Get the free Business Credit Application

Get, Create, Make and Sign business credit application

How to edit business credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business credit application

How to fill out business credit application

Who needs business credit application?

Understanding the Business Credit Application Form

Understanding the business credit application form

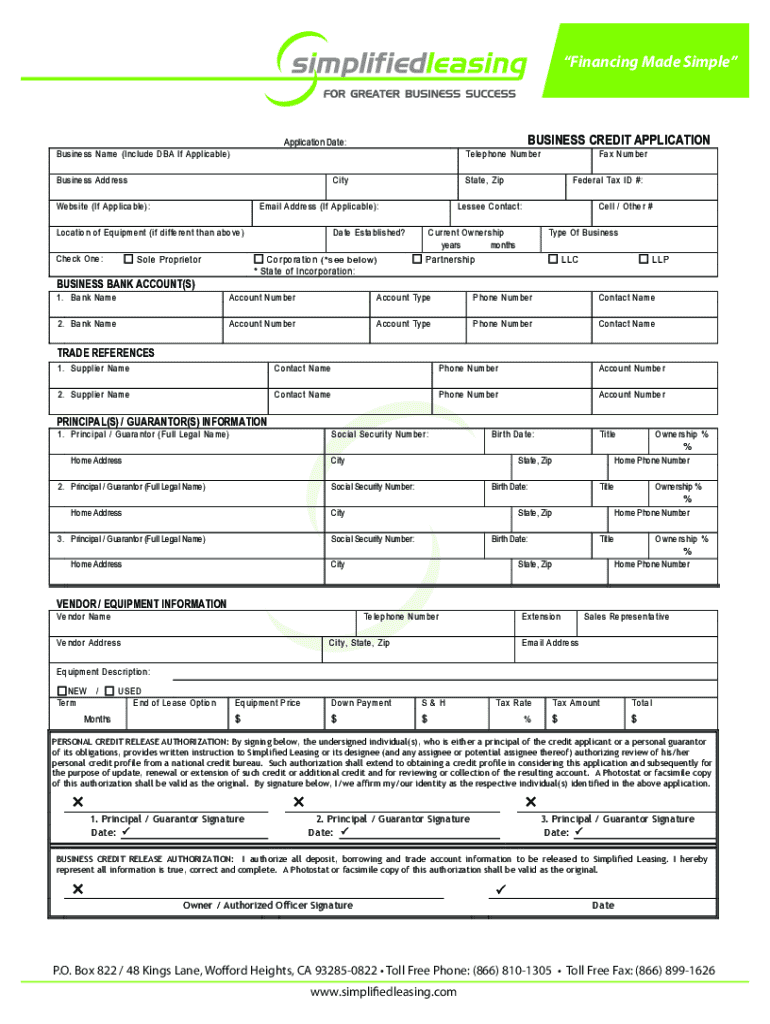

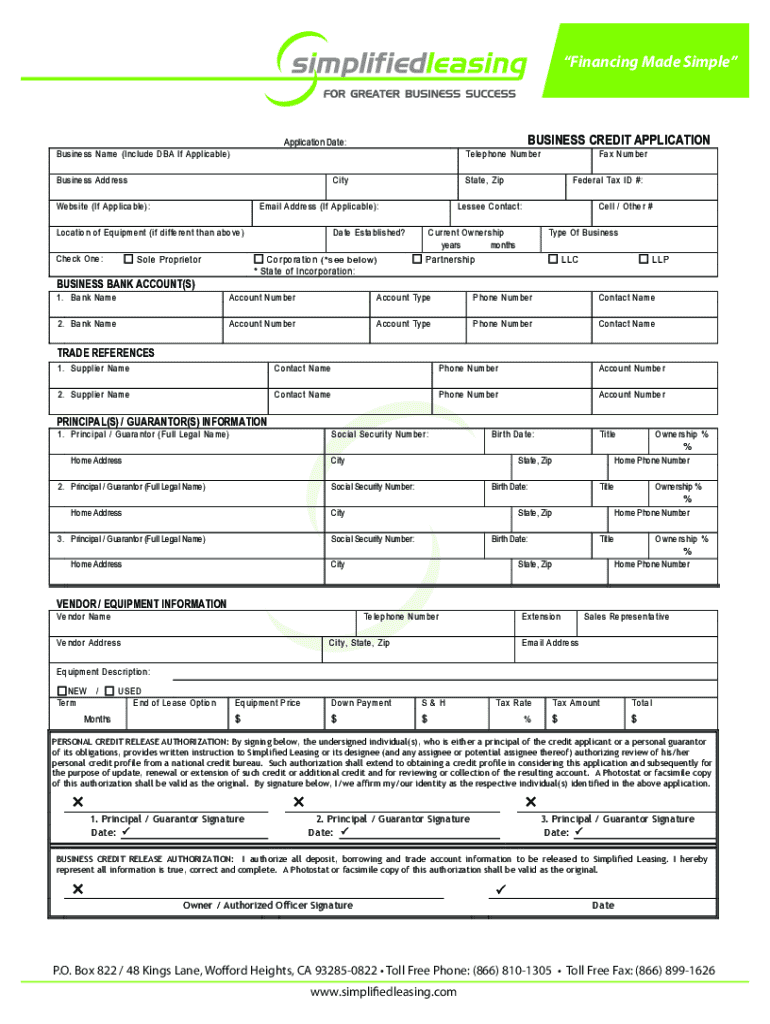

A business credit application form is a critical document used by companies to apply for credit from financial institutions and vendors. This form collects vital information necessary for lenders and suppliers to evaluate the creditworthiness of the business. It serves as a foundational step in establishing a credit relationship and is essential for maintaining cash flow and purchasing power.

For financial institutions, the business credit application form is essential for mitigating risk and effectively assessing an applicant's ability to repay debt. It provides insight into the business's financial health, operational structure, and overall viability. For companies, submitting a thoroughly completed application opens doors to improved liquidity, vendor relationships, and the flexibility required to seize growth opportunities.

Key elements of a business credit application form

To ensure a comprehensive evaluation, a business credit application form typically includes several key elements. Essential information required usually comprises the business name, contact details, ownership structure, and details about key personnel. Providing accurate and detailed information helps create a favorable impression and aids in swift processing.

In addition to the form itself, applicants may be required to submit additional documentation like tax returns and financial statements. Some forms might include specialized sections tailored for different business types such as limited liability companies (LLC) or corporations, which may have distinct requirements.

Crafting the perfect business credit application

Filling out a business credit application form correctly is paramount. The goal is to present your business in the best light while ensuring all necessary information is complete and accurate. Here are nine essential tips to help you create an effective application.

Common challenges in the manual credit application process

Submitting a business credit application is often fraught with challenges. Errors or incomplete information can delay approval, while lost documentation can lead to frustrations for both the applicant and the financial institution involved. Additionally, miscommunication can occur when follow-up requests for further information are not adequately addressed.

Common issues include mistakes in financial reporting or misinterpretation of the application instructions, which can result in delays or outright denials. In a manual processing system, applications may be subject to longer processing times, leading to operational inefficiencies and potentially lost business opportunities.

Embracing automation for business credit applications

As businesses evolve, so do their application processes. Embracing automation can significantly enhance the business credit application experience. Technology now plays a pivotal role in streamlining the application process, making it more efficient and user-friendly.

There are numerous tools available that can help automate the credit application process. These tools can simplify form completion, manage document sharing, and even facilitate e-signatures, ensuring a seamless workflow.

FAQs about business credit applications

When navigating the landscape of business credit applications, several common questions might arise. It's essential to understand the nuances to enhance your application experience. Factors affecting creditworthiness include your business's credit history, current financial stability, and the economic climate.

Best practices for managing business credit applications

To enhance the business credit application process, create a clear standard operating procedure (SOP) that delineates steps and responsibilities. Regularly review and update application forms to reflect changing financial regulations and market conditions.

Having structured procedures and dedicated training can minimize errors and promote a more robust credit application process, ultimately enhancing credit access.

Resources for business credit applications

Utilizing the right resources is crucial for effectively managing business credit applications. Leverage templates and samples of credit application forms available online to set a clear structure for your submission.

Addressing risks in credit applications

In any credit process, identification of common risks is fundamental for improving outcomes. Credit applications may be subjected to inaccurate information, missed deadlines, or fluctuating market conditions, all potentially jeopardizing approval.

Addressing these risks proactively can create a smoother credit application process, building long-term relationships with financial institutions.

Integrating the business credit application with other financial processes

To maximize efficiency, it's essential to connect the business credit application process with other financial functions such as accounts receivable management, treasury management, and cash flow forecasting. By integrating these systems, businesses can develop a holistic view of their financial landscape.

Such integration not only ensures seamless operations but also places your business in a better position to take strategic financial actions.

Advanced topics in business credit applications

Understanding legal considerations and compliance is paramount when navigating business credit applications. Different regions and institutions may have specific regulations that must be adhered to.

Staying informed about these advanced topics can empower businesses to better navigate the complexities of obtaining credit.

Contact experts for more information

Considering the intricacies involved in completing a business credit application, it may be beneficial to consult with financial advisors or attend workshops and webinars focusing on credit application strategies. This guidance can provide invaluable insights into best practices and trends.

Utilizing expert resources can significantly enhance your chances of securing the necessary credit to empower your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business credit application to be eSigned by others?

How do I execute business credit application online?

Can I create an eSignature for the business credit application in Gmail?

What is business credit application?

Who is required to file business credit application?

How to fill out business credit application?

What is the purpose of business credit application?

What information must be reported on business credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.