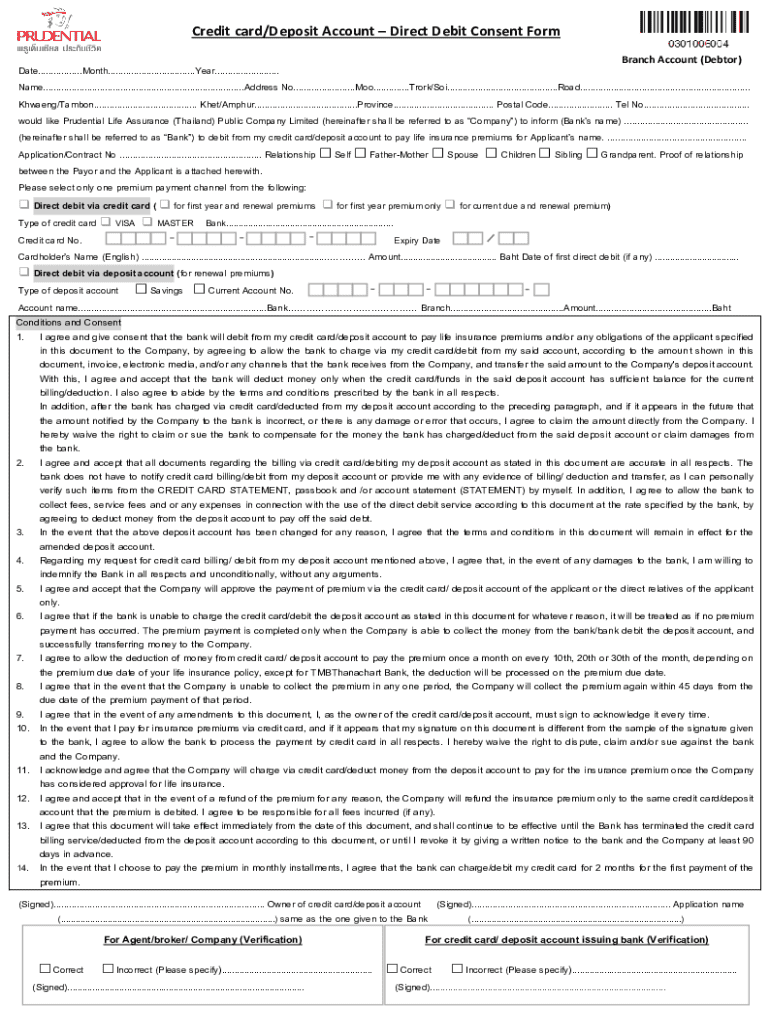

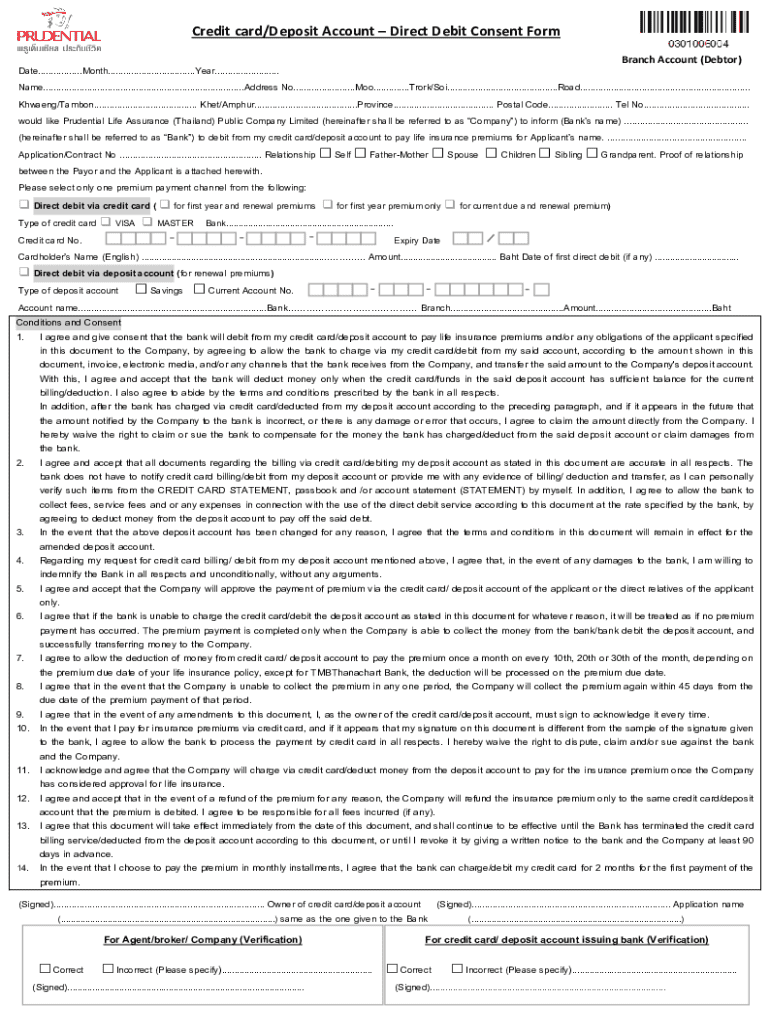

Get the free Credit Card/deposit Account – Direct Debit Consent Form

Get, Create, Make and Sign credit carddeposit account direct

How to edit credit carddeposit account direct online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit carddeposit account direct

How to fill out credit carddeposit account direct

Who needs credit carddeposit account direct?

Understanding Credit Card Deposit Accounts: A Comprehensive Guide

Understanding credit card deposit accounts

Credit card deposit accounts offer users a modern solution for managing their funds through a combination of credit and traditional banking functionalities. By linking a credit card to a deposit account, individuals gain the ability to deposit directly, enhancing their financial flexibility. These accounts help users to facilitate quick access to cash and secure holdings, making them an attractive choice for those looking to manage their finances innovatively.

Unlike traditional deposit accounts, which typically use only cash and checks, credit card deposit accounts incorporate credit limits into the mix. This unique feature empowers cardholders to leverage their credit for instant liquidity while still enjoying the security and advantages of a deposit account. The primary purpose of these accounts is to streamline how users handle everyday transactions, bill payments, and cash withdrawals.

Setting up your credit card deposit account

Opening a credit card deposit account enables individuals to take full advantage of the potential benefits these accounts offer. The process can be straightforward if approached step-by-step. Here’s how to set up your credit card deposit account seamlessly.

Filling out the credit card deposit account direct form

The credit card deposit account direct form is crucial for creating your account correctly. Understanding each section of the form ensures you accurately convey your information, which can expedite the approval process.

The first section requires personal information, including your full name, address, date of birth, and Social Security number. It's essential to double-check all entries for accuracy, as mistakes can delay your application.

The financial information section calls for details about your income and monthly expenses. Transparency in this area contributes to a strong financial profile, which could positively influence credit limits and account services. Lastly, selecting your account preferences allows you to tailor features like withdrawal limits and interest rates to your needs.

Editing and managing your credit card deposit account form

Managing your credit card deposit account form after submission is vital for ensuring that your account reflects the most accurate and current information. To access your submitted form, log in to your provider’s online banking system where you’ll find options to view and edit the submitted information.

It's crucial to keep track of any edits you make to your form. Maintain a well-organized digital document library, documenting all changes along with the dates they were made. This practice not only simplifies future updates but also strengthens your overall financial biography with accurate records.

Signing your credit card deposit account form

E-signatures have revolutionized financial transactions, making the signing process more accessible and efficient. For your credit card deposit account form, you’ll likely encounter an option for electronic signing, which is just as legally binding as traditional signed forms. To e-sign your document securely, follow the instructions provided by your provider's system.

Ensure compliance with legal requirements by confirming you're following guidelines established in your jurisdiction regarding electronic signatures. Many providers also offer security features, including two-step verification, to further secure your signature process.

Frequently asked questions (FAQs)

As you navigate the credit card deposit account direct form, you may encounter questions or uncertainties. Addressing these often-abundant queries can ease the application experience and enhance your understanding.

Exploring the benefits of credit card deposit accounts

Choosing a credit card deposit account over traditional banking options can yield significant advantages. Flexibility is a primary benefit; these accounts allow users to access funds from virtually anywhere, making them perfect for individuals who value mobility and immediacy in managing their finances.

Security features in credit card deposit accounts are typically enhanced compared to standard accounts. Many providers include advanced fraud protection measures, which can safeguard your financial information while offering peace of mind. Additionally, you may find that some accounts offer rewards programs that accumulate cash back or points for using your credit card, providing even more incentives to utilize this banking method.

Troubleshooting common issues

Encountering issues during the application process can be frustrating, but understanding troubleshooting steps can help you navigate these challenges smoothly. If your application is denied, don't hesitate to reach out to customer service. They can provide insights into the reason for denial and guide you on how to improve your application for future attempts.

Addressing issues with deposits might include insufficient funds alerts, incorrect account numbers, or card restrictions. Usually, these problems can be resolved quickly by contacting customer support or referring to your financial institution’s website for assistance troubleshooting. Keeping your details accurate is vital for smooth transactions.

Tips for maximizing your credit card deposit account

Maximizing the benefits of your credit card deposit account involves using its features wisely and maintaining robust account health. Familiarize yourself with the account's functionalities, such as automatic payments and budgeting tools, to help manage your funds efficiently.

Maintain a healthy account balance to avoid incurring unnecessary fees. Keeping track of your spending and setting reminders for payment dates can help avert late fees and improve your credit score. Understanding all fees associated with the account, like international transaction fees or account maintenance costs, can enable you to navigate your banking experience without surprises.

Downloading, signing, and submitting your form

To set up your credit card deposit account, you will need to download the respective direct form, which can typically be accessed through your provider’s website. Platforms like pdfFiller allow you to download, complete, and digitally sign your forms efficiently.

After downloading the form, follow the specified instructions for filling it out. Once completed, utilize pdfFiller's tools for e-signing, ensuring you maintain security and compliance during the submission process. Upload the signed document back to your provider’s portal, or submit it directly via the method indicated in their application instructions.

Key takeaways and next steps

Setting up a credit card deposit account is a manageable task if approached with care and understanding. By following the steps outlined in this guide, from choosing a provider to filling out the credit card deposit account direct form accurately, you position yourself for financial success.

For any questions or additional inquiries, don't hesitate to reach out to your provider's customer support resources. They can assist you in navigating any complexities and ensuring that your experience with your credit card deposit account is seamless and beneficial.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete credit carddeposit account direct online?

How do I make edits in credit carddeposit account direct without leaving Chrome?

How do I edit credit carddeposit account direct on an iOS device?

What is credit carddeposit account direct?

Who is required to file credit carddeposit account direct?

How to fill out credit carddeposit account direct?

What is the purpose of credit carddeposit account direct?

What information must be reported on credit carddeposit account direct?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.