Get the free Custodial Account Application

Get, Create, Make and Sign custodial account application

How to edit custodial account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out custodial account application

How to fill out custodial account application

Who needs custodial account application?

Comprehensive Guide to the Custodial Account Application Form

Understanding the custodial account

A custodial account serves as a financial account managed by an adult (the custodian) for the benefit of a minor. Typically established under the Uniform Transfers to Minors Act (UTMA) or Uniform Gifts to Minors Act (UGMA), custodial accounts allow parents or guardians to set aside assets for a child's future needs. These accounts are especially useful for teaching children about financial responsibility, saving, and investing.

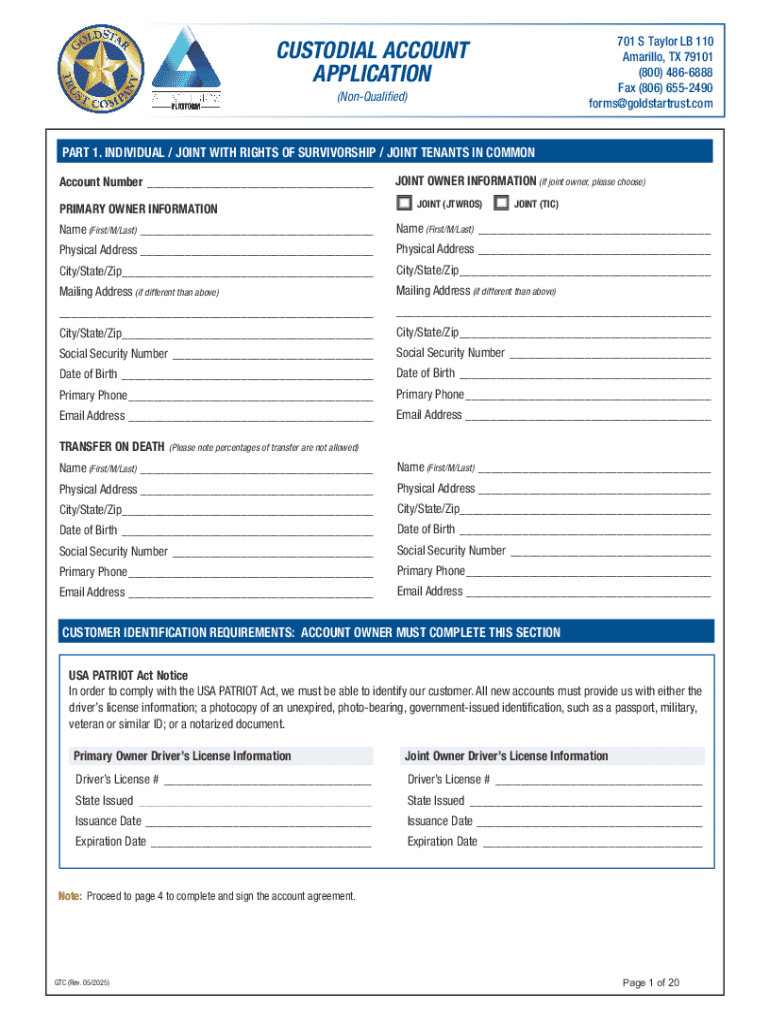

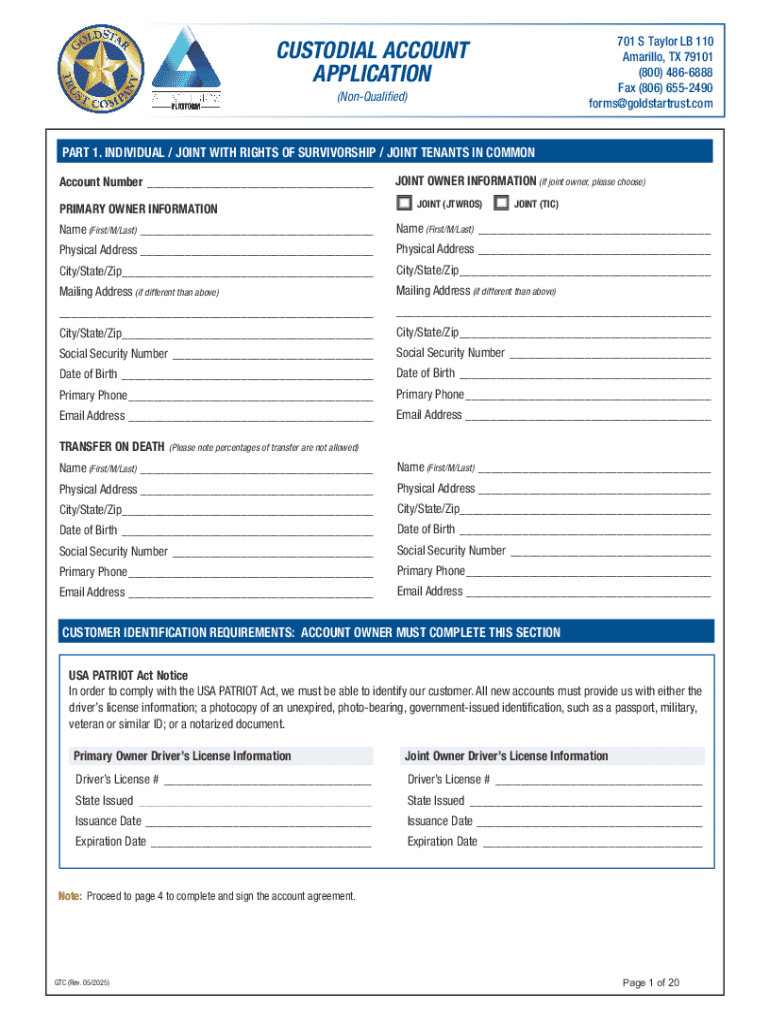

Key features of the custodial account application form

The custodial account application form is critical as it collects essential information required by financial institutions to set up the account. The information gathered typically includes personal details about the custodian, the minor, and relevant financial information that underpins the custodial arrangement. Providing accurate details helps ensure a smooth process and aids in avoiding future complications.

Accuracy is paramount in submitting the form. Small errors can delay processing and may require resubmission. Thus, ensuring that each section is thoroughly completed without mistakes helps streamline the application process.

Step-by-step instructions for filling out the custodial account application form

Filling out a custodial account application form should be approached methodically to ensure no information is omitted. Here’s a step-by-step guide to assist you in the process.

Editing and modifying your custodial account application

In the case where you need to make changes after filling out the custodial account application form, pdfFiller offers robust editing tools. These tools can help modify specific sections of the form without needing a fresh start.

Submitting the custodial account application

Once the custodial account application form is completed, the next step is submission. Depending on the institution, there may be several modes of submission.

After submission, be prepared for any follow-up inquiries from the institution to clarify or verify any specific details.

Managing your custodial account

After successfully establishing the custodial account, managing it effectively becomes crucial. This includes regular monitoring and accessing the account information as needed.

FAQs about custodial account application forms

Frequently asked questions can provide clarity on common concerns related to the custodial account application process.

Conclusion

Now that you've gained insight into the custodial account application form, utilizing tools from pdfFiller will ensure a smooth and efficient application process. The responsibilities tied to managing a custodial account can also serve as invaluable lessons about financial literacy for the minor involved. With the right knowledge and resources at hand, you're well-equipped to set a solid financial foundation for the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send custodial account application to be eSigned by others?

How can I get custodial account application?

How can I fill out custodial account application on an iOS device?

What is custodial account application?

Who is required to file custodial account application?

How to fill out custodial account application?

What is the purpose of custodial account application?

What information must be reported on custodial account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.