Get the free Return Form the Watch Now

Get, Create, Make and Sign return form form watch

How to edit return form form watch online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return form form watch

How to fill out return form form watch

Who needs return form form watch?

Return form: A comprehensive guide for seamless transactions with pdfFiller

Understanding return forms

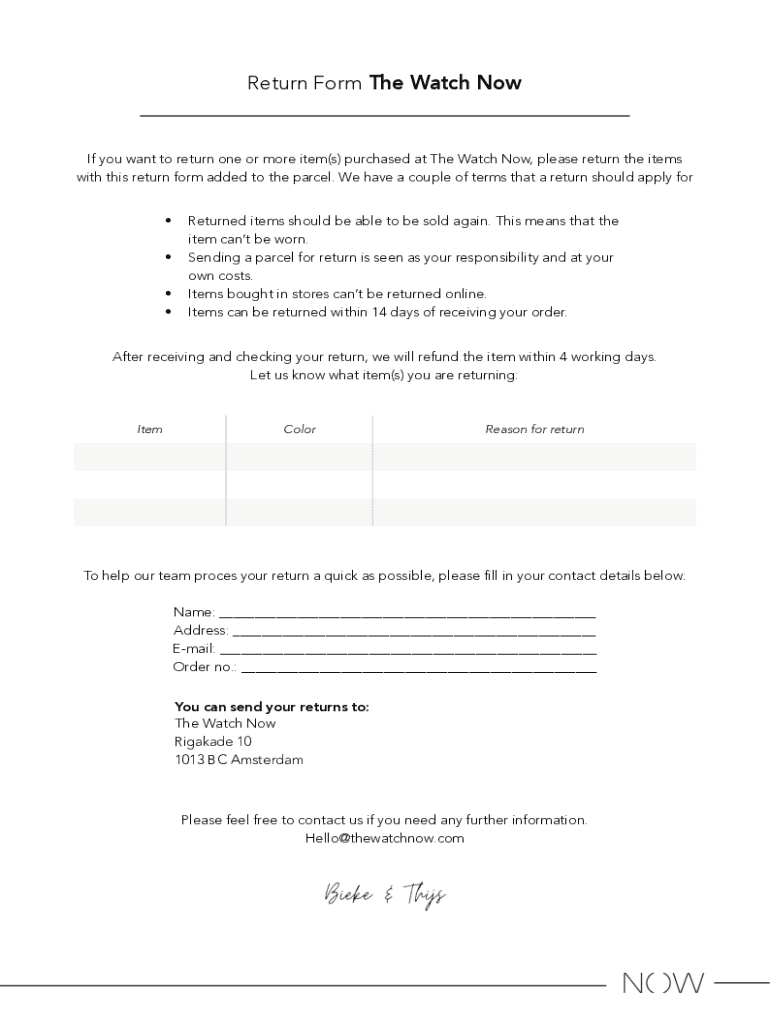

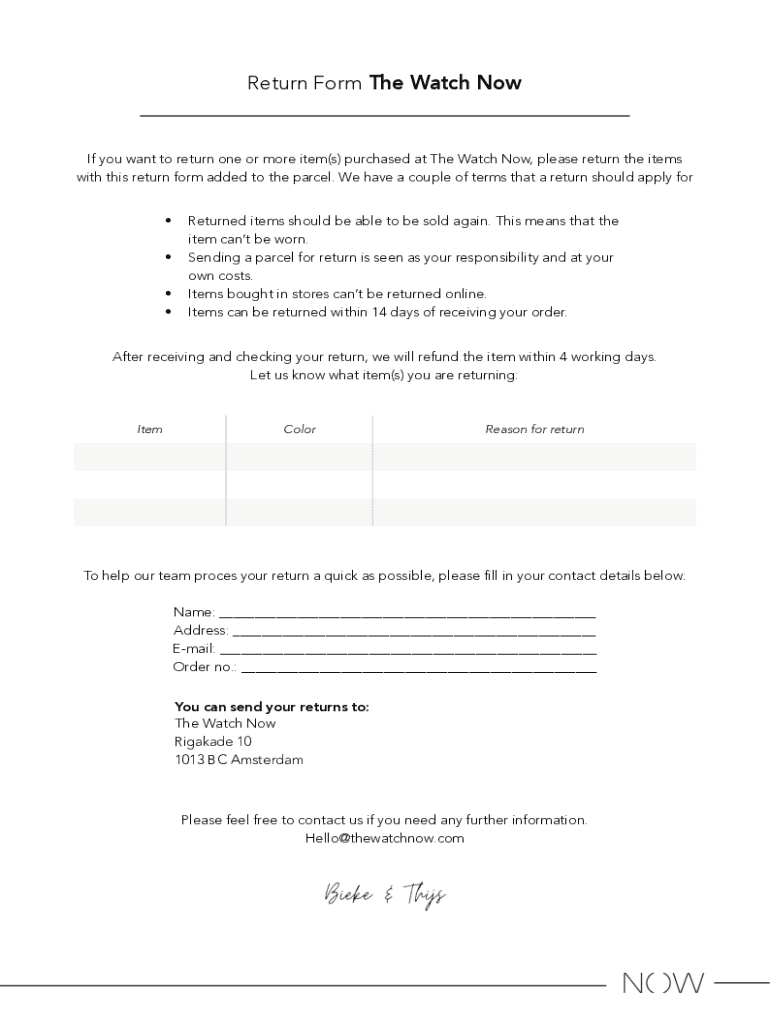

A return form is a document submitted by a customer to a retailer or service provider to initiate the process of returning a purchased item. This form serves as a critical tool in transactions, ensuring that both parties have a confirmed agreement regarding the return of an item. The importance of return forms cannot be overstated; they help streamline the return process, allowing businesses to efficiently track and manage returns while providing customers clarity on the procedure.

Common scenarios requiring a return form include receiving damaged products, ordering the wrong size or color, or simply deciding the item doesn’t meet expectations. By utilizing return forms, customers can outline the specifics of each case, facilitating a smoother and quicker resolution.

The different types of return forms

Return forms vary based on the context in which they are used, each serving unique needs. Understanding these differences is crucial for anyone involved in purchasing or managing products.

How to access and fill out your return form with pdfFiller

Using pdfFiller, users can easily find and fill out the appropriate return form using interactive templates designed for various situations. This digital platform significantly simplifies the process, making it accessible and efficient.

PdfFiller also offers editing features that allow users to add comments, notes, or even alter the layout of the form for clarity. This customization empowers users to present their cases effectively.

Tips for properly completing a return form

Proper completion of a return form can significantly expedite the process of receiving replacements or refunds. However, many individuals make mistakes that can slow down their claims.

Submitting your return form

Once your return form is completed, the next step is submission. This process can vary greatly depending on the vendor's policies.

After submission, always seek confirmation of receipt. This is crucial in tracking your return and ensuring it is processed promptly. Additionally, familiarize yourself with the vendor’s return policy to avoid misunderstandings and assess potential fees.

Tracking your return

Tracking your return is essential in understanding the status as it progresses through the return pipeline.

Utilizing pdfFiller’s tools for managing your return forms

pdfFiller equips users with robust document management features that enhance the efficiency of handling return forms and related documentation.

Best practices for record keeping

Maintaining accurate records is critical when dealing with return forms. Proper record-keeping practices can prevent future issues and provides protection should disputes arise.

Case studies: Successful return processes

Analyzing case studies of successful return submissions can offer valuable lessons and strategies for improving your approach.

Improving your workflow with pdfFiller

pdfFiller's comprehensive document management solutions revolutionize how users handle return forms, offering a cloud-based approach that significantly enhances workflow efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in return form form watch?

How do I edit return form form watch in Chrome?

How do I complete return form form watch on an Android device?

What is return form form watch?

Who is required to file return form form watch?

How to fill out return form form watch?

What is the purpose of return form form watch?

What information must be reported on return form form watch?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.