Get the free Form Adv

Get, Create, Make and Sign form adv

How to edit form adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv

How to fill out form adv

Who needs form adv?

The Complete Guide to Form ADV: Essential Insights for Investment Advisers

Understanding Form ADV

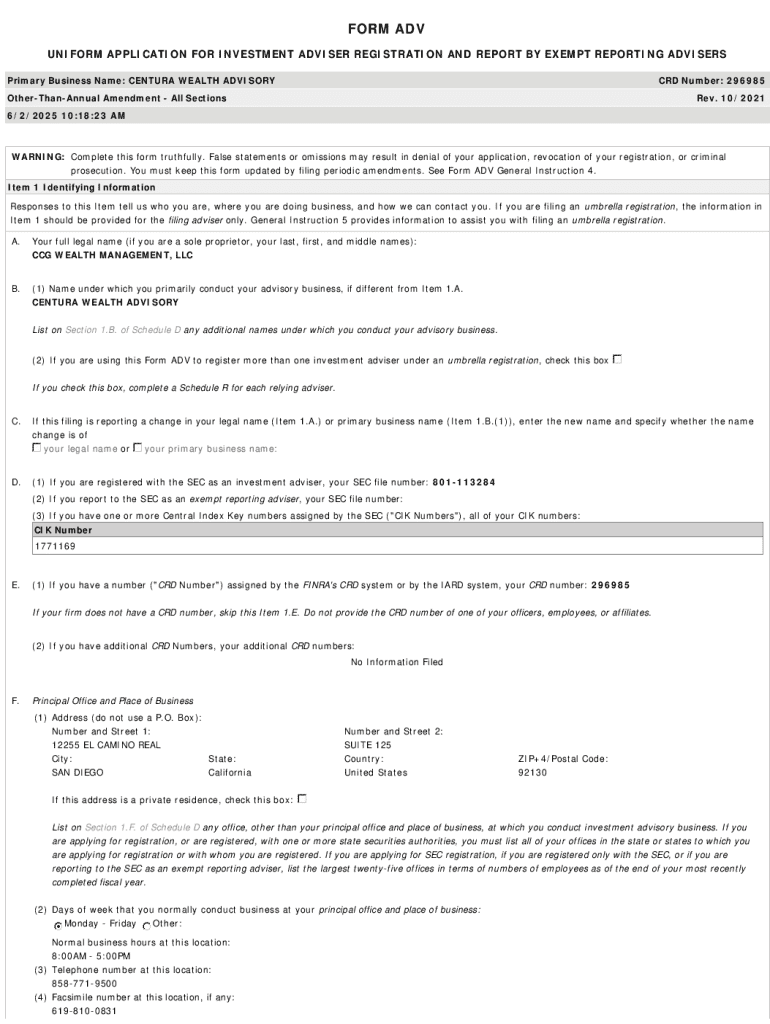

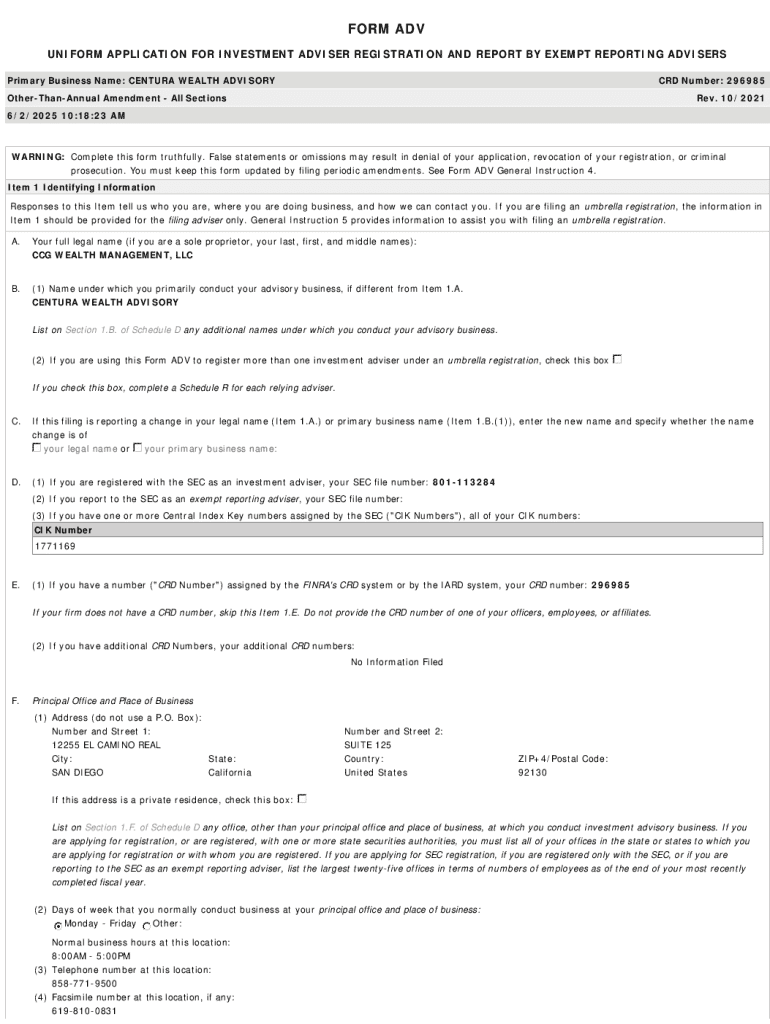

Form ADV is a critical document that investment advisers use to register with state regulators and the Securities and Exchange Commission (SEC). This form serves a dual purpose: it helps regulators assess the qualifications of the advisory firm and provides clients with essential information about the adviser’s practices, fees, and potential conflicts of interest. By filing Form ADV, investment advisers present themselves as transparent and compliant, which is crucial in building trust with clients.

Understanding the importance of Form ADV goes beyond statutory compliance; it’s about establishing a solid foundation for client relationships. A comprehensive filing can distinguish an adviser in a competitive market, showcasing professionalism and commitment to ethical practices.

Key components of Form ADV

Form ADV has two primary components: Part 1 and Part 2, each serving distinct purposes. Part 1 focuses on fundamental firm information, such as its ownership structure, services offered, and control persons. This section provides regulators with a snapshot of the firm’s operations and affiliations.

Part 2, often referred to as the ‘Brochure,’ is a critical document aimed at clients. It contains detailed narrative disclosures about the advisory services provided, the fees charged, and potential conflicts of interest. This part ensures that clients have a clear understanding of what to expect, fostering a transparent adviser-client relationship.

Who needs to file Form ADV?

Not every financial professional qualifies as an investment adviser. The SEC defines an investment adviser as any person or firm that, for compensation, engages in the business of advising others regarding securities. This includes traditional advisory firms, financial planners, and even certain affiliates of broker-dealers. If you provide investment advice or manage client funds, it is likely that you will need to file Form ADV.

However, various exemptions are in place, particularly for advisers with limited asset under management (AUM). For instance, advisers managing less than $25 million in AUM generally register at the state level rather than with the SEC. Understanding these distinctions is vital for compliance and avoiding regulatory missteps.

Detailed instructions for completing Form ADV

Filling out Form ADV requires careful attention to detail. The initial step involves gathering essential information about your firm. This includes not only basic identification details but also information about your services, fee structures, and any disciplinary history. Accurate information is critical, as errors can lead to compliance issues.

When it comes to the filing method, advisers can choose between online submission through the Investment Adviser Registration Depository (IARD) or opting for a paper filing. While online submission is recommended for its efficiency, some may prefer paper for record-keeping. Regardless of the method chosen, ensure that all information is double-checked for accuracy.

Review and submission processes

After completing Form ADV, conducting a thorough review is essential. Create a quality control checklist, including verifying firm details, ensuring complete disclosures, and confirming contact information. Accuracy is paramount; any discrepancies can jeopardize compliance and lead to regulatory scrutiny. Maintaining a high standard in your submission reflects the professionalism of your practice.

Once the form is reviewed, it’s time to submit. If you choose online filing, you will utilize the IARD system, which guides you through the submission process. After submission, don’t be alarmed if you don’t receive immediate feedback. The review process can take time, depending on the volume of submissions and the particulars of your filing.

After submission: what to know

Following the submission of Form ADV, it's crucial to monitor its status. Use the IARD system to track whether your filing has been accepted and to view any feedback from regulators. The typical timeframe for feedback can vary based on the jurisdiction and the complexity of your submission, so stay proactive.

Additionally, understanding when and how to make amendments is vital. If there are changes in your firm’s status, operations, or personnel, you will need to update Form ADV in a timely manner. Regular updates help ensure compliance and showcase your commitment to transparency.

Managing and storing your Form ADV documents

Proper document management practices are essential for advisers who file Form ADV. Keeping your records organized ensures compliance and enhances operational efficiency. Implementing cloud-based solutions can facilitate easy access and sharing of important documents, particularly for teams that may share responsibilities related to compliance.

Additionally, understanding the legal requirements for record-keeping is paramount. This includes retaining documents that supported your Form ADV filing for a certain period. Tools like pdfFiller can significantly ease the burden of document management and compliance by providing a comprehensive platform for organizing, storing, and retrieving sensitive documents.

Interactive tools for enhancing your filing experience

pdfFiller offers a wealth of features specifically designed to enhance the filing of Form ADV. Users can streamline the editing and eSigning processes, making document preparation faster and more accurate. Collaboration tools also benefit teams needing to work together on filings, allowing multiple users to access and modify documents concurrently.

Furthermore, pdfFiller provides access to templates and samples, which can be invaluable for new advisers looking to ensure compliance and completeness in their filings. Learning from examples of completed Form ADV filings can help demystify the process and establish a benchmark for your submissions.

FAQs about Form ADV

Many investment advisers have common questions regarding Form ADV. One concern often raised is about filing deadlines. If you miss a filing deadline, it’s essential to take immediate action to rectify the situation, as late filings can lead to penalties and compliance issues. Additionally, many advisers wonder whether they can file Form ADV in multiple states, which is permissible but requires understanding both state and federal regulations.

Other questions may arise about the required updates to Form ADV. Typically, advisers need to amend the form annually or whenever significant changes occur within the firm. Keeping up with these requirements is essential for maintaining compliance and ensuring an accurate portrayal of your advisory practices.

Engaging with the community

Staying engaged with industry news is crucial for investment advisers. Subscribing to newsletters and updates from regulatory bodies or professional associations can provide invaluable insights into changes affecting Form ADV and other compliance requirements. These resources are designed to keep you informed, ensuring your practices adapt accordingly.

Moreover, actively participating in forums and platforms dedicated to investment advisers can offer opportunities to share experiences and best practices surrounding Form ADV filings. Networking with other professionals allows you to learn from the community, helping improve your compliance process and effectiveness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form adv without leaving Google Drive?

Can I create an eSignature for the form adv in Gmail?

Can I edit form adv on an Android device?

What is form adv?

Who is required to file form adv?

How to fill out form adv?

What is the purpose of form adv?

What information must be reported on form adv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.