Get the free Direct Deposit Enrollment Form

Get, Create, Make and Sign direct deposit enrollment form

How to edit direct deposit enrollment form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct deposit enrollment form

How to fill out direct deposit enrollment form

Who needs direct deposit enrollment form?

Direct deposit enrollment form - How-to Guide

Understanding direct deposit

Direct deposit refers to the electronic transfer of funds from an employer or payment source directly into an employee's bank account. This process has gained immense popularity due to its reliability and convenience. Unlike traditional checks, which can be lost or stolen, direct deposit guarantees that funds are available immediately on payday. Additionally, employers benefit from reduced costs associated with printing and distributing checks.

The numerous benefits of direct deposit extend to both employees and employers. Employees enjoy the peace of mind that comes with timely access to their funds, while employers streamline payroll operations, minimizing errors and inefficiencies. Overall, direct deposit enhances financial security and encourages a seamless transaction process.

Preparing to enroll in direct deposit

Before completing a direct deposit enrollment form, it's crucial to understand the eligibility requirements. Generally, most employers allow their employees to enroll, but certain exceptions may apply based on employment status, such as contractors or part-time workers. Additionally, confirmation of employment may be necessary before submitting this form.

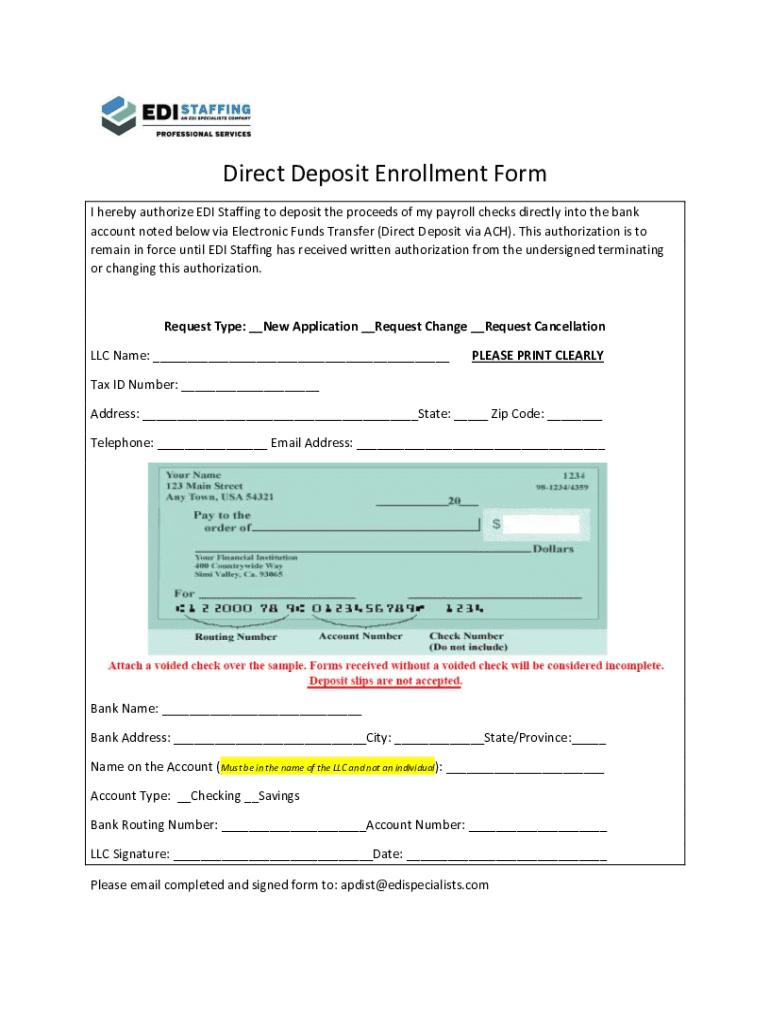

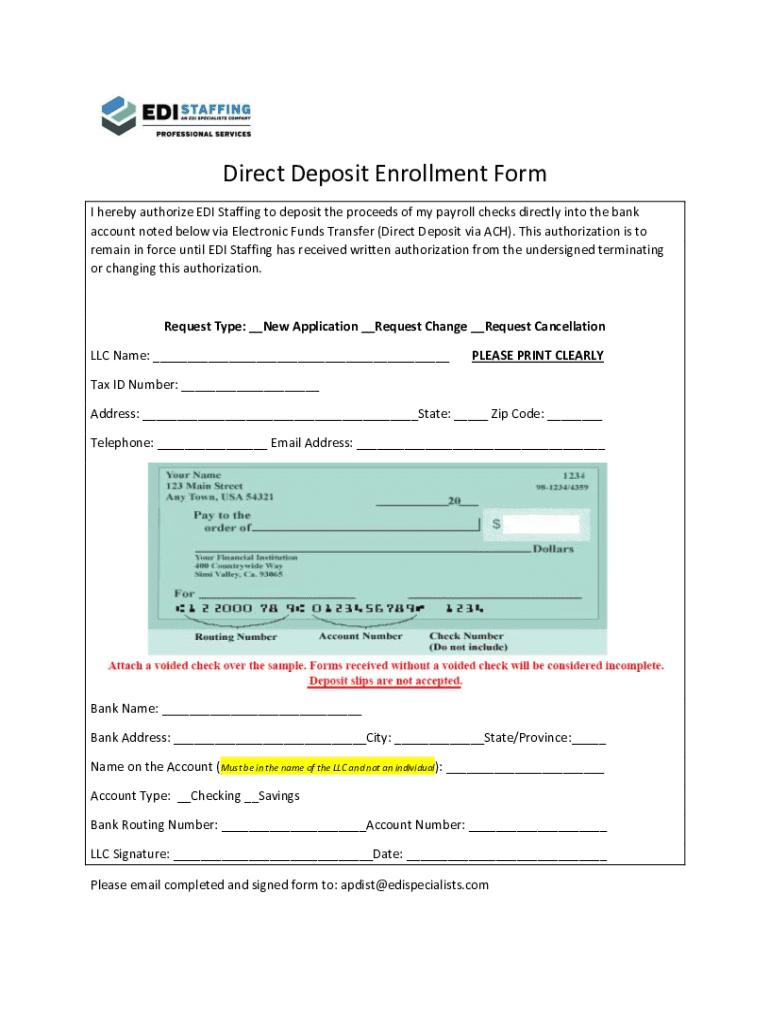

Next, collect all required documentation. This typically includes personal identification, your bank's routing number, and your account number. Having the necessary information ready can expedite the enrollment process. Ensure you also gather any relevant employer information, such as your job title and length of employment, which may be needed to complete the form.

Accessing the direct deposit enrollment form

Finding the right direct deposit enrollment form is essential for a smooth application process. The most convenient way to obtain this is through pdfFiller's platform. By visiting pdfFiller, users can find an easy-to-download template for direct deposit enrollment.

Once on pdfFiller, navigating to the direct deposit template is straightforward. Simply create an account if you don't already have one, or log in to access their extensive library of forms. From there, you can effortlessly locate the direct deposit enrollment form and prepare it for completion.

Completing the direct deposit enrollment form

Once you have accessed the direct deposit enrollment form, the next step is completing it accurately. Start by entering your personal information, including your full name, current address, and Social Security number. This information is crucial for identity verification and to ensure the successful transfer of funds.

Next, input your bank account details. Be sure to accurately fill in both your account number and the bank's routing number, as any discrepancies can lead to payment delays. Furthermore, provide your employment details for verification, including your employer's name and your job title. Finally, double-check all information entered to ensure accuracy and completeness, as errors could hinder the enrollment process.

Options for editing and customizing the form

pdfFiller offers a range of editing tools to enhance your direct deposit enrollment form. Users can insert text, signatures, or initials directly onto the form, making the process more efficient. Additionally, adding checkmarks or selecting options is straightforward, allowing for quick customization based on your specific needs throughout the enrollment process.

The platform also enables you to make the form fillable, which can expedite completion for multiple users. Customizing the form may involve adding notes or comments for clarity, ensuring that all parties involved understand the required steps or details.

Signing and submitting the enrollment form

After completing your direct deposit enrollment form, the next step is to sign it. pdfFiller makes this process simple, allowing you to add an electronic signature. eSignatures are widely accepted, offering legal validity equivalent to traditional handwritten signatures.

Once the form is signed, it's essential to understand the submission process. This typically involves submitting the completed form to your employer’s HR department or payroll office. Confirming successful submission is also vital; check with your employer to ensure they received the form and that your enrollment is processed.

Managing your direct deposit enrollment

Once you've submitted your direct deposit enrollment form, it’s crucial to keep track of your enrollment status. Verify with your employer or bank to ensure everything has been processed correctly and that your paychecks will be deposited into the correct account.

If you need to change your direct deposit setup, the process is generally straightforward. You will likely need to fill out a new enrollment form indicating the changes, whether switching banks or modifying account numbers. Always communicate with your employer's HR department to clarify any specific requirements they may have regarding updates.

Troubleshooting common issues

Encountering issues during the direct deposit enrollment process is not uncommon. If you face technical difficulties on pdfFiller, check their FAQ section for guidance on resolving common issues that users experience. Remember that delays can occur in the enrollment process, so staying proactive and following up regularly with your HR department is important.

For further assistance, don't hesitate to contact support. pdfFiller has dedicated customer service to help users navigate any problems, and your employer’s HR department is another resource for questions related to your direct deposit enrollment.

Staying informed about direct deposit policies

Each employer may have specific direct deposit policies, which can affect the enrollment process. Ensure you understand your employer's particular requirements, as well as any potential changes to direct deposit regulations. This knowledge empowers you to be proactive if you need to make adjustments to your enrollment or if new regulations come into effect.

Resources for ongoing learning about direct deposit are readily available. Regularly check financial blogs, articles, or even your employer's HR updates to stay informed about this essential aspect of payroll management, further enhancing your financial literacy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in direct deposit enrollment form?

Can I create an eSignature for the direct deposit enrollment form in Gmail?

How do I fill out the direct deposit enrollment form form on my smartphone?

What is direct deposit enrollment form?

Who is required to file direct deposit enrollment form?

How to fill out direct deposit enrollment form?

What is the purpose of direct deposit enrollment form?

What information must be reported on direct deposit enrollment form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.