Get the free New Account Opening Form

Get, Create, Make and Sign new account opening form

Editing new account opening form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new account opening form

How to fill out new account opening form

Who needs new account opening form?

A comprehensive guide to your new account opening form

Understanding the new account opening form

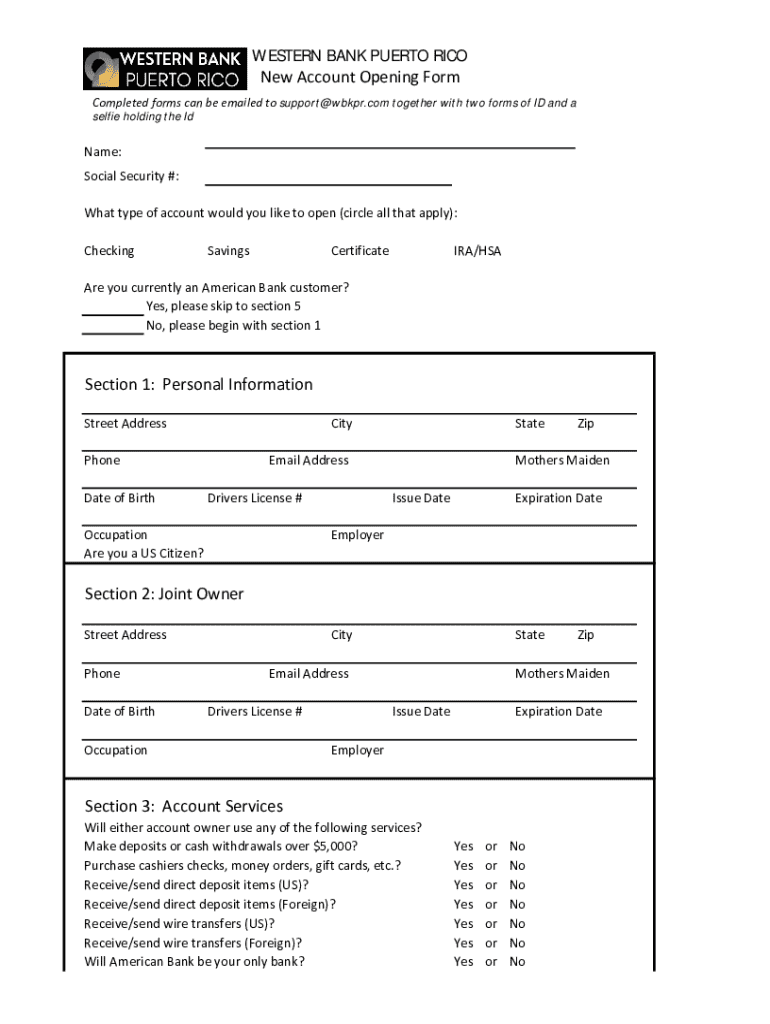

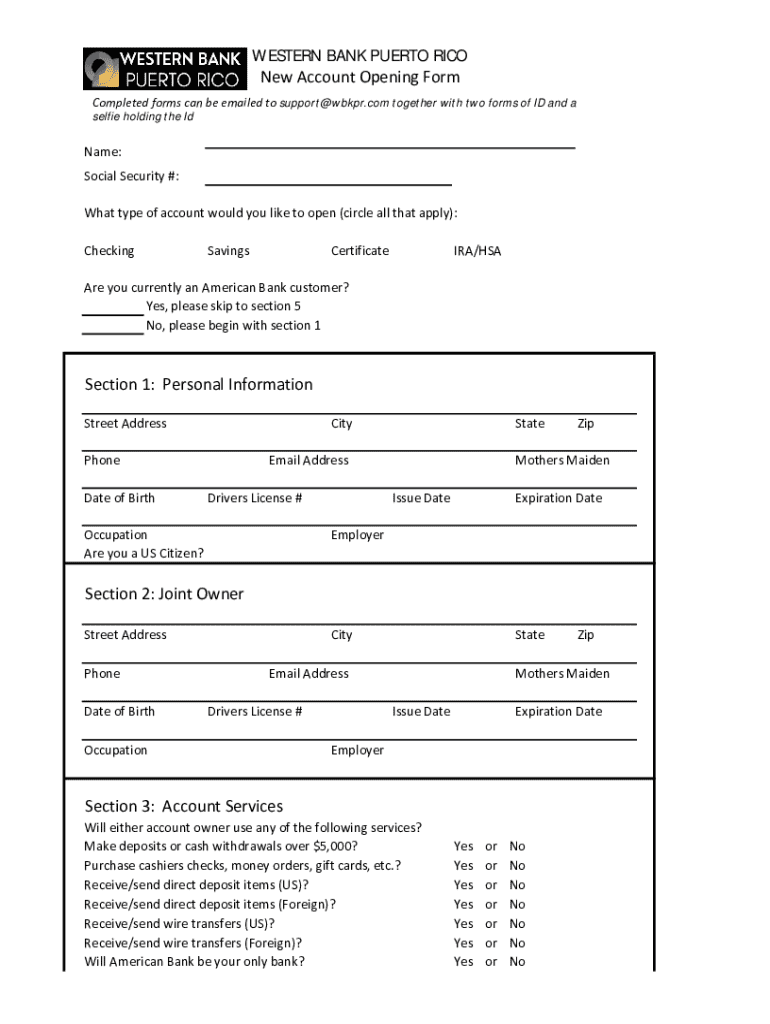

A new account opening form is a critical document used by banks and credit unions to collect essential information from individuals or entities looking to open a financial account. This form serves several purposes, including verifying the identity of applicants, understanding their financial background, and ensuring compliance with regulatory standards. The importance of this form cannot be overstated; it establishes the foundational relationship between financial institutions and their clients, ensuring that both parties understand the terms of engagement.

Moreover, a properly filled new account opening form plays a significant role in safeguarding both the customer and the bank against fraud. Financial institutions utilize the information presented to assess risk and comply with laws such as the USA PATRIOT Act, which requires customer identification in order to prevent money laundering and other illicit activities.

Key components of the new account opening form

When filling out a new account opening form, you will encounter several key sections, each designed to gather specific information:

How to obtain and fill out your new account opening form

Obtaining a new account opening form is straightforward, as banks and credit unions offer multiple ways to access it. You can typically find the form on the institution's official website or in their physical branches.

Where to access the form

For online banking options, simply visit the respective bank or credit union's website, navigate to the 'Accounts' section, and there you’ll find the option to download the new account opening form. Traditional banks usually provide hard copies in their branches, while resource platforms like pdfFiller allow you to find, fill, and download your form conveniently.

Step-by-step guide to filling out the form

Here's how to fill out the new account opening form effectively:

To avoid errors, double-check all entries for accuracy and completeness before finalizing your form.

Editing your new account opening form

If you need to make changes to your new account opening form, platforms like pdfFiller offer a user-friendly interface for editing. You can easily add or modify your information. After making adjustments, remember to save your draft, ensuring that you can come back to refine it further before submitting.

Signing and submitting the new account opening form

Once your new account opening form is adequately filled out, the next step is to sign and submit it to your chosen bank or credit union. Signature requirements may vary based on institutional policies.

eSigning your new account opening form

The adoption of electronic signatures has streamlined the process significantly. Here’s how you can eSign your form using pdfFiller:

This method not only saves time but also minimizes errors in signing, especially when working with digital documents.

How to submit the form

Submission protocols depend on your chosen financial institution. Generally, you can submit the form online through a dedicated portal, drop it off in-person at a branch, or mail it directly to the bank. Be sure to always review the submission guidelines provided by your bank, as following these ensures timely processing.

Managing your new account after opening

Congratulations! You’ve successfully filled out and submitted your new account opening form, and now it’s time to navigate the next steps.

Next steps after submission

After submission, you should receive a confirmation from your bank regarding the status of your account setup. Most banks will provide details via email, and you may also need to create credentials for online banking. This allows you to manage your finances from anywhere.

Common issues and resolutions

If you experience delays or issues with your new account setup, consider reaching out to the customer service department of your financial institution. Common problems may include discrepancies in submitted forms or requirements for additional documentation. Always keep records of your communications to ensure any follow-ups are smooth and productive.

Frequently asked questions about the new account opening form

Understanding the new account opening form may come with questions. Consider these common inquiries for clarity:

More templates like this

The new account opening form can vary based on the type of account being established. Here are a few variations you might encounter:

Additionally, other financial forms that may be relevant include loan application forms and investment account setup forms, which also require rigorous documentation and attention to detail.

Tips for a smooth account opening process

To ensure your account opening process is hassle-free, consider the following tips.

Exploring pdfFiller features for enhanced document management

One of the significant advantages of using pdfFiller for your new account opening form is the range of tools available that enhance document management.

Comprehensive PDF editing tools

pdfFiller offers a robust suite of tools for editing your documents. You can add annotations, collaborate with others, and make revisions easily, giving you control over your documents without any hassle.

Benefits of using pdfFiller for your banking needs

With pdfFiller, you can access your documents from anywhere, simplifying the account opening process. Additionally, it provides security features that ensure compliance with financial documentation standards, safeguarding your sensitive information.

How to maximize your use of pdfFiller for financial documents

Utilize pdfFiller to create templates for frequently used forms, making future document creation much simpler. Plus, with cloud storage, you'll have easy access to all your financial paperwork whenever you need it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete new account opening form online?

Can I sign the new account opening form electronically in Chrome?

How can I fill out new account opening form on an iOS device?

What is new account opening form?

Who is required to file new account opening form?

How to fill out new account opening form?

What is the purpose of new account opening form?

What information must be reported on new account opening form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.