Get the free Budget Form

Get, Create, Make and Sign budget form

How to edit budget form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out budget form

How to fill out budget form

Who needs budget form?

Mastering Your Budget Form: A Comprehensive Guide

Understanding the importance of a budget form

A budget form is a structured document that helps you track your income and expenses over a specific period. For both individuals and teams, a budget form serves as a financial map, guiding decision-making and resource allocation.

Budget forms are essential tools in financial planning. They allow users to gain clear insights into where their money is going, make informed decisions, and adjust their strategies as necessary. The primary benefit of utilizing a budget form is that it promotes accountability and discipline, whether it's in personal finance or among team members.

Types of budget forms available

Different financial situations call for different types of budget forms. Here are a few common formats:

How to use a budget form effectively

Maximizing the effectiveness of your budget form starts with proper usage. Here’s a step-by-step guide:

By maintaining an organized tracking method and making use of digital tools, you can simplify this process even further.

Strategic budgeting approaches

Employing effective budgeting strategies can significantly improve your financial health. Some of the well-known methods include:

Tailoring your budget form

One size doesn’t fit all when it comes to budgeting. Customizing your budget form can enhance its effectiveness for your unique financial situation. Many online platforms allow for extensive customization to address varied needs, including:

Overcoming common budgeting challenges

Many individuals face hurdles while budgeting. Common challenges include unpredictable expenses and irregular income. Here are strategies to overcome these challenges:

Additionally, answering frequently asked questions can help demystify the budgeting process: Can a budget form help save money? Yes, it adds transparency to your financial situation, allowing for informed decision-making.

Enhancing financial awareness through budgeting

A budget form is not merely a tool for tracking expenses; it is a fundamental component of achieving financial awareness. Analyzing your spending using the insights gained from your budget form allows for a nuanced understanding of financial patterns and behaviors.

Conducting regular budget reviews is essential. It ensures that you stay aligned with your financial goals and are prepared to adapt as necessary. Setting achievable financial goals and tracking progress systematically leads to lasting improvement in financial stability.

Tools and systems for budgeting success

With the rise of technology, there are numerous tools available to streamline budgeting. Utilizing complementary tools enhances the budgeting process and may include the following:

Several software options also integrate budget forms with financial applications, enhancing the overall budgeting experience.

Building a support system around your budget

Budgeting becomes more manageable with a support system. This might include collaborating with peers on shared budgets, which fosters accountability and group motivation. Engage professional financial advisors when faced with complex situations, and leverage community resources offering budgeting workshops or support groups.

When budgeting is shared, it can enhance motivation and foster a culture of responsibility within teams or families. Make use of online forums to discuss challenges and exchange tips.

Next steps after creating your budget form

Once your budget form is prepared, the next phase entails implementation. Regularly measure your success through defined metrics, such as adherence to spending limits or achievement of savings goals.

Adjust your budget form as needed to reflect any changes in circumstances, and consider sharing your financial goals with accountability partners to maintain focus and dedication. With ongoing adjustments and accountability, your budgeting efforts can lead to lasting financial health.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete budget form online?

Can I edit budget form on an iOS device?

Can I edit budget form on an Android device?

What is budget form?

Who is required to file budget form?

How to fill out budget form?

What is the purpose of budget form?

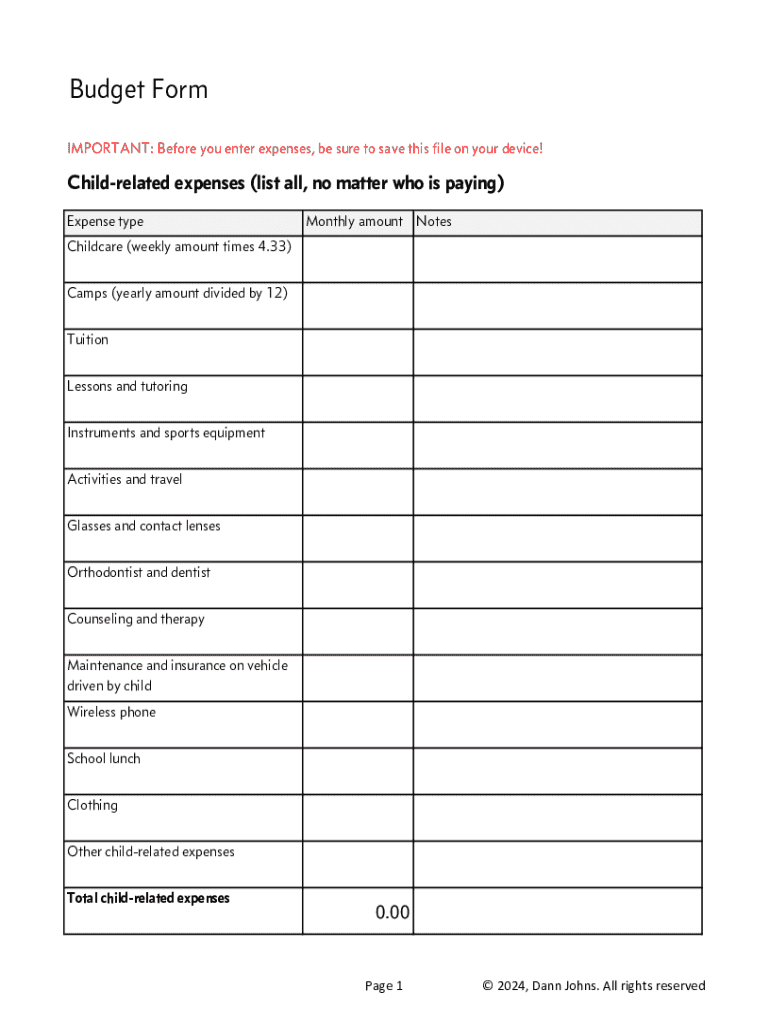

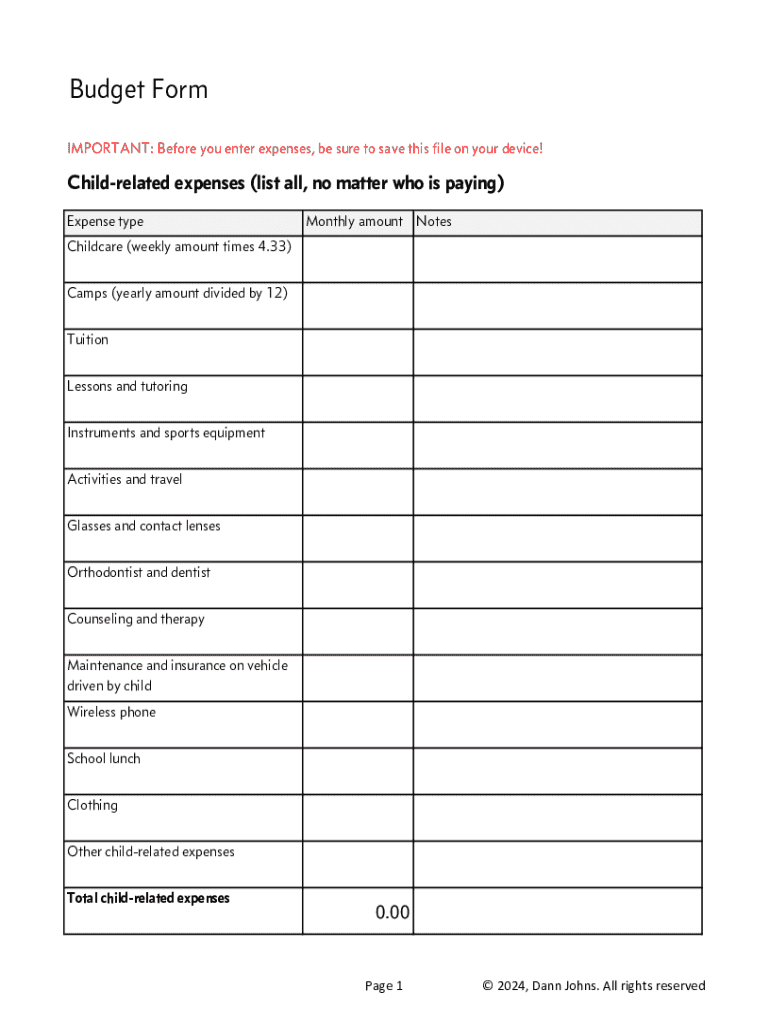

What information must be reported on budget form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.