Get the free Mortgage Questionnaire

Get, Create, Make and Sign mortgage questionnaire

Editing mortgage questionnaire online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage questionnaire

How to fill out mortgage questionnaire

Who needs mortgage questionnaire?

Mortgage Questionnaire Form - How-to Guide

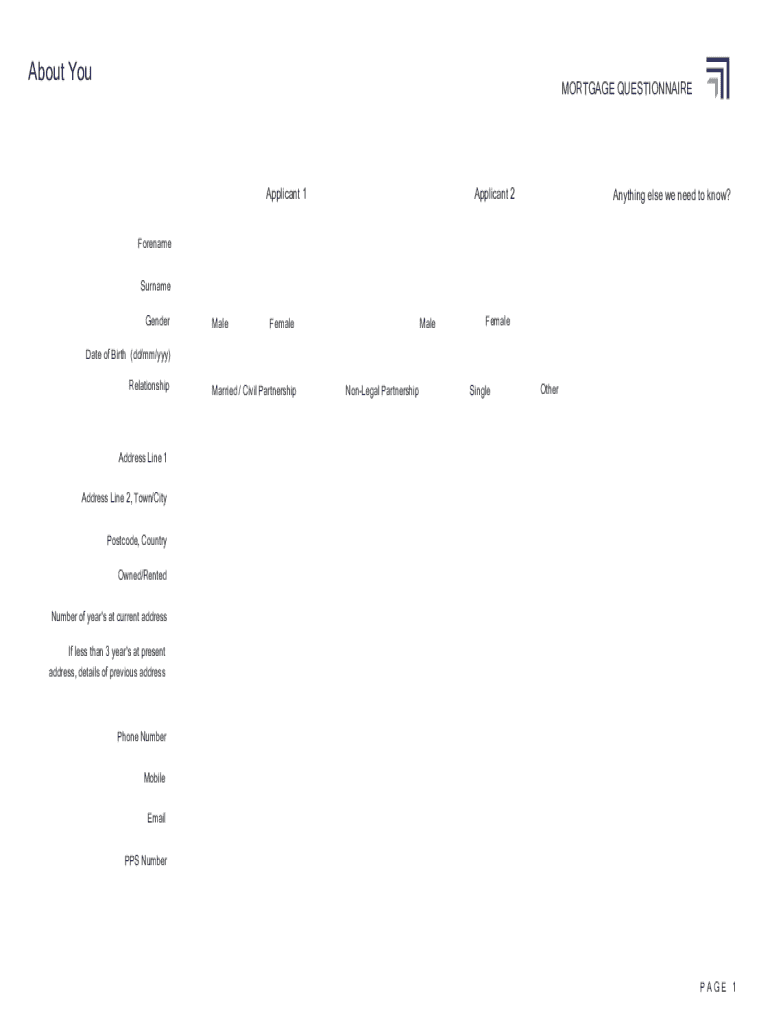

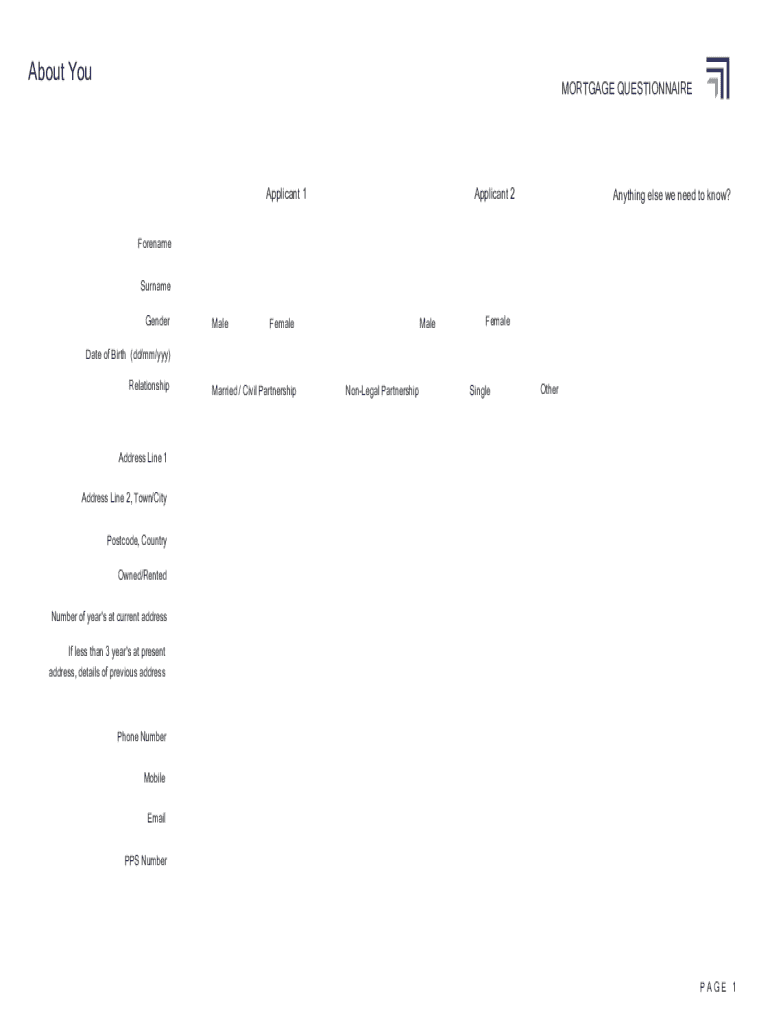

Understanding the mortgage questionnaire form

A mortgage questionnaire form is a crucial document in the mortgage application process designed to collect essential information from potential borrowers. This form serves not only as a tool for the loan officer to evaluate a borrower's eligibility but also streamlines communication and documentation between all parties involved in the transaction. The importance of this form cannot be overstated; it lays the foundation for the entire mortgage application process.

By gathering data such as personal information, employment history, financial commitments, and credit history, the mortgage questionnaire form enables lenders to make informed decisions swiftly. Additionally, it helps applicants to understand their own financial standing better, making the mortgage application process smoother and more efficient.

Key components of a mortgage questionnaire form

The mortgage questionnaire form comprises several essential sections that capture critical aspects of the borrower's financial profile. Understanding each component is vital for ensuring accurate and thorough submissions.

Completing the mortgage questionnaire form

Completing the mortgage questionnaire form requires careful attention to detail. Here’s a step-by-step guide to help you navigate the process efficiently.

Best practices for accuracy and efficiency include reviewing each section carefully, ensuring that every detail is accounted for. Common mistakes to avoid are rushing through the form, providing incomplete information, and failing to double-check for errors, which could delay your application.

Editing and customizing your form

Personalizing your mortgage questionnaire form can enhance clarity and organization. Tools like pdfFiller enable users to edit PDF documents seamlessly.

You can customize your form by adjusting questions to suit your specific circumstances or those of your team members. Collaborating with team members on the form's completion is also straightforward with cloud-based tools, allowing multiple users to work simultaneously and expedite the process.

eSigning the mortgage questionnaire

eSigning has become an integral part of the mortgage application process, offering a convenient and legally binding way to finalize documents. The importance of eSigning cannot be understated; it significantly speeds up the approval process and eliminates the need for paper-based documentation.

Security features protecting your digital signatures, like encryption and authentication methods, provide peace of mind, ensuring that your documents and identity remain secure throughout the process.

Submitting your mortgage questionnaire form

Once the mortgage questionnaire form is complete and eSigned, the next step is submission. Applicants have several options for submitting their forms, and choosing the right one is crucial.

Tracking your submissions for peace of mind can be done easily since most platforms will notify you when your documents have been received and processed.

Additional services related to mortgage questionnaire form

Exploring support and resources related to the mortgage questionnaire form can significantly enhance your experience. Services available through pdfFiller include expert customer support for any questions you may have while filling out your forms.

Connecting with expert mortgage advisers enables you to receive personalized advice tailored to your financial situation, potentially improving your chances of loan approval.

Commonly asked questions about mortgage questionnaires

Understanding the nuances of the mortgage questionnaire form is essential, which is why many potential borrowers have similar questions. Addressing these inquiries proactively can prevent confusion.

Essential tips for enhancing your mortgage questionnaire experience

Leveraging online tools can ease the process of completing and managing the mortgage questionnaire form. Using a platform like pdfFiller not only simplifies document management but also enhances collaboration among teams.

By implementing these strategies, applicants can enhance their experience, leading to smoother and more effective mortgage applications.

How to create a mortgage questionnaire for free (in 5 steps)

Creating a customized mortgage questionnaire form is straightforward with pdfFiller. Here’s how you can make one for free in just five simple steps.

This approach not only saves time but also ensures that the questionnaire meets your specific requirements, making the mortgage application process more efficient.

Industry insights and trends

Keeping abreast of the latest trends in the mortgage industry is vital for applicants. Recent updates indicate a growing preference for digital processes, as lenders prioritize efficiency and customer experience.

Staying updated with mortgage news, particularly through platforms like pdfFiller, can equip borrowers with valuable insights that influence their decisions. Feedback from applicants regarding the mortgage questionnaire process is also crucial in refining and enhancing the overall experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete mortgage questionnaire online?

How do I make edits in mortgage questionnaire without leaving Chrome?

Can I edit mortgage questionnaire on an iOS device?

What is mortgage questionnaire?

Who is required to file mortgage questionnaire?

How to fill out mortgage questionnaire?

What is the purpose of mortgage questionnaire?

What information must be reported on mortgage questionnaire?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.