Get the free Self-Directed Custodial - Trust Management, Inc.

Show details

Roth IRA Simplified Roth Individual Retirement Account Application ROTH IRA HOLDERS NAME AND ADDRESS ROTH IRA CUSTODIANS NAME, ADDRESS AND PHONE TMI Trust Company 901 Summit Avenue Fort Worth, TX

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self-directed custodial - trust

Edit your self-directed custodial - trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self-directed custodial - trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self-directed custodial - trust online

Follow the steps down below to benefit from a competent PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit self-directed custodial - trust. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self-directed custodial - trust

How to fill out self-directed custodial - trust:

01

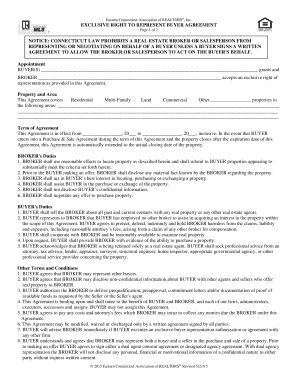

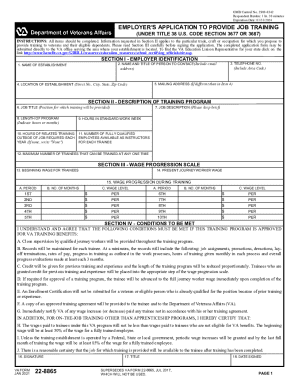

Obtain the necessary forms: The first step in filling out a self-directed custodial trust is to obtain the appropriate forms. These forms can typically be found on the website of the financial institution or custodian that will be managing the trust.

02

Provide personal information: The next step is to provide your personal information, such as your full name, address, social security number, and date of birth. This information is necessary for the custodian to properly identify and establish the trust.

03

Designate beneficiaries: In the trust, you will need to designate the beneficiaries who will receive the assets held in the trust upon your passing. This can include individuals, organizations, or even yourself if you plan to use the trust for your own benefit during your lifetime.

04

Determine the terms of the trust: You will need to specify the terms of the trust, including how the assets will be managed and distributed. This can include instructions on how the assets should be invested, when and how distributions should be made to beneficiaries, and any restrictions or conditions that should be placed on the use of the trust assets.

05

Select a trustee: A self-directed custodial trust requires a trustee to manage the trust on behalf of the beneficiaries. This can be an individual or an institution, such as a bank or trust company. The trustee will be responsible for carrying out the instructions outlined in the trust and making investment decisions.

Who needs self-directed custodial - trust?

01

Individuals with specific investment preferences: A self-directed custodial trust is ideal for individuals who want more control over their investments. By having the ability to direct the investments held within the trust, individuals can tailor their investment strategy to align with their specific financial goals and preferences.

02

Parents or guardians of minors: Self-directed custodial trusts are commonly used by parents or guardians to set aside assets for the benefit of their minor children. Through the trust, parents can designate how and when the assets should be used for the child's benefit, and also appoint a trustee to oversee the management of the assets until the child reaches a specified age.

03

Individuals planning for retirement: Self-directed custodial trusts can also be utilized by individuals who are planning for retirement and want a greater level of control over their retirement savings. By utilizing the trust, individuals can have the flexibility to invest in alternative assets, such as real estate or private equity, which may not be available within traditional retirement accounts.

In summary, filling out a self-directed custodial trust involves obtaining the necessary forms, providing personal information, designating beneficiaries, determining the terms of the trust, and selecting a trustee. This type of trust is beneficial for individuals with specific investment preferences, parents or guardians of minors, and individuals planning for retirement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit self-directed custodial - trust from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your self-directed custodial - trust into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an eSignature for the self-directed custodial - trust in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your self-directed custodial - trust and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out the self-directed custodial - trust form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign self-directed custodial - trust and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is self-directed custodial - trust?

Self-directed custodial - trust is a type of trust where the trustee has the authority to make investment decisions on behalf of the beneficiary.

Who is required to file self-directed custodial - trust?

Individuals or entities acting as trustees of self-directed custodial trusts are required to file.

How to fill out self-directed custodial - trust?

To fill out a self-directed custodial trust, you will need to provide information about the trust assets, beneficiaries, and the trustee's investment decisions.

What is the purpose of self-directed custodial - trust?

The purpose of a self-directed custodial trust is to allow the trustee to make investment decisions on behalf of the beneficiary in a tax-advantaged environment.

What information must be reported on self-directed custodial - trust?

Information such as the trust assets, income generated, investment decisions, and beneficiaries must be reported on self-directed custodial trusts.

Fill out your self-directed custodial - trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self-Directed Custodial - Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.