Get the free Manitoba Cultural Industries Printing Tax Credit

Get, Create, Make and Sign manitoba cultural industries printing

How to edit manitoba cultural industries printing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out manitoba cultural industries printing

How to fill out manitoba cultural industries printing

Who needs manitoba cultural industries printing?

A complete guide to the Manitoba cultural industries printing form

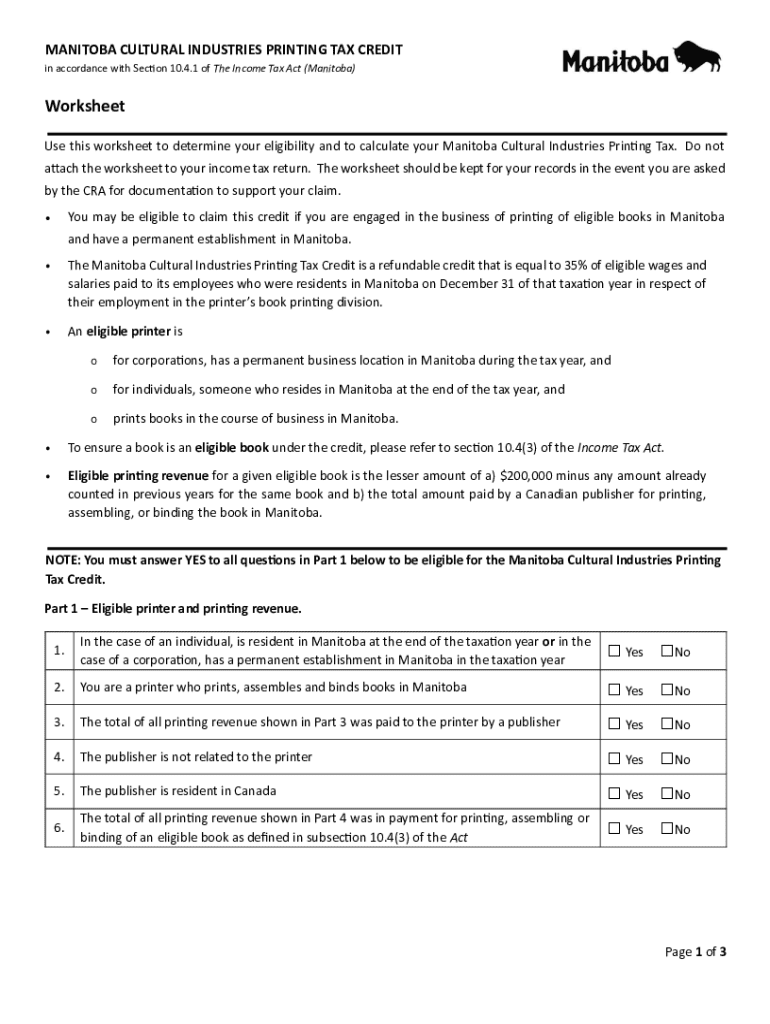

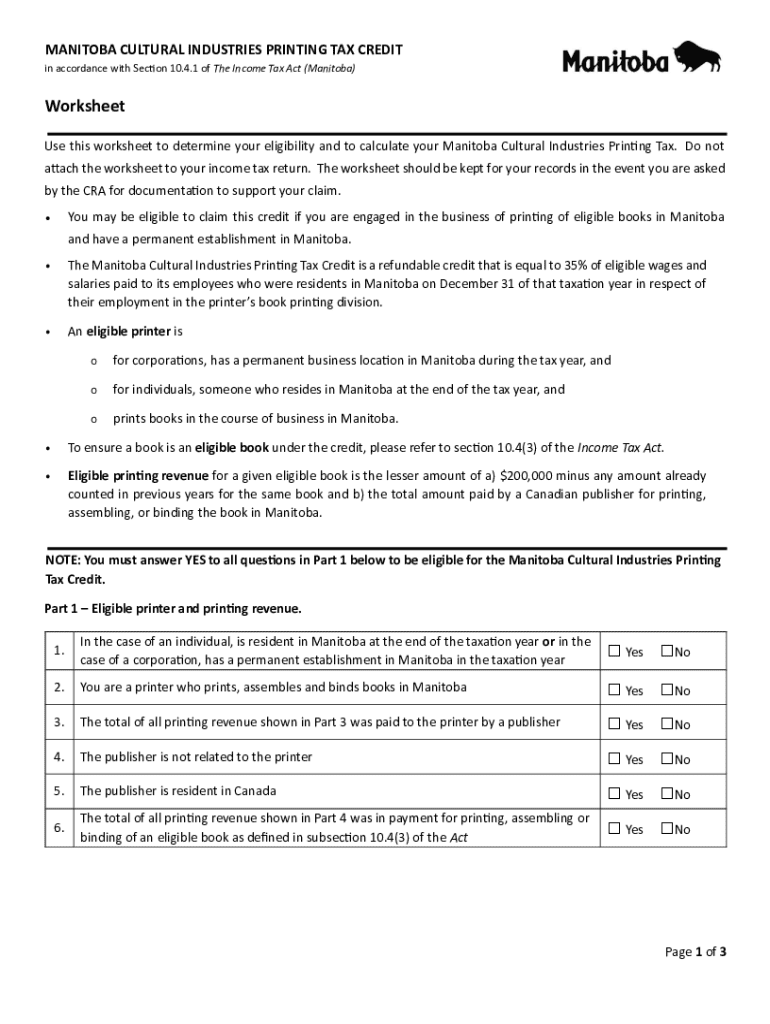

Overview of the Manitoba Cultural Industries Printing Credit

The Manitoba Cultural Industries Printing Tax Credit is designed to support the province's arts and culture sector by providing financial relief to eligible businesses engaged in cultural activities. This credit assists in offsetting costs related to the printing of cultural products such as books, magazines, and promotional materials. By encouraging investment in cultural industries, the credit plays a vital role in fostering growth and sustainability in Manitoba's creative landscape.

The primary purpose of the Cultural Industries Printing Tax Credit is to stimulate the development of Manitoba's cultural sector, enabling businesses to thrive amidst rising costs and competitive pressures. By alleviating the financial burden associated with printing, this tax credit empowers creators to produce high-quality materials that contribute to the rich cultural fabric of the province.

Navigating the Manitoba Cultural Industries Printing Form

Completing the Manitoba Cultural Industries Printing Form can initially seem daunting due to its numerous sections and technical language. However, understanding the structure of the form and the information required can make the process manageable and straightforward. The form is structured to collect essential information about the applicant, project details, and an itemized breakdown of eligible expenses, ensuring transparency and compliance with tax regulations.

Common mistakes can hinder the application process, resulting in delays or denials. For instance, failing to provide adequate details about the project or incorrectly categorizing expenses can be detrimental. Furthermore, applicants sometimes overlook the need for comprehensive documentation, which is crucial for justifying claims. Being aware of these pitfalls and preparing accordingly can significantly enhance the likelihood of a successful application.

Step-by-step instructions for completing the form

To help you successfully navigate the Manitoba Cultural Industries Printing form, here’s a detailed step-by-step guide.

Interactive tools to assist with the form

Utilizing tools available on pdfFiller can significantly streamline the process of completing the Manitoba Cultural Industries Printing form. Document templates tailored to the specific requirements of the form make it straightforward for users to insert relevant information without the hassle of formatting errors.

The eSigning features on pdfFiller allow for quick approvals, ensuring that both the applicant and any needed collaborators can digitally sign documents efficiently. Additionally, collaboration tools on the platform facilitate reviews with team members or stakeholders, making it easier to refine applications before final submission.

Managing your submission

Submitting the Cultural Industries Printing Form is a crucial step that requires attention to detail. The submission can typically be completed via online portals provided by Manitoba's cultural sector. Ensure that all sections of the form are fully completed and that all necessary documentation is attached. Following the submission process is essential to understand any further requirements or clarifications needed by the evaluation team.

Common FAQs regarding the Manitoba Cultural Industries Printing Tax Credit

As applicants navigate the Manitoba Cultural Industries Printing Tax Credit, several common questions often arise. Understanding these can help demystify the process and set realistic expectations.

Related forms and resources

In addition to the Manitoba Cultural Industries Printing form, various other cultural industry tax credits exist designed to support different aspects of the cultural sector. Being aware of these related forms can provide additional avenues for funding and support.

Case studies and success stories

Understanding real-life experiences from applicants who have successfully obtained the Manitoba Cultural Industries Printing Tax Credit can provide valuable insights. Case studies not only highlight the impact of this credit on growth and innovation but also demonstrate effective strategies for completing the application.

Insights into tax strategy for cultural industries

The current tax environment in Manitoba presents unique opportunities for cultural industries to maximize benefits through careful tax planning. Businesses would benefit from understanding how to navigate these landscapes while leveraging applicable tax credits effectively.

Final thoughts on leveraging the Manitoba cultural industries printing tax credit

The Manitoba Cultural Industries Printing Tax Credit presents a valuable opportunity for businesses involved in the cultural sector to enhance their growth potential. By taking full advantage of this credit, businesses can alleviate some financial pressures and invest more in creative projects.

However, accuracy and attention to detail in form completion cannot be overstated. Utilizing platforms like pdfFiller not only simplifies the process but also ensures you maintain compliance with all requirements. Regularly checking for updates on the program can further enhance strategy efficacy, ensuring continued access to essential resources in Manitoba’s vibrant cultural landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send manitoba cultural industries printing for eSignature?

How do I edit manitoba cultural industries printing on an Android device?

How do I fill out manitoba cultural industries printing on an Android device?

What is manitoba cultural industries printing?

Who is required to file manitoba cultural industries printing?

How to fill out manitoba cultural industries printing?

What is the purpose of manitoba cultural industries printing?

What information must be reported on manitoba cultural industries printing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.