Get the free Beneficiary Designation

Get, Create, Make and Sign beneficiary designation

How to edit beneficiary designation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation

How to fill out beneficiary designation

Who needs beneficiary designation?

Beneficiary Designation Form: A How-to Guide

Understanding beneficiary designation forms

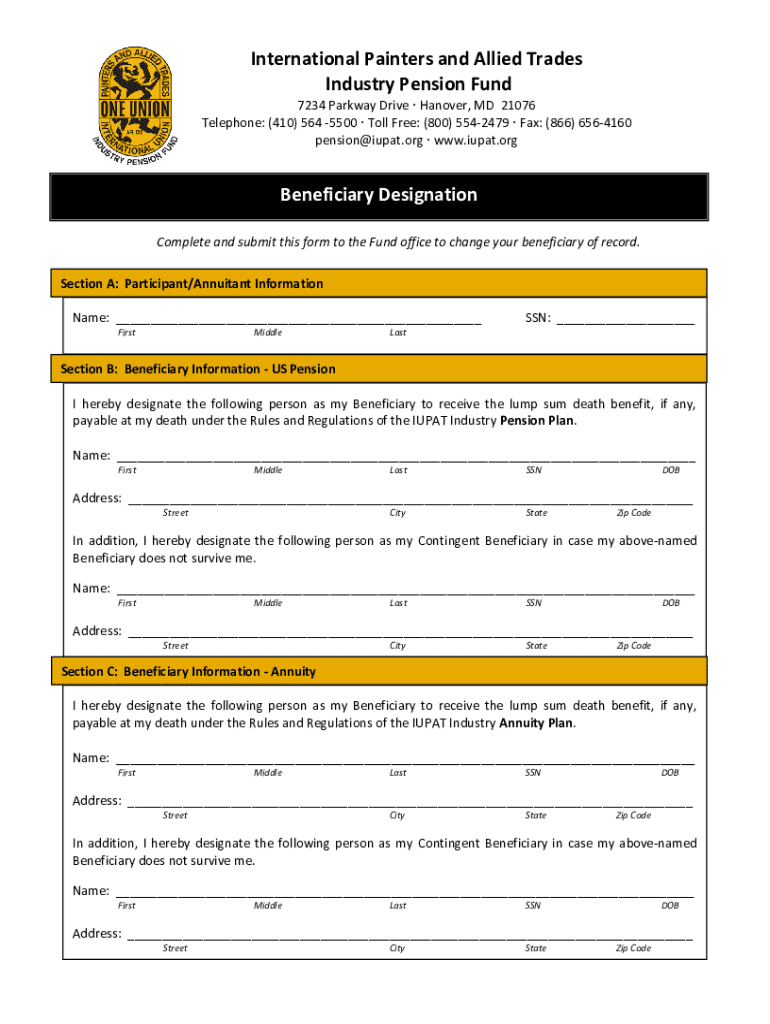

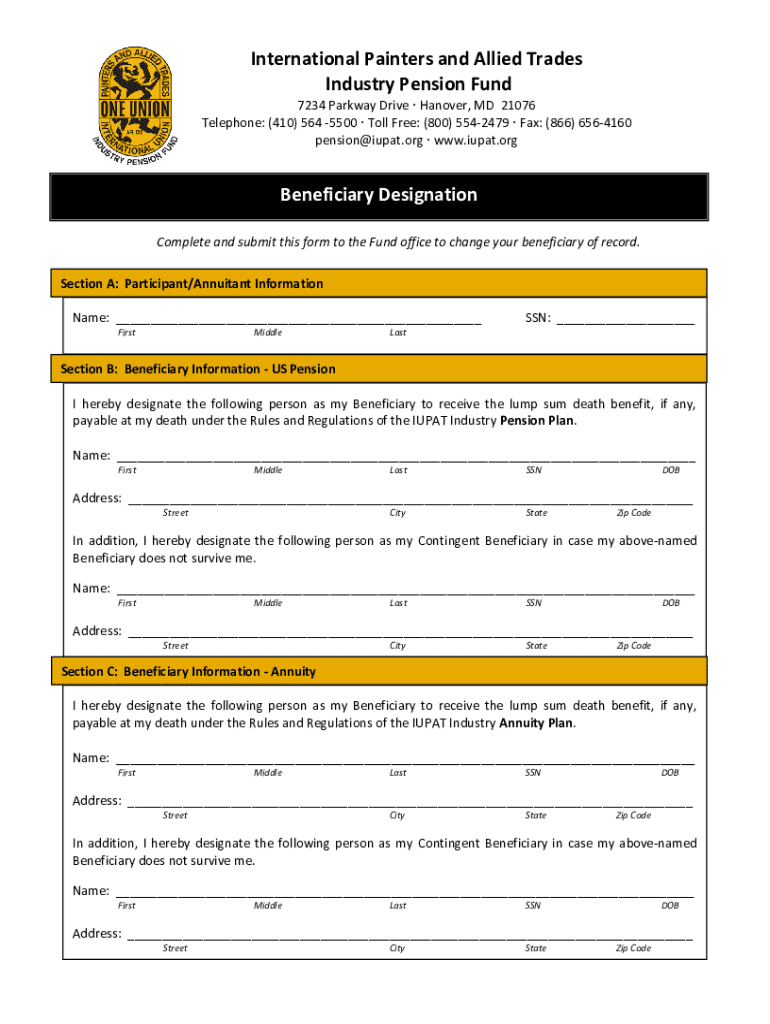

A beneficiary designation form is a legal document that allows individuals to specify who will receive their assets upon death. Typically utilized in estate planning, this form plays a critical role in directing the distribution of retirement accounts, life insurance policies, and other assets. Properly completing this form ensures that your wishes are honored, reducing complications and disputes among heirs.

The importance of a beneficiary designation form in asset management cannot be overstated. It helps avoid the potentially lengthy process of probate and can ensure that your heirs receive their benefits without unnecessary delays.

Why you need a beneficiary designation form

Having a beneficiary designation form is essential for both legal and financial reasons. Without a properly completed form, your assets may be distributed according to state law, which might not align with your wishes. Furthermore, many financial instruments offer tax benefits that can be passed on to beneficiaries, illustrating the dual importance of this document in both legacy and tax planning.

Several scenarios highlight the necessity of having an updated beneficiary designation. Changes such as marriage, divorce, or the birth of a child can significantly alter your intended beneficiaries. Additionally, planning for minors or individuals with special needs requires careful consideration to ensure that your assets are managed appropriately.

Components of a beneficiary designation form

When filling out a beneficiary designation form, certain pieces of information are mandatory to ensure its validity. The form typically requires personal details from the designator, including name, address, date of birth, and Social Security number. Furthermore, the form must include clear designations of primary beneficiaries, those who will first receive assets, and contingent beneficiaries, those who will inherit if the primary is unable to.

Along with required information, optional fields may allow for special instructions or conditions regarding the distribution of assets. This could mean specifying how assets are divided among multiple beneficiaries or identifying an alternate contact in case of disputes.

Step-by-step guide to completing a beneficiary designation form

Before diving into the form, it’s important to gather all necessary information. Compile personal identification details, the full names of desired beneficiaries, their relationships to you, and necessary identification numbers, such as Social Security numbers, when applicable. Familiarizing yourself with each section of the form will enable you to provide accurate and complete information, reducing errors.

Now, follow these steps to correctly fill out the form:

After completing the form, make the final reviews. It is wise to seek legal advice if you're unsure about any clauses or state-specific regulations to ensure compliance and enforceability.

Keeping your beneficiary designation form up-to-date

Life is full of changes that can directly influence your beneficiary designations. Factors such as marriage, divorce, the birth of additional children, or even the death of a beneficiary can necessitate an update to your form. Regularly reviewing your beneficiaries and the conditions under which they inherit can prevent future complications in estate management.

To update your beneficiary designation form, follow this simple process:

Timely notifications to financial institutions are crucial to ensure they can act on your most current wishes.

Common mistakes to avoid

Filling out a beneficiary designation form can seem straightforward, but there are common mistakes that can lead to significant issues. Incomplete or incorrect information may cause unintentional beneficiaries or the misallocation of assets. Take your time to fill out each section carefully and verify all names and details.

Failing to review your designations regularly can also present risks. Outdated information might lead to scenarios where your assets are distributed against your wishes. It’s equally important to familiarize yourself with state laws regarding beneficiary designations, as these can vary significantly by jurisdiction.

Tools and resources available on pdfFiller

pdfFiller offers a variety of tools to simplify the process of filling out a beneficiary designation form. With interactive templates readily available, users can easily enter and modify information to fit their needs. The platform not only allows for e-signatures, ensuring a legally binding document, but also offers secure storage options for easy access.

Collaboration features on pdfFiller enable teams to manage approvals and edits efficiently. Individuals can access their documents from anywhere, promoting the flexibility needed in today's fast-paced environment. This cloud-based platform empowers users to complete their forms seamlessly while retaining control over every aspect of document management.

FAQs about beneficiary designation forms

Understanding beneficiary designation forms can lead to a host of questions. Some common concerns include what to do if a named beneficiary predeceases the designator or how to ensure that the form remains current. Troubleshooting these issues is crucial for smooth asset distribution.

For those feeling overwhelmed by the completion process, remember that assistance is available online. Many platforms, like pdfFiller, offer customer support and resources to guide you through the specifics of your beneficiary designation form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify beneficiary designation without leaving Google Drive?

Can I sign the beneficiary designation electronically in Chrome?

How do I complete beneficiary designation on an iOS device?

What is beneficiary designation?

Who is required to file beneficiary designation?

How to fill out beneficiary designation?

What is the purpose of beneficiary designation?

What information must be reported on beneficiary designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.