Get the free Admissions Tax License Application

Get, Create, Make and Sign admissions tax license application

How to edit admissions tax license application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out admissions tax license application

How to fill out admissions tax license application

Who needs admissions tax license application?

Admissions Tax License Application Form: Your Comprehensive Guide

Understanding admissions tax

Admissions tax is a levy imposed on the sale of tickets for entertainment events, venues, and attractions. The purpose of this tax is to generate revenue for local and state governments while fulfilling various public service needs. For businesses involved in ticket sales, understanding this tax is crucial, as non-compliance can lead to fines and sanctions.

Compliance is essential not only for avoiding penalties but also for contributing to the betterment of community services funded by these taxes. Businesses must stay informed about the various rates and regulations that apply to them, depending on their location.

Breakdown of tax rates

Admissions tax rates can vary significantly between different jurisdictions. For instance, while some areas may have a flat rate, others utilize a tiered system based on the event type or attendance size. As of 2023, rates generally range from 2% to 10%, depending on local tax laws.

It's advisable for businesses to consult their local tax authority's website or resources to ensure they are aware of the current rates applicable to their operations. Doing so can prevent unexpected liabilities and ensure smoother compliance.

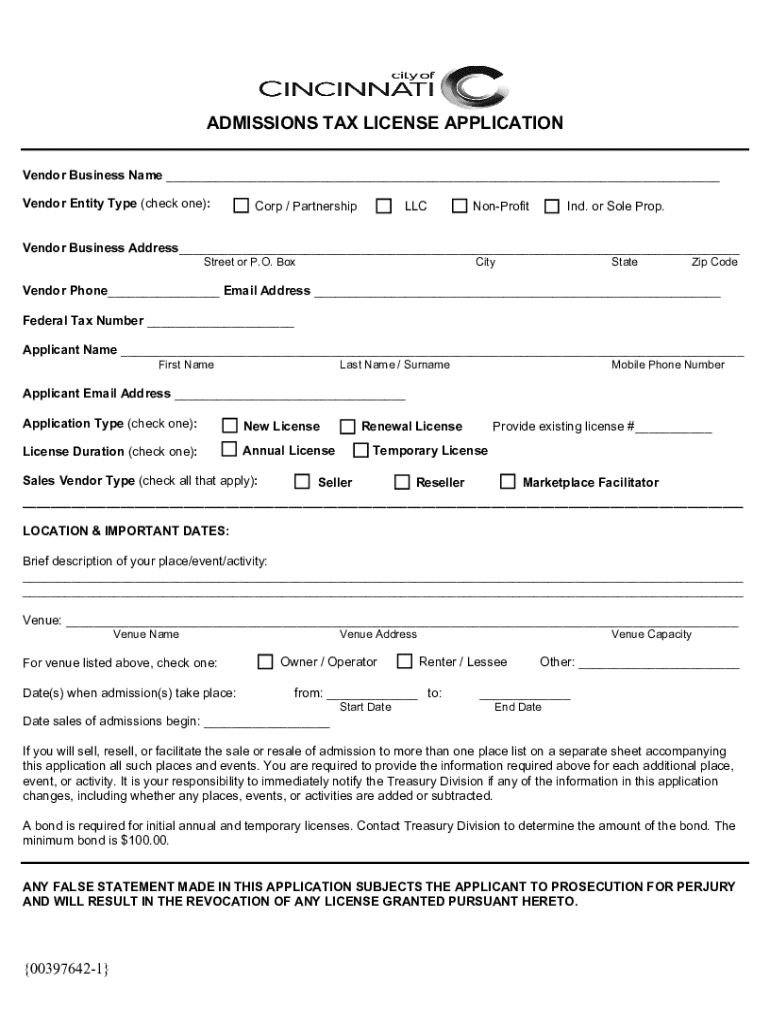

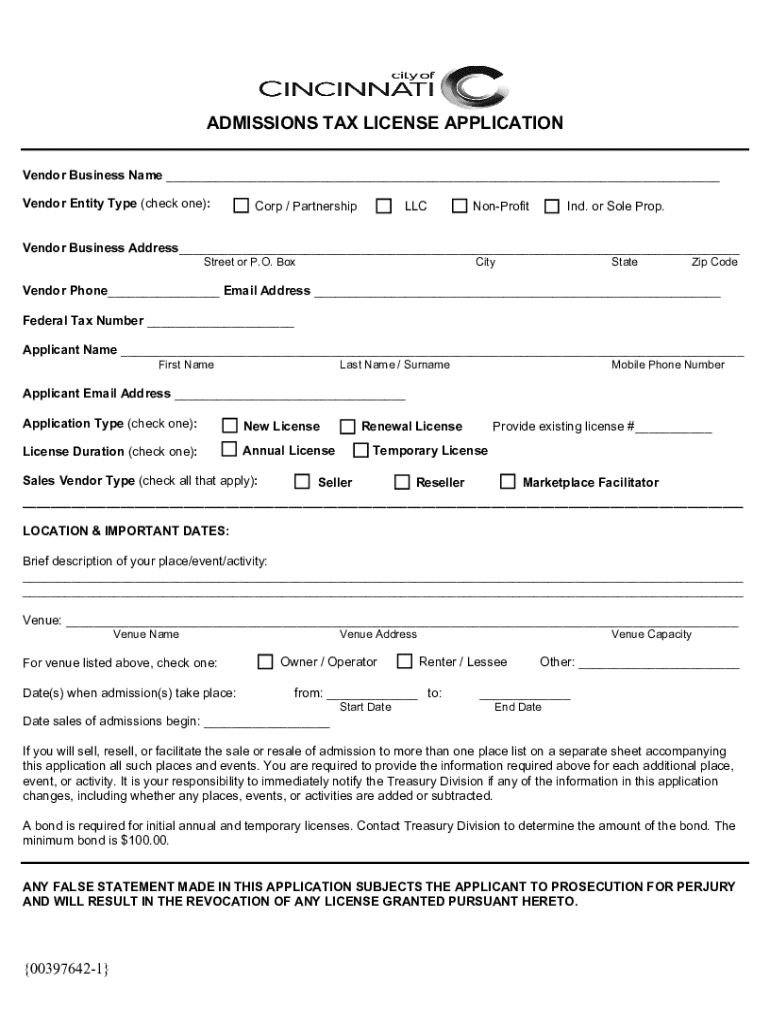

The admissions tax license application form

The admissions tax license is a critical component for businesses that sell admissions. It is required for venues, theaters, museums, and other establishments that charge fees for entry. Without this license, businesses may face penalties, including fines or the suspension of their ticket-selling capabilities.

Operating without a license can also damage a business's reputation, making it crucial to navigate the application process effectively. Understanding the key sections of the admissions tax license application form is the first step.

How to complete the admissions tax license application form

Completing the admissions tax license application form may seem daunting, but a step-by-step approach simplifies the process. Start by gathering all required documents, such as proof of business registration, previous tax filings, and personal identification.

Be meticulous when filling out the form to ensure all information is accurate. Even minor errors can delay processing times. Common mistakes to avoid include incomplete sections, incorrect tax rates, or outdated business information.

Submitting your application

Once the admissions tax license application form is complete, the next step is submission. Many jurisdictions offer online submission options, which can be done through platforms like pdfFiller. This method often speeds up the process and provides instant confirmation of receipt.

Alternatively, if you prefer in-person submission, ensure you follow all necessary guidelines and have copies of all documents ready. Processing times for applications can vary; however, it typically takes a few weeks. Monitoring progress through follow-up inquiries can be beneficial.

Managing your admissions tax license

Once you have obtained your admissions tax license, it's essential to know how to manage it. License renewal is a necessary process, generally required annually or biannually. Staying on top of key dates ensures that you don't accidentally let your license expire, which could lead to complications in your business operations.

If your business operations change significantly, such as moving locations or expanding services, you may need to reapply for your admissions tax license. Keeping detailed records of your renewals and any changes to your operations will help maintain compliance.

Compliance and reporting obligations

Maintaining compliance involves not only obtaining your admissions tax license but also keeping accurate records and filing admissions tax returns on time. Different jurisdictions will have varying requirements regarding how long you should retain records, so it's paramount to familiarize yourself with these stipulations.

Typically, businesses are expected to file admissions tax returns either quarterly or annually, depending on their sales volume. Accurate reporting of admissions income is essential in avoiding audits and penalties.

Exemptions and special circumstances

Certain entities may qualify for exemptions from the admissions tax license requirements. Nonprofit organizations and events specifically designated for charitable purposes often fall into this category. However, securing these exemptions requires navigating specific guidelines and demonstrating eligibility.

An understanding of detailed criteria for exemption will aid in avoiding unnecessary fees while complying with local regulations. Examples of exempt scenarios include fundraising events organized by registered charities.

Common questions and troubleshooting

Individuals and businesses often have common questions regarding the admissions tax license application form. Issues can arise, such as denied applications or changes in business status. In the case of a denied application, understanding the reasons behind the denial is crucial. This often involves consulting with local authorities to rectify issues.

If you no longer require a license—perhaps due to closing a business—it's essential to officially notify the relevant authorities. For document-related issues, pdfFiller provides reliable customer support to assist users throughout this process.

Additional considerations

As tax laws can frequently change, it's imperative to stay updated on recent legislative developments that impact admissions tax requirements. Subscription to relevant local tax bulletins and newsletters can help keep your business ahead of compliance issues.

Additionally, technology is playing an increasingly vital role in document management. Platforms like pdfFiller facilitate ongoing document management for tax compliance, simplifying the task of filing and managing necessary documents.

Interactive tools overview

Understanding the admissions tax license application form can be made significantly easier through interactive tools available at pdfFiller. These tools provide cloud-based access, collaborative editing, and seamless eSigning capabilities, allowing users to streamline the application process.

Tutorials available on pdfFiller guide users on how to effectively use features like document sharing and eSigning. The comprehensive nature of these tutorials ensures users can efficiently manage forms without hassle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in admissions tax license application without leaving Chrome?

Can I sign the admissions tax license application electronically in Chrome?

Can I create an eSignature for the admissions tax license application in Gmail?

What is admissions tax license application?

Who is required to file admissions tax license application?

How to fill out admissions tax license application?

What is the purpose of admissions tax license application?

What information must be reported on admissions tax license application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.