Get the free Notice of Non-payment by Owner to Contractor

Get, Create, Make and Sign notice of non-payment by

How to edit notice of non-payment by online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of non-payment by

How to fill out notice of non-payment by

Who needs notice of non-payment by?

Complete Guide to Notice of Non-Payment by Form

Understanding the notice of non-payment

A notice of non-payment serves as a formal communication indicating that a debtor has failed to meet their financial obligations. This document not only alerts the debtor of their overdue payments but also sets the stage for potential legal action if the debt remains unpaid. This notice is crucial for both businesses and individuals, as it allows creditors to document their attempts to collect what is owed before escalating the situation.

Legally, the notice of non-payment must adhere to specific regulations which vary by region. Failure to deliver the notice properly can impair a creditor's ability to pursue further collection efforts or legal claims. The importance of this document cannot be overstated, as it is often a necessary step before initiating legal proceedings.

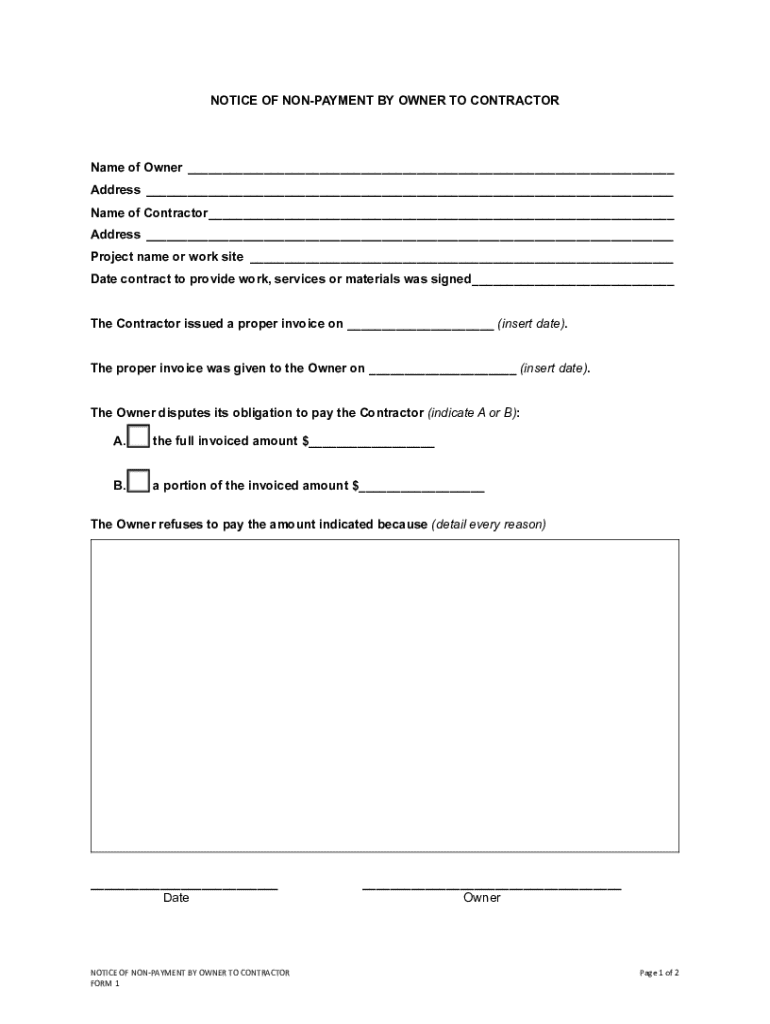

Overview of the notice of non-payment form

The notice of non-payment form features several key components that make it effective. Essential fields include debtor information, creditor details, the total amount owed, and payment terms. Each section must be filled out accurately to maintain clarity and facilitate the debt collection process.

Additionally, capturing credible signatures and including the date of issuance are vital to validate the notice. It's significant to understand that variations in the form can exist depending on local laws, and resources are available to find state-specific templates that comply with local regulations.

Step-by-step instructions for completing the form

Before starting to fill out the notice of non-payment form, it's essential to gather all necessary information. This includes the debtor's contact information, a detailed account of the debt, and any prior correspondence regarding the payment terms.

Editing and formatting your notice of non-payment

To ensure that your notice is professional and clear, utilizing tools for editing PDF forms like those offered by pdfFiller is beneficial. You can edit text, adjust formatting, and make modifications quickly and efficiently.

Maintaining clarity in your document is critical. Use straightforward language and correct legal terminology throughout to avoid confusion. This ensures that the debtor understands their obligations and the potential consequences of failing to respond appropriately.

Signing and sending the notice

Once your notice of non-payment is completed, you can eSign it using pdfFiller’s platform. eSignatures are valid in many jurisdictions, but it's prudent to verify their legality in your specific region to ensure your notice holds up legally.

After signing, consider the best delivery method. Options include certified mail, email, or personal delivery. Each method has its pros and cons; for example, certified mail provides proof of delivery, while email is quicker but may not serve as formal legal notice.

Managing responses to your notice of non-payment

Following the delivery of your notice, anticipate various responses from the debtor. They might acknowledge the debt and propose a payment plan, dispute the amount owed, or ignore the notice altogether.

If payment is made promptly, ensure you document the transaction. However, if the debtor disputes the notice or fails to respond, your next steps may involve considering legal action or consulting with a collections agency, depending on the severity of the situation.

FAQs about notice of non-payment forms

Common questions often arise concerning the notice of non-payment. For example, what should you do if the debtor disputes the notice? Understanding the dispute process and having clear documentation of the debt is essential. It's also important to know how long a debtor has to respond, as this varies by jurisdiction.

Additionally, navigating the form may present challenges. Troubleshooting tips include rechecking the information provided and ensuring clarity in your communication. Utilizing pdfFiller’s support can be a great asset in managing these issues effectively.

Popular topics and additional information

In conjunction with the notice of non-payment, other related forms may be beneficial. For instance, a notice of default or collection letters can provide a broader range of options for managing outstanding debts.

Utilizing pdfFiller’s platform can also enhance your document management strategy, providing resources and templates that simplify the process. Always check for ongoing support options to stay updated on best practices for managing notices.

Recent questions & answers about notice of non-payment

Debating trends in non-payment cases can shed light on common issues facing creditors today. Experts suggest that maintaining clear communication and documentation is paramount to resolving debts effectively.

Insights from legal experts emphasize the importance of understanding your rights and obligations when dealing with non-payment. This knowledge supports effective navigation through the complexities of debt recovery.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit notice of non-payment by straight from my smartphone?

How do I fill out the notice of non-payment by form on my smartphone?

How do I edit notice of non-payment by on an iOS device?

What is notice of non-payment by?

Who is required to file notice of non-payment by?

How to fill out notice of non-payment by?

What is the purpose of notice of non-payment by?

What information must be reported on notice of non-payment by?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.