designed specifically for editing and managing the Official Form 201 and other niche forms. This functionality is particularly beneficial for individuals navigating complex documents, ensuring accuracy and compliance with legal standards.

The cloud-based nature of pdfFiller provides significant benefits, allowing users to access their documents from any device, at any time. This flexibility empowers users to handle their forms conveniently, reducing the time and effort otherwise required for traditional document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete official form 201 online?

Can I create an electronic signature for signing my official form 201 in Gmail?

How do I fill out the official form 201 form on my smartphone?

What is official form 201?

Who is required to file official form 201?

How to fill out official form 201?

What is the purpose of official form 201?

What information must be reported on official form 201?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.