Get the free Ach Authorization Form

Get, Create, Make and Sign ach authorization form

How to edit ach authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ach authorization form

How to fill out ach authorization form

Who needs ach authorization form?

ACH Authorization Form - How-to Guide

Understanding the ACH authorization form

An ACH authorization form is a critical document that allows individuals or organizations to authorize automatic electronic payments directly from their bank accounts. This form is essential for facilitating ACH transactions, which are governed by the National Automated Clearing House Association (NACHA) rules and regulations. By providing permission through the ACH authorization form, account holders simplify the payment process, ensuring timely payments for services such as loans, subscriptions, or bills.

The importance of the ACH authorization cannot be overstated, as it provides security and clarity to both parties involved in an electronic transaction. Without this form, businesses cannot legally withdraw funds from customers' accounts, thus safeguarding against unauthorized transactions. This fosters trust and reliability in electronic payment systems.

Common use cases for ACH authorization forms include recurring utility payments, subscription services, payroll, and vendor payments. Businesses across diverse sectors rely on this form to automate transactions, which ultimately helps streamline operations and minimize the risk of late or missed payments.

Different types of ACH authorization formats

ACH authorization forms come in various formats, primarily distinguished by their functionality. ACH debit authorization forms are used to withdraw funds from a customer's bank account, while ACH credit authorization forms allow businesses to deposit money into an account. Understanding the difference between these two is crucial for selecting the right form for your specific transaction needs.

ACH authorization forms can also be categorized by their delivery method. Electronic forms offer quick processing, while paper forms may take longer to handle but are sometimes necessary for certain demographics or situations. Furthermore, verbal authorizations are applicable in limited scenarios, often when immediate transactions are required, but they should be recorded properly to ensure compliance and security.

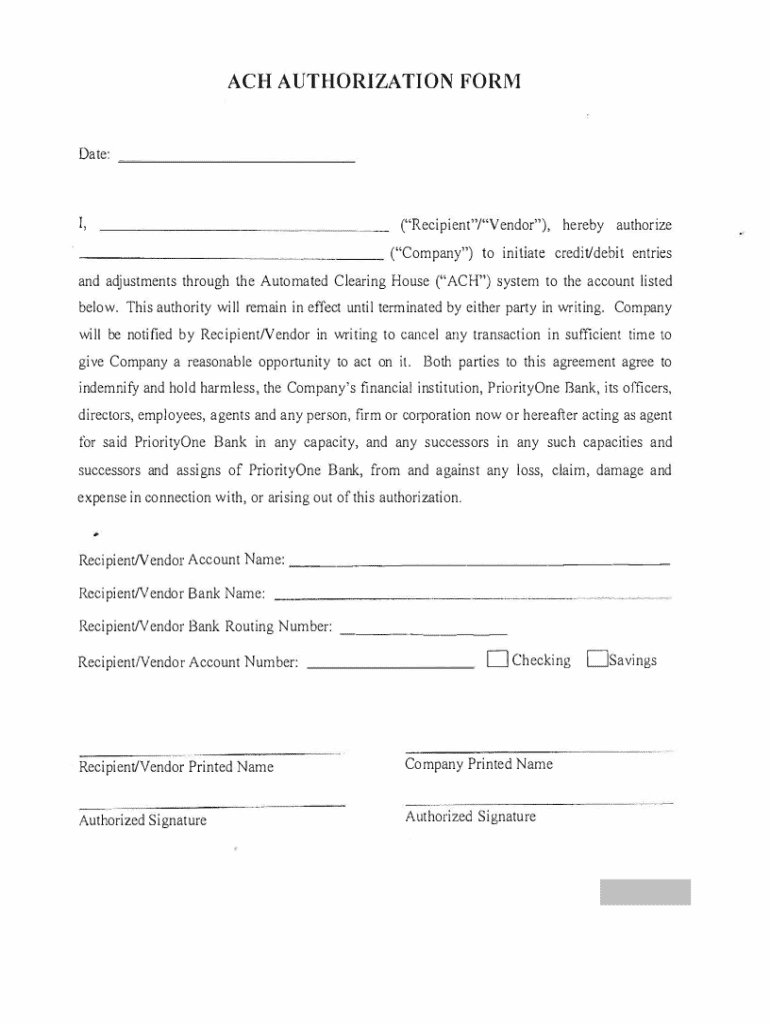

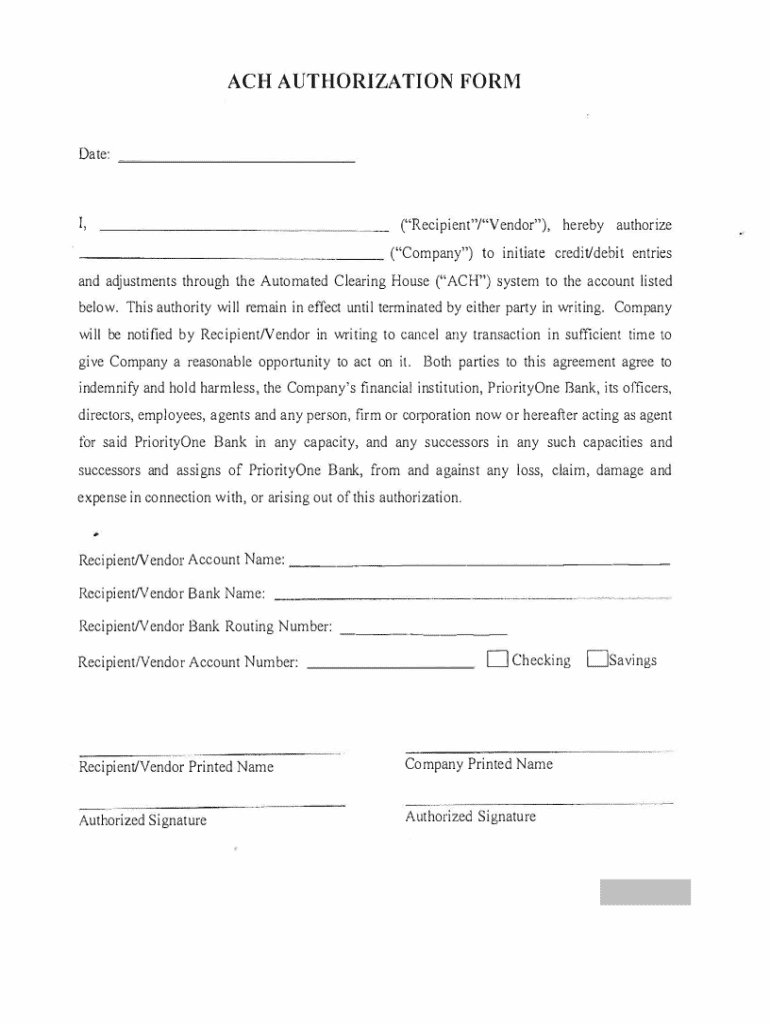

Components of an ACH authorization form

Each ACH authorization form contains several critical components ensuring clarity and legality in transactions. The first key component is the account holder details. This section requires accurate personal information such as the name, address, and contact details of the individual or organization granting authorization. Accurate data entry is vital as errors can lead to disputes or delays in transactions.

Next, bank account information must be provided, including essential details like the account number and bank routing number. It is crucial to understand the types of accounts (checking vs. savings) when filling out this section to avoid any transaction issues. Additionally, transaction details, such as the purpose of payments and whether they are one-time or recurring, should be explicitly stated.

The authorization statement comes next, which should clearly outline the account holder’s consent to the transaction, including all necessary legal language. Ensuring this statement is clear and comprehensive helps avoid potential disputes down the line. Lastly, the signature and date of consent are mandatory, verifying the account holder's approval of the authorization. Consideration should also be given to digital signatures, which are legally accepted in many jurisdictions and enhance convenience.

How to fill out an ACH authorization form

Filling out an ACH authorization form correctly is critical to ensure that payments are processed smoothly. Begin by gathering all necessary information, including your personal and bank account details. Read through the form carefully to understand what is required in each section before you start inputting your information.

A step-by-step approach is often most effective. Start with the account holder details, ensuring that each piece of data is accurate. Follow this by filling in your bank account information, double-checking the routing and account numbers. When specifying transaction details, clearly define the purposes, whether they are for a one-off transaction or for recurring payments, noting the expected frequency.

Pay special attention to the authorization statement; it should unequivocally articulate your permission for the transaction. Sign and date the form at the end to finalize the authorization. Common mistakes to avoid include incomplete sections, incorrect account information, and misunderstanding the authorization statement. To simplify the process, you can use interactive tools like pdfFiller to fill out and manage your forms efficiently.

Creating your own ACH authorization form

Creating an ACH authorization form can be simplified by utilizing templates available through platforms like pdfFiller. These templates come pre-filled with standard language and structures, allowing you to quickly adapt them for your specific needs. By using these ready-to-use options, you can save time and ensure compliance with applicable regulations.

Designing a custom form is also an option if your requirements are unique. When customizing, follow best practices by keeping the form clear and user-friendly. Make sure the most critical sections are highlighted and that the form includes all necessary components discussed previously. Consider embedding interactive tools that enhance usability, providing users with immediate, real-time assistance as they fill out their forms.

Managing your ACH authorization forms

Once you have generated your ACH authorization forms, managing them efficiently is essential. Keeping track of authorizations involves maintaining a reliable record-keeping system. This can be achieved through digital storage solutions, which not only save physical space but also enhance security and recovery options. Ensure your files are organized in clearly labeled folders for easy access.

Modifying an existing authorization can also be necessary over time, especially if there are changes in account details or transaction frequency. Be sure to follow proper procedures to communicate changes to involved parties promptly. Digital solutions allow for quick adjustments, ensuring you maintain up-to-date records and authorization agreements.

Canceling an ACH authorization

Canceling an ACH authorization should be done carefully to avoid potential issues. The process typically begins with providing written notice to the payer or payment processor, following the guidelines set forth in the original authorization agreement. In your cancellation request, clearly state your intention to revoke authorization and include relevant account information for processing. This ensures the receiving party can easily identify the appropriate records to update.

Understanding the compliance requirements is critical for cancellations, as specific timelines may apply. Be aware of the NACHA rules to ensure all necessary steps are followed. Best practices also include notifying affected parties, such as service providers or banks, to prevent any unauthorized withdrawals or transactions that could lead to disputes.

Compliance and best practices

To ensure that your ACH authorizations adhere to legal requirements, familiarize yourself with NACHA regulations and any relevant federal guidelines. Maintaining compliance is not just about following rules but also about building trust with customers and partners. It’s advisable to regularly review your processes to align with any changes in regulations.

Best practices include keeping detailed records of all ACH transactions and authorizations. These documents should be securely stored and easily retrievable for auditing purposes if necessary. Additionally, consider implementing a robust internal review process to catch potential issues before they lead to disputes. Documentation is key in substantiating transactions and protecting your business against claims.

Frequently asked questions (FAQs)

When it comes to ACH authorizations, many questions arise. One common area of confusion is the difference between ACH debit and credit authorizations, especially in how they affect transactions. ACH debit authorizations allow for charges to be withdrawn from the account, while credit authorizations deal with deposits.

Additionally, users often inquire about troubleshooting issues with ACH transactions, such as returned payments or delays. Maintaining up-to-date records and promptly addressing any errors can significantly reduce the likelihood of these issues. Last but not least, understanding how to stay compliant and anticipate changes in legislation is crucial for businesses engaged in electronic transactions.

Advanced topics in ACH authorization

As electronic payment systems evolve, so do the complexities surrounding ACH authorization. One advanced topic to explore is ACH authorization in international transactions, where different regulations apply across borders affecting how payments are processed. These include considerations for currency exchanges and compliance requirements that vary by country.

Further insights into trends reveal the growing shift towards digital payment authorizations, with innovations such as blockchain potentially reshaping how these transactions are processed. Companies must stay ahead of the curve to take advantage of these advancements. Moreover, discussing the future of ACH transactions entails examining the increasing integration of advanced technologies that promise to enhance efficiency and security in electronic payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ach authorization form on a smartphone?

How do I fill out ach authorization form using my mobile device?

How do I complete ach authorization form on an Android device?

What is ach authorization form?

Who is required to file ach authorization form?

How to fill out ach authorization form?

What is the purpose of ach authorization form?

What information must be reported on ach authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.