Get the free Financial Hardship Application

Get, Create, Make and Sign financial hardship application

How to edit financial hardship application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial hardship application

How to fill out financial hardship application

Who needs financial hardship application?

Complete Guide to the Financial Hardship Application Form

Understanding financial hardship

Financial hardship is defined as a situation where individuals or families experience challenges that make it difficult to meet their financial obligations. This state often leads to undue stress and impacts one’s quality of life. Understanding the nuances behind financial hardship is the first step toward seeking assistance and regaining financial stability.

Common causes of financial hardship include unexpected job loss or significant changes in employment status, which can undermine one’s primary source of income. Medical emergencies can arise unexpectedly, leading to high medical bills that may surpass savings. Additionally, family changes such as divorce or the death of a loved one can significantly impact household income and expenses, creating an immediate financial burden.

Addressing financial hardship is crucial not only for immediate relief but also for long-term financial health. Prompt action can mitigate the repercussions of financial struggles, allowing for quicker recovery and access to essential services and supports.

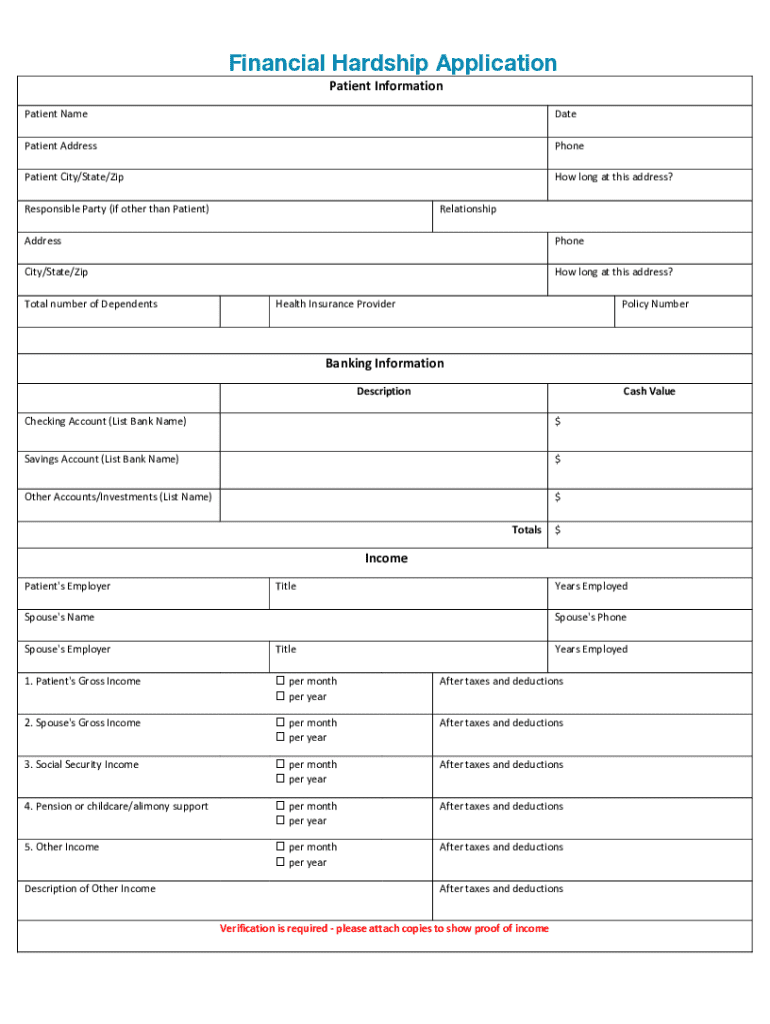

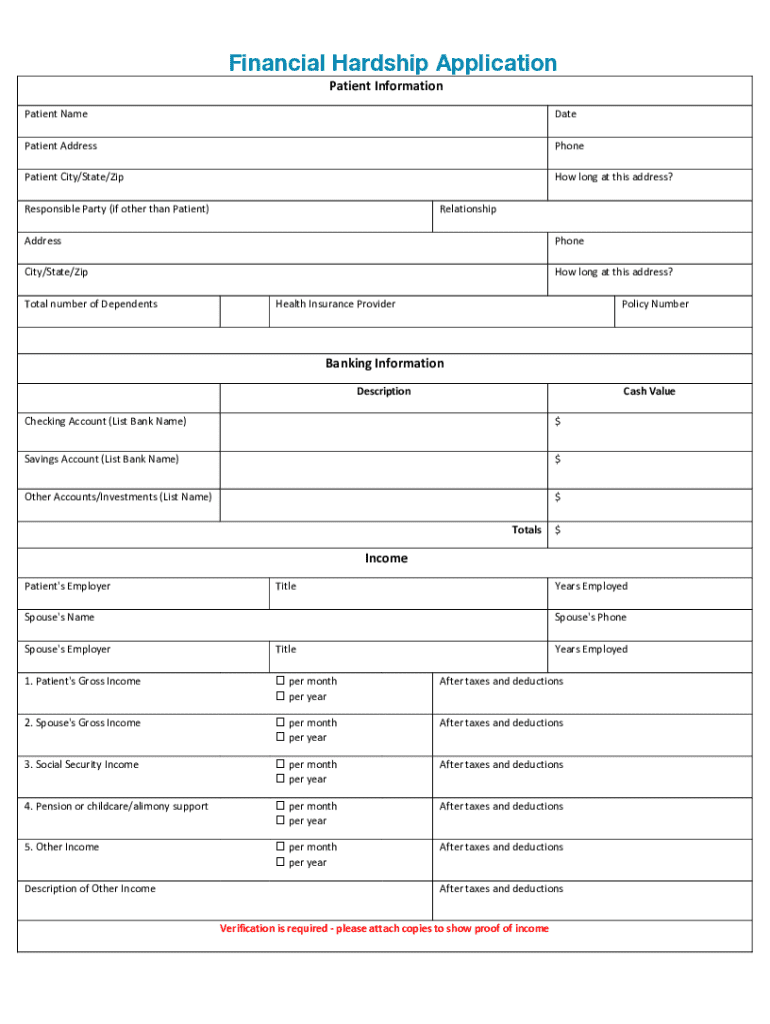

Overview of the financial hardship application form

The financial hardship application form is a crucial document allowing individuals to formally apply for relief due to their financial difficulties. This form serves multiple purposes: it collects necessary information about the applicant’s financial situation and facilitates the assessment process for granting assistance.

Eligibility to apply for financial hardship varies among organizations, but generally includes individuals facing genuine financial distress due to circumstances beyond their control. Commonly eligible applicants can include those who have lost their jobs, are facing medical bills, or those experiencing significant family transitions.

The application form provides several benefits, including streamlined documentation processes that can expedite access to financial assistance programs, ultimately helping individuals and families manage their financial challenges while they seek to rebuild.

Step-by-step guide to filling out the financial hardship application form

Filling out the financial hardship application form can seem daunting, but breaking it down into sections can make the process manageable. Start with Section 1, which is typically reserved for respondent information. Here, you will need to accurately input your name, contact details, and mailing address. It is crucial to follow the prescribed format for mailing addresses to ensure timely processing.

In Section 2, you will elaborate on your financial hardship situation. Clearly state the nature of your hardship using concise language. Be prepared to provide supporting documentation, such as pay stubs, medical bills, or any other relevant financial statements. A well-articulated explanation aids reviewers in understanding your situation better, and it’s advisable to include concrete examples.

Section 3 focuses on uploading supporting documents. Generally, you can include types of documents that substantiate your financial situation. With pdfFiller’s interactive tools, you can easily upload documents while ensuring your data remains confidential and secure during the process.

The final section is the Certification and Acknowledgment. Signing the application signifies that you verify all information is true and complete. pdfFiller provides an option for electronic signatures, making this step convenient. Remember, a signature also affirms that you understand the implications of your application.

Tips for a successful application

To enhance your chances of a successful application, avoid common mistakes often made on the financial hardship application form. One frequent mistake is overlooking required sections or failing to complete every part of the application. Additionally, many applicants neglect to attach the necessary documentation that validates their claims.

Best practices for submitting your application include double-checking for accuracy. Verify that all contact and financial information is correct to minimize processing delays. Also, ensure that you are aware of submission deadlines so that your application is considered on time.

After submitting your application, you may wonder about processing times. Typically, organizations will notify you about the expected turnaround. If you do not hear back, inquire about the status of your application to ensure it is moving through the system.

Assistance and resources

Navigating financial hardship can be challenging, but there are numerous support options available. Individuals and teams can utilize pdfFiller’s customer support for immediate assistance in filling out the financial hardship application form. Moreover, accessing FAQs and user guides through the platform can clarify common questions.

Financial counseling services are invaluable resources as they can help identify the right steps forward and provide budgeting assistance. Look for local organizations that specialize in financial literacy or community financial wellness programs. Online platforms also offer great resources for financial planning and budgeting.

Building a network of support can provide emotional and practical assistance as you navigate through challenging times. Community support networks often consist of individuals dealing with similar situations and can offer advice and encouragement.

Enhancing your document management with pdfFiller

One significant aspect of using the financial hardship application form is the ability to manage documents effectively. pdfFiller’s features allow users to edit PDFs anytime and from anywhere, providing flexibility when working on essential documents. This capability is especially beneficial when you need to make updates or corrections.

The advantages of using a cloud-based document solution are clear. You can access your applications from any device, ensuring that you are always prepared and that updates occur in real-time. pdfFiller’s eSigning capabilities can further streamline the signing process, enhancing convenience without compromising legal validity.

By integrating eSigning with your financial applications, you can expedite the submission process and ensure that your documentation is well organized and secure, making the entire process less daunting.

FAQs about the financial hardship application form

As you navigate the financial hardship application process, you might have questions about what to expect. Common inquiries typically include processing times—many applicants want to know how long it takes for their applications to be reviewed. Understandably, knowing what happens if your application is denied is also a frequent concern among applicants.

Clarifications about documentation and eligibility can also arise. Applicants frequently wonder what to do if they do not have all the necessary documents ready. In most cases, organizations provide a grace period for document submission, allowing applicants to gather their materials. Additionally, understand that it may be possible to apply on behalf of someone else if you have the proper authorization.

Additional tools and insights

Educational resources can significantly enhance your understanding of financial hardships and the application process. PdfFiller hosts a variety of articles that delve into financial literacy, offering crucial reading for individuals facing economic challenges. Furthermore, video tutorials that demonstrate effective usage of pdfFiller tools can elevate your document management proficiency.

Interactive tools available on pdfFiller include budget calculators and financial planning worksheets which can serve as invaluable aids in managing your finances while navigating hardships. By leveraging these resources, you can better organize your financial responsibilities and plan for the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit financial hardship application from Google Drive?

How do I make edits in financial hardship application without leaving Chrome?

How do I fill out the financial hardship application form on my smartphone?

What is financial hardship application?

Who is required to file financial hardship application?

How to fill out financial hardship application?

What is the purpose of financial hardship application?

What information must be reported on financial hardship application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.